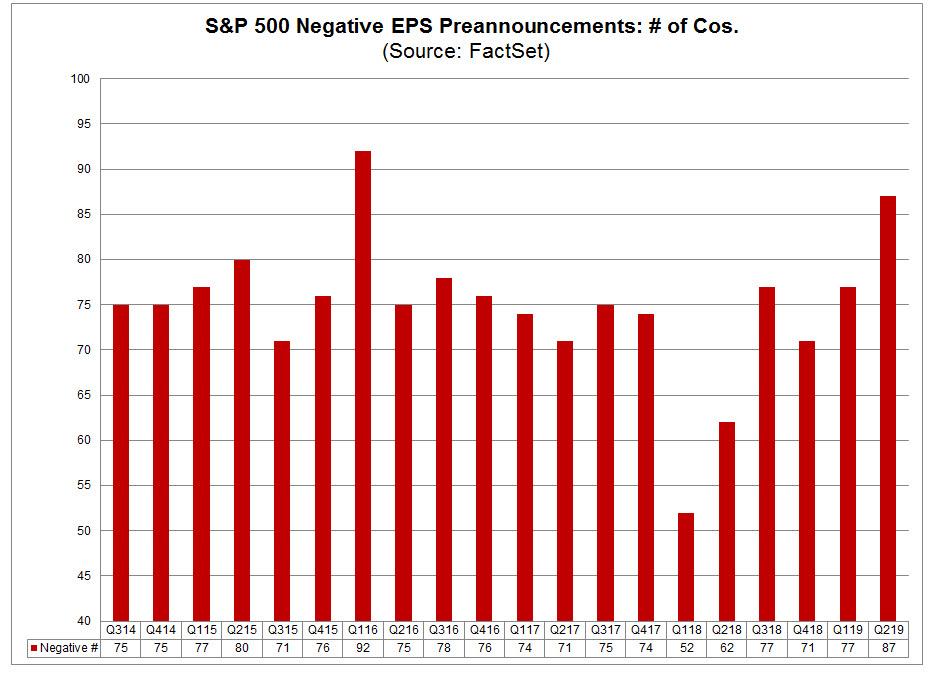

One of the biggest walls of worry facing the market, now that both the US-China “ceasefire” and the Fed’s imminent rate cut are in the rearview mirror, is just how bad the coming earnings season will be. As a reminder, last week we showed using Factset data, that the number of companies issuing negative guidance had risen to the second highest on record.

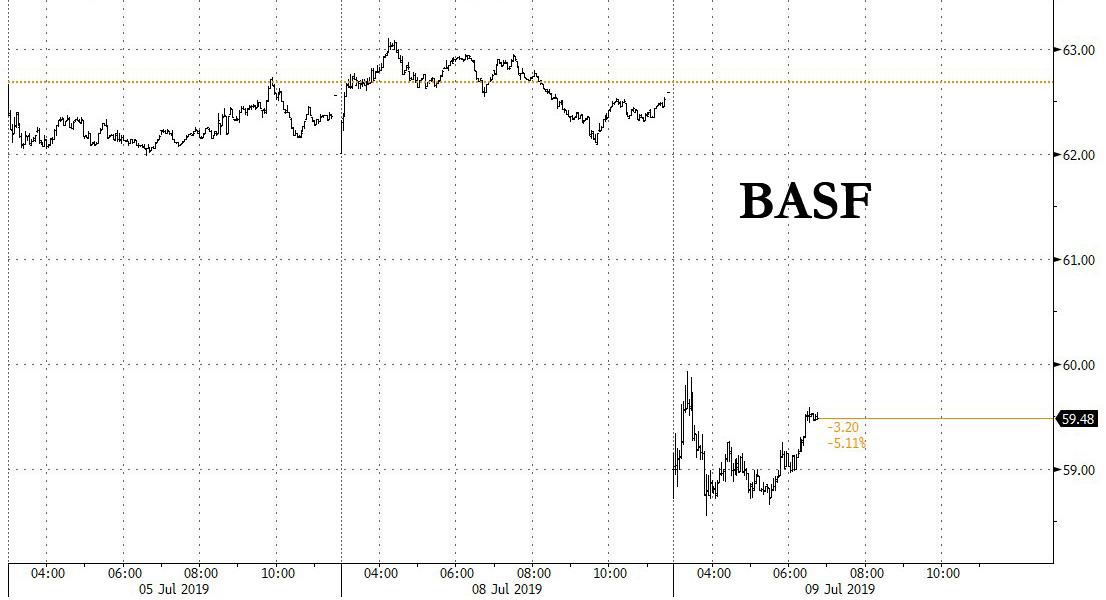

And if Monday’s draconian guidance cut from German chemical giant BASF which sent its stock tumbling…

… wasn’t enough, today’s dismal report by Fastenal suggest that the wall of worry can’t be high enough as the upcoming earnings season may be far worse than even the more pessimistic predictions.

Fastenal, one of the first industrial companies to report earnings and as Barron’s puts it, a “valuable source of insights about the health of US manufacturing”, not to mention the state of global manufacturing supply chains — reported far lower sales and earnings than Wall Street analysts were expecting.

The company earned 36 cents a share, less than half the 74 cent estimate. Revenue also missed, with the company reporting $1.37BN in Q2 sales, below the $1.38BN expected, sending the stock lower by as much as 6% to a low of $29.44, before it recouped some losses as the S&P 500 rose to a new all time high.

What was more concerning than the headline prints was that second-quarter sales growth at the company slowed to 8%, the first sub-10% growth in the past nine quarters. Fastenal highlighted double-digit percentage-point growth in its vending, On-Site and national account business, even as overall activity in its end markets slowed.

As if the data was not self-evident, the company also said it saw some slowing during the period compared to the first quarter.

As a result, profits were clearly squeezed as gross profit declined 1.8% Y/Y, and pretax earnings in the quarter as a percentage of sales dropped to 19.8% vs. 21% y/y

What was most informative about the company’s disappointing earnings report was the commentary, according to which “while we successfully raised prices as one element of our strategy to offset tariffs placed to date on products sourced from China, those increases were not sufficient to also counter general inflation in the marketplace,” the company said in its press release.

“We have taken additional actions in the third quarter of 2019 to counter the broader pressures we are experiencing on our costs as well as the additional tariffs that were levied on China-sourced products in May 2019″ the company previewed the current quarter, although it added gloomily that “the reality is, even in a 10% or 25% tariff environment, they often times are still the lowest cost producer of an item.”

Translation: profits are coming down. Fast.

As a result, FAST took additional actions in the third quarter to counter the broader pressures on costs, as well as the additional tariffs that were levied on China-sourced products in May. To be sure, while the increase in costs stemming from trade issues is a problem, analysts will likely focus more on the slowdown in sales growth.

As Barron’s adds, Fastenal’s results follow news of a poor quarterly performance from MSC Industrial Direct (MSM), another distributor of parts and other gear for manufacturing. MSC’s results missed Wall Street’s expectations and management issued a sales forecast for the current quarter that was below what analysts were predicting.

The question now is whether Fastenal is a gloomy harbinger of what to expect from other companies with Chinese exposure, and if so, just how big will the margin contraction be across the US manufacturing sector in particular, and the S&P in general.

via ZeroHedge News https://ift.tt/2XNffhS Tyler Durden