A China trade truce, surging chip stocks, and bad (economic) news that must be good ammo for The Fed to cut, BUT stocks faded all the gains – simply put, it’s never enough!!

Chinese stocks surged on the trade-truce and while they maintained gains, the afternoon session saw barely any follow-through…

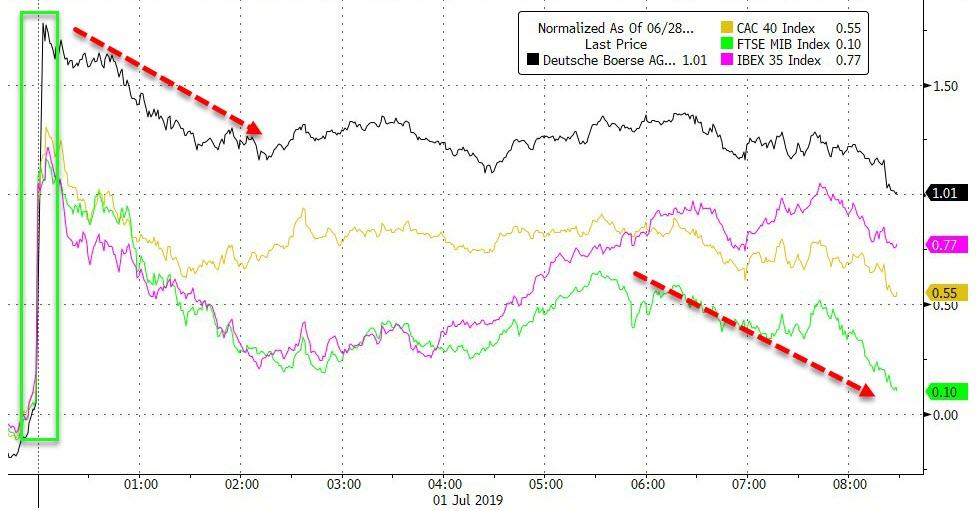

European stocks opened dramatically higher (on the trade truce) but faded practically non-stop from the open with Italy ending unch…

German bund yields fell to new record (negative) lows today and Italian yields dropped below 2.00% for the first time since May 2018…

