A curious paradox has emerged in the stock market: with stocks refusing to drop no matter how bad the news (see today’s Chicago PMI print which dropped into contraction for the first time since 2015), and with the S&P near all time highs, investor positioning – as gauged by Bank of America CIO Michael Hartnett – has “never been this negative amidst such strong equity & credit returns.”

It’s almost as if equity investors agree wholeheartedly with bond investors, who have dragged 10Y yields to recessionary levels, yet because of the Fed’s by now all too visible hand, are unwilling to sell even one share, resulting in a historic, and unsustainable, divergence between stocks and bonds.

Which brings us to the catalyst behind this increasingly more paradoxical market behavior: the Fed’s “Powellful Put” as Bank of America has called it.

As the bank’s economist Michelle Meyer writes, the Powell Fed has made a strong dovish pivot in only a matter of weeks. At the May 1st meeting, the message was one of patience, signaling comfort with the current stance of policy. Only 8 weeks later and Fed officials are signaling that rate cuts are on the horizon. What changed? Powell has pointed to three things:

- global outlook has dimmed with an escalation in trade tensions and weaker global data;

- the softness in inflation in 1Q which was believed to be transitory as of May could be more persistent;

- uncertainties are higher, weighing on sentiment.

As BofA shows, there are data to support each of these points.

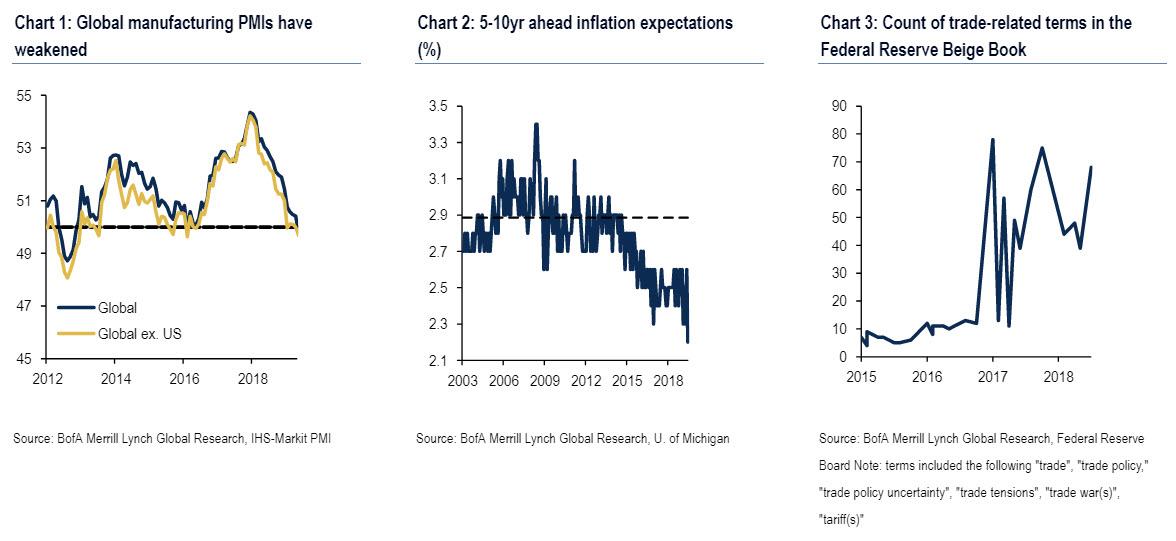

- First, on global growth, global PMIs have turned lower showing broad-based weakening in manufacturing (Chart 1).

- On inflation, the components which weakened in 1Q are still largely in the “transient” category but the concern is that as we showed recently, inflation expectations have dipped lower – according to both survey and market measures (Chart 2).

- And, on confidence, business sentiment continues to show concerns over trade with the number of mentions of trade-related comments in the Beige Book climbing (Chart 3).

