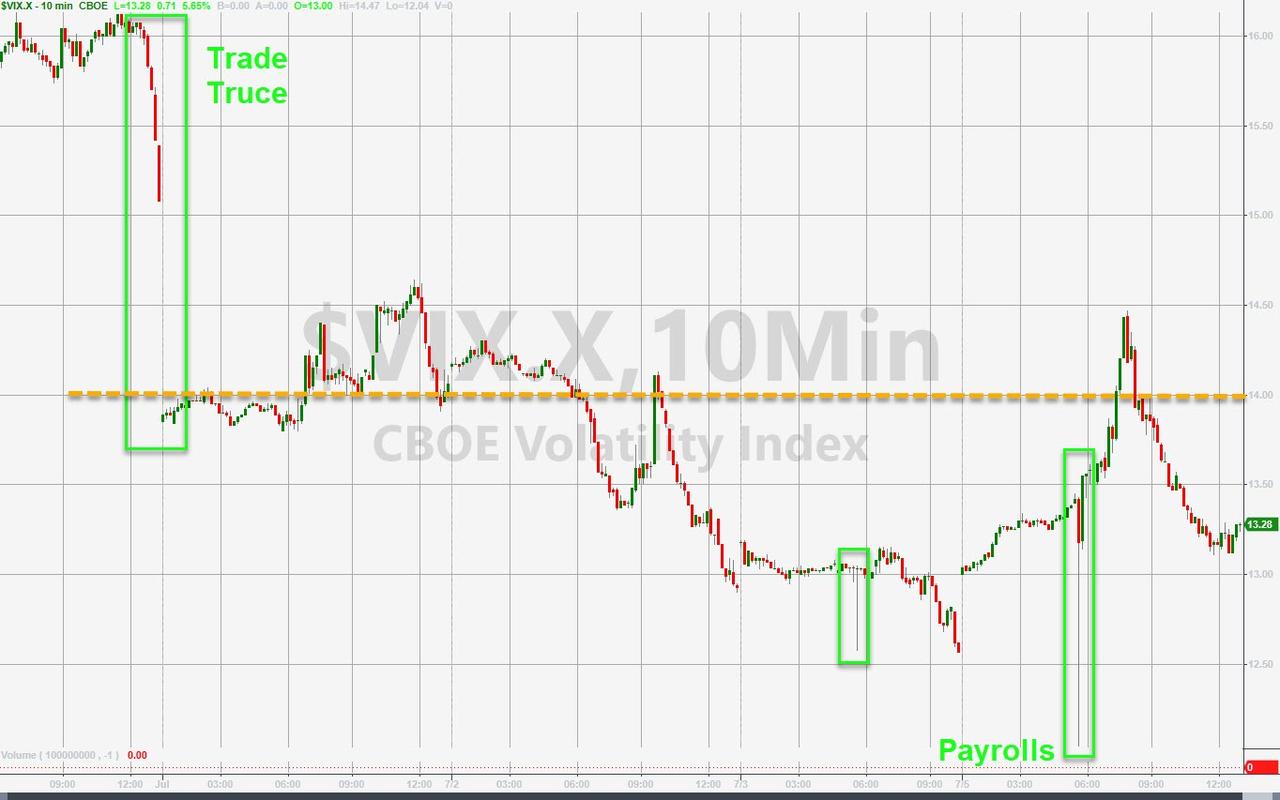

Trade-Truce ‘good‘ news was good news for stocks, ‘bad‘ news in macro data this week was good for stocks, and jobs ‘good‘ news today was bad news for stocks (initially)…

