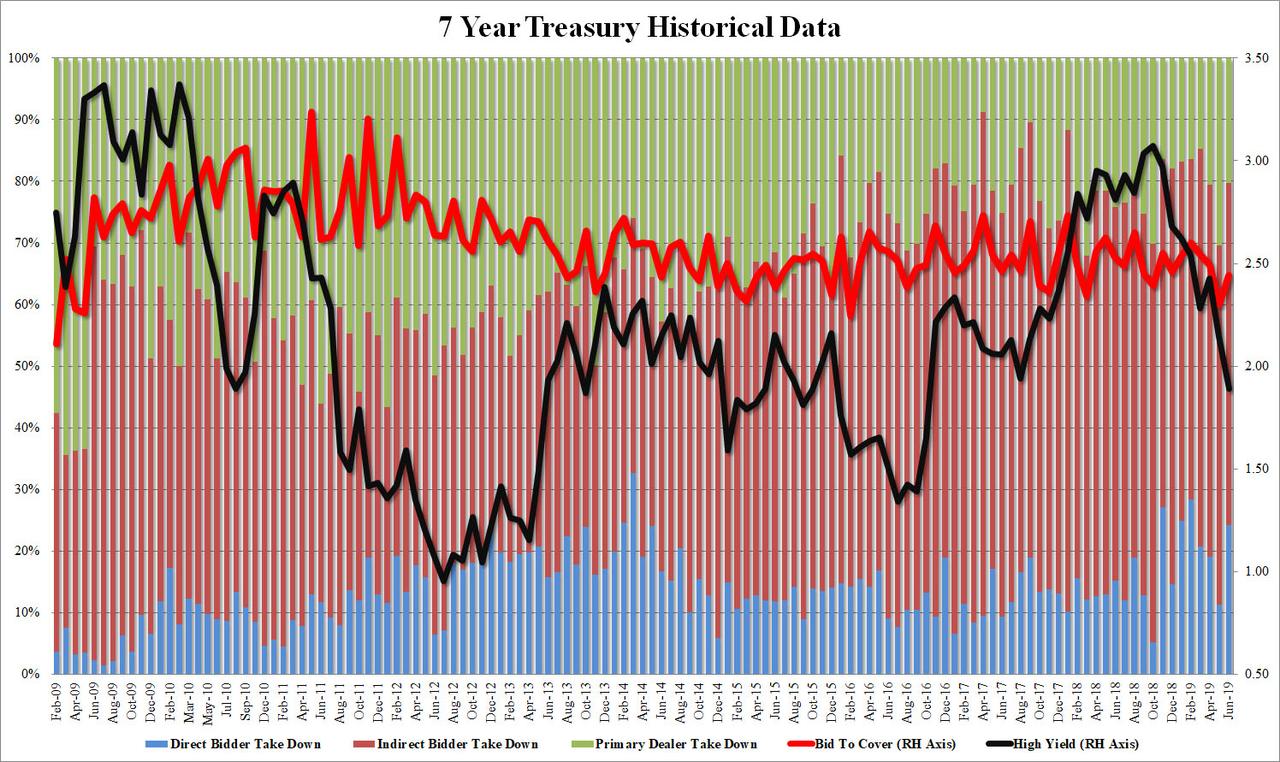

After a mediocre 5Y auction and a strong 2Y at the beginning of the week, this week’s sales of coupon paper ended with today’s auction ale of $32 billion in 7Y notes, which priced moments ago at a high yield of 1.889%, the lowest since October 2016, and below the When Issued 1.891%, in what was another mediocre at best auction.

The bid to cover rebounded from May’s 2.298 to 2.440%, which however was below the 6-auction average of 2.49.

Meanwhile, international demand did seem to wane, as Indirects took down only 55.52%, below the 58.25% last month and the lowest since February. This, however was at the expense of Direct demand which more than doubled from a takedown of 11.3% to 24.2% in June. Finally dealers were left holding just 20.25% of the bag, sharply lower from the 30.45% last month, although it was right on top of the 19.51% 6 auction average.

The bottom line: while the auction stopped through, the internals were lacking resulting in what was at best a mediocre auction.

via ZeroHedge News https://ift.tt/2X4pdL5 Tyler Durden