The much anticipated G-20 summit, which culminated in the latest trade truce between the US and China, has come and gone, and while the outcome was as largely expected, it will still push US equities to new all time highs just shy of 3,000.

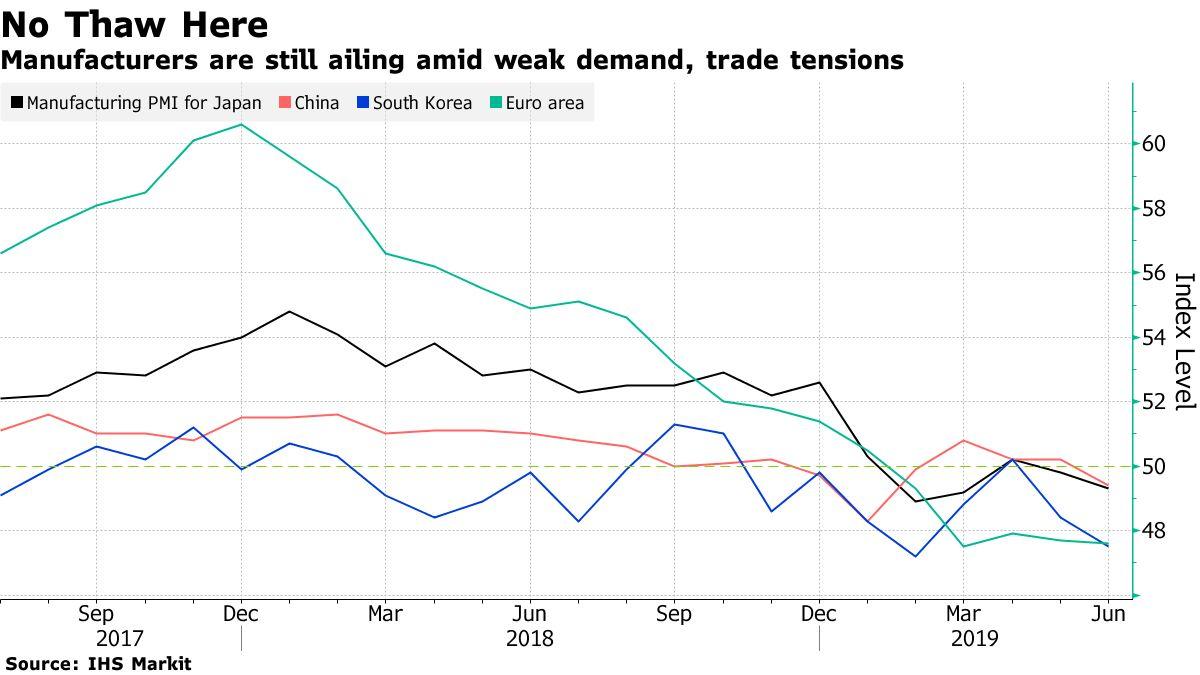

And with the US set for a holiday shortened week, the outcome of the Xi-20 meeting will dictate the tone in markets for the next 56 hours, until the July 4 holiday wreaks havoc with positioning, while the US employment report looms at the end of the week. We will also get PMIs – which are pointing at a global economic contraction – and US ISM data, which may print below 50, to digest along with an OPEC meeting and a scattering of central bank speak throughout.

With the G-20 in the rearview mirror, traders can once again focus on the economic fundamentals, which are not pretty. Across Asia and Europe, factory activity shrank in June, according to reports Monday. China’s manufacturers saw sales, exports and production fall, with unemployment sliding to a decade-low, while Germany suffered from weaker foreign demand. Exports from South Korea plunged almost 14%, and Japan’s Tankan confidence index dropped to a three-year low.