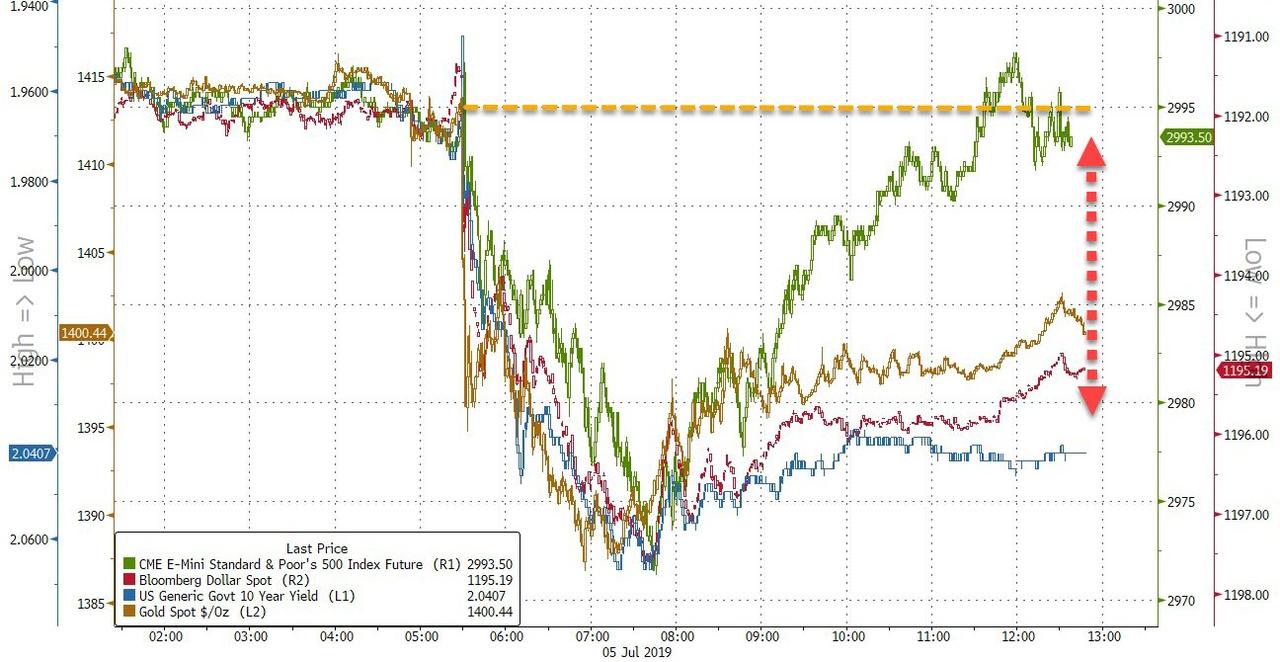

But only stocks rebounded from the hawkish-tilt from the payrolls print

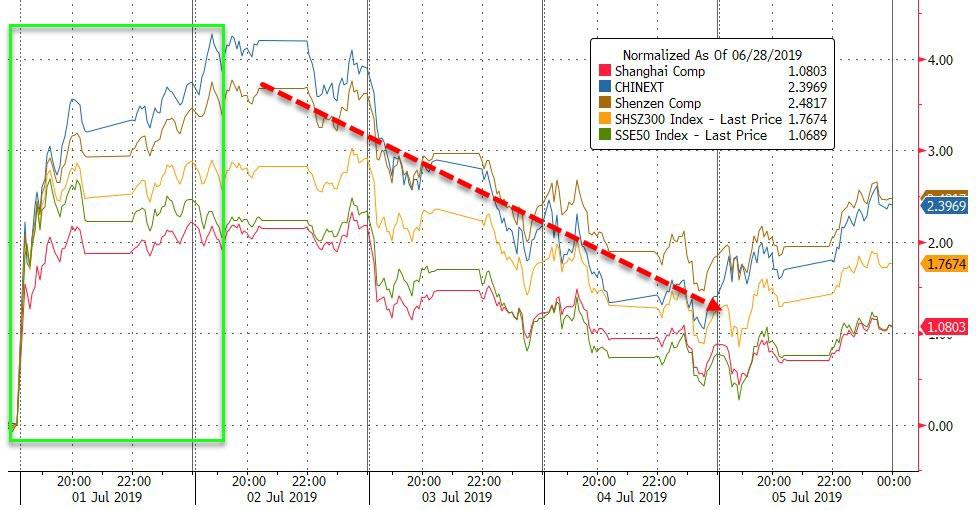

The Truce-Boost fizzled out in China…

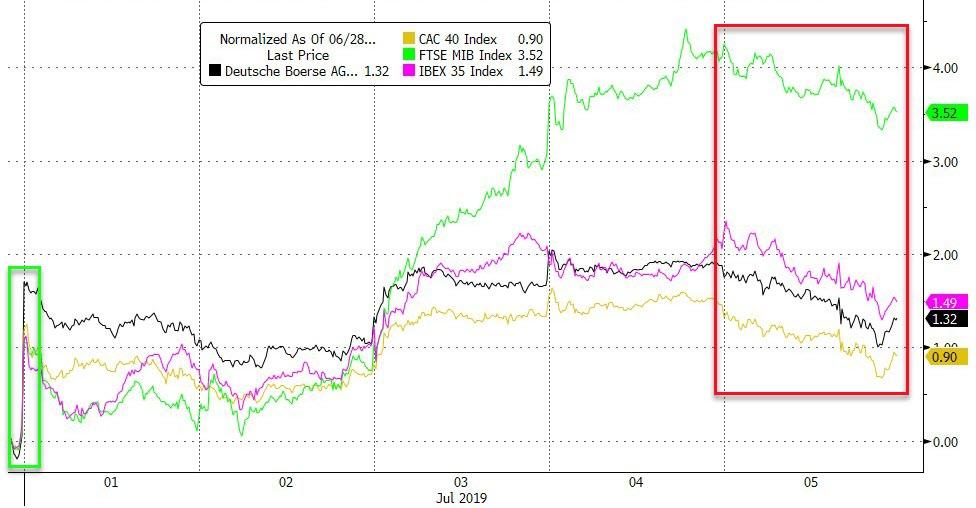

European stocks faded to end the week but remain notably higher post-trade-truce…

On the week, Trannies barely managed to hold on to post-trade-truce gains, while Nasdaq surged followed by the S&P and Dow…

Volume was well below average (though somewhat expected given the holiday)

But on the day, good news on jobs was initially dumped and then pumped back to unchanged… once it ran out of ammo, stocks faded into the close…Small Caps were the only major US index in the green on the day…

Defensive stocks dominated cyclicals on the week…

VIX mini-flash-crashed on the payrolls print, spiked higher then faded from the european close…

