Global bonds retreated on Monday (although losses were pared) as the U.S. and China agreed to restart trade talks, leading investors to pare wagers on aggressive policy easing by the major central banks.

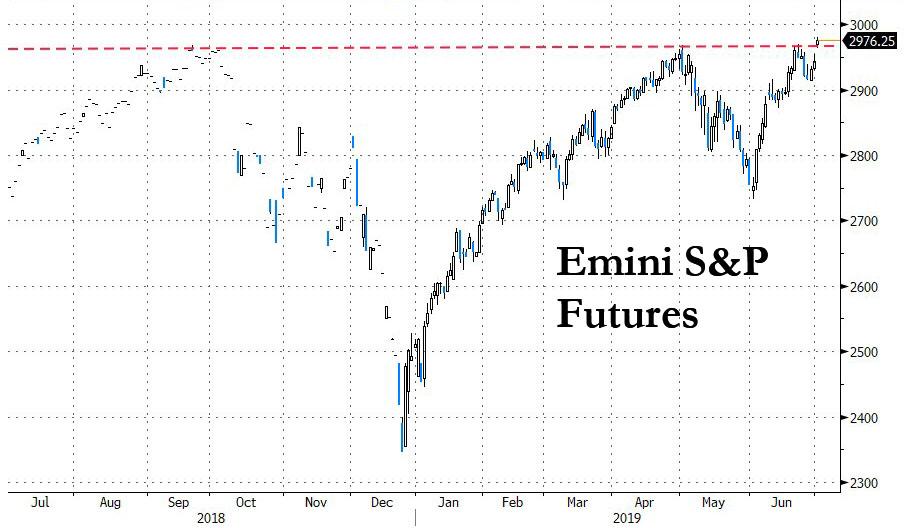

That, however, did not prevent stocks from surging out of the gate, with S&P futures set to open at new all time highs just 20 or so point below 3,000 even though as Bloomberg points out, the outcome of the G-20, or rather G-2, meeting was just as consensus expected.

Stocks are jumping even as none of the market Gremlins have left, with Hong Kong protests turning violent again on Monday (incidentally, there was zero mention of China’s growing pains in Hong Kong, just as Beijing wanted),while global PMI continued plumbing new cycle lows, and after both Chinese manufacturing surveys missed expectations, printing in contraction just below 50…

… the picture turned even uglier in Europe, where the UK PMI missed expectations, sliding to a three year low of 48, while Spain’s mfg PMI printed in contraction, or 47.9, for the first time in five and a half years.

Surveys from Japan and South Korea showed similar slowdowns as did the 19-country euro zone’s reading which contracted for fifth month running and at a faster pace than previously thought.

“Euro zone manufacturing remained stuck firmly in a steep downturn in June, continuing to contract at one of the steepest rates seen for over six years,” said Chris Williamson, chief business economist at IHS Markit. “The disappointing survey rounds off a second quarter in which the average PMI reading was the lowest since the opening months of 2013.”

None of this had an impact on stocks, however, with European markets rising over 1%, chasing the outperformance in Asia, as US equity futures ramped higher, even as the dollar firmed across the board, as traders reined in bets for a half-point rate cut from the U.S. Federal Reserve this month. And yet, the Fed’s dovishness which was responsible for the market’s gain in June (as a reminder PE multiple expansion accounted for 90% of the June surge), is being widely ignored on Monday, with the market’s attention focused on the G-20 outcome instead, where as we noted overnight (and this morning), nothing has been resolved.

To be sure, trader sentiment about the outcome was mixed: “It (Trump-Xi G20 meeting) played as well as possible,” said SEB Investment Management’s global head of asset allocation Hans Peterson. “So It gives us time to digest and get a bit better activity in the global economy.”

On the other hand, Bloomberg’s Cameron Crise was more skeptical, noting that “a truce is a long way from a deal, and it may be worth recalling that the sharp rally after the previous G-20 meeting between Trump and Xi lasted a mere 24 hours, albeit under a somewhat different backdrop. While there’s no guarantee that the rally fades by the end of the day, therefore, it wouldn’t come as a surprise to see a little late-session selling once the euphoria starts to cool off.”

