Authored by Mike Shedlock via MishTalk,

China’s currency reserves ought to be increasing given its persistent trade surplus.

They aren’t… due to capital flight.

“China’s travel-account deficit began to increase sharply in 2014. = 80% of deficit in service trade” It is calc frm forex trade at banks in China, payments by credit cards and smartphones, ATMs by tourists going overseas and students studying abroad.”https://t.co/RvSRXadcqT pic.twitter.com/4LJShOEm3g

— Adam Tooze (@adam_tooze) June 23, 2019

Question of the Day?

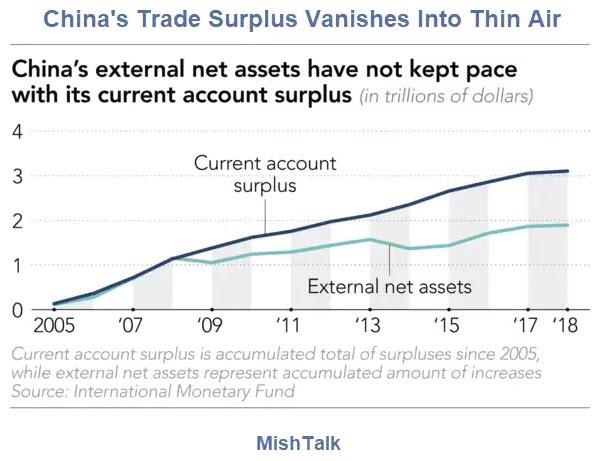

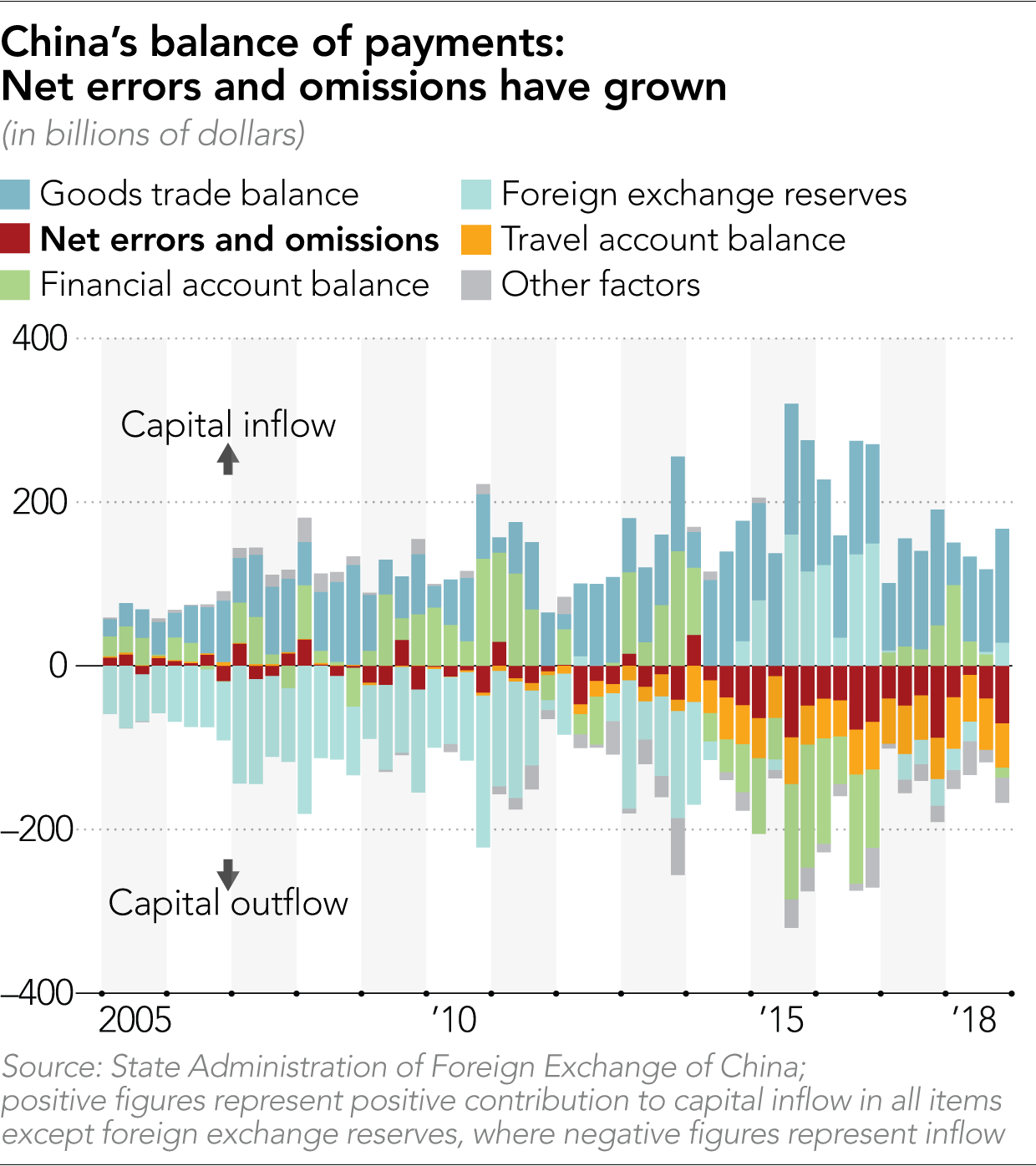

While China’s surplus grew by $2 trillion from 2009 to 2018, its external assets rose by only $740 billion in the same period. What explains the $1.2 trillion difference? “Net errors & omissions” and disguised capital flight? One for @Brad_Setserhttps://t.co/RvSRXadcqT pic.twitter.com/imBDdPiBj6

— Adam Tooze (@adam_tooze) June 23, 2019

Brad Setser Explains

this is a relatively straightforward BoP question —