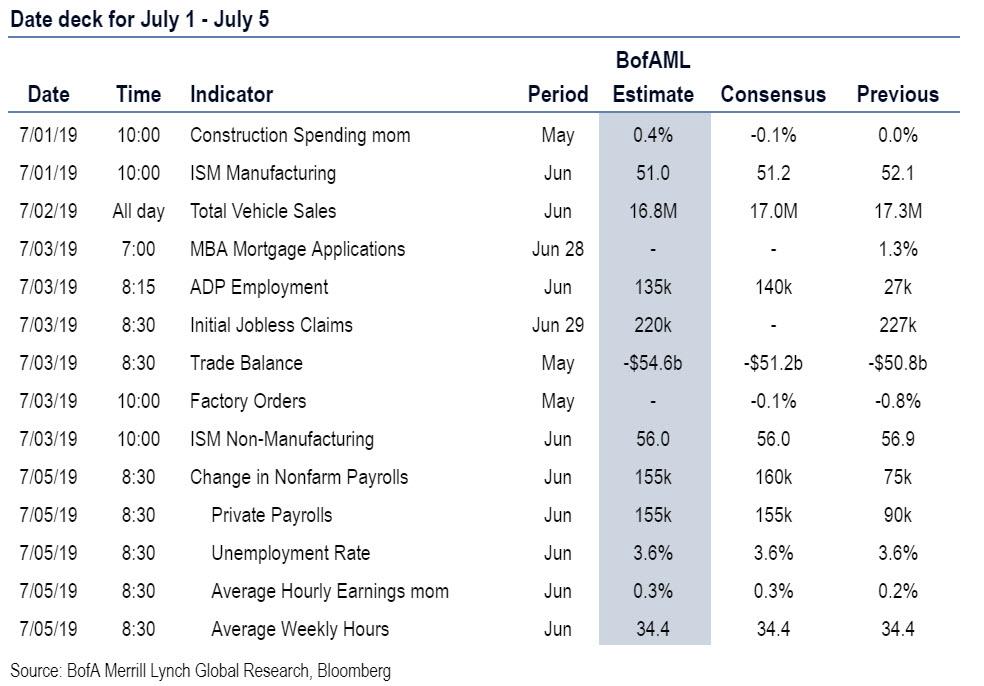

After the G-20, focus will turn to the June employment report in the US on Friday, and as Deutsche Bank’s Craig Nicol writes, the big rates repricing and subsequent dovish turn by the Fed last week has increased anticipation around this report. In terms of expectations, right now the consensus is for a 158k payrolls reading. A reminder that this follows that much weaker than expected 78k reading in May. The unemployment rate is expected to hold at 3.6% while earnings are expected to have risen +0.3% mom which would nudge the annual rate up one-tenth to +3.2% yoy.

That’s not the only significant data that we get next week in the US with the June ISM manufacturing reading due on Tuesday and non-manufacturing on Wednesday. The consensus is for a 51.2 manufacturing reading which would represent a drop of 0.9pts from May. Our US economists have warned about the ISM potentially declining towards 50, with sharp drops in recent regional Fed manufacturing surveys furthering this argument. So it’s a print worth watching.

Meanwhile, we’ll also get the final June manufacturing PMIs on Tuesday and services and composite PMIs on Wednesday across the globe.

Other data worth flagging in the US this week includes May vehicles sales on Tuesday, June ADP, jobless claims and final durable and capital goods for May on Wednesday. In the UK we get money and credit aggregates data for May on Monday and May factory orders data in Germany on Friday.

Elsewhere, the oil market is facing a mini test with OPEC meeting on Monday and OPEC+ (which includes Russia) on Tuesday in Vienna. A press conference is expected on Tuesday with nations expected to set oil production policy for the rest of the year. Reports last week – including in the WSJ – suggested that Saudi Arabia was expected to push to renew cutting output amid slowing global demand.

As for Fedspeak, Clarida is due to speak early on Monday at an event in Helsinki on the topic of monetary policy and the future of EMU. Williams is due to speak on Tuesday morning in Zurich on the global economic and monetary policy outlook while Mester will also speak on Tuesday during the afternoon in London on the economic outlook. Meanwhile, over at the ECB, Mersch is due to speak tomorrow, Guindos is due to speak on Monday, Thursday and Friday, Knot on Tuesday, Villeroy on Wednesday and Lane on Thursday. The BoE’s Cunliffe and Broadbent are also due to speak at separate events on Wednesday and PBoC’s Yi on Monday morning.

Other events worth flagging include the EU leaders meeting in Brussels on Sunday to discuss the next heads of the European Commission, ECB and European Council. Turkey’s Erdogan visiting Beijing on Tuesday. The European Commission potentially deciding to open a disciplinary procedure against Italy on Tuesday. Finally, we should highlight that US markets will be closed on Thursday for the Independence Day holiday. This will also likely include a half-day session on Wednesday for bond and equity markets.

Here is a summary of key events in the next few days, courtesy of Deutsche Bank:

- Monday: The final June manufacturing PMIs for Japan, Europe and the US will be the focus of the data releases along with the June ISM manufacturing reading in the US. The June Caixin PMI will also be released in China while the Q2 Tankan Survey is due in Japan. In Europe we’ll also get the June unemployment rate in Germany, M3 money supply data for the Euro Area for May and money and credit aggregates data for May in the UK. In the US the May construction spending print is also due. Away from that OPEC nations meet in Vienna to set oil production policy for the rest of the year. The Fed’s Clarida, ECB’s Guindos and PBoC’s Yi are due to speak also.

- Tuesday: Data includes June house price stats in the UK, May PPI for the Euro Area and June vehicle sales in the US. The Fed’s Williams and Mester are also due to speak along with the ECB’s Knot. Meanwhile, OPEC+ meet in Vienna and Turkey’s Erdogan visits Beijing. Tuesday is also the day that the US may begin imposing tariffs on almost all remaining imports from China (pending what happens at the G-20) and the European Commission may decide to open a disciplinary procedure against Italy.

- Wednesday: The remaining June PMIs will be the main data highlight. The remaining Caixin PMIs will also be out in China while other data in the US includes the June ADP employment report, May trade balance, jobless claims, June ISM non-manufacturing and final May durable and capital goods orders. The ECB’s Villeroy and Nowotny are due to speak along with the BoJ’s Funo and BoE’s Broadbent. US markets are also expected to close early.

