Authored by Fred Dunkley via SafeHaven.com,

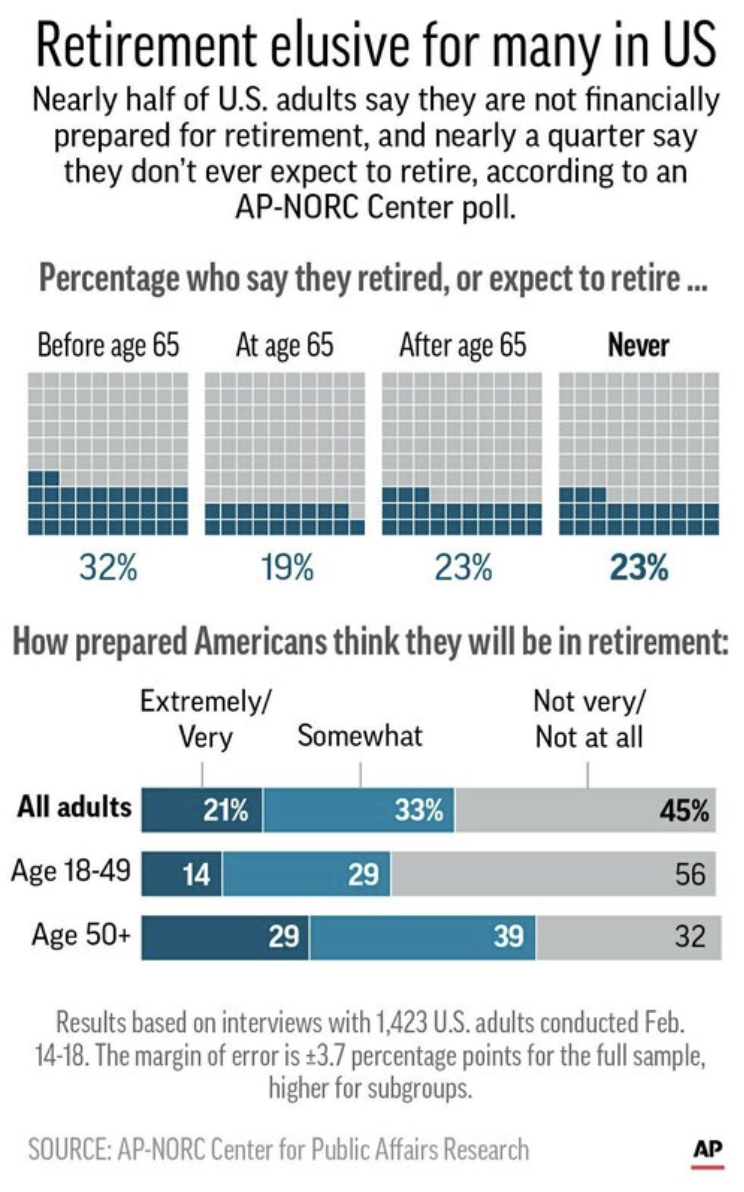

The word “retirement” used to describe the well-deserved free time that one earned after a long and productive work life. Not anymore. Today, 23 percent of Americans say they will never retire despite the grim realities of aging, according to a new poll from the Associated Press – NORC Center from Public Affairs Research.

The poll, conducted among 1,423 adults using a sample drawn from NORC’s probability-based AmeriSpeak Panel designed to be representative of the U.S. population, shows a disconnect between individuals’ retirement plans and the realities of aging in the workforce, suggesting that 23 percent of workers, including nearly two in ten of those over 50, don’t expect to stop working.

(Click to enlarge)

Source: AP-NORC Center for Public Affairs Research

Money was the primary reason for the delayed retirement; the poll shows that only 14 percent of Americans under the age of 50 and 29% over 50 say they feel extremely or very prepared. Also, 56 percent of younger adults say they don’t feel prepared for retirement.

Of those who had already retired, 38 percent said they felt they had been very or extremely prepared when they retired, while 25 percent said they had felt not very or not at all prepared.

“The average retirement age that we see in the data has gone up a little bit, but it hasn’t gone up that much,” says Anqi Chen, assistant director of savings research at the Center for Retirement Research at Boston College.

“So people have to live in retirement much longer, and they may not have enough assets to support themselves in retirement.”

A survey from Northwestern Mutual shows similar figures. Nearly half of Americans say they expect to work past age 65 and 18 percent of baby boomers and generation X say they plan to work until age 75 and beyond. The background of these figures once again shows that Americans are short on savings–56 percent of the respondents don’t even know how much money they should be saving, the Northwestern Mutual survey found.

Those who still think they know how much they should be saving, according to Charles Schwab survey, believe they need $1.7 million on average to retire, but most of them are still not even close to that number.

“That’s a pretty good number if you average out age and median salary across the U.S.,” said Nathan Voris, a managing director at Schwab Retirement Plan Services.

However, “the bulk of folks do not get there,” he said.

The estimate for 2016 from the U.S. Government Accountability Office released this March shows that 48 percent of those 55 and older had nothing put away in a 401(k)-style defined contribution plan or an individual retirement account, which is an improvement from the 52 percent without retirement money in 2013.

The Employee Benefit Research Institute found that Americans from households headed by someone age 35 to 64 face a combined retirement deficit of $3.83 trillion. EBRI estimates that 41 percent of these Americans are likely to run out of money in retirement, which is down 1.7 percentage points since 2014.

But what is really the average retirement age in the U.S.?

Using microdata on labor force participation from the U.S. Census Bureau, Smartasset data from 2017 found that national retirement age hasn’t changed and that by age 63 nearly half of the population is no longer working.

Many retirements are unexpected due to unforeseen circumstances such as health problems, disability or layoffs. Rare are those who are able to retire early because of an inheritance or diligent saving.

via ZeroHedge News https://ift.tt/2Ga5FQ9 Tyler Durden