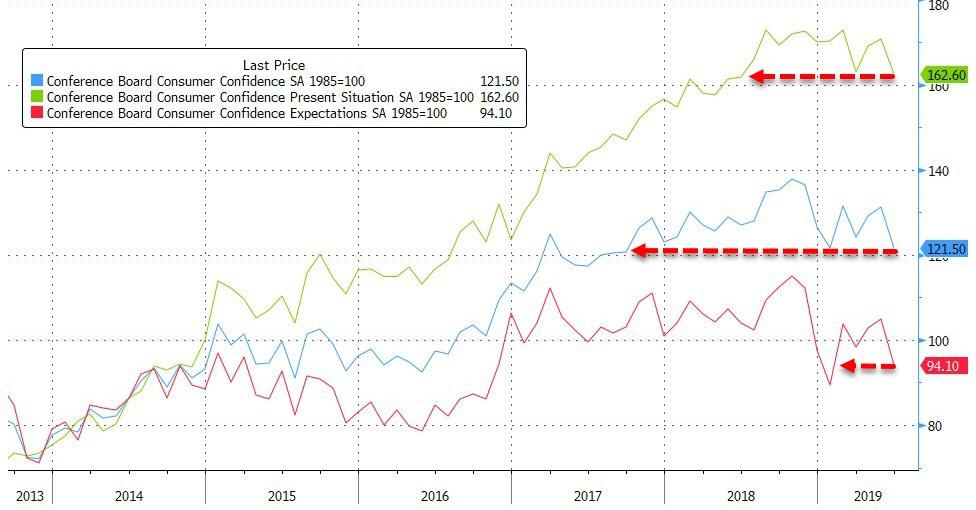

Meanwhile, even as the level of consumer confidence is still elevated, the June Conference Board report showed the biggest monthly drop since last December and the labor differential narrowed.

Which is why among this growing weakness in the consumer sector, the Fed is particularly concerned about the weakness in manufacturing data spilling into the consumer figures.

In any case, for a Fed which has previously warned against moving abruptly in the face of one or two data points – or at least when the data points suggested further tightening – this dovish turn shocked many. Amusingly, BofA notes that as Powell noted in his speech this week, “it’s important not to overreact in the short term to things that happen to be temporary or transient.” But then he reiterated his comments from the press conference that preemptive policy can be effective stating that “an ounce of prevention is worth a pound of cure.”

Well, which is it?

Here, BofA’s Meyer thinks that as of this moment, the “no longer patient” Fed is willing to move simply on heightened risks of below-trend growth but they do not need to wait for confirmation in the data. In addition, inflation is low and they are moving in the direction of embracing a more explicit “make-up” strategy for inflation to get it above the 2% target and have expectations move higher. Fed officials are concerned about limited policy space given the proximity to the effective lower bound (ELB), and the best chance of ultimately getting more policy space is to ensure that the recovery continues. In other words, “use bullets now with hopes that it helps get you even more ammo later.”

Of course, the Fed should be careful just how powerful the bullets are: as we wrote earlier, i) the Fed has never cut 100bp within a year in an easing cycle outside a recession, and ii) The Fed has never started an easing cycle with a 50bp cut outside a recession. But we digress.

Going back to the Fed, Powell now has to thread an especially thin needle or else risk upsetting the market, which is why Fed officials will be monitoring every piece of data between now and the July meeting with a particular focus on the following: outcome of the G20 meeting around trade, ISM manufacturing and services surveys and the employment report. Let’s address these:

- G20 (June 29-30): As we wrote in the G-20 preview, we expect a friendly meeting between Presidents Xi and Trump with both sides agreeing to delay further trade measures while negotiations continue. However, a substantial deal is unlikely to be reached. This would be a somewhat “neutral” outcome.

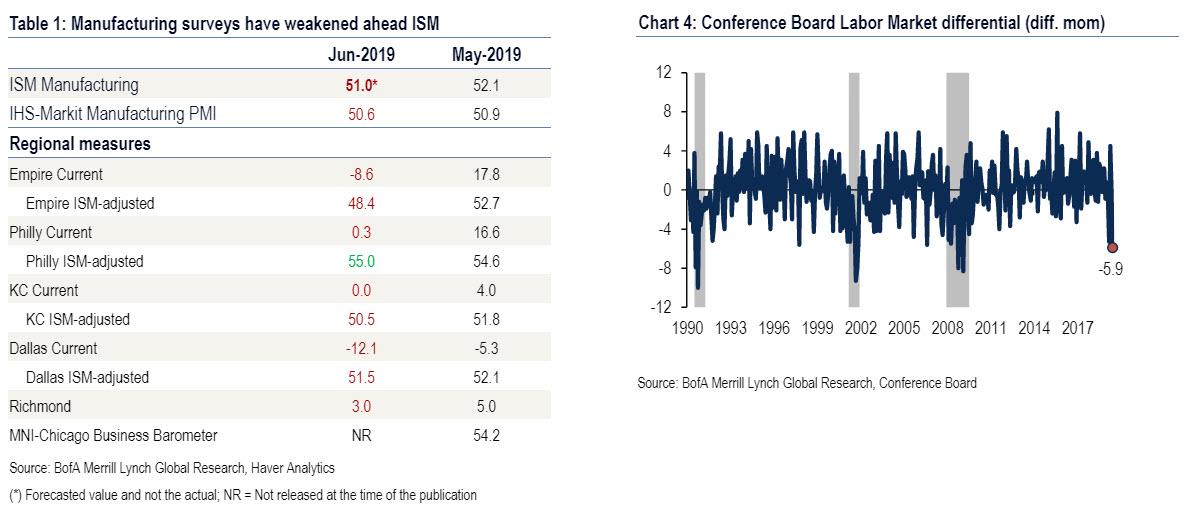

- ISM surveys (July 1 and 3): Manufacturing surveys, declined further in June with several falling into negative territory (Table 1). After adjusting these to mimic the ISM measure-a simple average of five indexes: new orders, production, employment, supplier deliveries and inventories-the decline is not as stark as the headline readings suggest. That said, we expect the ISM index to decline in June to 51.0 from 52.1, with risks that it falls more.

