Well that was a month… and good luck if you’re long (or short) into this weekend’s headline horrors…

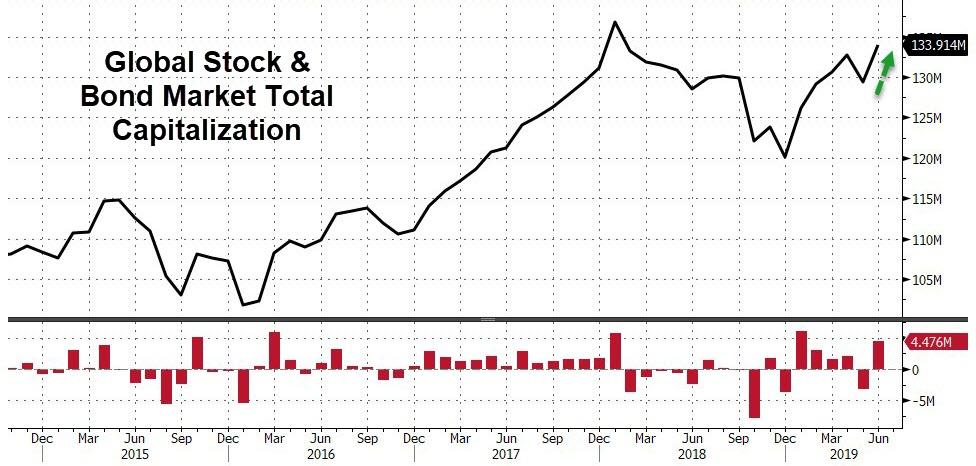

Global Bond and Stock Markets added $4.5 trillion to global wealth in June

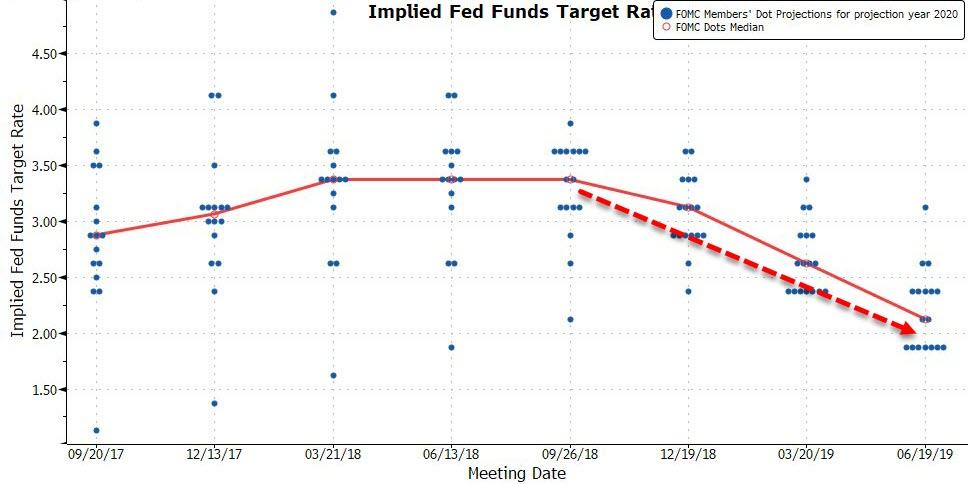

Powell Pivot, Fed Fold, or Complete Capitulation by Cowardly PolicyMakers…

Catching down to the market’s demands…

And everything was up in the first half of the year (via BofA):

H1 Scores on the doors: global stocks 15.5%, commodities 16.2%, HY corporate bonds 9.3%, IG corporate bonds 7.7%, government bonds 4.9%, cash 1.2%, US dollar 0.0%.

H1 return winners: #1 Bitcoin +194%, #2 iron ore 67%, #3 Russian equities 33%, #4 WTI oil 31%, #5 tech stocks 23%.

H1 return losers: #1 natural gas -22%, #2 Turkish lira -8%, #3 biotech stocks -2%, #4 US dollar 0.0%, #5 T-Bills 1%.

H1 flow winners: #1 Corp IG $136bn, #2 Govt bonds $34bn, #3 EM debt $27bn, #4 Munis $21bn, #5 Corp HY $15bn.

H1 flow losers: #1 EU equities -$71bn, #2 US equities -$41bn, #3 bank loans -$18bn, #4 financials -$10bn, #5 TIPS -$8bn.