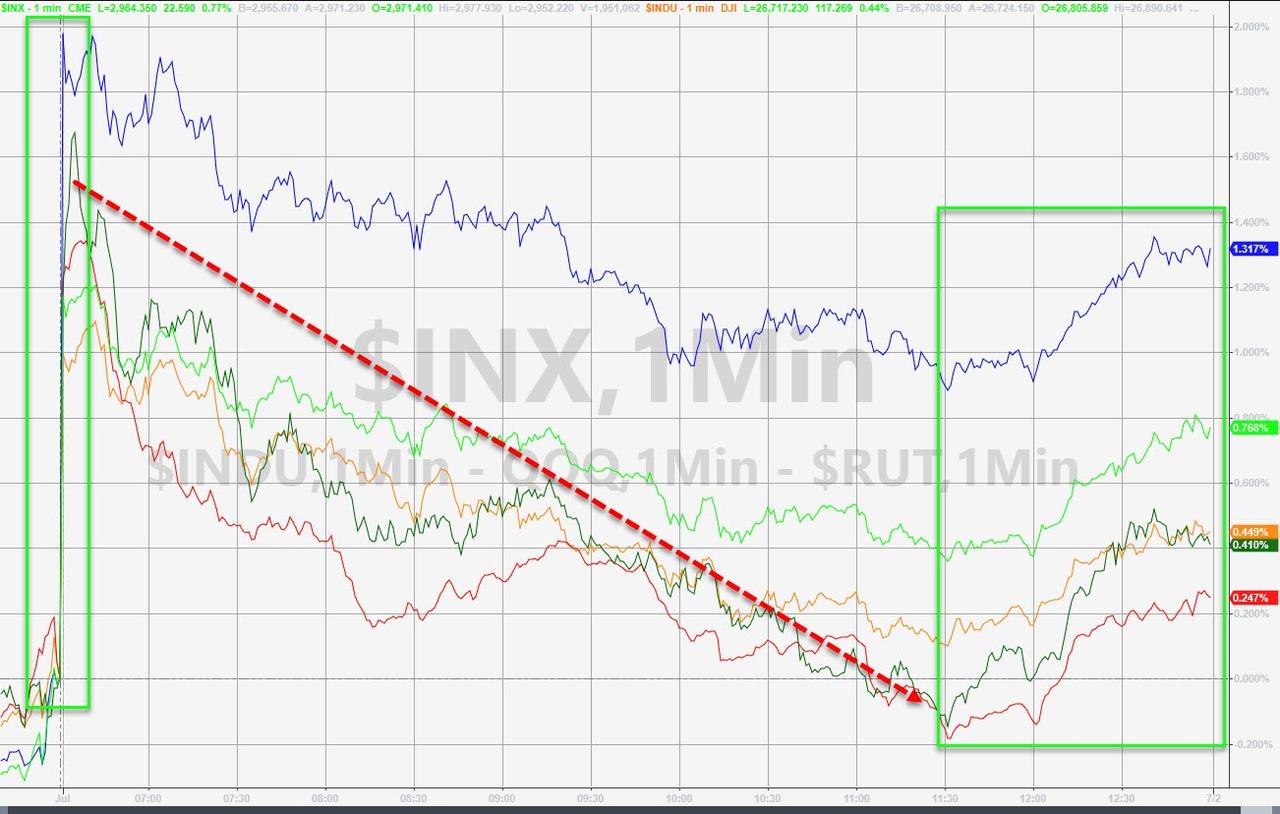

Almost from the cash market open, US equities went in only one direction as “sell the news” dominated the nothing-burger truce deal…

Stocks managed a pretty good run into the close starting at 3pmET to ensure The S&P closed at a record closing high…

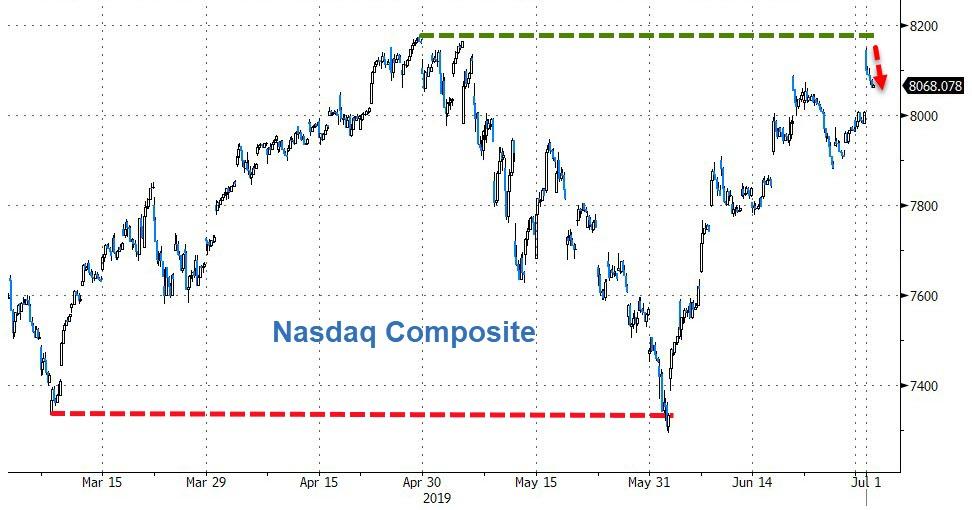

The Nasdaq outperformed however, helped by the biggest gap-up opening in SOX (Semis dramatically outperformed) in its history…

But notably, Nasdaq Composite failed to make new highs and was down by around 100 points from the highs…

