Authored by Taiki Murai and Gunther Schnabl via The Mises Institute,

The European Central Bank’s recent move away from the exit from ultra-loose monetary policy has revived the debate on Europe’s potential “Japanification.”

The Japanese scenario is gloomy. Since the bursting of the Japanese bubble in the early 1990s, growth has been stagnating, wage levels have been falling, and an increasing number of people has been forced into precarious employment. The so-called Abenomics, an immense Keynesian spending program financed by the central bank, has failed so far to jumpstart the ailing economy. Instead, statistics are interpreted and designed creatively.

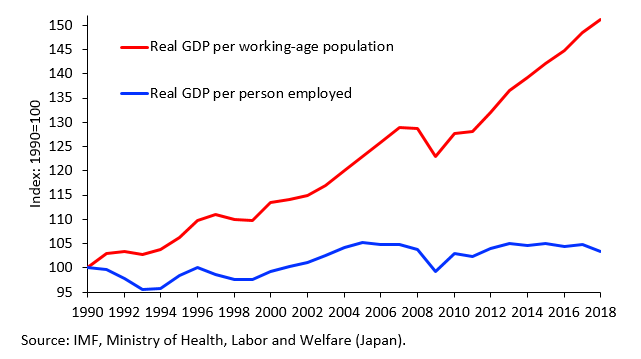

Fig. 1: GDP Per Capita Based on Working Age Population and Employed

Paul Krugman (2014) has argued that the development of real GDP per capita in Japan since the early 1990s hardly differs from those in the US and the euro area. He came to this result by using working-age population as a denominator for the calculation of GDP per capita. In Japan, due to low birth rates and low immigration, the number of people between 15 and 64 is declining rapidly. Therefore, the real GDP per working-age population (i.e., between 15 and 64) has increased significantly (Fig. 1). Many commentators now follow this calculation method, thereby putting Japanese economic policy in a good light. However, Japan’s three lost decades have forced particularly women and pensioners to enter or to remain in the labor market to maintain the standard of living for themselves and their families. The upshot is that GDP per person employed has stagnated since 1990 (Fig. 1), pointing to low productivity growth. Yet, productivity gains are the prerequisite for real wage increases.

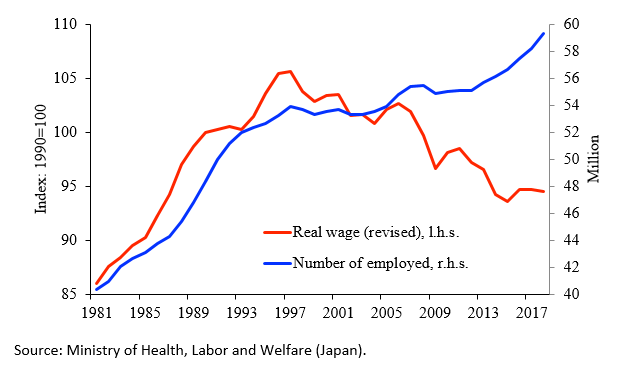

Fig. 2: Real Wage Level and the Number of Employed in Japan

More recently, a dispute has raged over the Japanese real wage development. The issue drew nationwide attention because the real wage level has been trending downward since the 1998 Japanese financial crisis (Fig. 2). In 2004, the Ministry of Health, Labor and Welfare had removed two thirds of large enterprises in Tokyo from the labor market statistics. Because the wage level is higher in Tokyo than in other parts of the country, the statistically measured real wage level declined substantially. As a positive side effect, the Japanese government saved social security expenditures which are paid to those, who have a personal income significantly below the average wage.

This statistical distortion, which was in conflict with Japan’s legal provisions for statistics, was secretly corrected in 2018. This caused a substantial rise of the real wage level, by 0.6%. Prime Minister Shinzo Abe could praise the real wage increases as proof for the success of his Abenomics (Prime Minister of Japan and His Cabinet 2018). An impressive recovery of the Japanese economy was reported worldwide (see, e.g., Reuters 2018). But when a member of the ministry’s staff accidentally revealed the reasons, the Japanese opposition launched a controversial debate on the credibility of Japanese statistics. Finally, the Ministry of Health, Labor and Welfare corrected the real wage increase for 2018 downward to 0.2%, while the opposition sees real wages still falling by -0.5%.

To contain the damage to the reputation of Japan’s government, Prime Minister Abe has announced that the unpaid social benefits of around half a billion dollars will be compensated. Yet, the reputation of the Japanese statistical offices and the formerly highly respected ministerial administration has suffered. Fumio Hayashi, president of the influential Japanese Economic Association (2019), expressed in an open letter to the government concerns that the country’s academic credibility is damaged. He offered support from highly renowned academics.

Whether this will help, remains questionable. Creative design of statistics cannot solve the persistent crisis. The core of the problem lies in a misguided economic policy that zombifies the Japanese economy and thus undermines prosperity. Instead, sound public finances and a stability-oriented monetary policy should strengthen Japan’s growth dynamics. That way, the country could become a positive role model for the member states of the European Monetary Union and the European Central Bank.

via ZeroHedge News https://ift.tt/2YobrV8 Tyler Durden