Even though unemployment has hit a 49 year low, more than half of Americans are lying awake at night worrying about money, according to MarketWatch.

But we thought jobs were everything?

Instead, a recent report from the Board of Governors of the Federal Reserve System concludes many people are living with wildly fluctuating incomes. In addition, consumer confidence fell to a two-year low in June.

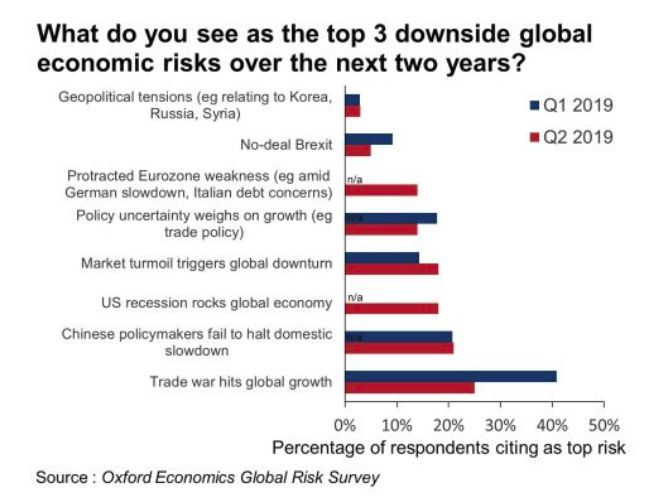

Lynn Franco, senior director at the Conference Board, said: “The escalation in trade and tariff tensions earlier this month appears to have shaken consumers’ confidence. Continued uncertainty could “diminish” people’s confidence in the economic expansion.”

Lynn Reaser, chief economist of the Controller’s Council of Economic Advisors said: “A major trade war between the U.S. and China represents our greatest economic risk.”

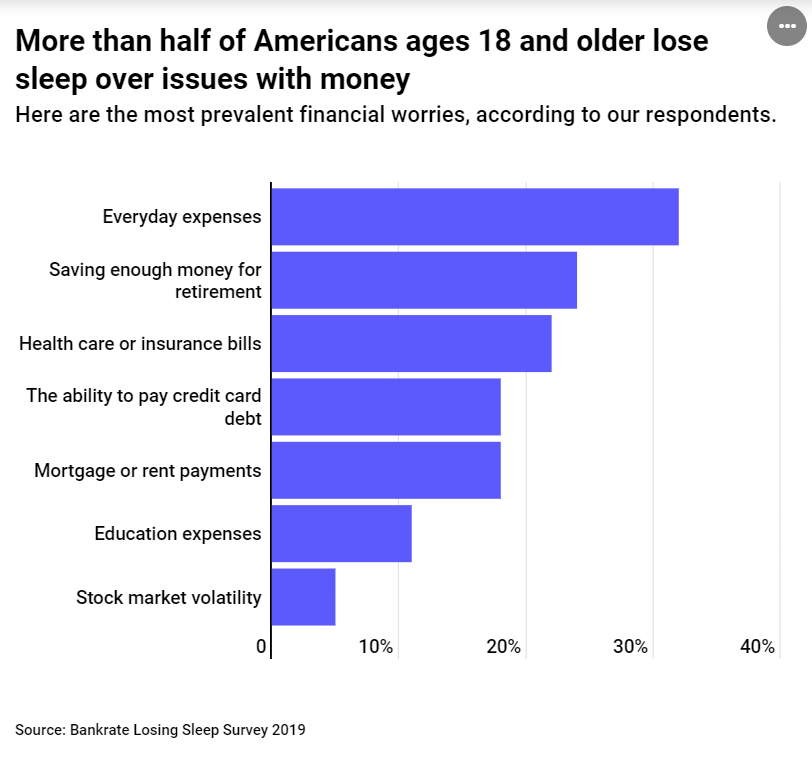

And the worries are starting to pile up. According to a Bankrate survey of 2,500 people:

-

78% of adults are losing sleep over work, relationships, retirement and other worries

-

Over half (56%) of Americans are lying awake at night worrying about money.