For now, however, risk is certainly higher, with Europe’s STOXX 600 and Japan’s Nikkei climbed 1% and 2.1% respectively to hit two-month tops and MSCI’s global index added 0.2% having only just missed out on its best first half to a year.

In Asia, Chinese blue chips jumped 2.6% to their highest since late April, Germany’s export-heavy DAX sprang 1.5% to its highest since August, Wall Street futures were up over 1% while the combination of the Huawei hiatus and M&A activity hoisted Europe’s the tech sector to a one-year high.

In the US, E-Mini futures for the S&P and Nasdaq rose 1.1% and 1.7%, with the former breaking out above resistance, and just whispers away from 3,000 whereas in the bond market Treasury futures slid 10 ticks as yields on 10-year notes edged up 4 basis points to 2.04%.

Ironically, the S&P may hit 3,000 on the day the ISM dips below 50 (expectations for the Mfg ISM is for a 51.0 print).

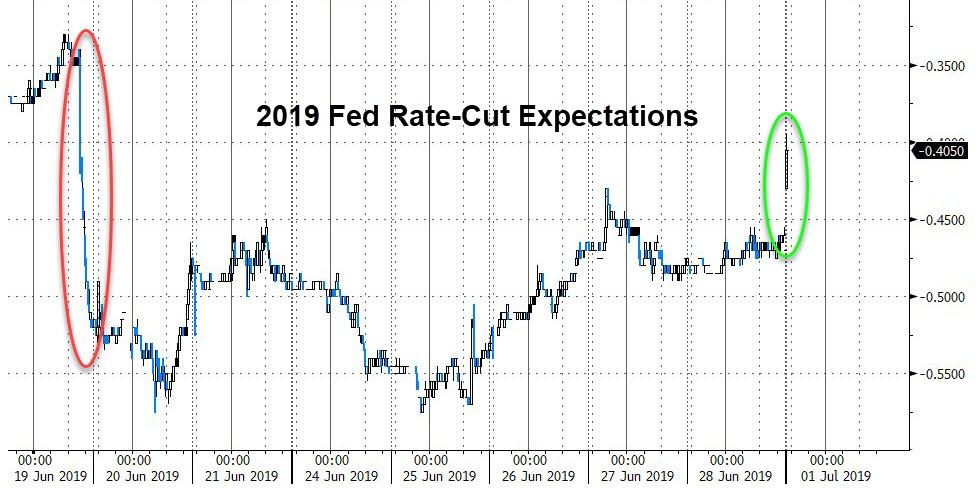

As noted last night, Fed funds dropped over 5 ticks as the market scaled back the probability of a half-point rate cut this month to around 15%, from nearer 50% a week ago. “I think the Fed expectations in the market are very aggressive. Possibly a bit too aggressive,” SEB’s Peterson added.

The reaction in currency markets was to strip some recent gains from safe harbors like the yen and Swiss franc. The dollar crept up 0.4% on the yen to 108.26 and 0.7% on the franc to 0.9830. The dollar strengthened versus all its Group-of-10 peers, while haven currencies weakened. Weaker-than-forecast manufacturing PMIs from the euro zone weighed on the euro and capped losses in the region’s bonds. The pound slipped following disappointing U.K. manufacturing data and before Conservative leadership contender Jeremy Hunt is expected to detail contingency plans for a hard Brexit

In commodities, oil prices sprang higher on news OPEC and its allies look set to extend supply cuts at least until the end of 2019 as Iraq joined top producers Saudi Arabia and Russia in endorsing the policy. Brent crude futures rose $1.85 or 2.8% to $66.40, while U.S. crude gained $1.84 or 2.75% to $59.90 a barrel.