a) there is a bit of capital flight embedded in the current account (the overstated tourism balance)

b) errors and omissions (hot money, flight capital has been roughly equal to the surplus in the basic balance since 14)— Brad Setser (@Brad_Setser) June 23, 2019

This is a relatively straightforward BoP question —

a) there is a bit of capital flight embedded in the current account (the overstated tourism balance)

b) errors and omissions (hot money, flight capital has been roughly equal to the surplus in the basic balance since 14)

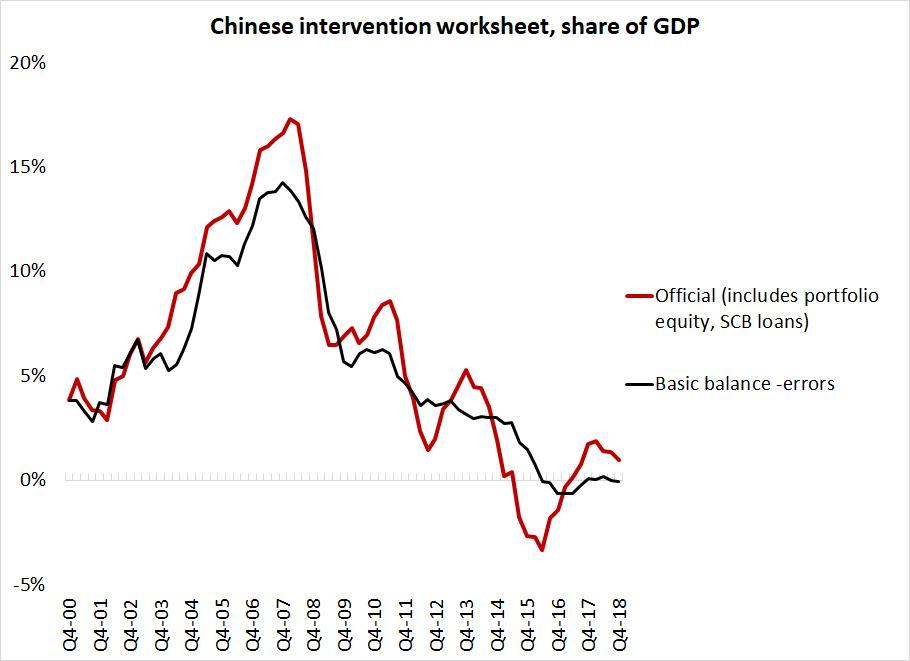

I have written about this in the past, but in the context of explaining why the equilibrium level of intervention by China has fallen (e.g. reserve growth no longer tracks the current account surplus)

In the preceding chart I subtracted errors from the basic balance, and compared it to my measure of the buildup of official assets — the difference is recorded private capital flows (in and out) — e.g. there was a modest net private inflow in 18.

