The US trade war with China may have entered a tentative truce period, but a brand new, emerging trade feud threatens to jeopardize an entirely new universe of technological supply chains.

On Tuesday, Japan unexpectedly announced that it was considering imposing stricter export controls on more items bound for South Korea, in an apparent effort to raise pressure on Seoul to help resolve a bilateral dispute over compensation for wartime labor. The envisaged plan comes in response to what Tokyo views as Seoul’s failure to address the months-long dispute properly and prevent it from hurting mutual trust between the two neighbors.

Expanding the list of items, possibly to include electronic parts and related materials that can be diverted to military use, will likely exacerbate bilateral tensions, according to the Japan Times, and some within the government remain cautious about taking further steps, even though Japan has already announced that effective today, it will require manufacturers to file applications when they export to South Korea three materials used in the production of semiconductors and displays for smartphones and TVs.

Prime Minister Shinzo Abe on Wednesday defended the government’s export controls.

“We cannot give the preferential treatment that has been afforded until now, as the other country has not kept its promise,” he said during a nationally televised debate with leaders of other political parties, a day before official campaigning begins for the July 21 Upper House election. “This does not go against WTO agreements at all.”

Meanwhile, Seoul, which regards the move as conflicting with the spirit of free trade, has threatened to launch a complaint against Japan at the World Trade Organization.

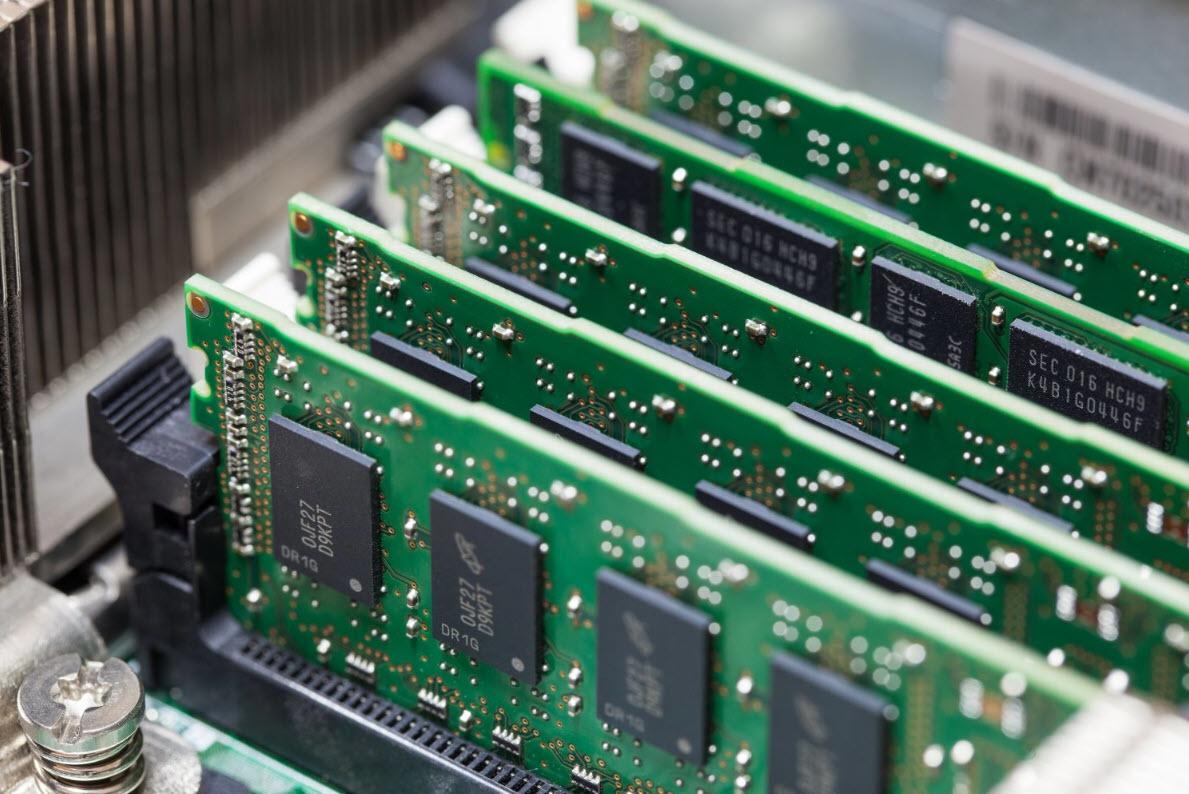

Commenting on the latest trade feud, the Nikkei warned that Japan’s new export controls on South Korea, a country that produces the bulk of the world’s memory chips, threaten a ripple effect that spreads beyond the two wary neighbors to electronics manufacturing globally, and could result in another semiconductor shockwave across the globe.