Expected data include manufacturing PMIs. No major company is scheduled to report earnings

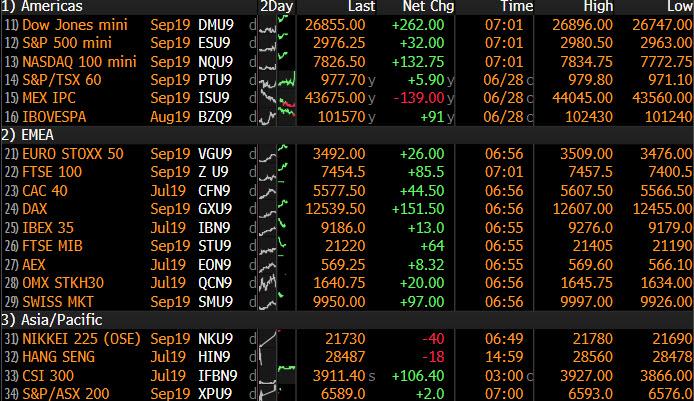

Market Snapshot

- S&P 500 futures up 1.1% to 2,976.25

- STOXX Europe 600 up 0.7% to 387.73

- MXAP up 0.8% to 161.38

- MXAPJ up 0.4% to 529.96

- Nikkei up 2.1% to 21,729.97

- Topix up 2.2% to 1,584.85

- Hang Seng Index down 0.3% to 28,542.62

- Shanghai Composite up 2.2% to 3,044.90

- Sensex up 0.8% to 39,716.91

- Australia S&P/ASX 200 up 0.4% to 6,648.10

- Kospi down 0.04% to 2,129.74

- German 10Y yield unchanged at -0.326%

- Euro down 0.4% to $1.1331

- Italian 10Y yield fell 3.2 bps to 1.74%

- Spanish 10Y yield fell 1.3 bps to 0.382%

- Brent futures up 2.8% to $66.53/bbl

- Gold spot down 1.5% to $1,388.10

- U.S. Dollar Index up 0.4% to 96.51

Top Overnight News

- President Donald Trump declared the U.S. was “winning” the trade war a day after reaching a temporary truce with Chinese President Xi Jinping. Gauges of activity in China’s manufacturing sector showed the economy remains fragile, underlining the need for the truce with the U.S. forged at the weekend to be a lasting one

- Manufacturers in the euro area remained firmly stuck in a slump last month as new orders slid and business confidence remained subdued

- Tension returned to Hong Kong’s streets Monday as protesters attempted to break into the city’s legislature and thousands more began marching in opposition to the city’s China- backed government

- Sentiment among Japan’s large manufacturers deteriorated to the lowest level in almost three years amid trade tensions that are adding to uncertainties for the economic outlook

- Jeremy Hunt and Boris Johnson, the candidates competing to become U.K. prime minister, reiterated their willingness to take the nation out of the European Union without a deal if necessary, as both insisted they have the fiscal space to fund their spending plans

- The ECB presidency won’t be decided at the EU summit in Brussels, a high-ranking German official said, who declined to be identified because the matter is confidential. That decision will be postponed until September in an attempt to move it away from the highly political nominations for the commission and council presidencies

- Oil raced higher after Russian President Vladimir Putin struck a deal with Saudi Crown Prince Mohammed Bin Salman at the G-20 to extend output cuts for the rest of this year and potentially into early 2020, while the U.S. and China called a temporary truce in the trade war

- Factory sentiment across Asia became even more frigid in June, signaling a worsening in the region’s growth outlook as U.S.-China trade tensions continue to simmer

- The European Central Bank could be headed for its first-ever female president as European Union leaders haggle over top policy positions

