Authored by Danielle DiMartino Booth

-

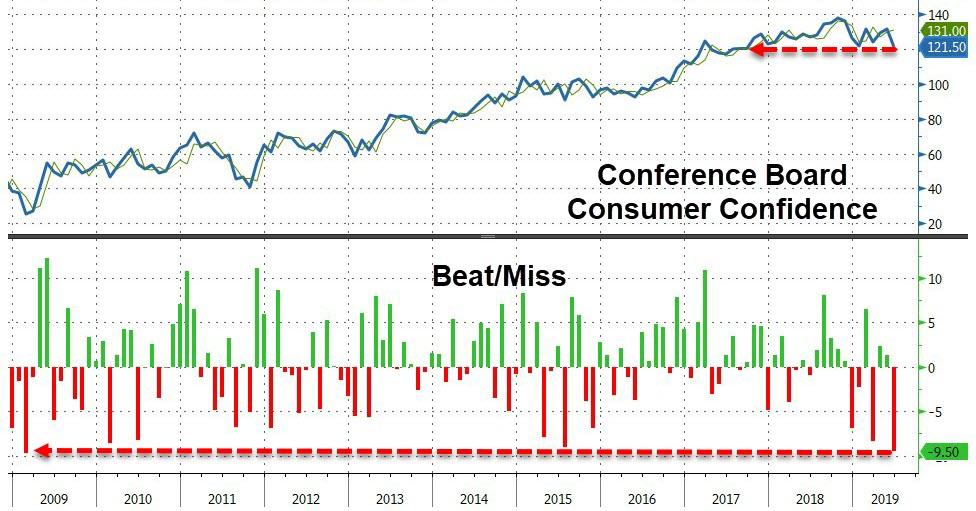

June’s 10-point slide in Consumer Confidence was the largest miss relative to expectations in nine years; the Conference Board warned that continued uncertainty will result in further declines in the Index and in due order, increase consumers’ fear of recession

-

“Jobs hard to get” – rose 4.6 points in June to 16.4, a two-year high; since 1980, every time the increase in “jobs hard to get” exceeded 4 points, the same month’s official unemployment rate rose by approximately 0.4 percentage points

-

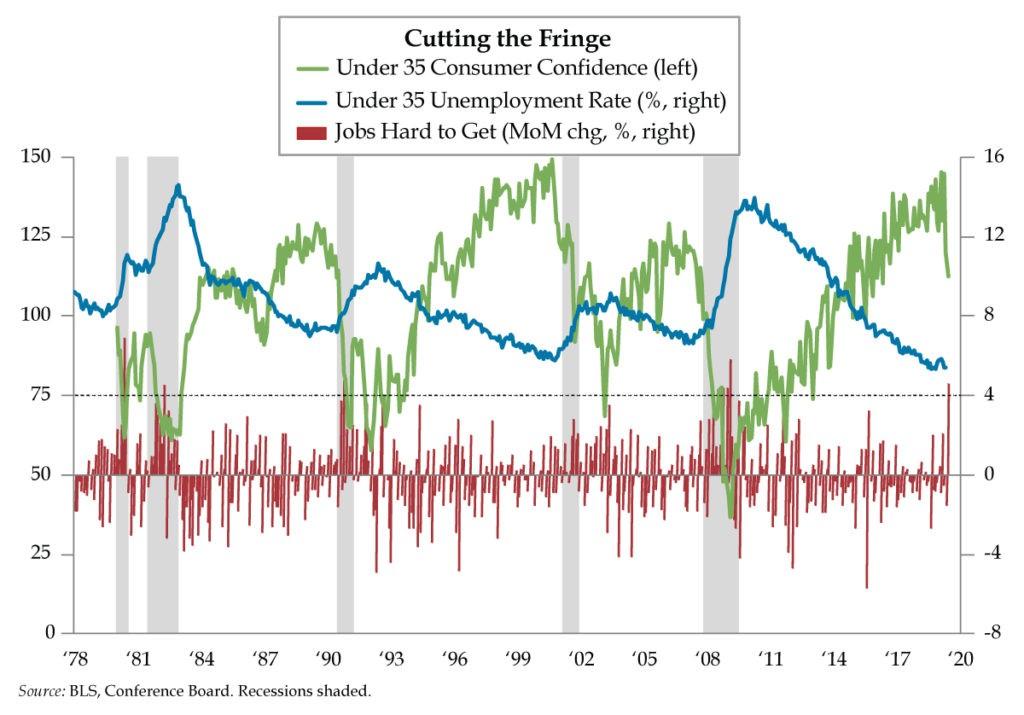

Consumer confidence for those under age 35 as well as for those earning under $15,000 have fallen precipitously over the last four months; these workers’ dour outlook is flagging end-of-cycle labor cuts as corporations begin to incorporate persistent weakness in future business