- Employment report (July 5): the early indicators are mixed. On the one hand, initial jobless claims have remained low and our internal data suggests private payrolls growth of 234k. On the negative front, the labor differential in the conference board survey narrowed significantly, showing a recession-type decline on the month (Chart 4). We forecast job growth of 155k, close to the 3-month average.

The Fed will also keep a close eye on the University of Michigan survey (released on Friday. June 28th after this goes to press), to see whether the drop inflation expectations is confirmed. The China PMI on June 29th will get some attention.

Assuming there are no shock outcomes, a 50bp cut at the July meeting seems unlikely (although the market is pricing 30%+ odds of a double cut). But it will be a close call between a 25bp cut in July or September. It goes back to the push and pull of not “overreacting” and being preemptive on policy. But if the outcomes are more negative – tariffs go into effect for the remainder of Chinese imports, the ISM manufacturing survey slips below 50 and payrolls are under 100k – the Fed will not blink an eye at cutting 50bp and promising more (at which point the recession will be official)

How to avoid a Tantrum

With that said, BofA reminds us that there is an important variable missing from these scenarios: market expectations. As noted above, the bond market is virtually certain that the Fed will cut in July pricing in 32.5bp of cuts (implying a split between a 25 and 50bp cut). It is possible that the data and events over the next few weeks send a decisive message and either confirm or deny market pricing. But if the message is muddled, Fed officials will have to employ “open mouth operations.” This is particularly the case if they want the option of not cutting as quickly.

Of course, in a world in which only the Fed matters, with current pricing a failure to cut would cause a major shock to the markets.

This begs the critical question: is the Powell-Fed willing to push back against markets or are they too worried about a tantrum? As parents know well, when your toddler has a tantrum, there is one golden rule: ignore him and do not reinforce his bad behavior. The louder the toddler yells, the softer you should speak and the more calm you should be. Post-tantrum-once your kid is calm-you gently explain why you couldn’t meet his demands.

But, as Meyer correctly points out, it doesn’t seem that Chair Powell has studied parenting books. Instead this Fed is very concerned about markets behaving badly and, in turn, derailing the recovery. It is therefore possible that the Fed tries to talk the markets back from a cut in July, but if markets react badly to their guidance, they end up delivering the cut.

Which brings us to the final observation of the “Powellful Put” Paradox: how would one rate the Fed as a risk manager?

According to BofA, the Fed is supposed to be a master of risk management with the goal of achieving full employment and price stability. This means that the Fed will be weighing the costs and benefits of every policy decision. How is the Fed thinking about rate cuts:

Benefits:

- The recovery will be extended with growth back above trend as monetary policy successfully offsets the drag from the trade war and fiscal tightening.

- Inflation expectations turn higher on the view that the Fed is going to remain accommodative.

- Realized inflation moves higher as capacity is used and expectations head higher.

Costs:

- Financial market instability as rate cuts further inflate asset bubbles and feeds the “Fed punchbowl.”

- What if using these precious bullets does not yield desired results given the structural forces holding back inflation?

- Easier policy by the Fed “forces” other central banks to also ease. There are limited tools globally.

In a risk management world, if the Fed makes a mistake, they would prefer it to be in the order of cutting too much. The Fed has plenty of tools to tighten policy if they ease too significantly: just recall Bernanke’s “15 Minutes” comment. But if they wait and policy ends up being too tight, the tools are limited to ease. The Fed understands this constraint and it seems to be pushing them into the direction of cutting sooner rather than later.

Which brings us back full circle: the market, just like the petulant toddler named above, knows that the only reason why the market is at all time highs is because the moment its cries, the Fed will cut rates. Of course, the market is also not stupid, and understands very well that the economy is on the verge of, if not already in, a recession, and that the Fed can only ease so far before the fundamental contraction take over, and results in a market crash (the type both Paul Singer and Goldman Sachs are now warning about).

But for now, as the Fed has removed the ability – or need – to act rationally, and will instead feed the toddler until it explodes, everyone continues to buy risk assets despite the clear knowledge that this will all end in disaster, which also explains why investor sentiment, as BofA noted at the very top, has never been more negative.

via ZeroHedge News https://ift.tt/2XfvbOd Tyler Durden