- Thursday: US markets will remain closed for the Independence Day public holiday. As for data, the only release due in Europe is May retail sales for the Euro Area. The ECB’s Lane and Guindos are also due to make comments.

- Friday: The June employment report in the US will be the main highlight for data. Prior to that we get May factory orders in Germany, May trade balance in France, June house prices data in the UK and Q1 labour costs in the UK. The ECB’s Guindos is also due to speak.

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the ISM manufacturing report on Monday, the ISM non-manufacturing report on Wednesday, and the employment report on Friday. There are several scheduled speaking engagements from Fed officials this week, including one by Vice Chair Clarida on Monday, and one by New York Fed President Williams on Tuesday.

Monday, July 1

- 02:15 AM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will speak at a conference on monetary policy and the future of the EMU at the Bank of Finland.

- 09:45 AM Markit US manufacturing PMI, June final (consensus 50.1, last 50.1)

- 10:00 AM ISM manufacturing index, June (GS 50.5, consensus 51.0, last 52.1): All regional manufacturing surveys but Richmond declined by more than expected in June, and caused our manufacturing survey tracker — which is scaled to the ISM index — to fall to its lowest level since mid-2016 (-3.1pt to 50.4). Other idiosyncratic factors roughly offset for this month, and we thus expect the ISM manufacturing index to decline by 1.6pt to 50.5 in June. A simple analysis based on the historical deviations between the ISM and our survey tracker suggests slightly more than a one in three chance of the ISM manufacturing index falling into contractionary territory.

- 10:00 AM Construction spending, May (GS +0.2%, consensus flat, last flat): We estimate a 0.2% increase in construction spending in May, with scope for an increase in private nonresidential construction, but scope for a decrease in residential construction.

Tuesday, July 2

- 06:35 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak on the global economic and monetary policy outlook at an event in Zurich. Prepared text and audience Q&A are expected.

- 11:00 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak on the economic outlook to the European Economics and Financial Centre in London. Prepared text and audience Q&A are expected.

- 5:00 PM Wards Total Vehicle Sales (GS 17.1m, consensus 17.0m, last 17.3m)

Wednesday, July 3

- 08:15 AM ADP employment report, June (GS +125k, consensus +140k, last +27k): We expect a 125k gain in ADP payroll employment, reflecting a drag from lagged payrolls, lower oil prices, and modestly higher jobless claims. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 08:30 AM Trade balance, May (GS -$54.3bn, consensus -$53.5bn, last -$50.8bn): We estimate the trade deficit increased by $3.5bn in May, reflecting a rise in the goods trade deficit.

- 08:30 AM Initial jobless claims, week ended June 29 (GS 225k, consensus 220k, last 227k): Continuing jobless claims, week ended June 22 (last 1,688k); We estimate jobless claims edged down by 2k to 225k in the week ended June 29, after increasing by 10k in the prior week. There were several auto plant shutdowns.

- 09:45 AM Markit US services PMI, June final (consensus 50.7, last 50.7)

- 10:00 AM Factory Orders, May (GS -0.7%, consensus -0.5%, last -0.8%): Durable goods orders, May final (consensus -1.3%, last -1.3%); Durable goods orders ex-transportation, May final (last +0.3%); Core capital goods orders, May final (last +0.4%); Core capital goods shipments, May final (last +0.7%): We estimate factory orders decreased by 0.7% in May following a 0.8% decline in April. Durable goods orders moved down in the May advance report, driven by a further decline in aircraft orders.

- 10:00 AM ISM non-manufacturing index, June (GS 55.4, consensus 55.9, last 56.9): Our non-manufacturing survey tracker declined by 0.8pt to 53.9 in June, following mixed regional service sector surveys. We expect the ISM non-manufacturing index to decline by 1.5pt to 55.4 in the June report. The index appears elevated relative to other service sector surveys, suggesting some scope for catch-down.

Thursday, July 4

- US Independence Day holiday observed. US equity and bond markets are closed.

Friday, July 5

- 08:30 AM Nonfarm payroll employment, June (GS +175k, consensus +163k, last +75k); Private payroll employment, June (GS +160k, consensus +155k, last +90k); Average hourly earnings (mom), June (GS +0.4%, consensus +0.3%, last +0.2%); Average hourly earnings (yoy), June (GS +3.2%, consensus +3.2%, last +3.1%); Unemployment rate, June (GS 3.7%, consensus 3.6%, last 3.6%): We estimate nonfarm payrolls increased 175k in June, more than double the 75k pace in May. Our forecast reflects low jobless claims, the continued expansion indicated by our employment survey trackers, and an expected rebound in public education payrolls related to the timing of the survey periods. We believe the May report overstates the magnitude of the slowdown in trend job growth, which we believe remains well above potential. We also note that labor supply constraints are historically less binding in June: in years with relatively tight labor markets, payroll growth tends to slow in May then reaccelerate in June and July (as students and recent graduates are absorbed into the labor force).

Source: Deutsche Bank, BofA, Goldman

via ZeroHedge News https://ift.tt/2ZYALl2 Tyler Durden