Jay Powell rehearsing his testimony to Congress…

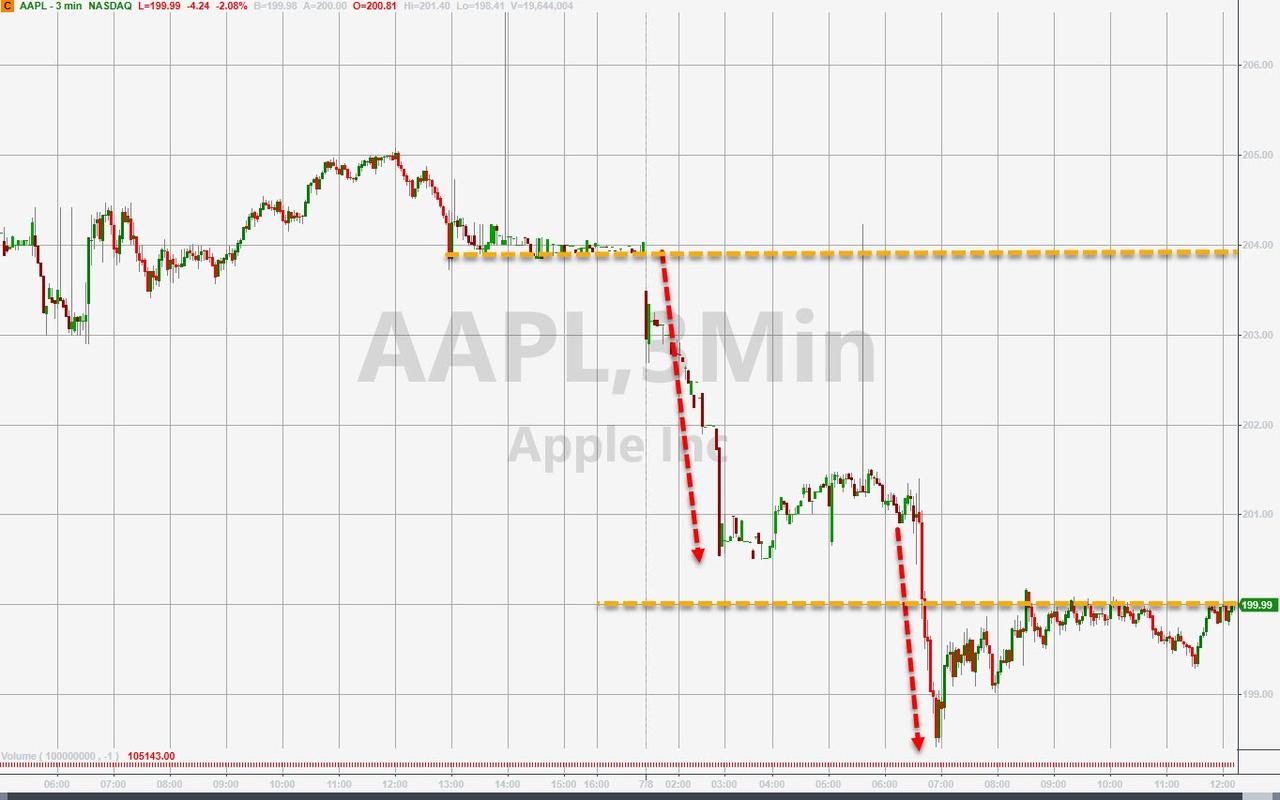

The biggest market news, on a slow news day ahead of Powell’s testimony to Congress, was the downgrade of AAPL – which for once actually sparked some selling (down over 2% and back below $200)…

Apple fell after Rosenblatt Securities downgraded the iPhone maker to sell. That brought the total number of bearish analysts up to five among the 57 ratings tracked by Bloomberg, the highest number since at least 1997.

This weighed down Nasdaq immediately…

On the day, The Dow (weighed down by Boeing) and S&P outperformed the major US peers but all major US equity indices were down…

NOTE – the machines tried to ignite momentum off the opening lows but, for once, it failed.