Asian equity markets began H2 with gains across the board as global sentiment was buoyed following the US-China trade truce at the G20, while President Trump also met with North Korea leader Kim at the Demilitarized Zone and became the first sitting US President to step into North Korean territory. ASX 200 (+0.4%) was lifted by the trade sensitive sectors, as well as energy names after oil prices were buoyed by news of a Russia and Saudi agreement regarding the output cut deal. Advances in Nikkei 225 (+2.2%) were exacerbated by favourable currency moves and the KOSPI (U/C) was subdued by domestic tech weakness amid a dispute with Japan related to wartime forced labour in which the latter is to restrict chip material exports to South Korea. Elsewhere, the Shanghai Comp. (+2.2%) was buoyed by the US-China trade truce and after comments from President Trump which raised hopes of a potential U-turn on Huawei. This underpinned tech and telecom stocks with mainland Chinese markets the regional outperformers despite the miss in Chinese Manufacturing PMI data and absence of Hong Kong participants for holiday. Finally, 10yr JGBs were lower as they mirrored the slump seen in T-notes and heavy losses across safe-havens, while the BoJ also recently announced its bond buying intentions last week in which it reduced the amounts of JGBs with 3yr-5yr and 10yr-25yr maturities.

Top Asian News

- Applied Materials Said to Buy Kokusai Electric From KKR

- Turkish Assets Rally After Trump Seen Softening Sanctions Threat

- Iron Ore Tests $120 as Australia Lays Bare Global Market Squeeze

- Dubai’s DP World Acquires Topaz Energy in $1.1b Deal

Major European bourses are posting gains this morning [Euro Stoxx 50 +0.9%] as the positive sentiment generated by the US and China temporary trade truce rolls over from the Asia-Pac session. Sectors are mixed, though predominantly in the green, outperformance is seen in Energy names which are also bolstered by the broader complex; in terms of the laggards, the defensive sectors, i.e. utility and consumer staples sectors are in negative territory. Towards the top of the Stoxx 600 are a number of semiconductors for example, STMicroelectronics (+5.5%), Dialog Semiconductor (+4.4%) and ASML (+3.3%) on the aforementioned US-China updates; however, also of note for chip names is that Japan are to restrict chip material exports to South Korea amidst a dispute concerning the countries ruling on wartime forced labour. Other notable movers include, ArcelorMittal (+3.0%) after the Co. has completed the sale of several steel-making assets to Liberty House Global for EUR 740mln. At the other end of the spectrum is Ericsson (-0.5%), who opened lower by around 1.5% as US President Trump commented that the US is to ease restriction on Huawei; as previously the likes of Huawei and Nokia have benefited from the Huawei restrictions.

Top European News

- ECB May Cut Rates by 20bps, Restart QE in September: Goldman

- Generali Is Said to Lead Bidding for Apollo’s Tranquilidade

- LafargeHolcim Is Said to Join Race for BASF Mortars Unit

- Germany’s DAX Set to Enter Bull Market as Trade Clouds Clear

In currencies, the Franc has slumped across the board and only in part on a loss of safe-haven demand after the US-China trade truce forged on Saturday, as Swiss retail sales and manufacturing PMI both misses consensus by considerable margins, and the SMI kicks off H2 on its own after the EU severed links with the Swiss bourse. Usd/Chf is back up near 0.9850 and Eur/Chf has rebounded further above 1.1100 to just over 1.1150 vs recent lows of sub-1.1000 and circa 1.1055 respectively.

- GBP – Sterling has also succumbed to all round selling in wake of the latest UK manufacturing PMI that was weaker than forecast and deeper in contraction territory, while output fell sharply from 50.3 to 47.2 and the worst level since October 2012. Cable recoiled from around 1.2707 at best through 1.2665-63 support that held several times in late June before breaching 1.2650 and a 1.2646 Fib on its way to a 1.2635 base, while Eur/Gbp has jumped towards 0.8970 from close to 0.8925 at one stage even though the single currency was pressured by disappointing Eurozone manufacturing PMIs as well.

