The big news overnight came from the South China Morning Post, which echoed what Bloomberg reported earlier this week, namely that the US and China have “tentatively” agreed to another truce in their trade war in order to resume talks aimed at resolving the dispute, with details of the agreement being laid out in press releases in advance of the meeting between Chinese President Xi Jinping and US President Donald Trump at the G-20 leaders summit in Osaka.

According to the report, such an agreement would avert the next round of tariffs on an additional $300 billion of Chinese imports, which if applied would extend punitive tariffs to virtually all the country’s shipments to the United States.

Citing a source, the SCMP reported that Xi’s price for holding the meeting in Osaka was that Trump delay additional tariffs, which of course is a risk: “The reality, though, is President Trump could always have a change of heart,” the source said. “But the truce cake seems to have been baked.”

A senior Trump administration official told POLITICO earlier this week that it is possible that tariffs could be delayed but cautioned that “nothing is certain. Absolutely nothing.” A Washington-based source familiar with the talks said that there were “ongoing attempts to coordinate press messaging”, but added that there was no specificity yet regarding decisions on tariffs or timing within that messaging.

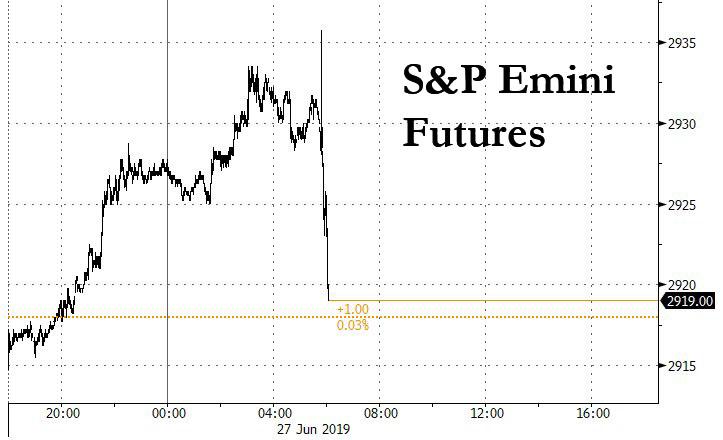

But while the original SCMP report helped boost risk sentiment overnight, sending futures to session highs, a subsequent report by the WSJ in turn slammed sentiment, after it detailed that the ceasefire is not unconditional but instead Chinese President Xi Jinping will present Trump with a set of terms the U.S. should meet before Beijing is ready to settle a market-rattling trade confrontation, raising fresh questions whether a ceasefire will even be implemented and the two leaders will agree to relaunch talks.

Among the preconditions noted by the WSJ, Beijing is insisting that the U.S. remove its ban on the sale of U.S. technology to Chinese telecommunications giant Huawei Technologies Co. Beijing also wants the U.S. to lift all punitive tariffs and drop efforts to get China to buy even more U.S. exports than Beijing said it would when the two leaders last met in December.

In short, simply to agree to a ceasefire, Beijing demands that Trump concede to many of the currently implemented steps in the ongoing trade war in return for, well, nothing.

How or why Trump will agree to any of this is unclear and is why futures stumbled immediately after the WSJ report hit.

As the WSJ further adds, despite his preconditions, “Xi isn’t expected to take a confrontational tone with Mr. Trump, according to the Chinese officials.”

Rather, they say, he will sketch out what he envisions as an optimal bilateral relationship, which includes China’s help on security issues vexing to the U.S., especially Iran and North Korea.

It is unclear whether Trump will give any sort of deadline for the talks to reach an agreement, as he had before. Two SCMP sources suggested a deadline of six months, which would put the deadline at the end of the year. Since the trade war started nearly a year ago, Trump has imposed 25 per cent tariffs on US$250 billion worth of Chinese goods.

Of course, if the WSJ is right and Beijing has such high-threshold conditions to even agree to a truce, it may well be that absolutely nothing is announced after the meeting between the two presidents concludes, and the market is starting to price it in.

via ZeroHedge News https://ift.tt/2LhI5nQ Tyler Durden