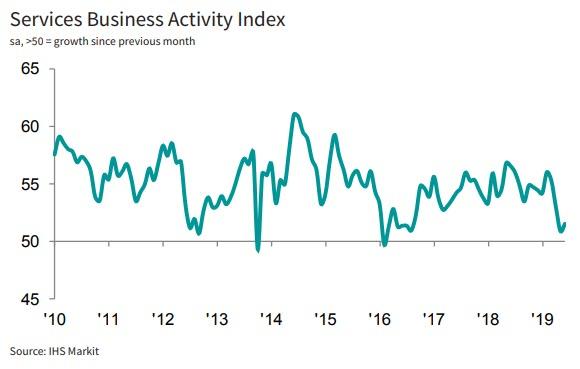

With the global composite manufacturing PMI tumbling into contraction, hope remains high that ‘services’ can save the world and Markit’s Services PMI did indeed offer some hope today with a small rebound from May’s 39-month lows.

US Services PMI rose from 50.9 to 51.5 in June (up from the flash 50.7 print also) but remains very close to 3 year lows with business expectations dropping to 58.7 from 59.2 in May, this is the lowest reading since June 2016 (pre-Brexit vote).

ISM Services bounced in May and was expected to slow in June, but slowed more dramatically, falling to 55.1 from 56.9, the lowest since July 2017.

Three of the ISM survey’s four components slipped, with employment dropping by the most in 16 months and new orders declining to the lowest level since December 2017.

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“A major change since the first quarter has been a broadening-out of the slowdown beyond manufacturing, with the service sector growth now also reporting much weaker business activity and orders trends than earlier in the year.

“Hiring was hit as firms scaled back their expansion plans in the face of weaker than expected order inflows and gloomier prospects for the year ahead. Jobs growth was the weakest for over two years and future expectations across both services and manufacturing has slipped to the lowest seen since comparable data were first available in 2012.

“Trade wars and geopolitical concerns topped the list of companies’ worries about the year ahead, alongside forecasts of slower economic growth. Progress in US-China trade talks could therefore be key to helping lift confidence in coming months.”

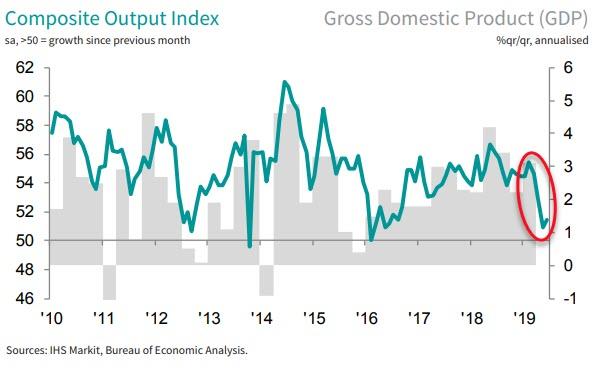

Finally, Williamson notes the impact on GDP:

“An improvement in service sector growth provides little cause for cheer, as the survey data still indicate a sharp slowing in the pace of economic growth in the second quarter.

The PMI data for manufacturing and services collectively point to GDP expanding at an annualised rate of 1.5%.”

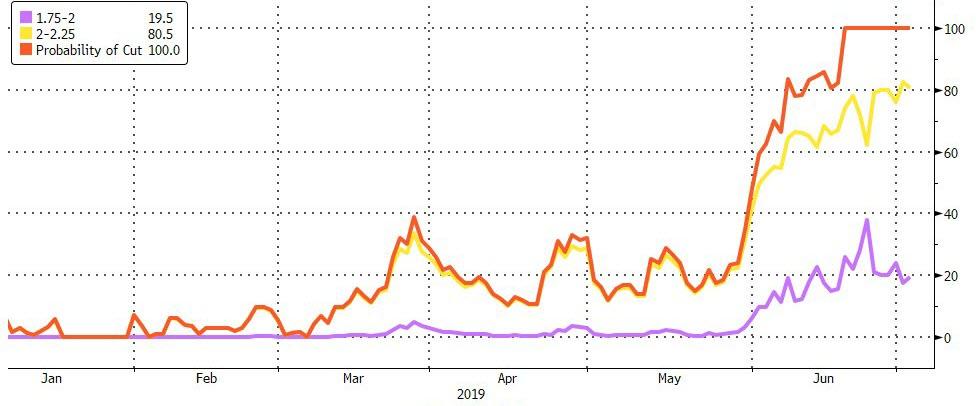

Is all of this enough to spook The Fed to cut by 50bps?

via ZeroHedge News https://ift.tt/2KWPh9G Tyler Durden