-

The key worries are retirement (24%), health care and/or insurance bills (22%), the ability to pay credit-card debt (18%), mortgage/rent payments (18%), educational expenses (11% versus 26%) and stock-market volatility (5%)

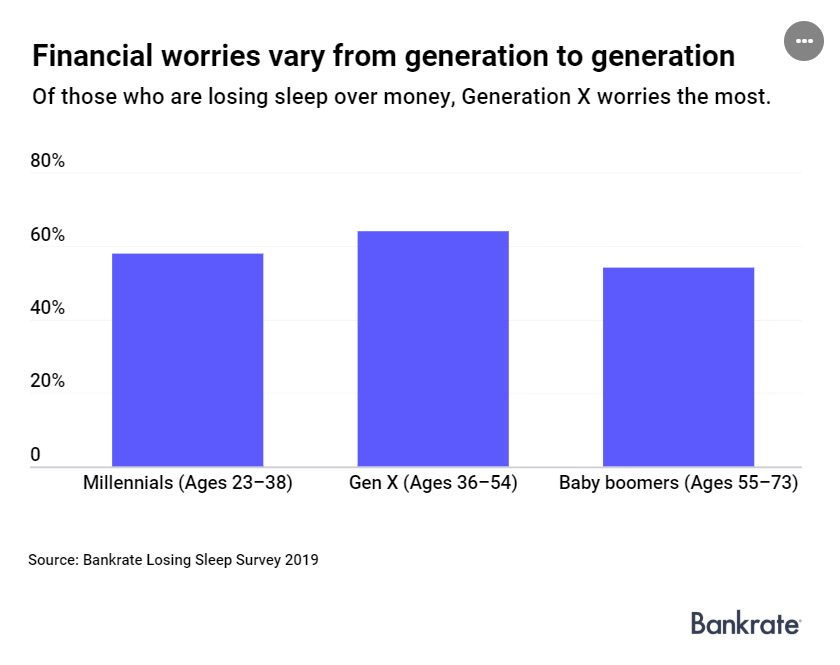

In addition, 40% of people in a separate poll by that site say they feel the next recession has already begun or will begin within the next 12 months. 45% of U.S. workers have a second job to make ends meet and middle aged workers are feeling the pressure too, including 48% of millennials, 39% of Generation Xers and 28% baby boomers.

Many believe a recession to be an inevitability at this point. Oxford Economics predicts that fallout from the next recession could trigger a 30% drop in the S&P 500.

Jesse Colombo, analyst at Clarity Financial said: “Virtually everyone is underestimating the tremendous economic risks that have built up globally during the past decade of extremely stimulative monetary policies.”

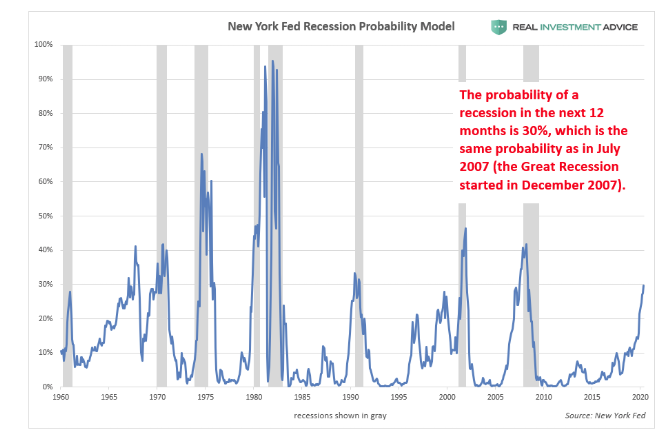

According to the NY Fed’s Yield Curve based model, there remains a 27% probability of a U.S. recession in the next 12 months.

“The last time that recession odds were the same as they are now was in early 2007, which was shortly before the Great Recession officially started in December 2007,” Colombo continued. He sees a 64% likelihood of a recession within the next year.

Colombo continued: “The New York Fed’s recession probability model has underestimated the probability of recessions in the past three decades because it is skewed by the anomalous recessions of the early 1980s. That model was skewed by a then-Federal Reserve Chairman Paul Volcker’s unusually aggressive interest rate hikes that were meant to ‘break the back of inflation.’ Looking at the New York Fed’s recession probability model data after 1985 gives more accurate estimates of recession probabilities in the past three decades.”

The bubbles that Colombo is now watching? Global debt, China, Hong Kong, Singapore, the art market, U.S. stocks, U.S. household wealth, corporate debt, leveraged loans, U.S. student loans, U.S. auto loans, tech startups, global skyscraper construction, U.S. commercial real estate and – stop us if you’ve heard this one before – U.S. housing.

via ZeroHedge News https://ift.tt/2ZV6ELf Tyler Durden