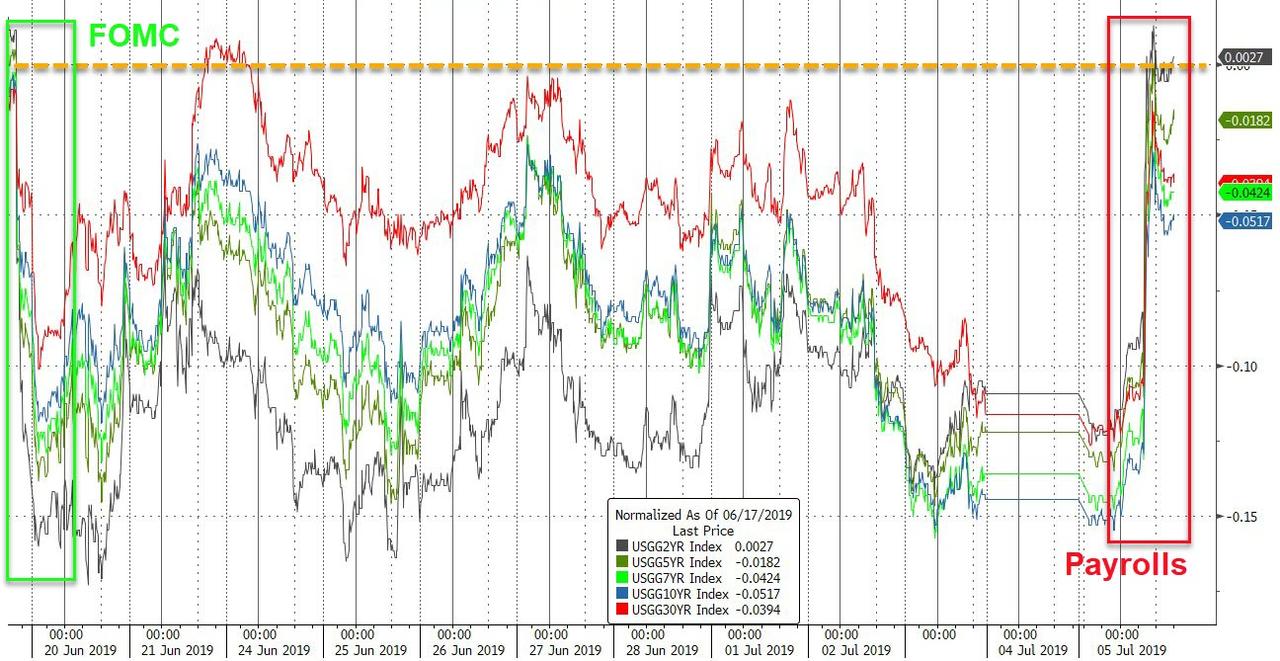

Treasury yields screamed higher today, erasing the week’s bond price gains and erasing yield’s drop since The FOMC for the short-end…

As good-ish jobs data ruined the Fed’s 50bps rate-cut party, crashing the odds to just 2.5%!…

The spike in yields stalled at critical resistance once again…

And the yield curve collapsed, erasing the post-FOMC steepening…

3m10Y spreads are inverted for the 30 straight days…

The Dollar index had the best week since February, spiking today after the good payrolls data…

The Dollar spike stalled at critical resistance…

Yuan gave up all its trade truce gains and ended at the lows of the range…

As the dollar rallied, cryptos stumbled with Bitcoin and Ripple down 8% on the week (and Litecoin unch)…

