As we first reported on Sunday afternoon, after weeks of warning that the fun was coming to an end, Morgan Stanley’s head of cross-asset strategy Andrew Sheets, had enough foreplay and writing that he was “Putting Our Money Where Our Mouth Is”, downgraded Morgan Stanley’s allocation to global equities from equal-weight to underweight, effectively telling the bank’s millions of “wealth managed” clients to sell stocks.

Then, overnight, Morgan Stanley’s entire cross-asset team, including equity doomsayer Michael Wilson, published a note explaining the bank’s rationale for this unprecedented move to turn bearish at a time when penguin after penguin analyst after analyst was chasing the S&P into record high territory, and revising their forecasts higher by the day (here’s looking at you Barclays and your “Melt-up scenario now the base case“).

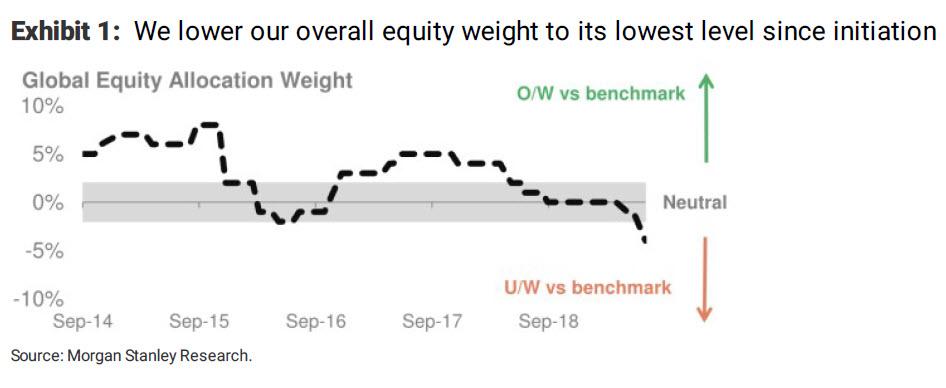

As the bank writes, “we’re reducing our overall equity weight via reduction in US and EM equities, the regions with the lowest upside to our 12-month price targets. Our global equity weight is now -4 (on a scale of +10 to -10)” which is the lowest since the bank initiated coverage in 2014, in other words on record.

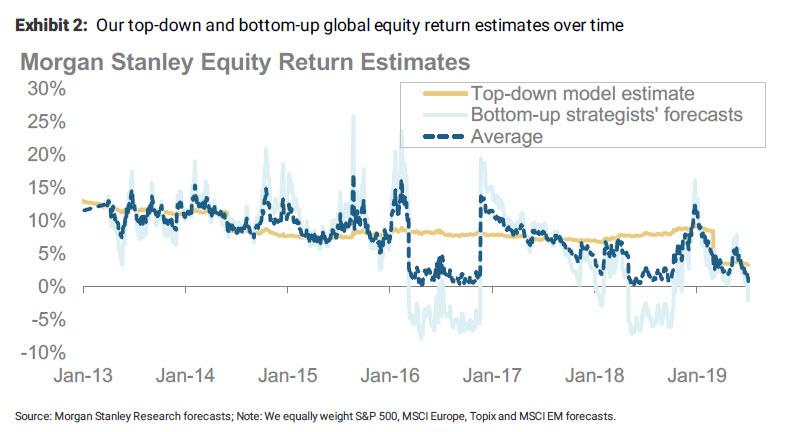

The reason for the bank’s sudden bearish turn is that in its view, the expected risk-adjusted returns for global equities have fallen sharply, “under both Morgan Stanley forecasts and our top-down cycle-adjusted numbers”, and combined, the average expected return for global stocks is near a six-year low.

What are the reasons for this gloomy forecast? As the bank explains, three broad dynamics drive a more cautious equity view:

- Valuations/expected return: Higher prices now mean our expected 12-month returns for global equities are near their lowest levels in six years. That result is similar based on bottom-up Morgan Stanley forecasts or top-down approaches.