- JPY/AUD/EUR – The Yen has succumbed to the broad post-G20 recovery in risk sentiment, but not to the same extent as the Franc noted above, with 108.50 vs the Greenback tested and marginally topped before a relatively deep pull-back towards 108.25. A decent 1 bn option expiry may have capped the headline pair, while the DXY also faded after edging above 96.600 and a lack of follow-through buying to test near term resistance at 96.711 (June 21 peak). However, the Aussie remains on the backfoot just under 0.7000 ahead of Tuesday’s RBA policy meeting with a firm majority anticipating back-to-back 25 bp rate cuts, and the Euro is holding near the bottom of a hefty expiry zone from 1.1320 to 1.1335 (1.6 bn) having lost grip of the 200 DMA (a few pips below 1.1350) in the run up to the aforementioned poor PMIs and then breaching the 10 DMA (at 1.1328) to a 1.1315 low.

- CAD/NZD/SEK/NOK – The Loonie and Kiwi are both down vs their US counterpart, but holding up better than most major rivals, bar the Scandi Crowns, with Usd/Cad only just above 1.3100 and Nzd/Usd hovering close to 0.6700. A firm rebound in oil prices is impacting, and also boosting the Nok (through 9.7000 vs the Eur), while the Kiwi is eyeing the impending NZIER Q2 survey for independent impetus. Note, Eur/Sek is back below 10.5500 in response to a rare manufacturing PMI beat from Sweden that will likely keep the Riksbank in hawkish mood on Wednesday.

- EM – The Lira has extended gains made on the back of a relatively cordial meeting between Turkish President Erdogan and his US peer Trump on the G20 sidelines that assuaged concerns about sanctions over Russia’s imminent S-400 delivery with additional momentum coming in the form of a less contractionary manufacturing PMI. Usd/Try reversed from 5.7910 to 5.6735 in response before settling around 5.6950.

In commodities, WTI (+2.7%) and Brent (+2.7%) have started the week firmly on the front foot, with WTI having breached the USD 60/bbl level to the upside. Gains in the oil complex are stemming from a sentiment-driven gains (from constructive US-China G20 and North Korea outcomes) alongside an agreement between Russia and Saudi Arabia to extend the OPEC+ deal. The leaders discussed an extension of six to nine months at the level it is currently at (1.2mln BPD), with Russian Energy Minister Novak stating that the extension is a consolidated agreement and other countries are in favour of such an extension. Novak’s comments, and Russia agreeing to extend the OPEC+ deal, have removed a uncertainty from the discussion surrounding the deals future; as until these comments it was not known precisely what Russia’s position around an extension was and whether or not they would support one. In terms of scheduling for today we have both the JMMC and the OPEC meeting, with the closed session of the JMMC having commenced as of 10:00BST, and OPEC’s opening session is due to begin at 13:00BST, closed session at 14:00BST and a presser at 16:00BST, where we may get further insight into the OPEC+ extension; though an official decision will not be released until the presser following tomorrows OPEC+ meeting at 12:00BST. Note, the timing of the various sessions for JMMC, OPEC & OPEC+ is at best an indicative guide only.

Elsewhere, Gold (-1.3%) is suffering due to a firmer USD and a safe-haven unwind, as are other havens including JPY and CHF, with the yellow metal giving up the USD 1400/oz handle after this weekend’s positive trade/geopolitical developments; having printed a session low of USD 1381/oz after the metals largest intraday fall for a year. In contrast, the trade truce has supported copper prices which are just shy of the 6-week high posted earlier in the session at USD 2.72/lb. Finally, iron ore prices have rallied in excess of 4.0%, supported by the overall risk sentiment and underpinned by supply woes.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 50.1, prior 50.1

- 10am: ISM Manufacturing, est. 51, prior 52.1; ISM Employment, prior 53.7; ISM New Orders, est. 52.5, prior 52.7

- 10am: Construction Spending MoM, est. 0.0%, prior 0.0%

DB’s Jim Reid concludes the overnight wrap

Welcome to July and a very happy 10th birthday to this economic expansion. Today takes us into unchartered territory in the US with this upswing now being the longest on record of all the 34 back to the 1850s. A reminder that we published a note a couple of weeks ago looking at the long cycle world we’ve been in since the 1980s and how it’s only been possible due to a massive global levering up, unparalleled money printing, and likely lower productivity. See the link here .

