A quick blurb from this morning’s Early Morning Reid (from DB’s Jim Reid), which confirms that the vast majority of investors expect deflation to pick up from here, and yields to drop further before (if) they rebound.

I’m at a big 2-day macro DB hosted conference at the moment with investors representing over 25 trillion of investable capital attending.

There were a few shows of hands through day one to gauge the mood and a couple of the interesting takeaways from me was that about 90% expected 10yr US yields to go to 1.70% next versus 2.30%, and around a similar percentage expected the Euro construct to look similar in 10 years time than it does today (in terms of countries in it) – so relatively sanguine about Italy. On the second question I was one of the 10%! The conference was held in beautiful 30 degree London sunshine but that seems to have been near Arctic like conditions compared to what was the hottest June day on record in mainland Europe.

This should probably not come as a surprise because as the last BofA Fund Manager Survey found, a near-record, or 32%, of FMS investors expect short-term interest rates to fall over the next 12-months, and just 10% expect long-term interest rates to rise vs. 89% expecting higher short-term yields & 63% expecting higher long-term yields respectively as recently as Nov’18.

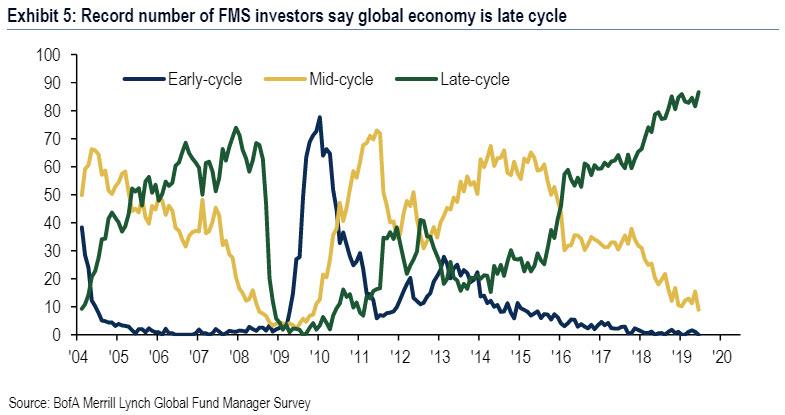

The reason: a record number of investors think the recession is imminent as an all time high 87% of investors say the global economy is late cycle.

Everyone knows what follows the “late cycle.”

via ZeroHedge News https://ift.tt/2Nm5oQ5 Tyler Durden