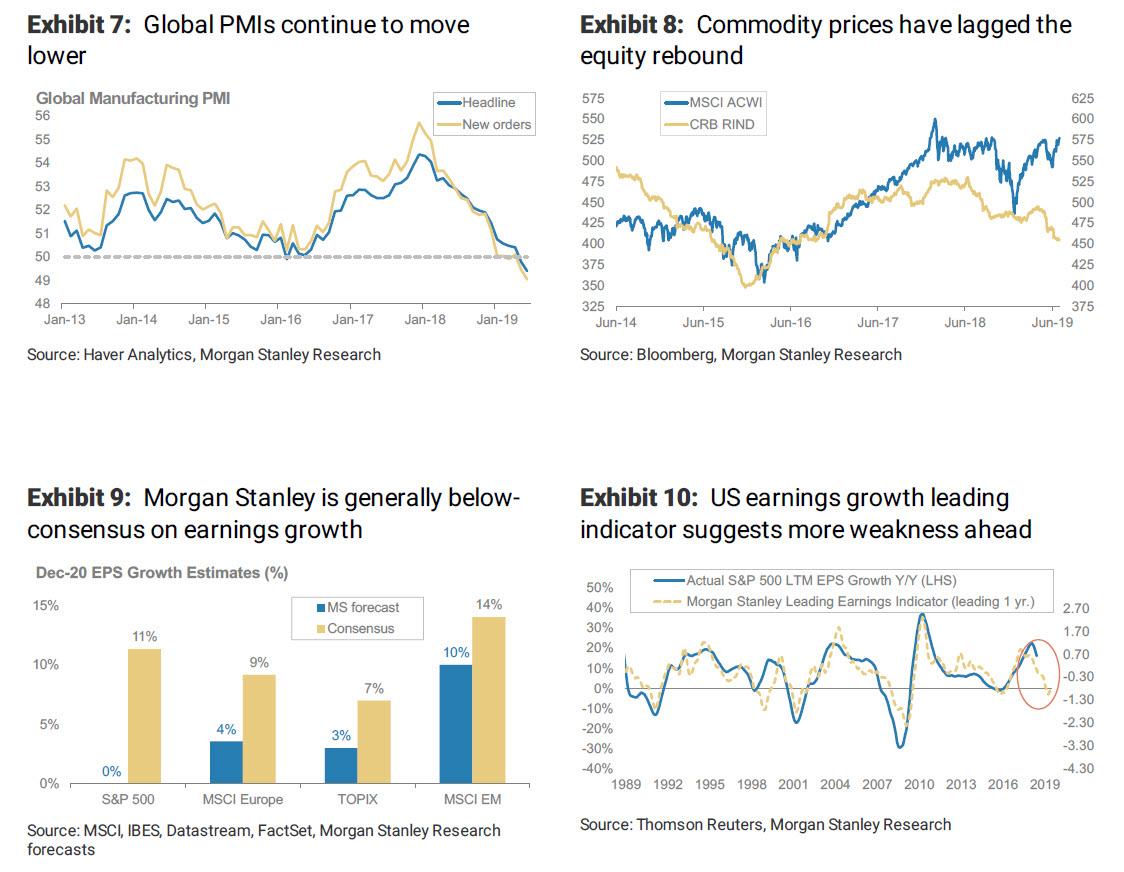

- Fundamentals: Those valuations face additional pressure as we think consensus earnings in the US, Europe, Japan and emerging markets remain too high. Meanwhile, continued weakness in global PMIs and commodity prices suggests that the economic risks are real.