Before we get to a big weekend for news, Craig has published the latest performance review for H1, Q2 and June. June saw all 38 of our non-FX assets in our survey higher – only the second time in 150 months since we started collating the data in 2007 with January this year being the other. Indeed for H1 2019, 37 out of 38 assets were higher – the highest H1 ratio over the same period. See the full report here .

It feels that the weekend saw positive progress on a lot of things. A US/China trade truce, a constructive surprise Trump meeting with Kim Jong Un, positivity over US/Turkey relations, a Russian/Saudi OPEC+ agreement on extending cuts (official OPEC/OPEC+ meetings today/tomorrow), and in the background the EU and Mercosur (South American trading block) brokered a trade deal after 20 years of negotiating. That timespan is something to consider when thinking about Brexit! On the flip side China’s manufacturing PMI stayed at 49.4 – a tenth below expectations with new export orders edging down 0.2pts to 46.3, the weakest since February. The non-manufacturing PMI slipped a tenth to 54.2 (54.3 expected) bringing the composite to 53.0 (vs. 53.3 expected). China’s Caixin manufacturing PMI also printed this morning at 49.4 (vs. 50.1 expected and 50.2 last month), the weakest since January, with both the new orders and new export orders components falling into contractionary territory, after rising in May.

The main G-20 summit was a sideshow really and the released communique was unanimous only by being bland and not committing anyone to anything. Disagreements on trade and climate change continue. As for the main event, although expectations were building ahead of the Trump/Xi meeting, on balance they exceeded them even if it still feels like a fragile equilibrium. At the moment I’m relieved we went back to being more constructive on credit a couple of weeks ago as news of this meeting broke at the same time as Draghi’s very dovish Sintra speech. The two most positive things from the weekend were that President Trump won’t put the additional tariffs on China for the “time being” and that he softened his stance on Huawei. He will allow US companies to sell some equipment to Huawei, as long as it was “no great national security problem”. At the moment there is no clarity on whether this means Huawei will be taken off the ‘entity list’ of the US Commerce Department, but Trump has promised to discuss this soon and suggested they’ll leave this controversial issue to the end of trade negotiations which is likely to be seen as a positive as its now not standing in the way of an outline deal. However, Trump’s decision to grant Huawei some temporary relief has drawn criticism back home with Senator Marco Rubio tweeting “If President Trump has agreed to reverse recent sanctions against #Huawei he has made a catastrophic mistake.”

Trump also said Xi promised that China will buy “tremendous” amounts of US agricultural products, and that the US will “give them a list of things” they would like China to buy. However, Chinese official media reports are not as clear on this and suggested only that Trump hopes China will import more American goods as part of the trade-war truce. Meanwhile, there has been no official communication from China. So whether China sees things the same way is not clear, but on balance it seems a more positive backdrop for talks to continue even if there is not currently any roadmap. Elsewhere, Trump continued his criticism of the Fed over the weekend saying the Federal Reserve “has not been of help to us at all” in his trade spat with Beijing and added “Despite that, we’re winning, and we’re winning big because we have created an economy that is second to none”.

Meanwhile, in an interview on Fox News, Larry Kudlow, the White House National Economic Council director, said that Mr Trump isn’t offering a “general amnesty” to Huawei Technologies as part of an agreement to restart trade talks while adding that there are no firm promises and no timetable for completion of a potential sweeping trade agreement, and that China still needs to address the issues that the U.S. has said caused the discussions to fall apart in early May. He repeated that the U.S. and China are 90% done on a trade deal but the final 10% will be the hardest.

