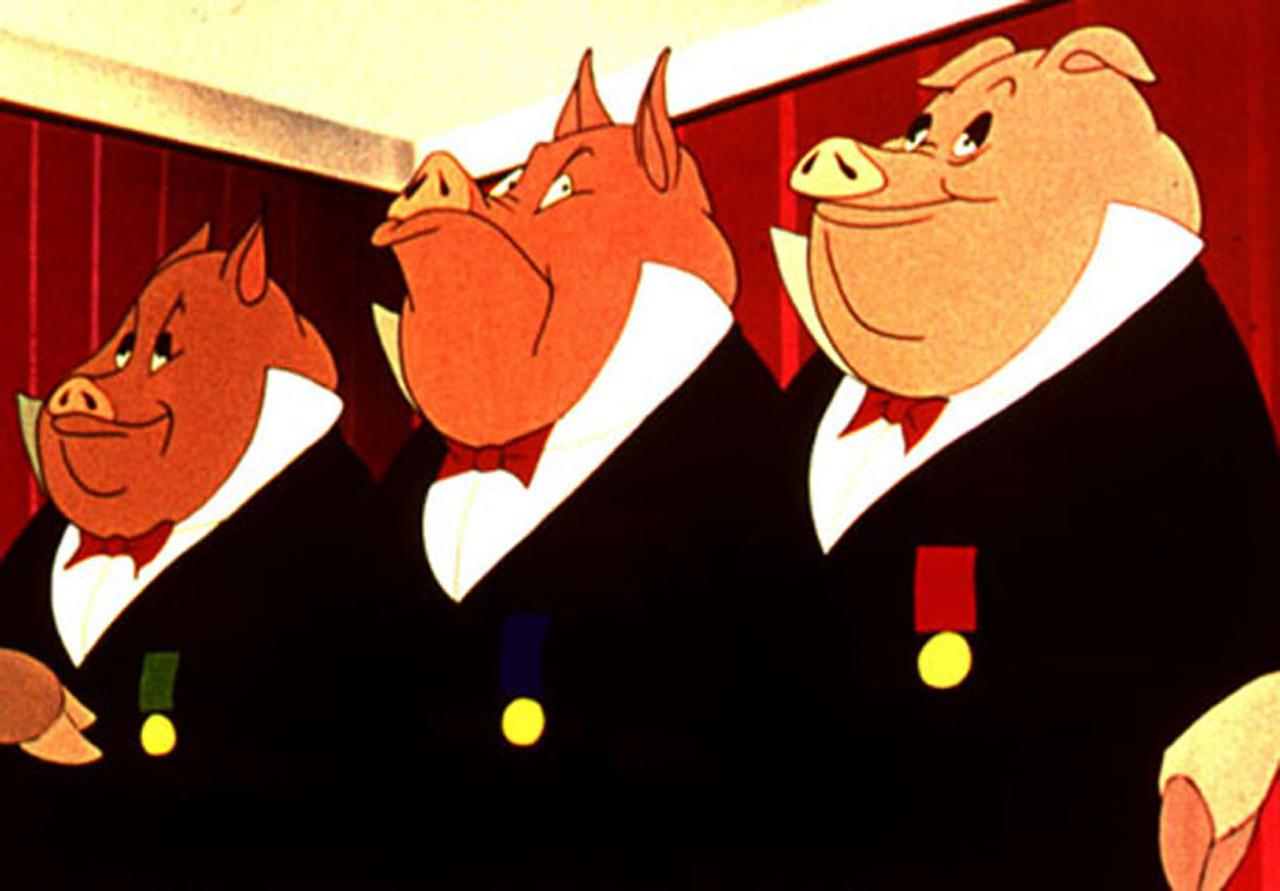

The Wall Street Journal Editorial Board has responded to a Monday open letter by “Nineteen uberwealthy Americans” spearheaded by George Soros, who called on 2020 presidential candidates to support a “moderate” wealth tax in order to make Billionaires ‘pay their fair share.’

As the Journal notes, however, this is nothing more than high-level virtue signaling.

