Just over a week ago, by Morgan Stanley, we concluded that if the bank is right, “the world is now in a recession.” As a reminder, last Friday we reported that the Morgan Stanley Business Conditions Index just suffered its biggest one month drop in history.

Predictably, this was sufficient ammo for Morgan Stanley’s doom and gloom equity strategist Michael Wilson to launch on what may be his most bearish tirade so far this year, and as the strategist writes, “data points and analyst sentiment are falling and we think PMIs and earnings revisions are next.” That’s just the beginning:

Decelerations and disappointments are mounting:

- Cass Freight Index

- Retailer earnings

- Durable goods orders

- Capital spending

- PMIs

- May payrolls

- Semiconductor inventories

- Oil demand

- Restaurant performance indices…

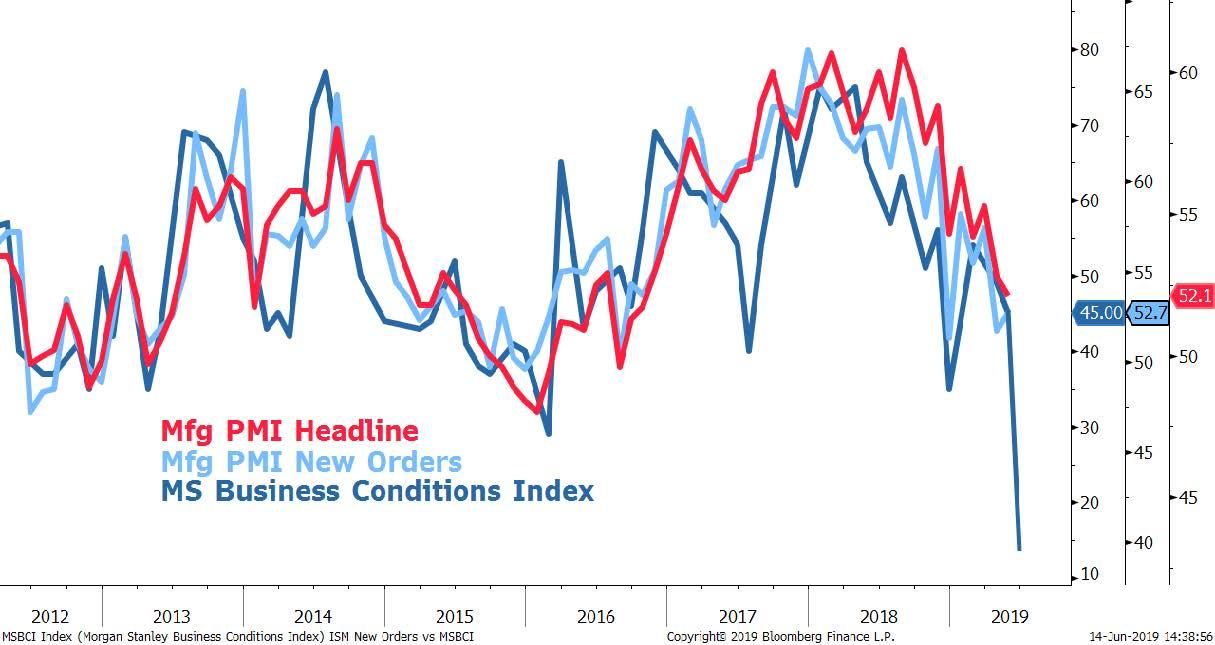

and our own Morgan Stanley Business Conditions Index (MSBCI). Looking at the MSBCI in particular, the headline metric showed the biggest one-month drop in its history going back to 2002 and very close to its lowest absolute reading since December 2008.

This index has a tight relationship with ISM new orders and analyst earnings revisions breadth. Our analysis shows downside risk to ISM new orders (25% y/y), S&P earnings revisions breadth (6-13%) and the S&P 500 y/y (8%) if historical links hold.

While we showed the MS BCI last week, here it is again in the context of PMI Headline and New Orders. As Wilson warns, “be prepared for a sharp fall in PMIs” as the MSBCI suggests the Mfg PMI New Orders component will fall to 40 over the next few months, which would be down approximately 25% on a y/y basis. Another way of putting it – if Morgan Stanley’s indicator is right, the world is already in a recession.

But it’s not just Morgan Stanley’s proprietary indicator that confirms a global contraction has begun.