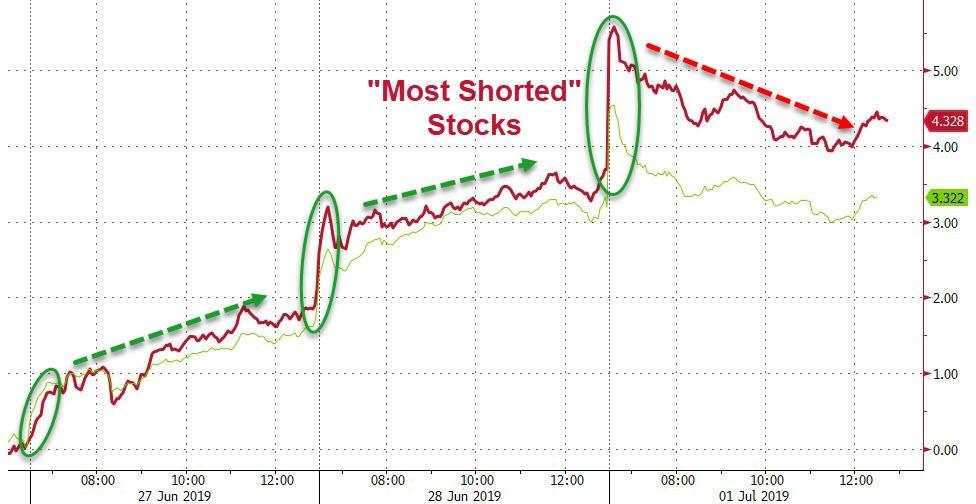

Giant short-squeeze at the US cash open – for the 3rd day in a row…

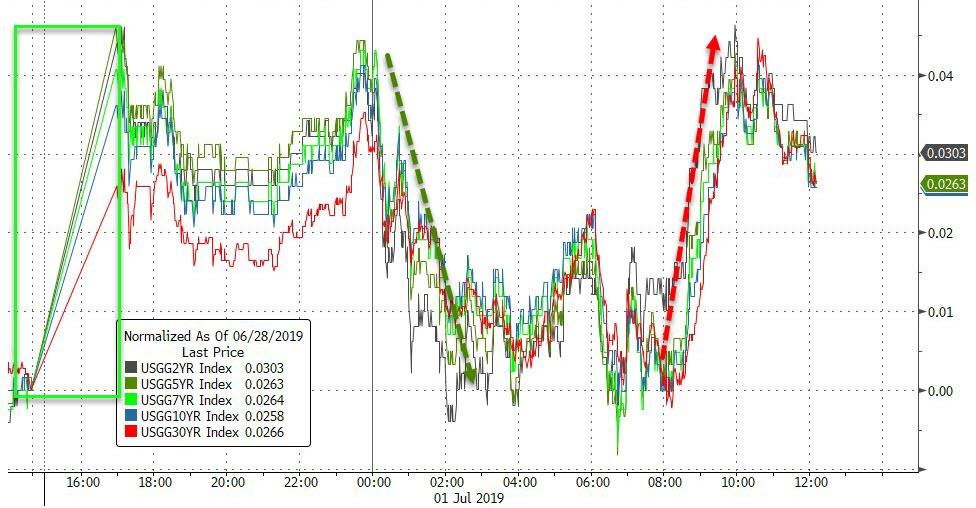

Treasury yields were higher on the day by around 2-3bps across the curve (after rallying from the higher yield open to unchanged)…

10Y Yields tested down to 2.00% once again (but bounced)…

As it seems “sell all the things hit shortly after the US open)