Defensive stocks dominated trading today (just as they did on Friday)…

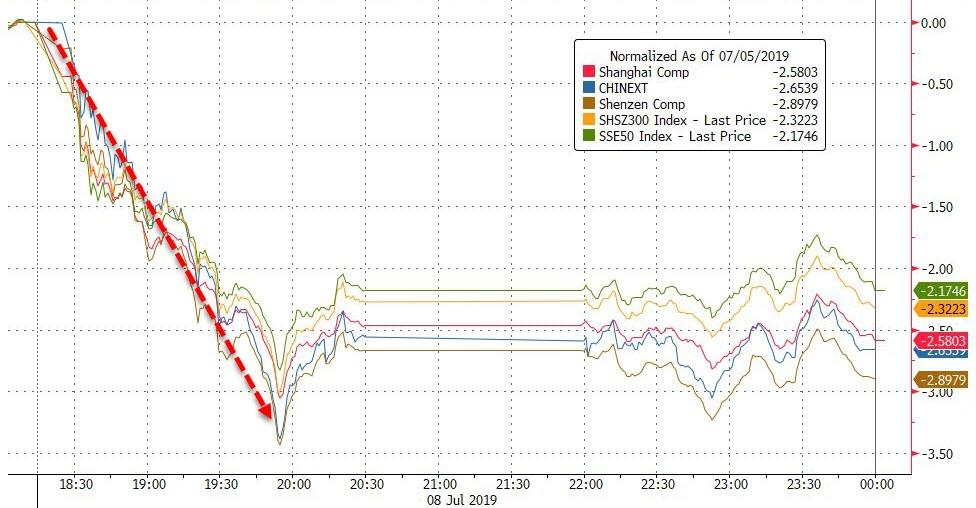

It was ugly overnight in China…

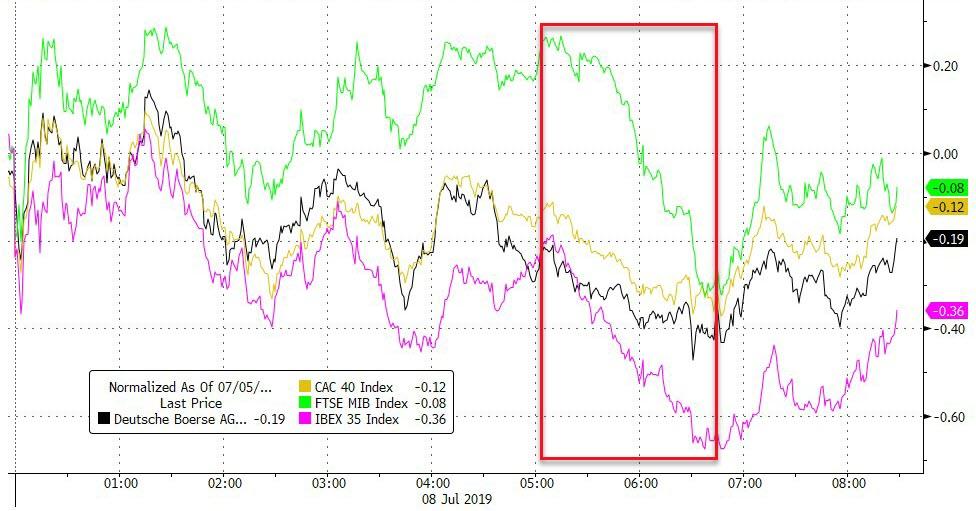

And European stocks were lower on the day…

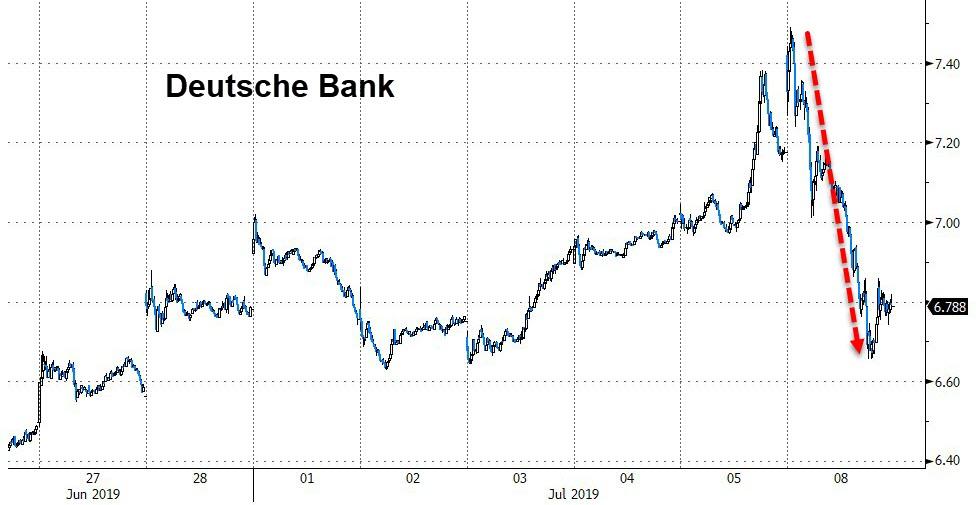

Weakness in Europe was not helped by the collapse of Deutsche Bank after its massive restructuring…