As The Market Ear points out today, there are two other signals which are pretty much fail safe coincident recessionary indicators:

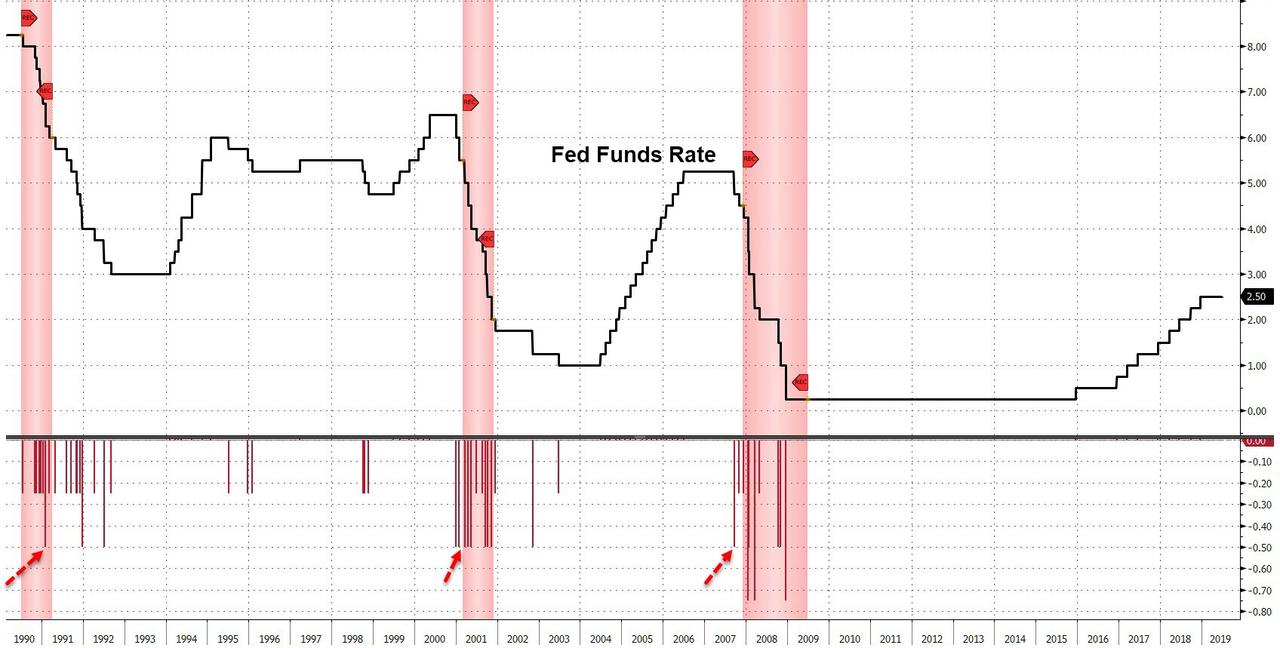

- The Fed has never cut 100bp within a year in an easing cycle outside a recession.

- The Fed has never started an easing cycle with a 50bp cut outside a recession.

These are notable, because as the first chart below shows, 4 rate cuts over the next 12 months are now effectively priced in.

Meanwhile, a 50bps cut, which almost all now expect will be announced in July, is indeed a traditional recessionary indicator.

What is fascinating is that while the bond market clearly agrees, with the 10Y yield back to 2.00%, equities continues to float, and levitate, in a world of their own, confident that Fed rate cuts will be more than sufficient to offset the economic slowdown that a recession will usher in.

Meanwhile, speaking of “surprise” 50 bps rate cuts, and the massive dislocation between the bond and equity markets which has resulted in another record divergence in the market’s “alligator jaws”…

… here is an anecdote from the Global Macro Investor and founder or Real Vision, Raoul Pal, which shows why any trader who correctly times the convergence between stocks and bonds, may just be able to retire afterwards.

From Raoul Pal’s twitter account on “the story of the greatest macro trade I’ve ever seen.”

Back in 2000, the macro backdrop was very similar to now and the forward looking data was suggesting a recession with the bond market was pricing in around 75bps of cuts but sell side analysts would hear none of it. They were sure the good times would continue to roll. But the macro guys, many of whom had been forced to close shop in 1999/2000, knew that the first recession in 10 years was imminent.