H1 in a nutshell: asset prices rose as bearish positioning coincided with a bullish monetary policy pivot; interest rate expectations collapsed offsetting lower EPS expectations; lower credit spreads & volatility meant higher stock prices; investors went down-in-quality in credit, and stuck with growth stocks.

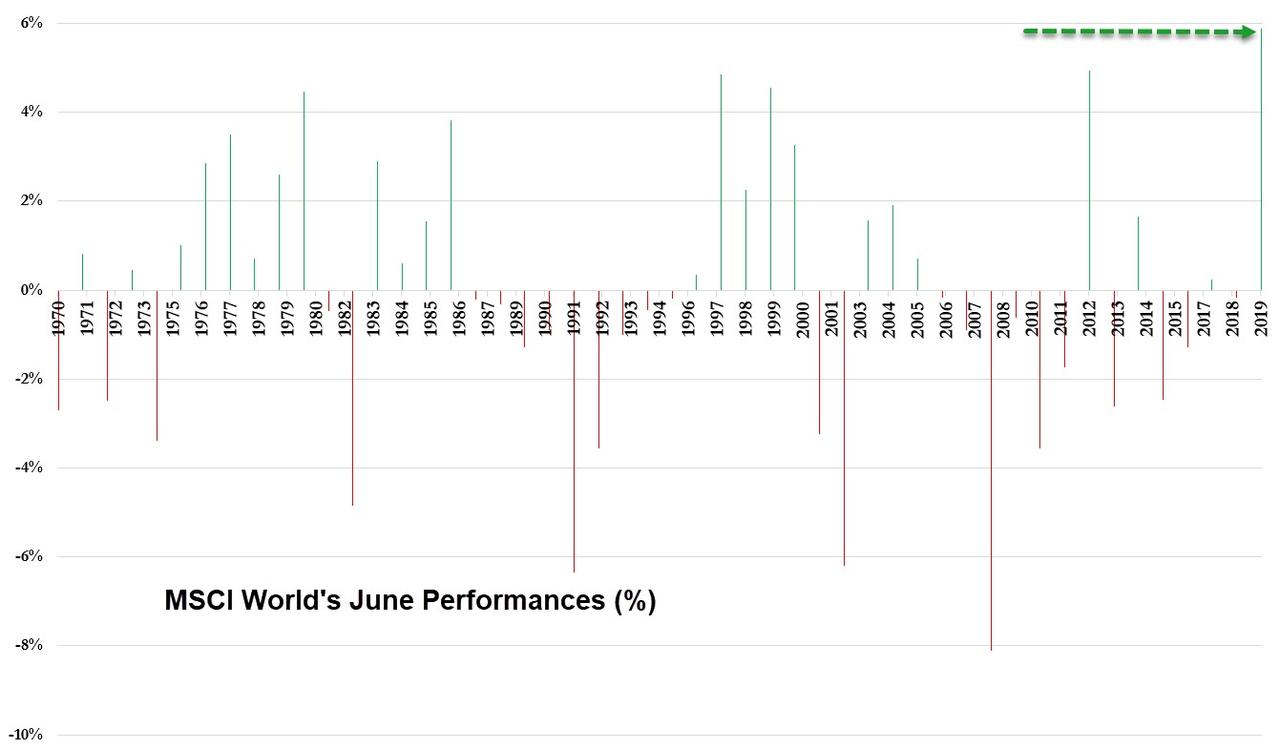

Global stocks (MSCI World) just had their greatest June performance in history…

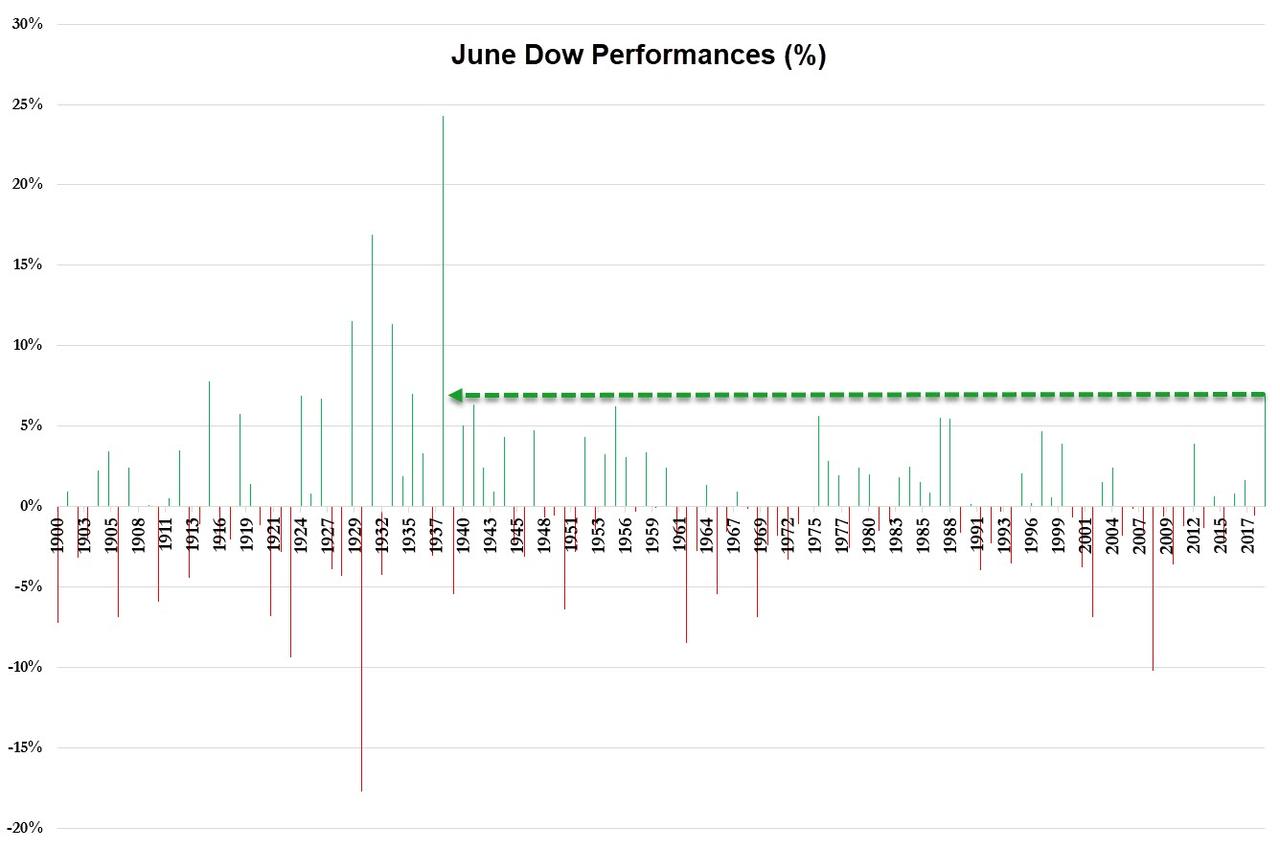

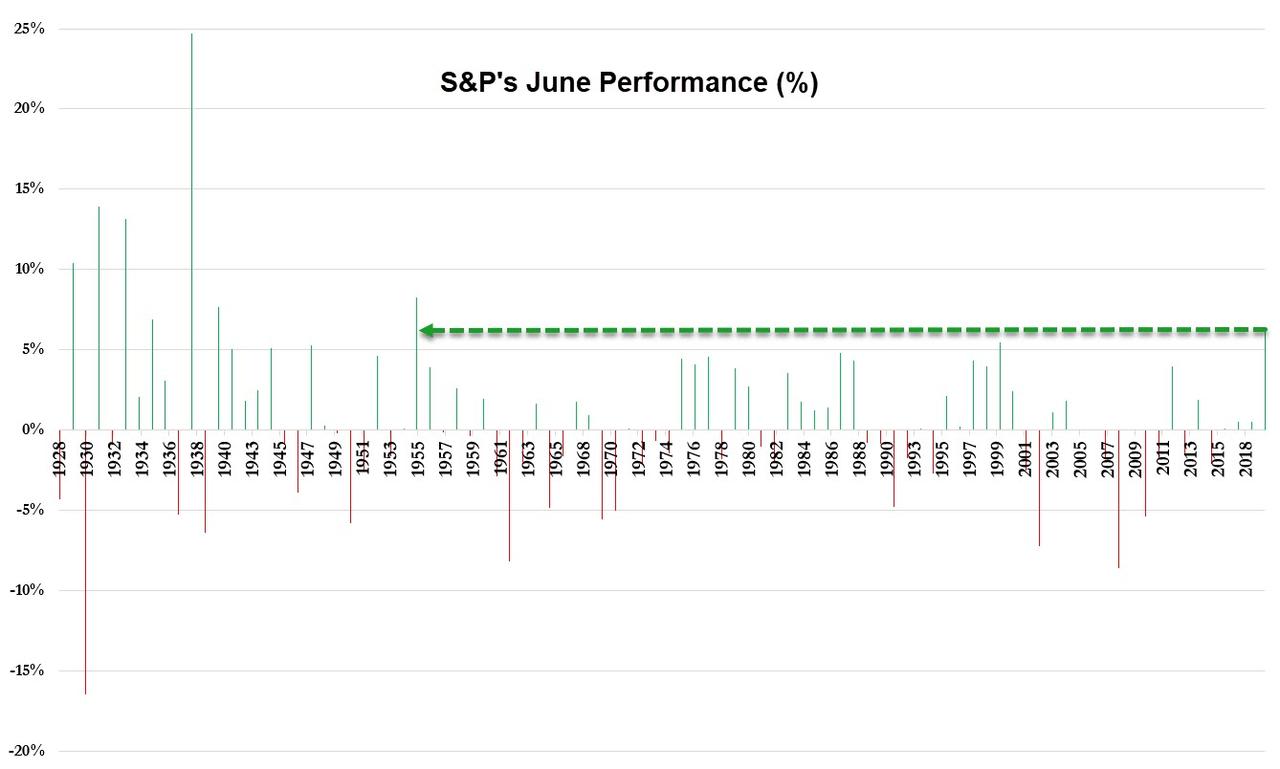