Asian markets have started the week on a firm footing buoyed by the trade war truce. Chinese markets are leading the advances with the CSI (+2.47%), Shanghai Comp (+1.88%) and Shenzhen Comp (+2.93%) all up along with the Nikkei (+1.91%). The Kospi (-0.06%) is trading down on news that Japan plans to slap export restrictions on some tech items sent to South Korea, a sign of escalating tension between the pair over recent compensation claims for Korean workers dating back from the colonial period. Samsung electronics is down -1.17% on the news. Meanwhile safe haven assets are trading down this morning with the Japanese yen trading weak (-0.39%) and gold prices down -1.19%, the largest drop since March this year. The Chinese onshore yuan is up +0.49% this morning to 6.8332 while the Turkish Lira is up +1.03%. Elsewhere, futures on the S&P 500 are +0.87% with WTI oil prices +2.38% on the likely extension of output cuts. US treasury yields are around 2-3bps higher across the curve. Markets in Hong Kong are closed for a holiday.

Yesterday also saw an EU leaders summit to discuss the important top jobs about to need filling. They have so far failed to agree on candidates with talks getting dragged into a second day. Meanwhile, here in the UK, the Telegraph has reported that in a speech today, Conservative Leadership Candidate Jeremy Hunt will announce plans for a £20 bn “war chest” for a no deal Brexit which would see dramatic tax cuts designed to turbo-charge the economy. Under the plan, Hunt would set aside £6 bn to help farmers and fishermen and spend £13bn cutting corporation tax from 19% to 12.5% to help businesses amongst other measures. So in addition to Mr Johnson’s plans, a no-deal Brexit will likely unleash a huge fiscal spending spree in the UK – another show to drop in the global fiscal movement. Staying with the UK, yesterday Nigel Farage’s Brexit Party announced that it was ready to fight a general election as it unveiled 100 people it said would be candidates.

As for this week, US Independence Day on Thursday will break up the week and activity with US bond and equity markets closing at half time Wednesday and all of Thursday. However we do have some important data including the remainder of today’s global manufacturing PMIs/US ISM, Wednesday’s services equivalent, and Friday’s US employment report which will be important as evidence starts to slowly build of a softening of the strong US labour market. Consensus is at +158k vs +78k last month. The weekend truce will take the edge of any weak numbers in today’s PMIs with hopes that business confidence can slowly start to rebuild again with the caveat that the truce could break at any time. The rest of the week ahead is at the end today.

In advance of the G-20, equity markets ended last week on a positive foot but mixed overall on the week. The S&P 500 ended the five days -0.32% lower (+0.55% on Friday) while the Stoxx 600 was close to flat at +0.03% (+0.70% Friday). On both sides of the Atlantic, financials outperformed, with US and European bank shares up +2.22% and +1.79% (+2.37% and +0.75% Friday) respectively. The moves mostly came after all major banks passed the Fed’s stress tests on Thursday night. US tech firms had more muted price action, with the NASDAQ down -0.32% (+0.48% Friday) and the NYFANG index +0.54% (+0.18% Friday). The DOW lagged slightly trading down -0.45% (+0.28% Friday), as its largest member Boeing dropped (-2.09% on the week and flat on Friday) on new revelations about safety issues with its 737 Max plane. In Europe, performance was a bit bifurcated, with the DAX outperforming +0.48% (+1.04% Friday) while Italy’s FTSE MIB and Spain’s IBEX lagged, down -0.72% and -0.31% (+0.59% and +0.56% Friday) respectively.

The rally in fixed income markets continued relentlessly, with 10-year treasury yields down -4.9bps on the week (-0.9ps Friday). That marks the 8th consecutive weekly rally, the longest streak since 2012. Two-year yields fell less sharply, dropping -1.7bps (+0.6bps Friday), which caused the curve to flatten -3.0bps (-1.3bps Friday). Similar dynamics were at play in Europe, where bunds and schatz rallied -4.2bps and -1.3bps (-0.7bps and -1.4bps Friday), respectively. Action in currency markets was relatively muted, with the dollar index trading listlessly to end the week flat. EM currencies fell -0.30% (+0.06% Friday), though there was heterogeneity within the asset class, e.g. the Brazilian real fell -0.56% (-0.61% Friday), but the South African rand appreciated +1.77% (+0.59%).

via ZeroHedge News https://ift.tt/2ZZIeAm Tyler Durden