President Trump has renewed his attacks on the greenback lately by ratcheting up pressure on the Fed to deliver a steep rate cut this month (which, in Trump’s mind, would help Powell stay one step ahead of the uber-dove Mario Draghi and his probable successor, Christine Lagarde), and accusing Europe and China of manipulating their currencies to disadvantage the US.

And according to the most recent report from Bloomberg, Trump has tasked his aides with figuring out exactly what can be done to safely weaken the greenback, and he has also asked both Judy Shelton and Christopher Waller, his two latest nominees to fill the empty Fed board seats, about their views on the dollar.

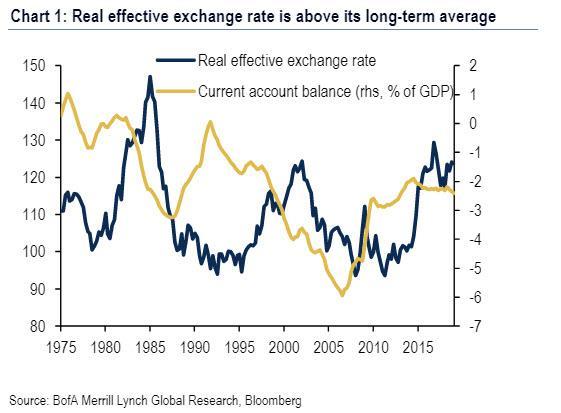

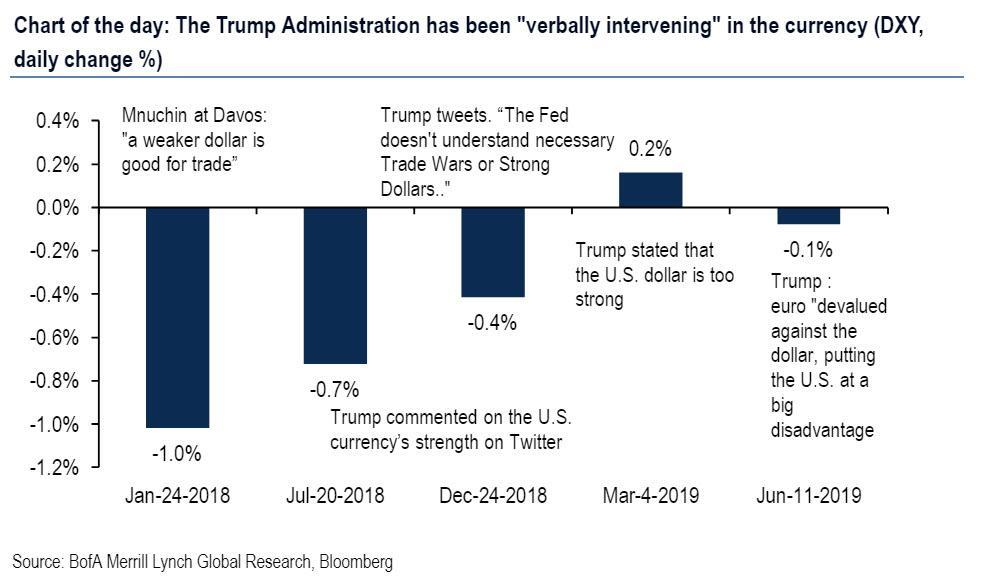

So far, Trump’s attacks on the dollar have been mostly bluster. But as Bank of America pointed out in a notably prescient research note published last month, jawboning is one of Trump’s most reliable tools for knocking down the dollar. BofA affirmed that the dollar is trading 13% above its long-term average, a sign that Trump is correct to call it overvalued.

BofA warned that the administration might soon take direct action to weaken the dollar, either through jawboning, or perhaps even direct intervention via the New York Fed’s markets desk. Pressing the Fed to ease – although the odds of a rate cut have fallen since Friday’s surprisingly robust jobs report – is another option outlined by BofA. A weaker dollar would, in theory, help bolster US exports and act as a shot in the arm for the economy as Trump prepares to battle it out for a second term.

And as BofA showed, incidences of Trump jawboning the dollar have grown more frequent over the past year.

Of course, when moving to weaken the dollar, the Trump administration must tread carefully or risk igniting an all-out currency more among its G-20 allies. In a communique, the group agreed to avoid targeting exchange rates for the purposes of competitive devaluation. Though there is some wiggle room: temporary interventions to stabilize one’s currency would be permitted under the agreement.

During his interview with Trump, Waller, currently the head of research at the St. Louis Fed, led by the dovish James Bullard, said the Fed doesn’t explicitly target exchange rates (then again, that’s what they all say). But one of Trump’s top economic officials, Larry Kudlow, appeared to come around to his boss’s position during an interview with CNBC on Tuesday, where he said that “price level stability and a steady dollar” should be the primary objectives of Fed policy, not employment.

Wall Street strategists are starting to come around to the notion that the greenback’s impressive bull run may have reached a Trump-assisted inflection point.

“Although it would be highly unusual for a US government to attempt further measures to weaken the dollar, it is not beyond the realms of possibility that the Trump administration will try,” said Jane Foley, head of currency strategy for Rabobank.

When it comes to strategies for weakening the greenback, Trump could seek a ‘Plaza Accord 2.0’ with other major economies (since a weaker dollar is broadly in the interest of emerging-market economies that borrow in dollars). Mnuchin could also order the Fed to intervene, as we mentioned above, using money from the Treasury’s exchange stabilization fund and the Fed’s own dollar-denominated assets.

Intervening to weaken the dollar is one thing: Doing it in a way that’s sustainable would be significantly more difficult. That’s because a weaker dollar would stoke inflationary pressures by making imports more expensive. This, in turn, would likely push yields higher and pressure the Fed to hike interest rates.

But even if the administration doesn’t succeed, Trump has already set up the greenback as the perfect scapegoat if the economy goes south between now and election day, 2020. The strong dollar left the US at a competitive disadvantage – and the Fed, not Trump, should shoulder the blame.

via ZeroHedge News https://ift.tt/30xAuG9 Tyler Durden