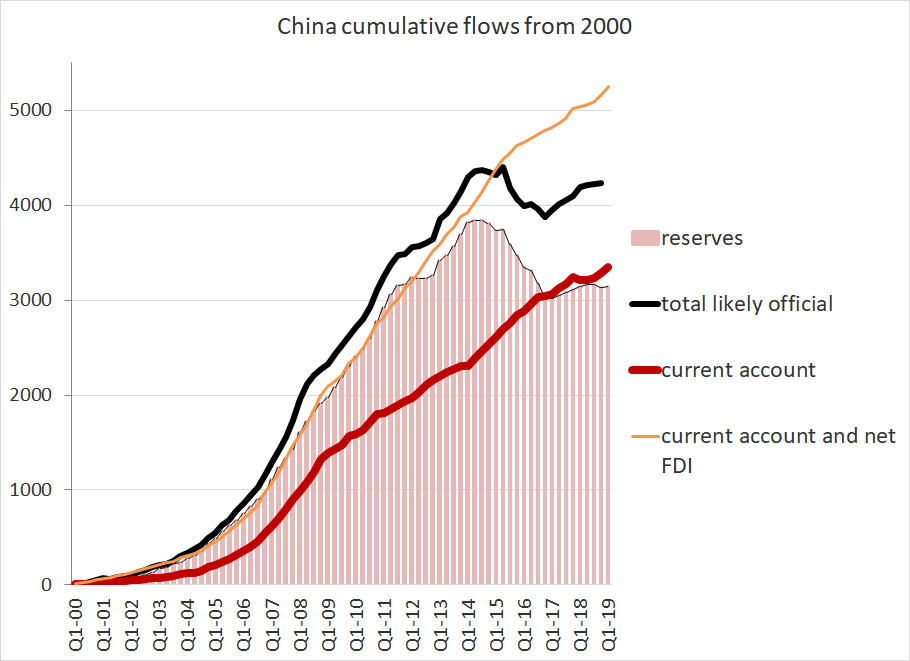

Here is another way of cutting the data. Cumulative reserve growth v the cumulative basic balance (CA surplus plus net FDI). There is a bit of a gap, e.g. there has been some leakage. But China also has ~ $1 trillion more in state assets than shows up in reserves.

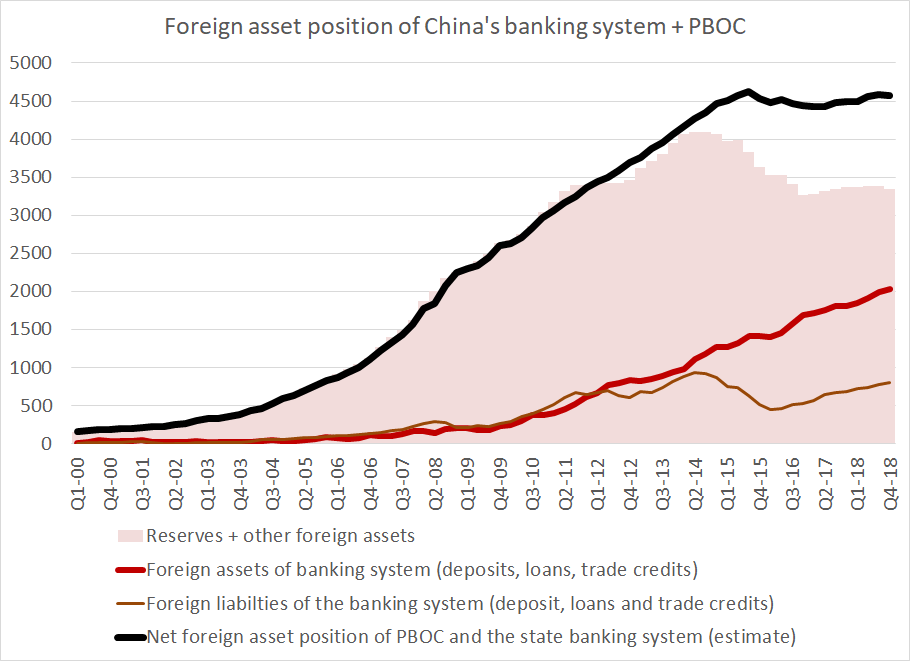

Bottom line as far as I am concerned — China’s state (between the PBOC, SAFE and the big state banks) has ~ $5 trillion in assets (over $3 trillion as SAFE/ CIC, almost $2 trillion in bank assets), just under $1 trillion in liabilities

Chinese residents have a growing (but unrecorded) offshore asset position from the “flight capital” of the last five years (easily $1 trillion) — and as is well known FDI inside China tops Chinese FDI abroad.

Bottom line: there is capital flight, but it is covered out of the goods surplus– and the net foreign asset position of the Chinese state remains massive even if it isn’t growing as fast as before. I personally would not spin this as something all that alarming.

There is plenty to worry about in China: notably the domestic financial system’s fragilities and the ongoing inability of China to sustain its growth without rapid growth of credit and investment. But I don’t really see a case for worrying about the BoP.

1.2 Trillion Disappears

Asian Review reports Quiet Capital Flight Dents China’s Sway as $1.2 Trillion ‘Disappears’

The IMF says China had $2.1 trillion in external net assets as of 2018 — the third-largest total after Japan’s $3.1 trillion and Germany’s $2.3 trillion, but well below its current-account surplus.

Normally, a current-account surplus moves in tandem with an increase or decrease in external net assets. But while China’s surplus grew by $2 trillion from 2009 to 2018, its external assets rose by only $740 billion in the same period.

