Two weeks ago, when looking at the record plunge in the European five-year forward five-year inflation swaps, a measure of expectations for price increases in coming years, which had dropped to 1.1385%, far below the ECB’s target of 2%…

… we said that this, together with a similar tumble in US 5Y5Y forward, is clear indication that central banks are losing control over the most important monetary commodity: inflation expectations.

There was more.

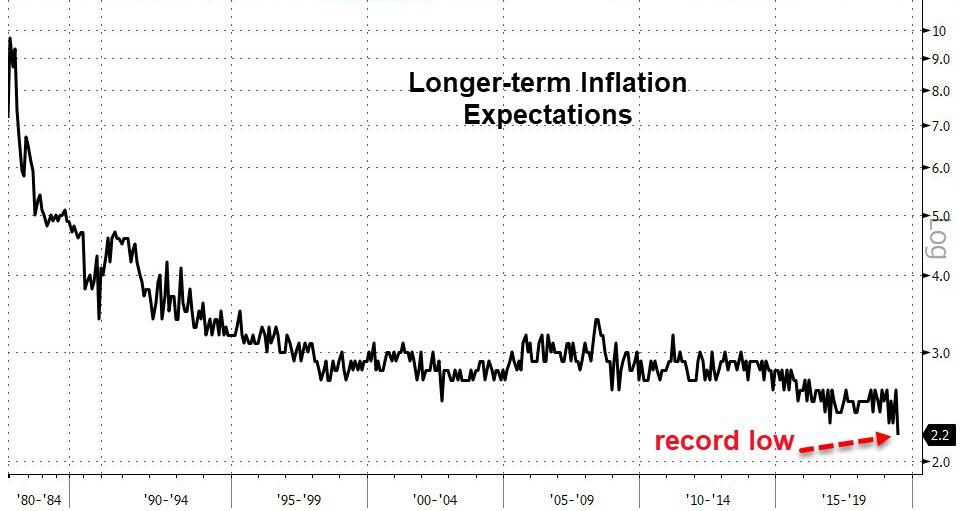

As we further expounded, it was not just the ECB that was losing market confidence at an alarming pace: in the latest UMich consumer confidence report, consumer expectations for long-term (5-10) inflation also dropped to a fresh all time low of 2.4%, hinting that the Fed too is on the verge of losing the war against unanchored inflation expectations. The good news is that this thesis will be tried and tested in the coming months, as the market is now certain the Fed will resume an easing cycle shortly. The far bigger problem is what happens if the Fed does cut – and/or restart QE – and inflation expectations fail to rebound.

Why does all of this matter, because as we wrote earlier, SocGen’s Albert Edwards is now convinced that a recession is imminent as the re-steepening of the flat yield curve has begun.

Of course, Edwards’ opinion on the duration of the business cycle hardly matters (if it did, we would be in the ice age circle of hell right now), what does matter is the official view of the NBER, and while the bureau of economic research has so far not opined, they may do so shortly, because as Edwards comments, if in the NBER’s infinite wisdom, decides that the US economy slipped into a recession in the first half of this year, investors cant say that they havent had ample warning.

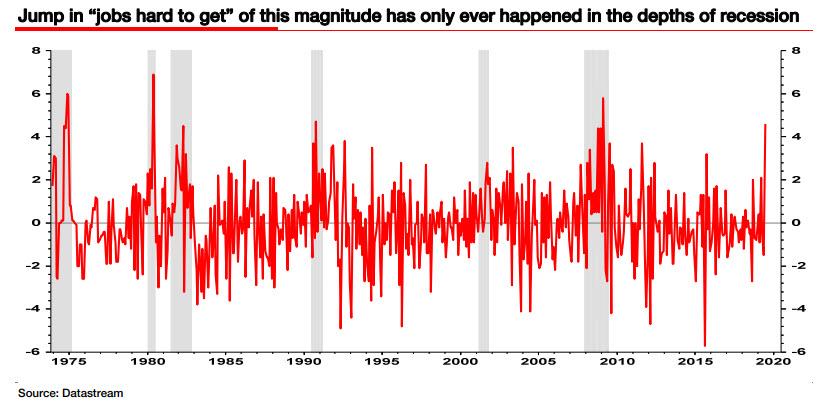

To be sure, there are plenty other recessionary indicators, and while many have so far dismissed the sudden slowdown in the June payrolls to “only” a 75,000 increase as erratic, “the wholly separate Conference Board Survey showed a MASSIVE 4.6% leap in the percent of respondents saying jobs are hard to get.” As the SocGen strategist clarified, “a surge of that order of magnitude has only been exceeded four times since the survey began in 1974, and only in the middle of recessions (see chart below, shaded areas are recessions).”

So, as Edwards notes, it’s not just the steeping yield curve that is screaming recession, it’s the huge jump in the jobs hard to get component of the Consumer Confidence Survey.

Ok fine, recessionary signals are screaming, but we started with a discussion of declining inflation expectations, by both the market and the broader population. What does that have to do with the above?

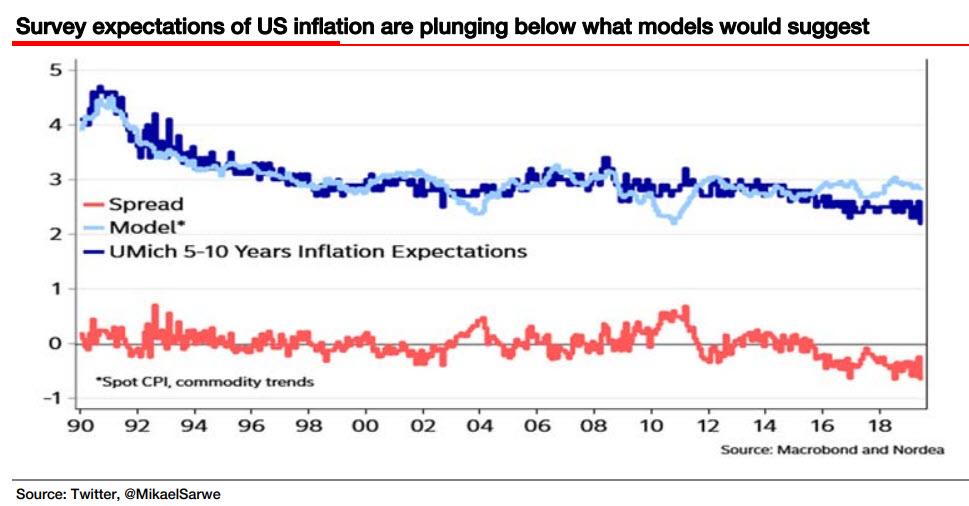

Well, to put it all together, in addition to the sudden lurch down in May’s US economic data, including virtually all the regional PMIs, SocGen highlights a recent observation from Nordea, which points to another major worry: “They note that if the Fed inflation models are anything like their own, the slump in surveyed inflation expectations (5-10y) to only 2.2% is considerably below their model prediction of 2.85% (using commodities and spot inflation, see chart below).”

According to Nordea, this is “the largest de-anchoring in the history of the survey”!

Why does all of this matter? After all stocks are bonds are both at all time highs, so what if inflation expectations have become unanchored? The answer, as we first said two weeks ago, is that loss of confidence always start somewhere, in this case with one of the more trivial aspects of central bank policy implementation (and purists will argue that inflation expectations are the most important charge of central banks).

Once central bank credibility is lost in one place, very soon the market will test to see just how unstable the entire house of cards is. And if Pimco is right, the answer will be nothing short of catastrophic.

via ZeroHedge News https://ift.tt/2NhZ3oR Tyler Durden