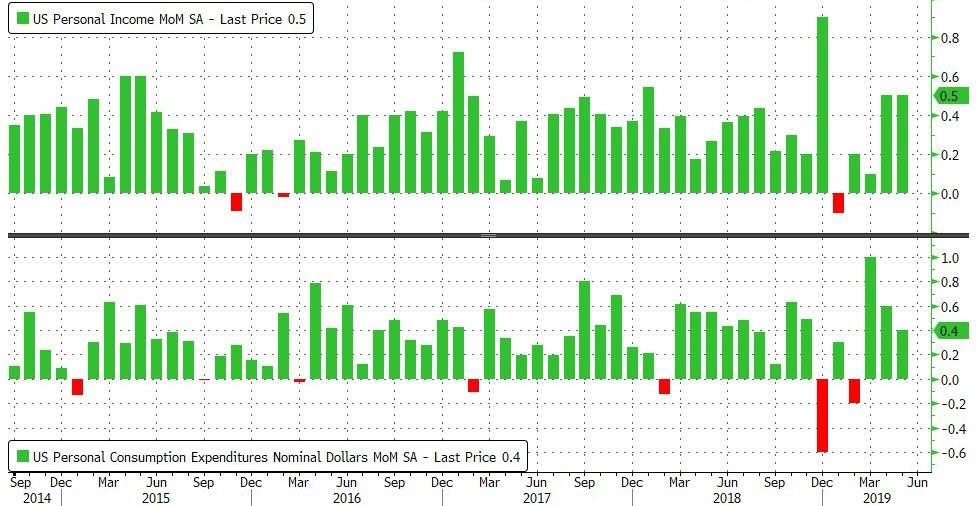

Echoing April’s data, Personal Income rose more than expected in May and Personal Spending rose less than expected.

-

Income rose 0.5% MoM (better than the 0.3% MoM expected)

-

Spending rose 0.3% MoM (worse than the 0.5% MoM expected)

On a YoY basis, Americans lived beyond their means for the 4th consecutive month as incomes grew 4.1% and spending rose 4.2%…

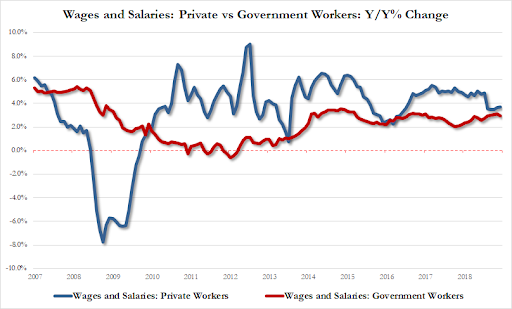

On the income side, government wages growth slowed modestly in May as Private worker wages grew faster…

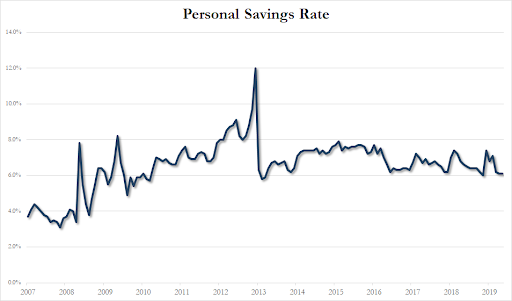

Which leaves the savings rate hovering at 6 year lows…

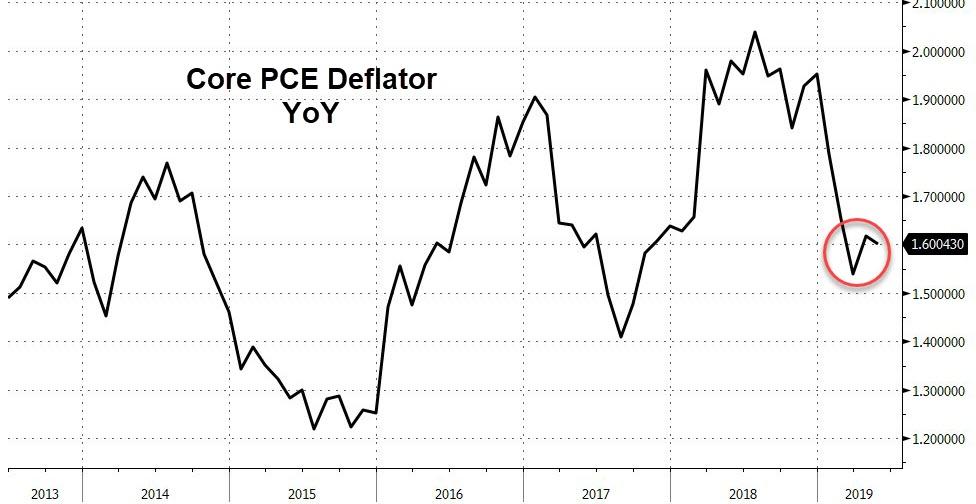

Finally, we note that the Core PCE Deflator rose 1.6% YoY in May (hotter than expected but modestly lower than in April) – this is noteworthy since it is allegedly The Fed’s most-watched inflation indicator.

Not exactly inspiring for any avoiding of a rate-cut.

via ZeroHedge News https://ift.tt/2XG4Ic0 Tyler Durden