US equities erased all those ridiculous rebound gains and caught back down to bonds, gold, and the dollar…

Most of the Treasury curve was modestly higher in yield today but the longer-end outperformed…

NOTE – yields spiked a little in the last hour as a CBO report on minimum wage hikes hit…

2s30s continues to flatten hard, now below the pre-FOMC levels…

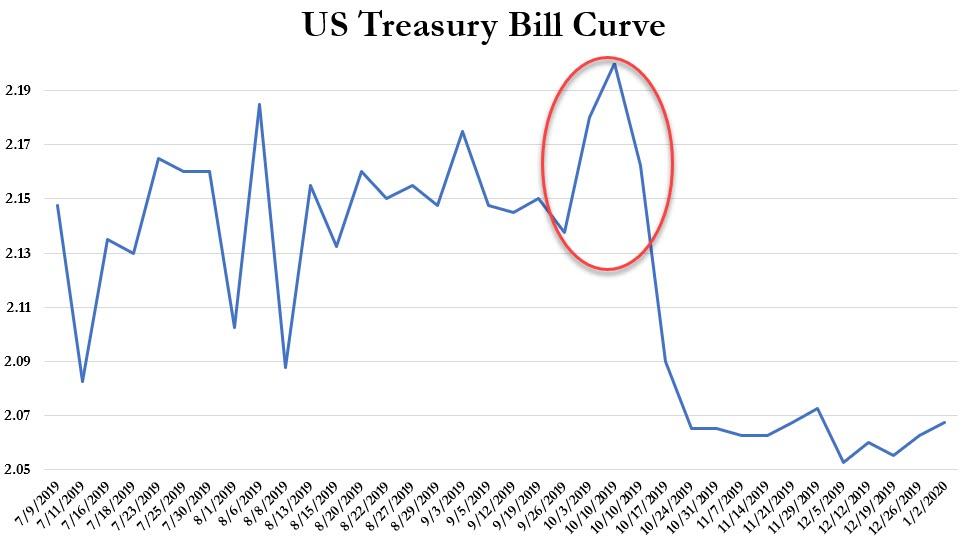

And Debt Ceiling anxiety is starting to impact the T-Bill curve…

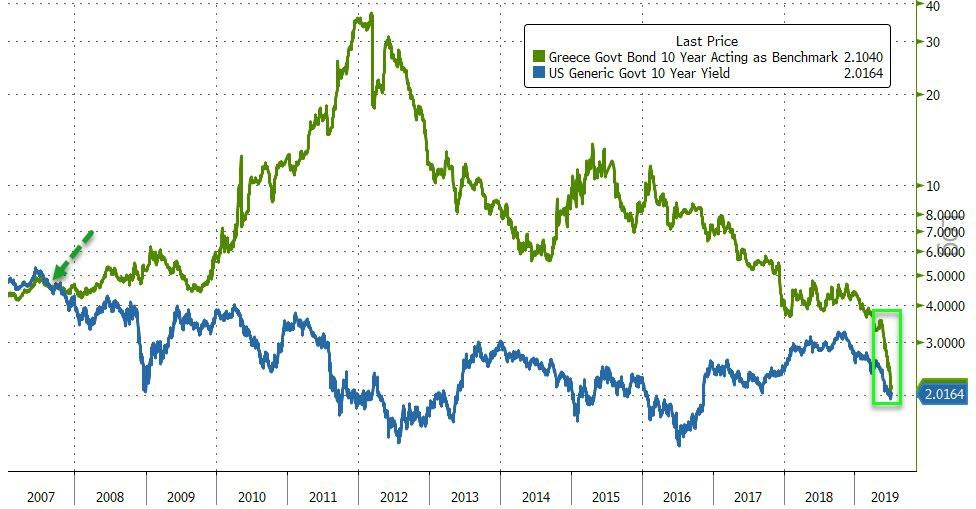

Before we leave bond-land completely, here’s a fun fact – Greek 10Y bond yields fell below US 10Y yields today for the first time since Oct 2007…