The restrictions mark the latest setback in a bilateral relationship between the two Pacific Rim nations, fraught with colonial-era grievances. The move prompted Seoul to say it was considering retaliatory measures and left chipmakers to confront an immediate supply challenge.

Adding to the complications, Japan’s government expects export reviews to take about three months. But South Korean chipmakers typically keep only one to two months’ worth of parts and materials in stock.

A source at chipmaker SK Hynix told Nikkei the company does not have three months of inventory. The chipmaker would have to halt production if it cannot procure necessary materials from Japan for that long, the source said. Top memory chip maker Samsung Electronics said it was assessing the situation, without elaborating.

The impact could spread worldwide.

South Korean players control 70% of the global market for dynamic random access memory and 50% for NAND flash memory. Samsung leads the global chip market by revenue, with SK Hynix in third. These chips go into devices such as Apple’s iPhone, rival models from Huawei Technologies, personal computers made by HP and Lenovo Group as well as televisions from Sony and Panasonic.

A representative at a major Japanese electrical equipment maker expressed concern that the new controls could backfire.

“If supplies of things like memory from South Korea are delayed and production of Apple’s iPhone falls [as a result], there could be an impact on our provision of parts,” the representative said.

Lesser-known Japanese companies hold leading market shares in the three restricted materials. Polyimides are used to make flexible organic light-emitting diode displays. The others are used in forming circuit patterns: resist – a coating substance – and etching gas. These companies include JSR, Showa Denko and Shin-Etsu Chemical – all of which are a third or more owned by foreign investors.

Japan also plans to remove South Korea by August from an export “whitelist” of 27 friendly countries that includes the U.S., Germany and France, meaning that shipments of products with potential military applications will require government approval. No country has ever been dropped from the list.

* * *

Tokyo cited a deteriorating relationship with Seoul as the reason for the controls, seemingly referring to a long-running dispute over compensation from Japanese companies to South Koreans for wartime labor.

The move follows Tokyo’s increase in inspections of some South Korean seafood that began last month, reportedly in retaliation for continued curbs on imports of food from areas affected by Japan’s 2011 Fukushima Daiichi nuclear disaster.

“It’s become difficult to manage exports based on a relationship of trust with South Korea,” Japanese Deputy Chief Cabinet Secretary Yasutoshi Nishimura told reporters Monday.

* * *

In response to the sudden trade aggression, South Korean Vice Foreign Minister Cho Sei-young summoned Japanese Ambassador Yasumasa Nakamine to demand that the export controls be removed. He expressed concern about the impact on South Korean industry and bilateral relations, and argued that the restrictions directly contradict Japan’s advocacy for “free and fair trade” at the Group of 20 summit in Osaka last week.

Cho said that the government would work with businesses to prepare countermeasures. South Korea’s Ministry of Trade, Industry and Energy also said it would respond with “appropriate measures,” including filing a complaint with the World Trade Organization.

“We’ll make this an opportunity to enhance South Korea’s technological capabilities,” industry Minister Sung Yun-mo said.

Experts differed on whether the new regulations are valid under WTO rules. “This is an area where Japan can make decisions on its own, so it’s probably not a violation,” said Keisuke Hanyuda, partner at Japan-based Deloitte Tohmatsu Consulting. But Yuka Fukunaga, a professor at Waseda University in Tokyo, argued that the curbs may violate WTO agreements, as they fall into a “gray area.”

Whether a quick ceasefire follows in the coming weeks, and whether the US trade war with China ends up in a deal, remains unclear, but should trade relations collapse between Japan and South Korea, two nations at the cutting edge of global semi and tech manufacturing, the consequences not only for global trade but for corporate profitability would be disastrous. And case in point, this just hit:

(URGENT) Samsung Electronics Q2 operating profit dips 56.3 pct to W6.5tln https://t.co/RbCqnVVdVi

— Yonhap News Agency (@YonhapNews) July 4, 2019

via ZeroHedge News https://ift.tt/2Xuh9bR Tyler Durden