The Dow just had its best June since 1938…

Additionally, the S&P saw its best June since 1955…

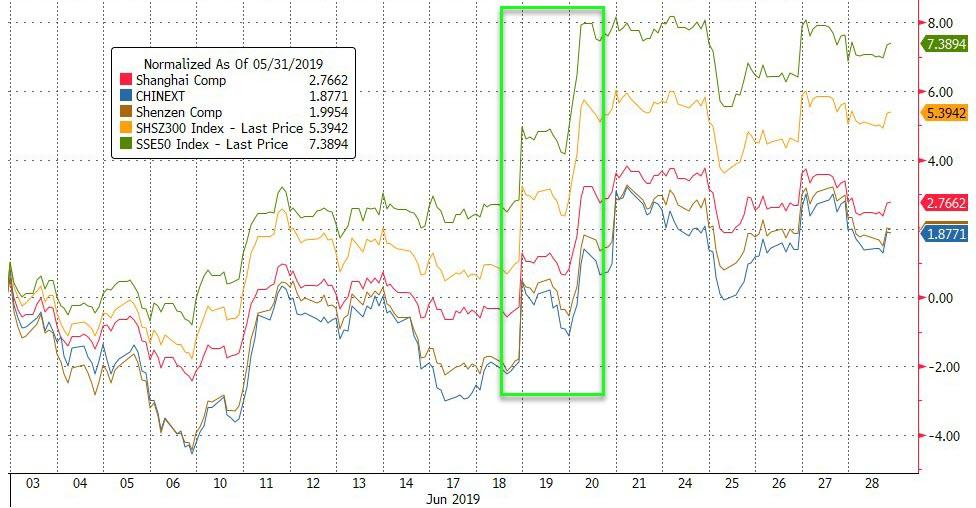

Chinese stocks are up 20% in the first six months of the year, the best six-month run since June 2015…