Bitcoin remains above $11,000…

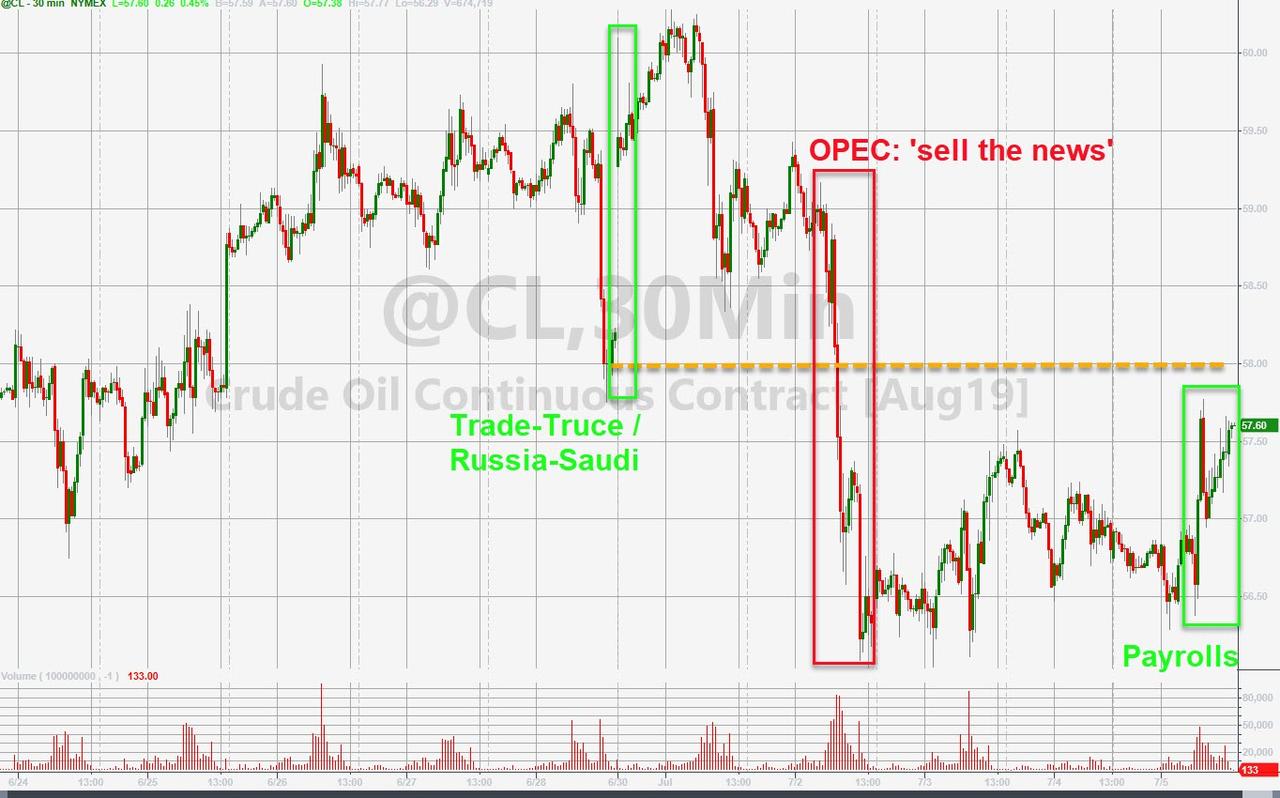

Commodities were all lower on the week not helped by the dollar strength…

Gold suffered its first losing week in seven weeks, but ended back above $1400…

Ugly week for oil after OPEC’s deal and the trade-truce…

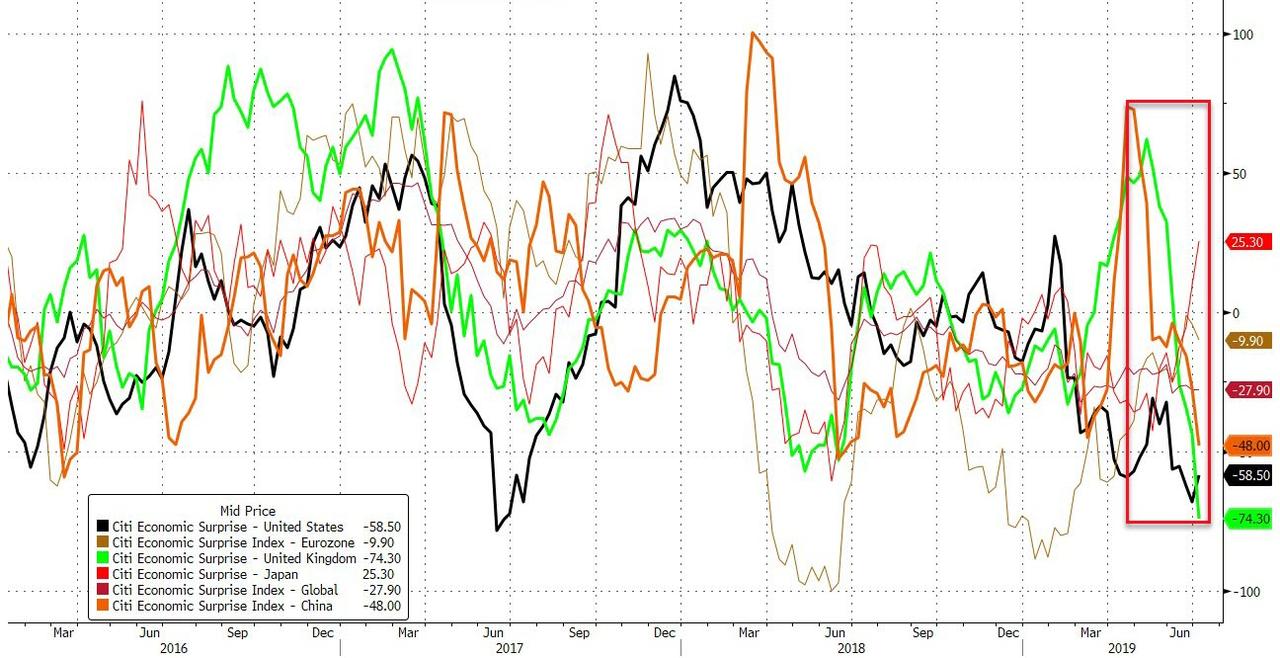

Finally, we note the recent collapse in UK, China, and US macro data…

As bonds agree with the data, but stocks only know one thing…

Until it all ends badly…

via ZeroHedge News https://ift.tt/2FVH4y7 Tyler Durden