The auto industry continues to look like a bursting bubble in progress and all around sad state of affairs, despite low rates and the “prosperity” of the stock market hitting new all time highs. Meanwhile, under the surface of those numbers, the actual economy – especially in autos – is telling a different story.

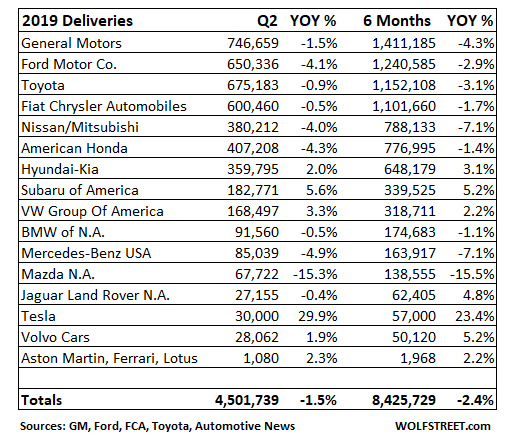

New vehicle deliveries, combining fleet sales and retail sales, were down 1.5% in Q2 to 4.5 million vehicles, according to Wolf Street.

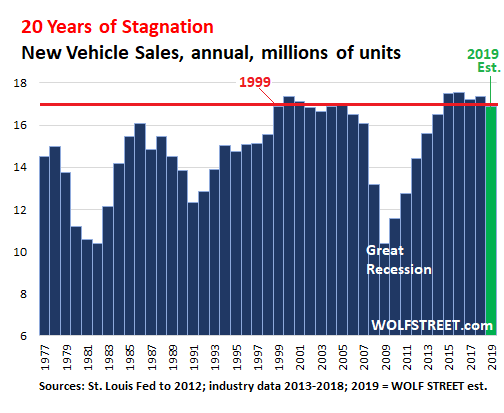

For the first half of the year, vehicle deliveries fell 2.4% to 8.4 million vehicles. This puts the pace for new vehicle sales on track to fall below 17 million for the year, which would be the worst level since 2014. Further, it has lowered estimates for the full year to 16.95 million units delivered, on par with a “horribly mature market” in 1999. In addition to a struggling consumer, these lowered estimates are also result of rising interest rates and competition from off-lease vehicles.

This has resulted, simply, in fewer customers splurging on new cars.

As we noted on Friday morning, it’s likely Ford and General Motors are breaking a sweat after the latest slate of economic data hit the wires. Though its overall truck sales held up, those of Ford’s signature F-Series pickup truck fell over last year in June. GM was not as fortunate with sales of its Silverado and Sierra trucks down, especially on the heavy-duty side of the line-up. With the caveat that fleet sales can indeed be trucks and comprised 24% of Fiat Chrysler’s June sales, Ram pickups were nonetheless the standout as a fresh redesign and fat incentives drove sales up over 2018.

Ford’s sales fell 4.1% in Q2. Car sales at Ford plunged another 21.4% to just 110,195 units, as customers continue to favor new pick up trucks, SUVs and vans instead. Truck sales rose 7.5% but F-series pickups fell 1.3%, cannibalized by Ford’s midsized pick up, the Ranger. However, even the company’s SUV sales look ugly – they fell 8.6% to 215,898 units.

According to newly released data on Friday, Ford also posted an abysmal quarter in China, selling a total of 154,042 vehicles in the second quarter, a 21.7% decrease compared to the same period last year.

General Motors saw sales fall 1.5% in Q2 after plunging 7% in Q1. Fiat Chrysler sales fell 0.5% in Q2 and the company announced that it will abandon reporting deliveries on a monthly basis, following in the footsteps of Ford and GM. Here’s a better look at Q2 numbers for most auto makers:

No matter how you look at it, 2019 has been ugly:

-

Year to date, Toyota Motor sales are down 3.1% to 1,152,108 vehicles.

-

Year to date, Honda Motor sales have fallen 1.4% to 776,995 vehicles.

-

Year to date, Nissan sales are down 8.2% to 717,036 vehicles.

-

Year to date, Fiat Chrysler sales are down 2% to 1,096,110 vehicles.

-

Year to date, total GM auto sales in the U.S. are down 4.2% to 1,412,499.

-

Over the first half of 2019, total Ford sales are down 2.9% to 1,240,585.

To try and continue capitalizing on truck demand, automakers are flooding the market “with efficient and restructured versions of pickup trucks”. And the industry – not unlike most market participants across all sectors in general – is hoping for help from the Fed. A rate cut this summer could help drive more business to dealerships heading into the middle of the third quarter.

