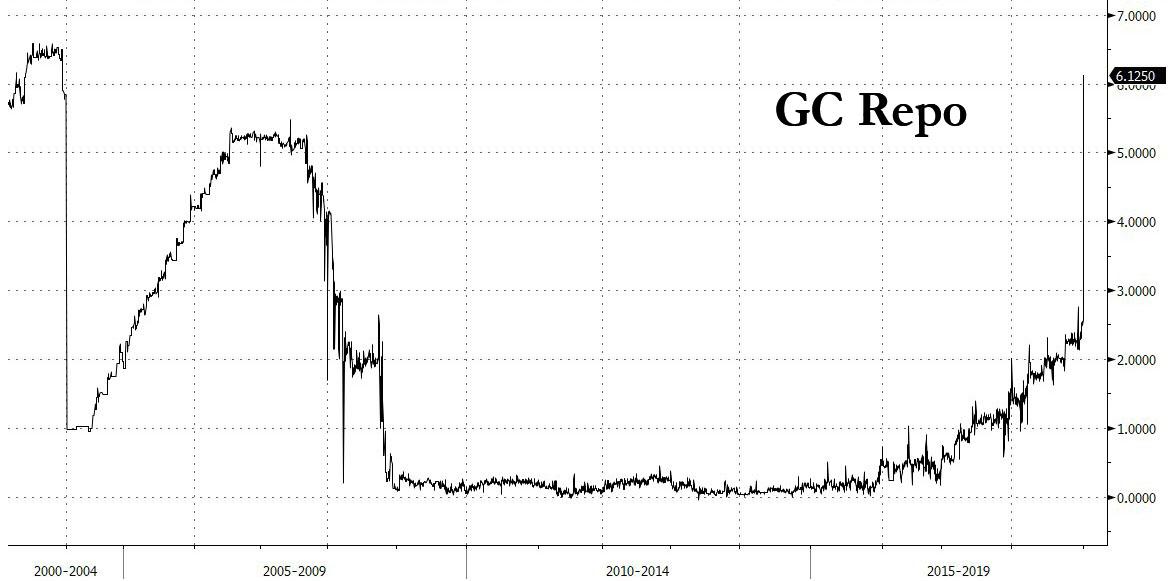

Back on January 2, we showed what was arguably the strangest move that took place on the last trading day of 2018, when the overnight general collateral repo rate shot up from 2.5% to as high as 6.125% on Monday, Dec. 31, the biggest one day move on record, bringing overnight GC repo to the highest level since January 2001.

To be sure, while violent year-end moves are well-known in the overnight funding markets, the magnitude of the Dec. 31 surge was simply unprecedented, and commenting on the GC Repo surge, Scott Skyrm, EVP at Curvature Securities said that “the cash never came in,” noting that while “funding pressure should be about 50 basis points” and yet what we got was “350 basis points.”

Numerous theories emerged to try and explain this unprecedented move, with most agreeing that this was a case of aggressive quarter and year-end liquidity (mis) management by banks, with Bloomberg pointing out that as banks “tidy their balance sheets at year-end when regulatory surcharges are calculated… As part of their bid to lessen these regulatory imposts, banks tend to pare their exposure to repo, which in turn makes it more expensive for borrowers.” Others also blamed such artifacts of the increasingly broken market as shrinking reserves, regulatory requirements and year-end window dressing.

“It was an atypical but typical year-end, because bank balance sheets were even more scarce than people thought,” TD Securities analyst Gennadiy Goldberg said, adding that it “isn’t a funding issue, it’s balance-sheet scarcity that was worse than expected.”

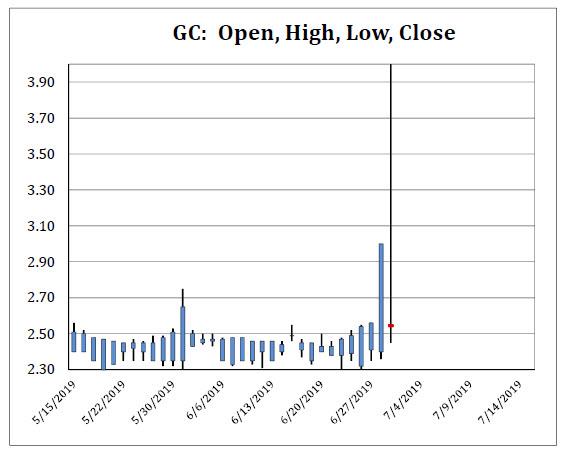

We bring this up because this morning we saw precisely the same overnight funding spike in the repo market strike again, only this time with a twist.

As repo market expert, Scott Skyrm, once again first noted, about half way through the morning, there was a major back-up in rates. “At first it appeared as though it was a dislocation between collateral sellers and buyers, but quickly it was apparent some cash did not yet return to the market after quarter-end”, Skyrm noted.

No doubt it was a combination of quarter-end carryover, traders on vacation, and the $41 billion in net new issuance settling today. But the magnitude of the move is very surprising.

The chart below shows just how surprising the intraday GC repo surge truly was:

But what was even more surprising than the repo spike which was a carbon copy of the market shock observed on Dec 31, if slightly lower in magnitude, is that unlike back then, the June “quarter-end” cash dislocation did not occur on quarter-end this time around; instead it occurred the day after, sparking even more questions about what caused this delayed aftershock, and confirming that whatever liquidity plumbing and funding issues existed at the turn of the year, they have not gone away.

The good news, according to Skyrm, is that while the market is expecting some continued carry-over pressure with GC priced at 2.55%-2.52% for tomorrow, he expects rates will be back to normal on Wednesday; probably opening at 2.47%-2.45%. In other words, the funding market may be broken, but at least it is so for just one or two days (for now) per year.

And in totally separate news, today’s auction of 3-Month Treasury bills priced at 2.145%, notably higher than the 2.085% previous week. According to Bloomberg, “the backup in yield at Monday’s three-month Treasury bill auction suggests some investors are starting to consider the impending debt-ceiling deadline, since that’s when the Treasury could potentially exhaust its current borrowing authority.”

And so, for those who keep tabs on objects in the market’s wall of worry, they can now add the Technical Default of the US Treasury to the list of catalyst that will keep pushing the S&P well above 3,000 for the next few months.

via ZeroHedge News https://ift.tt/2Xhispw Tyler Durden