The IMF says China had $2.1 trillion in external net assets as of 2018 — the third-largest total after Japan’s $3.1 trillion and Germany’s $2.3 trillion, but well below its current-account surplus.

Yu Yongding, an economist and former member of the People’s Bank of China monetary policy committee, offered a theory. If a Chinese company exports products worth $1 million to the U.S., it logs the amount as sales in trade with the U.S., according to Yu. But sometimes, only $500,000 ends up in the company’s bank account in China, while the other half remains abroad.

Yu said the accumulation of such money explains a portion of the $1.2 trillion. In China’s official statistics, a category called “net errors and omissions” covers such hazy transactions. For the 2009-2018 period, China recorded minus $1.1 trillion in this segment — suspiciously close to $1.2 trillion.

Net Errors and Omissions

Let’s label that correctly: Capital flight.

IMF Forecast

Trump Placated?

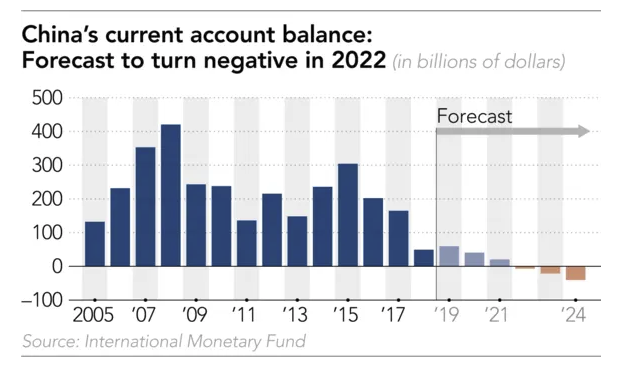

The IMF believes China’s net current account surplus will turn negative in 2022.

Setser does not see that yet and it’s easy to dismiss the IMF because the IMF is wrong far more often than right.

Yet, assume the IMF is correct. Does this placate Trump?

Not quite. It is highly likely that China’s surplus with the US simply moves elsewhere.

I discussed that idea two days ago in “Made in China” Soon to be Replaced by “Made in Taiwan”

Tariffs Won’t Work

In response, a friend of mine summed up things nicely: “The world has just changed too radically for tariffs to work like Trump expects. It’s like trying to fight World War III with muzzle loaded guns.“

If Trump puts tariffs on the entire world, few manufacturing jobs will return because everything is so automated. The only “success” Trump will see is turning the US into the highest cost producer.

Our Currency But Your Problem

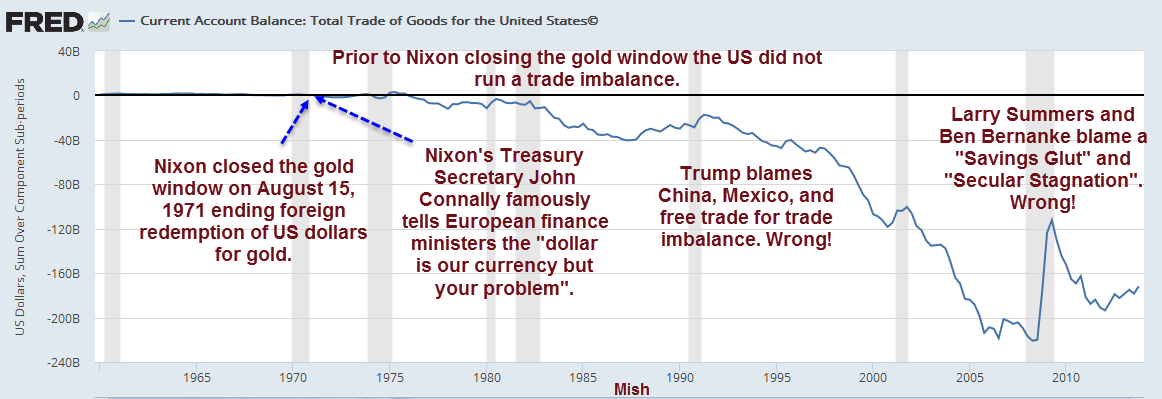

This all goes back to Nixon who closed the gold window on August 15, 1971, ending redemption of dollars for gold. Nixon’s treasury secretary then famously stated “The dollar is our currency but your problem.”

Following Nixon’s “temporary” move, fiscal deficits exploded globally and the US bore the brunt of trade deficits.

Trade imbalances are now Trump’s pet peeve. But Tariffs cannot possibly fix the problem.

Trump is fighting a 1968 Vietnam-style “guns and butter war” (wanting both) with tools that cannot possibly work.

via ZeroHedge News https://ift.tt/2RHFi8C Tyler Durden