2004’s National Treasure has something for everyone: adventure, action, suspense, mystery, romance and comedy. From the start of the film, Benjamin Gates (Nicolas Cage) gets on the wrong side of his former friend and fellow treasure hunter Ian Howe (Sean Bean) when he refuses to steal the Declaration of Independence. From that point on, the chase is on to save the Declaration from falling into the wrong hands. As twists and turns have it, after catching up to Gates and his crew, Ian and his henchmen obtain it on the streets of Philadelphia. Fast forward to New York’s Trinity Church where Ian forces Ben to team up with him and venture far beneath Wall Street and Broadway only to reach an apparent dead end in the treasure hunt. Ian’s greed and patience almost run out when Ben’s father Patrick Gates (Jon Voight) turns the tables by giving Ian a fake clue. His line, “The status quo has changed, son,” marked the turning point of the movie.

Turning points in business cycles are also triggered when the status quo changes. And, yes, it does have to do with the labor market. First, let’s define the status quo. There’s a constant asymmetry present 24/7/365 in the labor market. At the apex of the cycle, about 96% of the workforce are collecting paychecks and around 4% are unemployed. Even at the worst point of the cycle, about 90% have a job and 10% do not. Because most people in the workforce have a job regardless of where we are in the cycle, bad news about the job market among households travels fast.

So revered is National Treasure in the halls of Quill Intelligence (QI), it was the inspiration for QI’s regular contributor Dr. Benjamin Franklin Gates. In his estimation, there’s a message from the movie in yesterday’s Conference Board Consumer Confidence survey.

Confidence fell nearly 10 points in June. It was the biggest disappointment vis-à-vis consensus expectations in nine years. Both major components – present situation and consumer expectations – registered declines as did a broad-based swath of different demographic categories by age, income bracket or region of the country. Numbers like this should strike us.

But it was the Conference Board’s press release that left the biggest impression:

“The escalation in trade and tariff tensions earlier this month appears to have shaken consumers’ confidence. Although the Index remains at a high level, continued uncertainty could result in further volatility in the Index and, at some point, could even begin to diminish consumers’ confidence in the expansion.”

Didn’t that sound like someone trying to soften the blow? Our less comforting interpretation (in bold): “The escalation in trade and tariff tensions earlier this month has shaken consumers’ confidence. Although the Index remains at a high level, continued uncertainty will result in further declines in the Index and, at some point, will begin to increase consumers’ fear of recession.”

Nowhere was this veiled translation more blatant than in the bad news on current employment conditions, encapsulated in the negative response, “jobs hard to get.” In June, it rose to a two-year high of 16.4% after the May reading, which had been the cycle low at 10.9% before it was revised up to 11.8%. This rendered the February 2019 reading the new cyclical low point.

The bigger news, however, was the 4.6-percentage point vault in “jobs hard to get” in June. In data back to 1980, there are only six other months when this metric rose four points or more. Every time it did, the official unemployment rate rose in the same month to the tune of 0.4 percentage points. We can say with full confidence that an unemployment result like this will not be forecast by the consensus for the next jobs report on July 5.

But one nugget of the narrative did not make sense. So we dug deeper and found that confidence for those under age 35 (illustrated above) as well as for those earning under $15,000 (not illustrated) have fallen out of bed in the last four months. Since the 1980s, the 30-plus-point decline registered between this February and June have only been rivaled in recessions.

Cutting fringe workers. The youngest and least-skilled and lowest-earning workers turning decidedly pessimistic in sync lights a roman candle on unemployment.When it is lit, the flare signals the first phase of end-of-cycle labor cuts. This would only happen if firms foresaw persistent headwinds to top-line revenues, bottom-line earnings, or some combination of both.

To test our thesis, we created an under-35 unemployment rate (also illustrated above). While it bottomed in November 2018, it has yet to have a fire lit under it. Dry wick and all, we don’t think we’ll have to wait long for proof that the status quo has changed.

via ZeroHedge News https://ift.tt/31YZBTR Tyler Durden