On January 3rd 2001, with the US economy still growing at 1.4%, the Fed surprised with a 50bps cut when many people hadn’t even returned back to work from the holidays. But one ex-GS prop trader, now at one of the worlds most famous hedge funds, drove to his half empty office and went limit long December 2001 Eurodollar interest rate futures. His bet was that after a massive equity bull market, a tech bubble, Y2K inventory unwind and over confidence, the economy was likely to be very fragile and the Fed were going to have to massively cut rates.

You see it’s not rocket science. The Fed generally don’t cut once. And Greenspan LOVED low rates. So, though the markets were pricing in 75bps, this trader thought it was massively mispriced. After putting on the maximum position he could, he left the office and flew to his house in Mallorca to continue his vacation and stop himself trading.

His entire bet was one trade only. Nothing else but the Dec 2001 Eurodollar futures. On Jan 31st the Fed cut again, another 50bps. This was a huge shock and the market quickly realised that the Fed were well behind the curve and the full downside of the extended business cycle lay ahead. The hero of our story was now up, what is technically known as a “shit ton” of money. He did nothing, just hung out at his house in Mallorca, where no brokers or other traders could talk him out of his massive conviction.

The Fed continued to cut and the economy began to tank as rates were in free fall. By June he was a few hundred basis points on side and with the stunning leverage offered by Eurodollars, his positions was ENORMOUS and he was now up “large” (technically more than a shit ton). But over-positioning, & government and Fed jawboning caused a rather large correction (around 70bps if my memory serves me correctly). His boss, one of the most famous risk takers in history, flew to London and asked the trader to join him at office to talk about his trade. They met at their offices outside London and big boss explained that the trade had been amazing but he’d given a lot back therefore did he want to take profit or not. The trader, without blinking, said, I’d like to double up!

Big boss could tell the trader was in the groove, and increased his limits, in one of the best risk management calls I’ve ever seen. Our hero doubled his position flew back to Mallorca. So, by June, he had only traded twice; once to enter the trade and once to double it.

In November, the trader flew back to London, closed his position for an absolutely enormous profit and basically retired from the payout. Now, that is how to trade macro. When a set up is so perfect and so clear, you get one shot at the prize – The fabled “Career” trade. Another example would be Richard Rainwater’s enormous long trade in oil in 1999 from the $11 low. The perfect set up. The billion dollar trade. Soros had it in Sterling and PTJ in 1987 and 1990 (Japan).

What was so good about the Eurodollar trade is the trader understood that the Fed couldn’t cut once, or too little, or a bigger panic would ensue (I.e the Fed’s put isn’t it enough). Also, unlike equities or commodities, Eurodollars are relatively predictable if you know where rates are likely to head, as they are anchored to Fed funds, in essence ( unlike bonds too, I guess). Thus, it perfectly expressed the view.

I strongly believe we have the near exact same set up now, with the added kicker that if the dollar goes up, there is a gigantic tailwind to the trade, making it an extremely skewed risk reward. Maybe one of the best I’ve ever seen. This set up has been in place for 9 months now and is why I’m very long Eurodollar interest rate futures. Options were ultra cheap and the dollar hasn’t yet made its move. Vol is too low compared to the potential upside in these as we head to negative rates, if the dollar squeezes higher. This makes an asymmetric trade crazily asymmetric.

What’s even better is that at the start of Q4 2018, the market was record short Eurodollars, skewing it even further in its asymmetry. But, all the action so far has preceded the first Fed cut. When the cuts start the odds are that they will be bigger and faster than expected and the real juice on the trade is still to be had, just like in 2001 because rates will go negative and then they will force the long end down to zero. Maybe the greatest trade in the world is still to be made. This is why I love macro. Also, remember, before you @ me, time horizon matters. Mine is long as that where I think my edge is.

So for all those who – like Pal – believe that the tag team of Powell and Trump will send rates negative to deflect the now inevitable recession, unleashing the infamous Albert Edwards “ice age”, the “trade of a lifetime” is not to short stocks, which may just as easily keep rising if the Fed has decided to debase the dollar (see Weimar, Zimbabwe, Venezuela), but to simply go long ED futs and just wait for that retirement check to be cashed… or perhaps not cashed as at that time any cash deposits will likely result in an interest payment to the bank.

via ZeroHedge News https://ift.tt/2Nlk55Z Tyler Durden