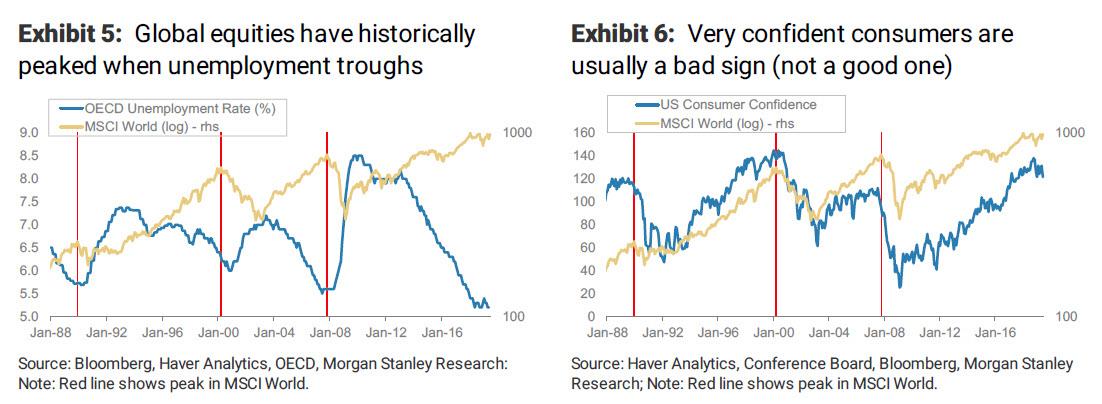

- Technicals: While positioning isn’t heavy and sentiment is far from ‘euphoric’, we see worrying signs in other ‘technical’ factors including market leadership and seasonality. Meanwhile, crowding does look significant within sector and style

Adding to the downside pressure, the “pause” in US/China trade tensions out of the G20 is not sufficient to undo the damage already inflicted on corporate confidence and investment, leading the bank’s economists to lower their prior estimates for global growth. Meanwhile, expectations for central bank accommodation are high, which means the market can only be disappointed if the Fed or other central banks refuse to cater to the market’s every whim.

Why is MS doing this now? As it notes, “the G20 ‘pause’ resulted in lower Morgan Stanley global growth forecasts. We think 2Q earnings could lead to weaker guidance. Seasonality tends to get worse from mid-July to mid-October as liquidity weakens.“

As Sheets wrote on Sunday, “for trivia fans out there, July 13-October 12 has historically been the worst 90-day period for equity returns since 1990, possibly because liquidity and risk appetite tend to worsen after 2Q results.”

Additionally, as the bank notes today, a variety of indicators it follows have been flashing more cyclical caution: its US cycle indicator has moved to ‘downturn’, which feeds directly into its return framework. Global PMIs continue to move lower, rapidly approaching levels seen under much worse equity conditions in 2011, 2012 and 2016. Commodity prices have conspicuously lagged the equity rebound, and neither the yield curve nor inflation expectations reflect much bond

market confidence that central bank easing will ‘work’, reviving growth and realized inflation.

For these reasons, Morgan Stanley reduces global equities to underweight, moving from -1 to -4, while while the bank concedes “is not ‘maximum negativity’ it does think it reflects the poor risk/reward we now see for global stocks, and a number of approaching challenges.”

What is the catalyst “to focus the market on these dynamics?” According to Sheets et al, “it will be 2Q earnings season, which kicks off in earnest next week.” Morgan Stanley elaborates that it is below-consensus on earnings growth, and believes that 2Q reporting could act as a catalyst to bring numbers down.

Additionally, layoff announcements and capex guidance will be other features to watch through reporting season. However, if earnings and employment prove more resilient than we expect, and if global growth starts to inflect higher through 2H19, we may need to reevaluate our view.

Finally, while the bank is fairly confident things are about to go south, as a hedge laying out where it could be wrong, the bank cautions that – naturally – the biggest risk is even more dovish central banks, to wit: “where could we be wrong: further policy easing in line with our economists’ call could boost markets, although we think that the effect could be offset by weaker data and already high central bank expectations.”

Additionally, global data improving as central banks ease would be bullish for the market: “a bear steepening in yields, higher inflation and higher commodity prices would reflect this view”

via ZeroHedge News https://ift.tt/32gIexF Tyler Durden