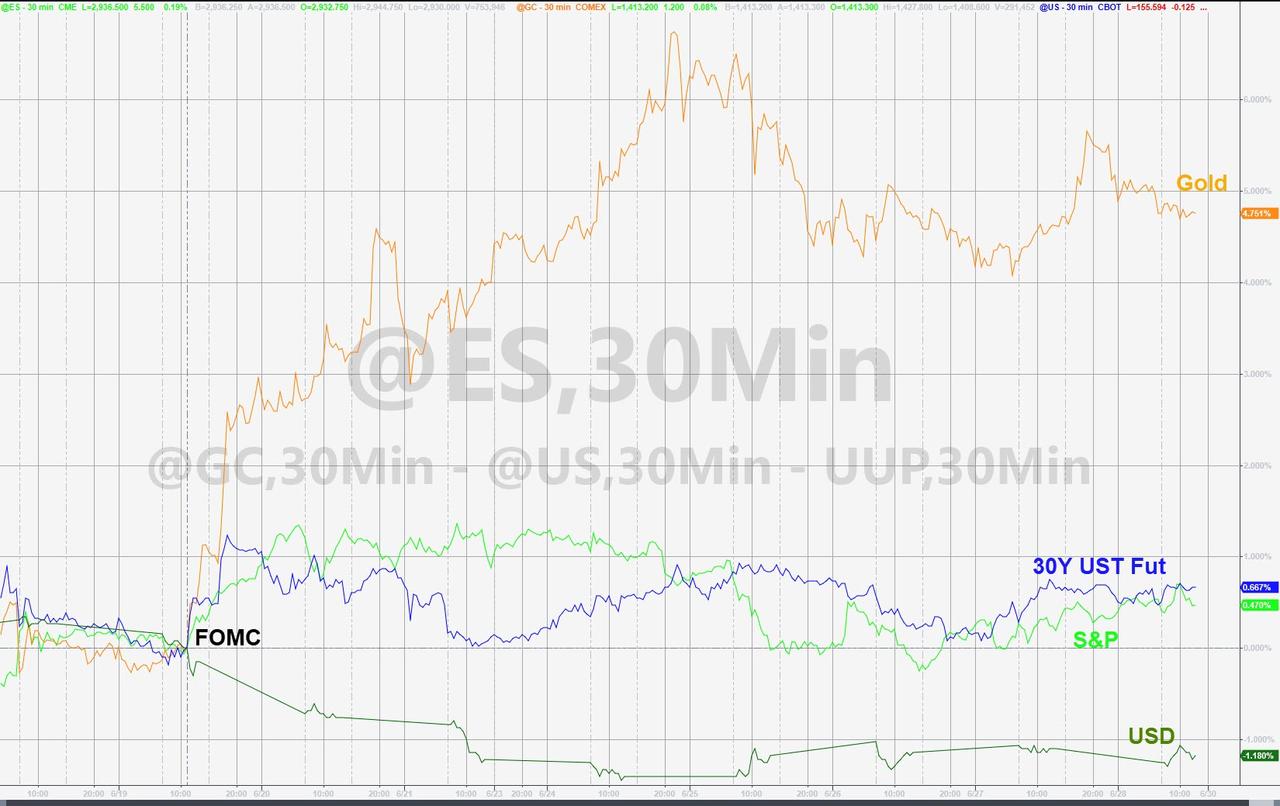

June was also a big month but dominated by the mid-month ECB/FED/BoJ fold…

European stocks saw their best monthly performance since Dec 2016 (Thanks to Draghi and Powell mid-month)…

And best first half of the year since 1998…

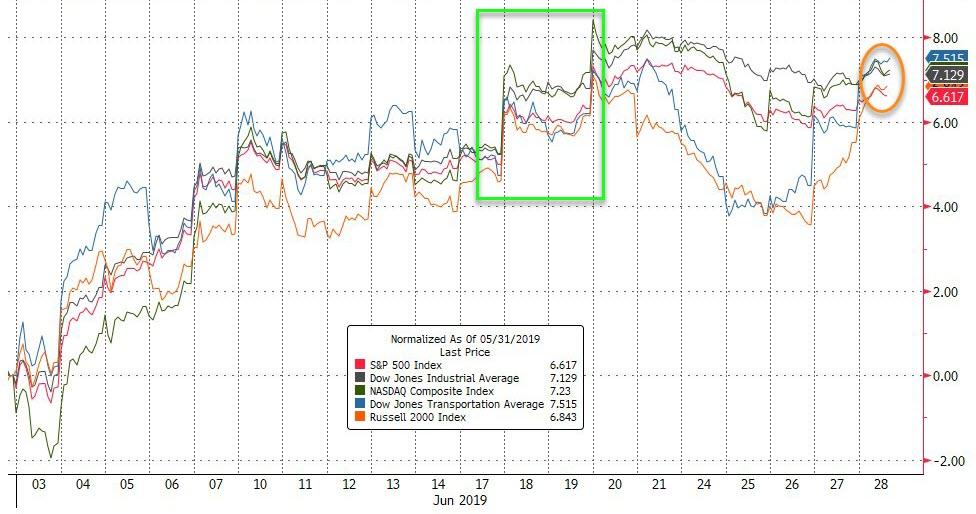

June was – as noted above – was almost unprecedented for US stocks…

NOTE – look at how tightly clustered US major equity index returns are for such a wild month.