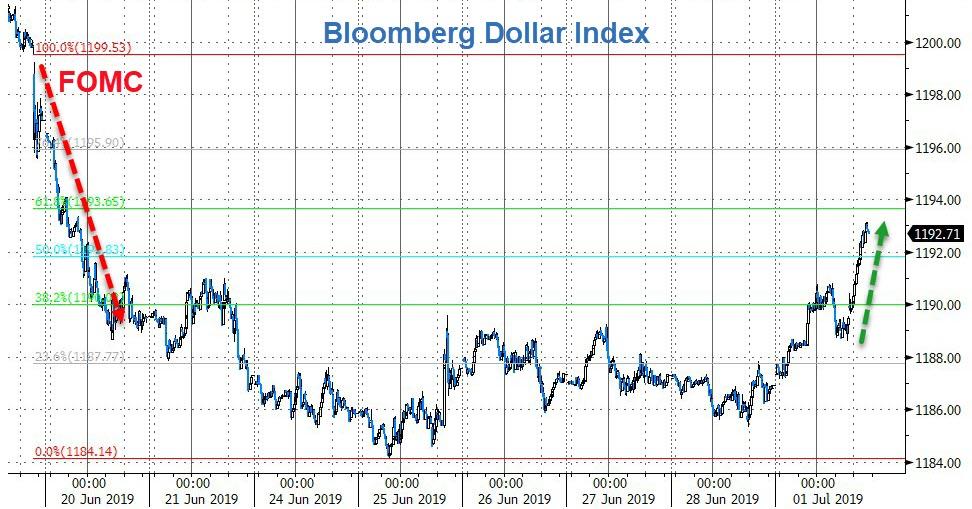

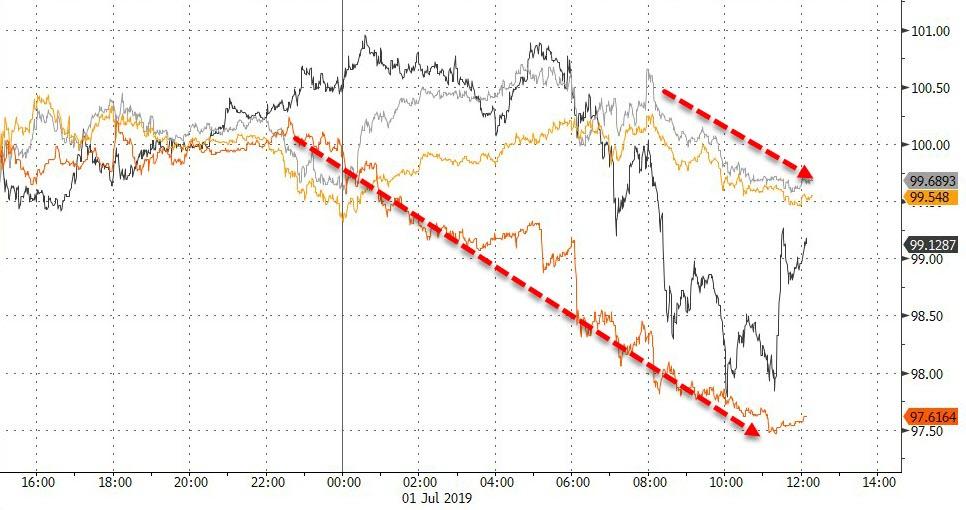

The dollar surged (retracing almost the Fib 61.8% of the post-FOMC losses)…

Yuan erased almost all of its trade-truce gains…

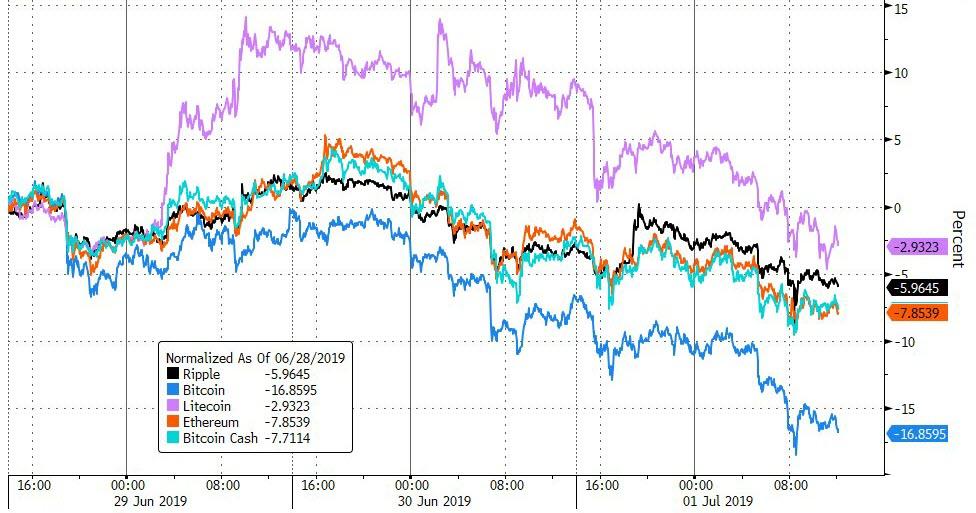

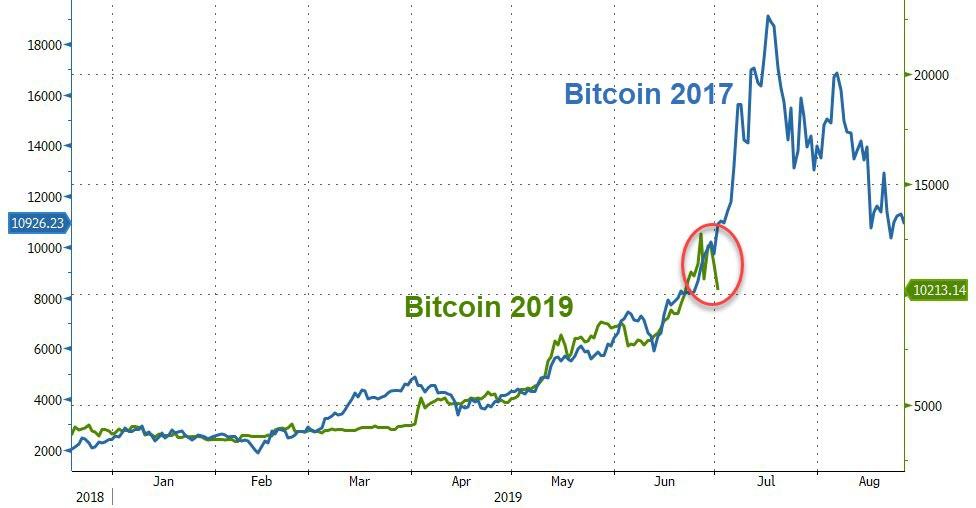

Cryptos extended the weekend’s declines…

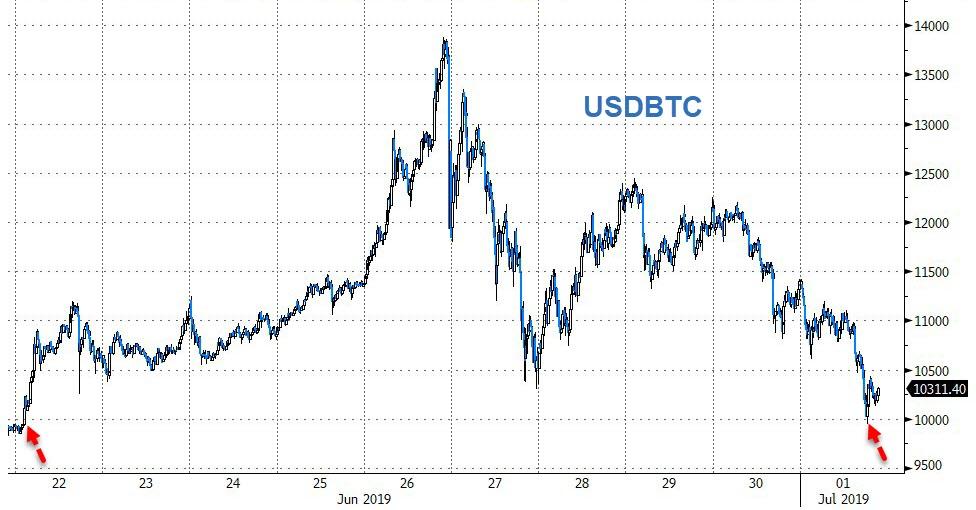

Led by Bitcoin which tested below $10,000 briefly…

As the 2017 analog loses its trajectory…

Dollar strength sent commodities broadly lower (even WTI faded despite OPEC+ deal chatter), gold and silver was least hit…