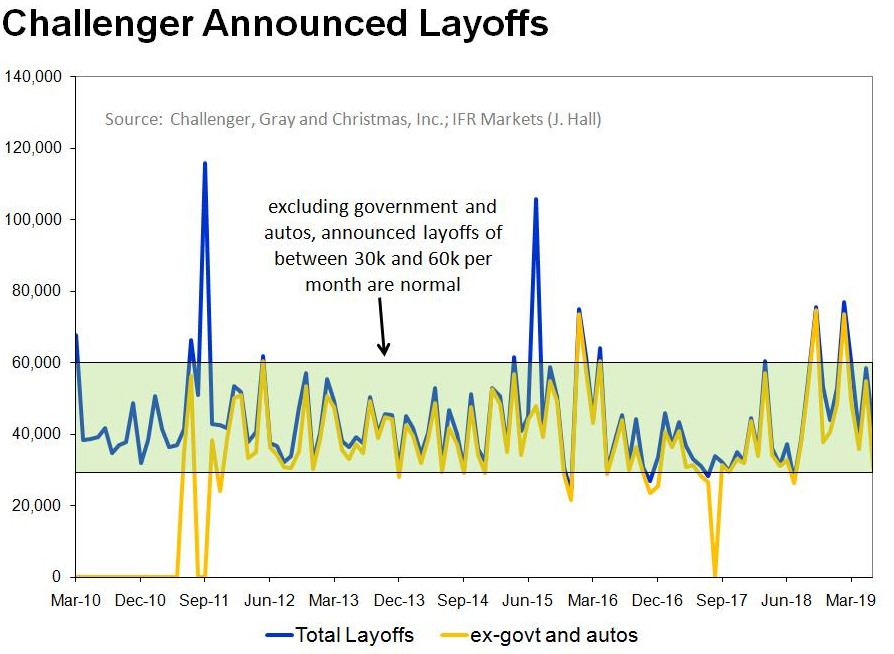

Recall, we reported just days ago that more than 25% of June’s 41,977 announced job cuts came in the automotive industry, according to Managing Economist for Refinitiv Jeoff Hall. Hall commented on Twitter that the industry’s 10,904 redundancies were the most in seven months and the second most in seven years.

Hall also noted that excluding autos, there were only 31,073 job cuts in June, the fewest in 11 months, in low-normal range.

About a month ago we focused on layoffs in the auto industry, noting that China, the United Kingdom, Germany, Canada and the United States have all seen at least 38,000 job cuts over the last six months.

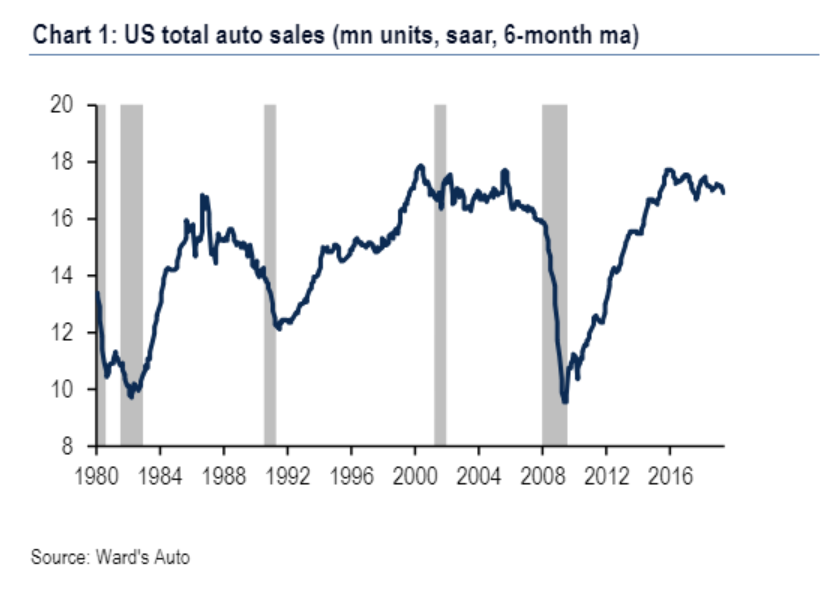

Recall, at the beginning of June we noted that Bank of America had said that “the auto cycle had peaked”.

While Bank of America attributed much of the downturn in the manufacturing sector to the ongoing trade war, it singled out the automotive industry as a specific area for concern. Calling the problem a “classic story of demand/supply mismatch”, the bank pointed out that producers continue to ramp up output at a time when demand has softened. It’s easy to see in the two following charts – one showing auto sales topping out and the other showing output and production not falling.

via ZeroHedge News https://ift.tt/30jtwUP Tyler Durden