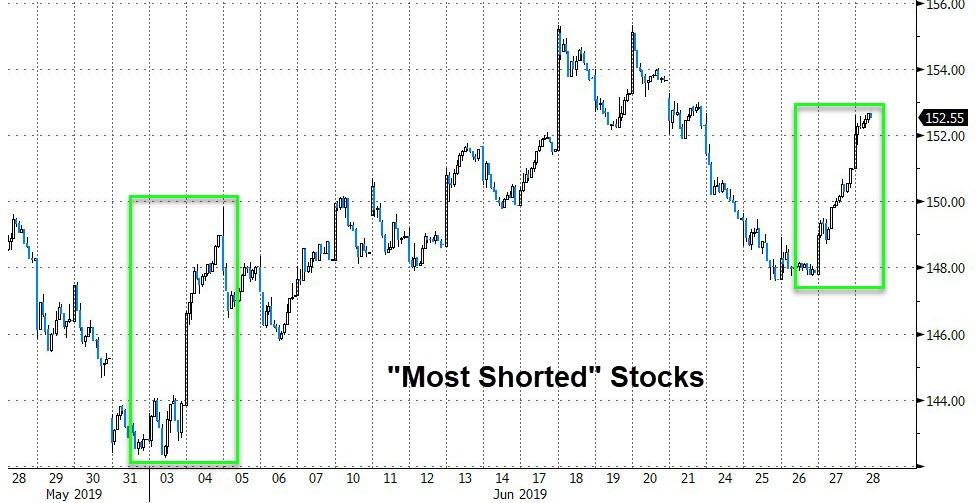

On the week, Trannies and Small Caps surged – on a huge short squeeze – but Dow, S&P, and Nasdaq all lost ground…

NOT – big spike at the close on a $4bn MOC to buy program – did pensions really wait until the last 10mins of the quarter to rebalance?

“Most Shorted” Stocks have exploded higher in the last two days, echoing the first two days of the month – this is the biggest monthly squeeze since January…

VIX was lower on the month BUT as stocks rallied since June 6th, VIX has been flat…

Credit markets dramatically compressed in June – decoupling from equity risk…

But credit and equity are notably divergent in this bounce…

Bond vol has dramatically decoupled from equity vol too…

The decoupling between bonds and stocks is unprecedented…

Treasury yields tumbled in June (but notably the long-end dramatically underperformed)…

10Y yields tested back down below 2.00% to end the month – the lowest monthly close since Oct 2016…

The yield curve (3m10Y) steepened over 11bps in June (the biggest steepening since Jan 2018) but remains inverted for the 26th day straight…

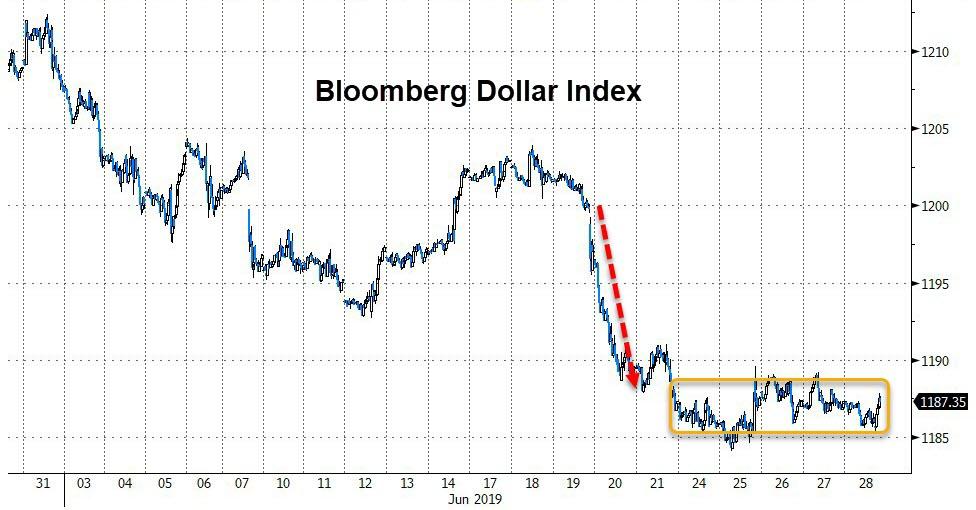

While The Dollar Index trod water this week after the Powell plunge, June’s 1.6% drop was the worst month since Jan 2018

Offshore Yuan jumped most since January in June – driven mainly by easing chatter from Fed/ECB…