The dollar inched higher on the day but remains well off Friday’s spike highs…

The Turkish Lira tumbled after Erdogan fired the central bank chief…

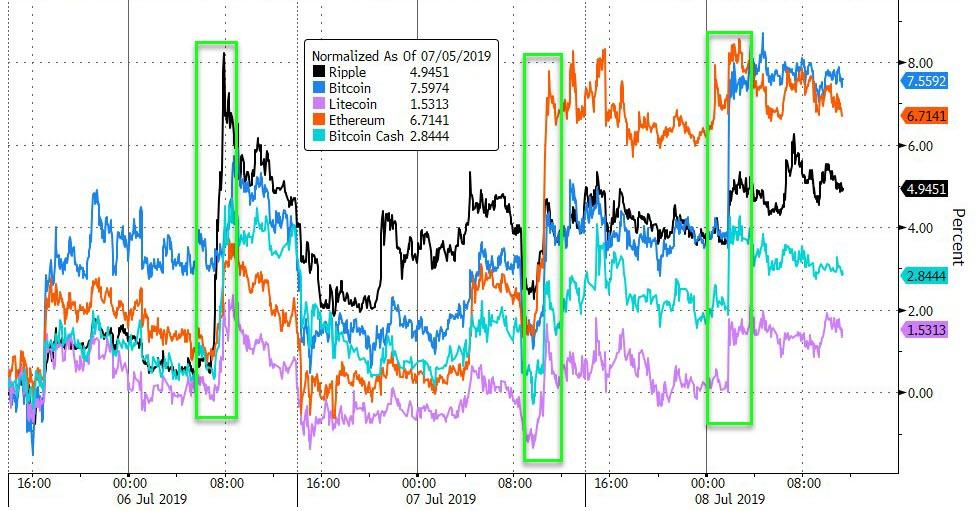

Big positive jolt overnight in cryptos pulled them all green from Friday with Bitcoin and Ethereum leading…

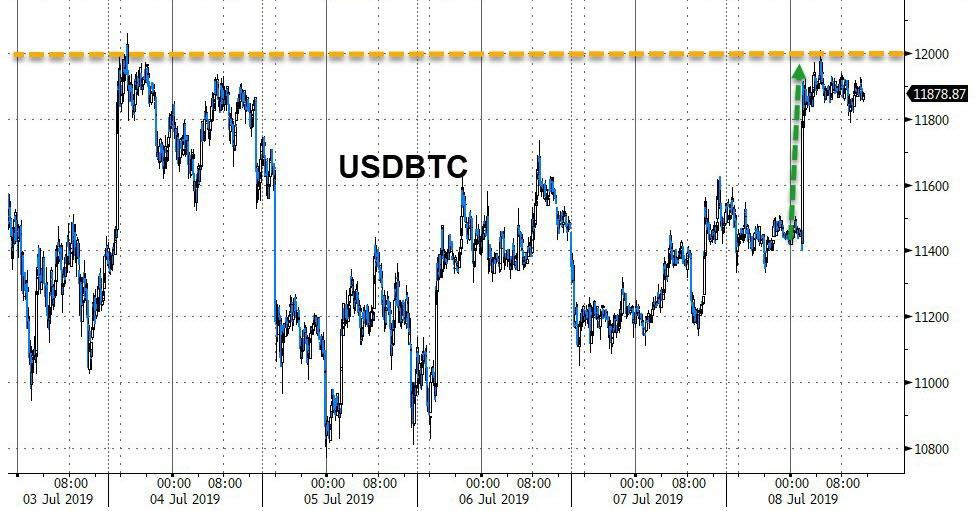

Bitcoin tagged $12,000 this morning but couldn’t quite hold it, for now…

And Ethereum broke back above $300

Silver surprised with some outperformance as copper and gold dipped…oil dropped notably into the NYMEX close…

Gold fell back below $1400…

The Gold/Silver ration pulled back very modestly from 93x once again…

WTI snapped back below $58 as the NYMEX settle loomed…

Finally, in case you’re fed up with hearing about how awesome the economy is BUT we still need an “insurance cut” – here’s Gluskin-Sheff’s David Rosenberg to explain just how bad it actually is…

For those who “can’t see the recession”, it’s illustrated for you in this chart. The NY Fed model now pegs recession risk at 32.9%, a 12-year high. History shows there’s no turning back at this level. pic.twitter.com/hUteBhNOzr

— David Rosenberg (@EconguyRosie) July 8, 2019

Adding insult to injury was the OECD leading indicator, which dipped in May to 99 from 99.1 in April and 99.3 at the turn of the year. The overall level is now the lowest since the global economy was trying its utmost to climb out of the Great Recession in late summer 2009. pic.twitter.com/oQsNormL2j

— David Rosenberg (@EconguyRosie) July 8, 2019

But, of course, we know fun-durr-mentals don’t matter anymore…

Powell better deliver or this entire ponzi will collapse.

via ZeroHedge News https://ift.tt/2Jl0KgY Tyler Durden