Gold fell back below $1400…

Oil price behavior was quite shocking, spiking on hype about an OPEC+ deal (Russia and Saudi agreeing a deal at G-20), then rolling over from the US equity market open, then spiking towards the NYMEX close…

And if the trade truce is so awesome, why did copper crap the bed?

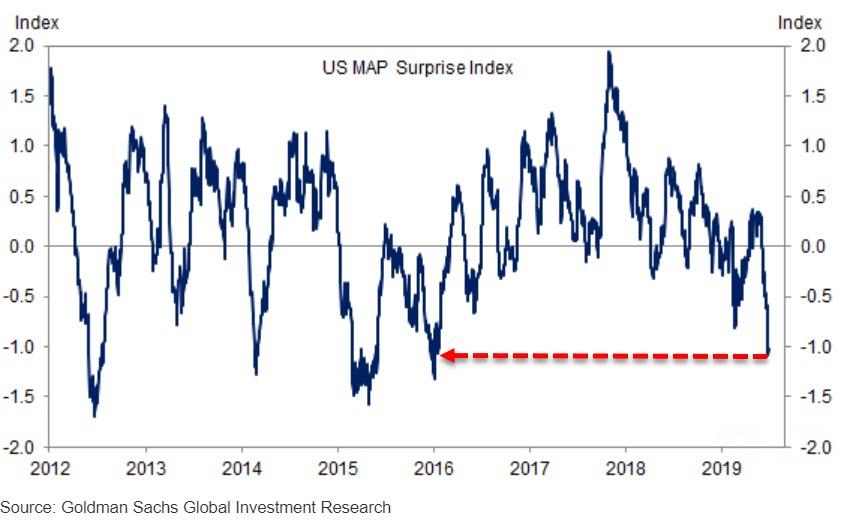

Finally, more dismal global macro data today, not helped at all by the US…

Seems to confirm bonds have it right…

So for all those buying stocks, do you really feel that lucky?

via ZeroHedge News https://ift.tt/2Lwz22r Tyler Durden