“What’s stopping them?” asks the Editorial Board. “If billionaires see themselves as a threat to “the stability and integrity of our republic,” they could cease being billionaires any day.”

And instead of “routing their largesse through the government,” the Journal EB suggests “They could start contributing more today…”

***

Via the Wall Street Journal Editorial Board

Nineteen uberwealthy Americans posted an open letter Monday calling on “all candidates for President” to support a “moderate” wealth tax. Signatories include the investor George Soros, Berkshire Hathaway scion Molly Munger, Mickey Mouse heiress Abigail Disney, Facebook co-founder Chris Hughes, and a couple of Hyatt Hotel progeny from the Pritzker family.

“America has a moral, ethical and economic responsibility to tax our wealth more,” they say. Revenue squeezed from the top 0.1% could fund “smart investments,” such as “clean energy innovation,” “infrastructure modernization,” “student loan debt relief,” and “public health solutions.” A wealth tax could safeguard democracy, too, since countries with high economic inequality are more likely to “become plutocratic.”

The letter brushes by the arguments against a wealth tax, calling them “mostly technical and often overstated.” Would courts find it unconstitutional? How would assets like Picassos be valued? Why has Europe largely abandoned this kind of taxation? Doesn’t it diminish the incentive to save and invest? What’s to keep a wealth tax from expanding, like the income tax did, to cover more and more Americans?

Instead of seriously grappling with these objections, the letter tries to sweep readers along in sheer patriotic fervor. The rich “should be proud to pay a bit more,” the authors say. “Taking on this tax is the least we can do to strengthen the country we love.”

Well, what’s stopping them? If billionaires see themselves as a threat to “the stability and integrity of our republic,” they could cease being billionaires any day. If retiring student debt is vital, they could put out a call to graduates and start paying off loans. If the climate is a priority, they could fund a green Manhattan Project.

Maybe they’re intent on routing their largesse through the government, since it already does such a bang-up job of setting priorities and spending prudently. Again, though, why wait for legislation? They could start contributing more today. First, they could pledge to forgo all tax write-offs, including on charitable donations and foundations. As a side benefit, this would save them money on accountants.

Second, they could put their money where their convictions are by writing a big annual check—3% of assets each year, going by Elizabeth Warren’s wealth tax—to local, state or federal government. The Treasury accepts “Gifts to the United States” at P.O. Box 1328, Parkersburg, W.Va. Donations usually go to the general budget, but state policies differ, and maybe an exception could be made to let benevolent billionaires specify an earmark in the “memo” line. A few ideas:

• California’s bullet train is stalled, which hurts everybody who will need to get to Fresno in a hurry sometime after 2025. The Trump Administration is trying to claw back $2.5 billion in federal funds, and these 19 generous donors could easily fill that gap.

• Or what about the Northeast’s vaunted Gateway Program? That’s surely “infrastructure modernization,” as anyone who’s sniffed Penn Station can attest. The funding is in limbo, and billionaires could rescue the project. Heck, build a new Penn Station and put a Hyatt on top.

• The New York City Housing Authority could use a bailout. In a recent Nycha upgrade, switching public-housing lights and fixtures to efficient LEDs cost $1,973 per apartment. Since Nycha has 170,000 units, doing the whole works at that rate would cost a mere $330 million.

• Public pensions are underwater everywhere, but Illinois’s are swimming the Marianas Trench. As of February the state pension debt was $134 billion. Perhaps the Pritzker clan could pitch in, especially since one of their own sits in the Illinois Governor’s mansion.

This list is hardly comprehensive. The billionaires could use their imaginations, or hire people to do that. The point is that if they think government will perform more good with more funds, they should put up the cash now, without waiting for Congress to make them.

If a wealth tax is patriotic, a self-imposed one would be doubly so. “It is not in our interest to advocate for this tax,” the letter says, “if our interests are quite narrowly understood. But the wealth tax is in our interest as Americans.” In that case, billionaire, tax thyself.

Appeared in the June 27, 2019, print edition.

via ZeroHedge News https://ift.tt/2X8RjoR Tyler Durden