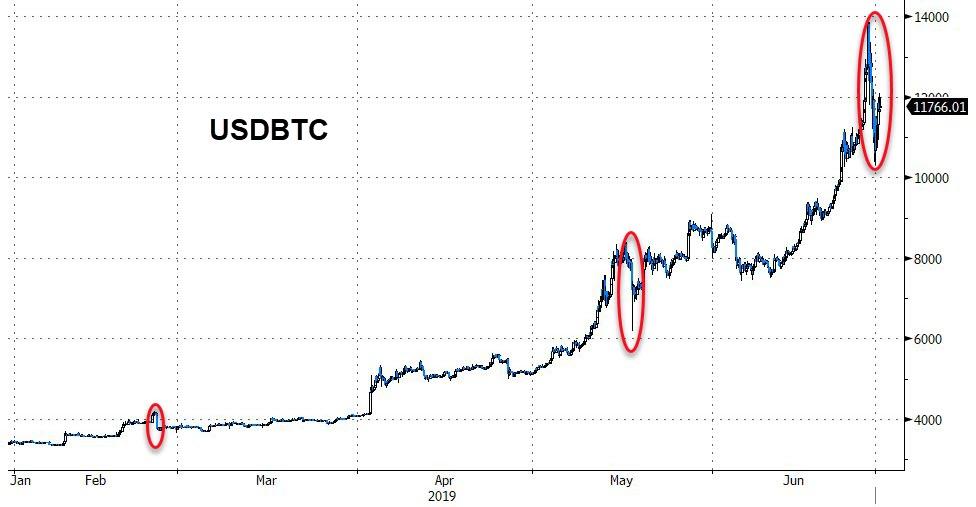

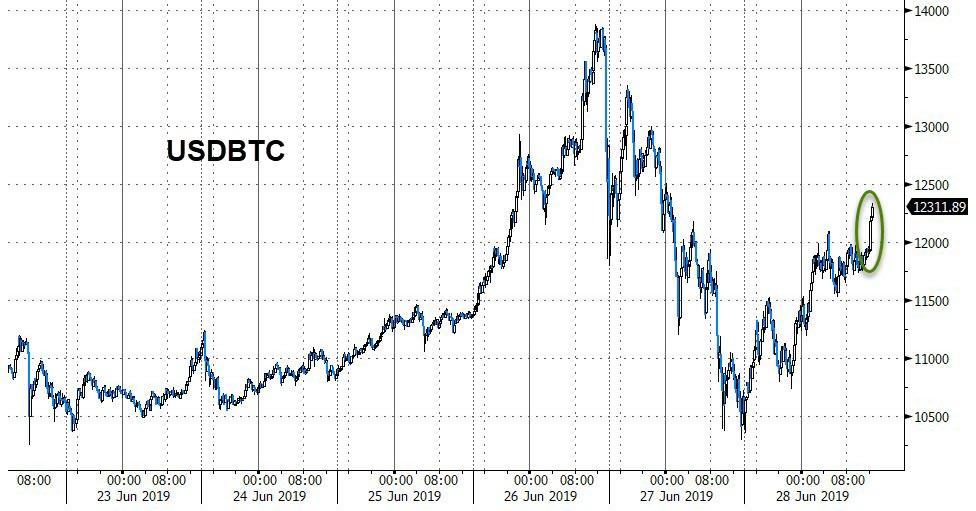

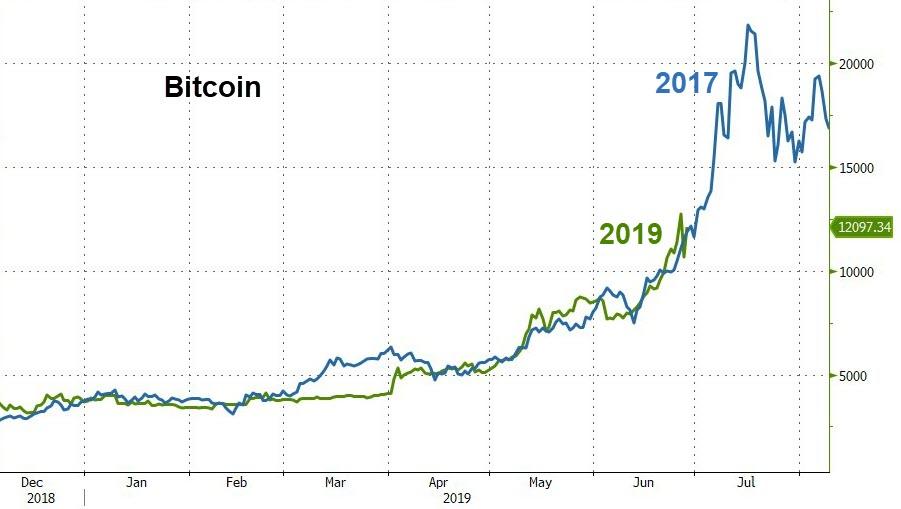

Bitcoin managed to hold on to gains this week, despite the midweek bloodbath…

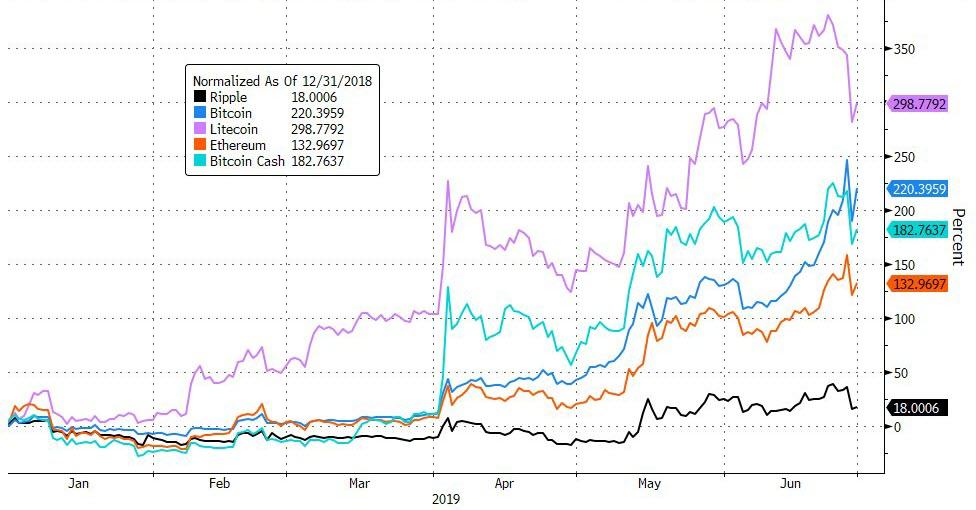

Cryptos soared in June, Q2 and H1 with Litecoin up 300% YTD and Bitcoin up 200% YTD…

Bitcoin is up 5 months in a row…

Bitcoin was bid into today’s close ending around $12,300

Tracking 2017’s trajectory very well…

Oil and Gold outperformed but the dollar weakness sent all commodities higher…

Gold surged over 8% in June, its best month since pre-Brexit in June 2016…

Gold is the dramatic winner since The Fed went full dovetard…

Gold made new all time highs in multiple currencies (AUD, SEK, MYR, CLP, and ZimDollar)

As the precious metal becomes ever more valuable in a world of negative yielding debt…

WTI had its best month since January but tumbled after the close today erasing the gains from the inventory data earlier in the week after Europe announced the Iran-Sanction workaround was operational…

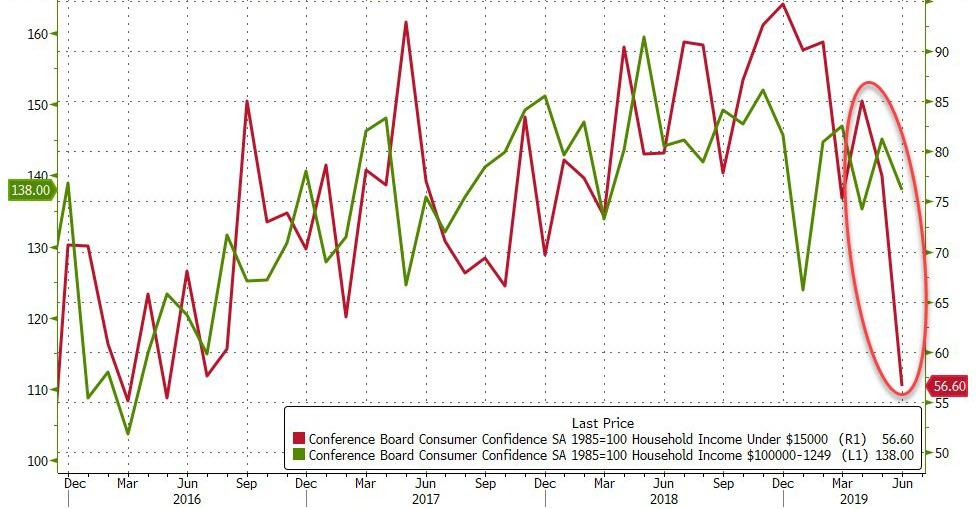

Finally, among all the superlatives in markets, June saw US Macro data collapse most since April 2017…

So, US stocks are within an inch of record highs and macro-economic data is near its weakest since 2011?

Well, it sure looks like the poorest Americans aren’t loving it…

via ZeroHedge News https://ift.tt/2KMfacc Tyler Durden