Authored by Janet McGurty at Platts

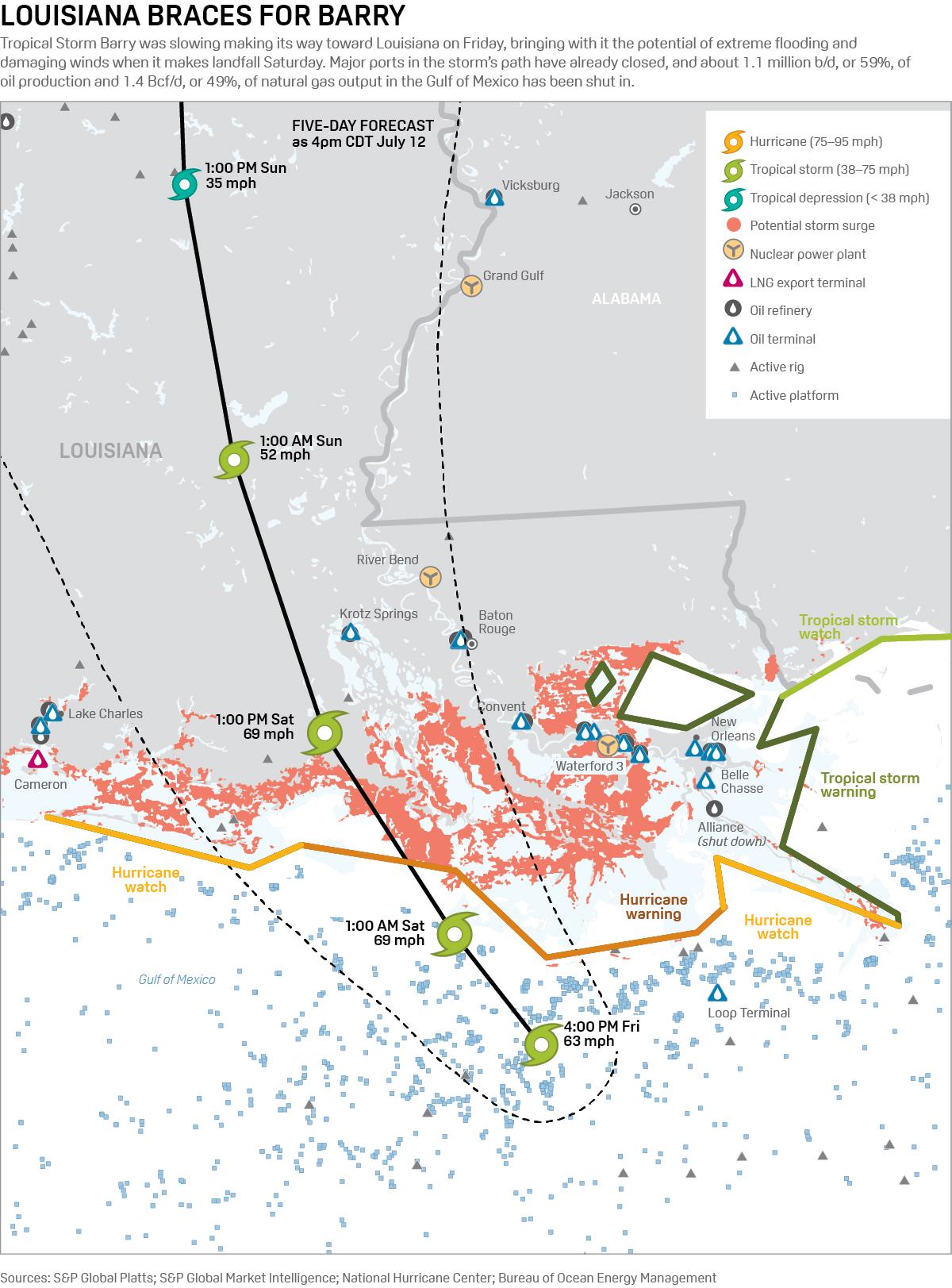

Tropical Storm Barry is expected to make landfall over the central Louisiana Coast Saturday, bringing the potential for extreme flooding, National Hurricane Center information showed Friday.

The NHC forecasts storm winds could reach hurricane strength when Barry reaches the Louisiana Coast. But the slow movement of Tropical Storm Barry will result in a long, heavy rainfall and flooding along the central Gulf Coast. The NHC has warned that extreme rain will flood the coastal regions south of Baton Rouge and New Orleans.

This could impact operations at regional refineries.

Phillips 66 Friday completed the “orderly shutdown” of its 294,700 b/d Alliance refinery in Belle Chasse, Louisiana, because of the mandatory evacuation of Plaquemines Parish. While crude and feedstock processing has ceased at the plant, Phillips 66 said utilities at the facility “remain active for restart facilities to begin as soon as it is safe to do so.”

Other regional refiners remain watchful, but are unlikely to shut down plants because they are not in the direct path of Barry.

“We continue to closely monitor the storm, follow [the] hurricane preparedness plan, as well as coordinate with appropriate local agencies,” Valero spokeswoman Lillian Riojas said.

Valero has two refineries in the New Orleans region — the 125,000 b/d Meraux plant and the 215,000 b/d Norco facility.

Chevron, ExxonMobil, and Shell said their USGC refineries were operating normally.

About 1.1 million b/d, or 59%, of oil production and 1.4 Bcf/d, or 49%, of natural gas output in the Gulf of Mexico remained shut-in as Tropical Storm Barry approached, the US Bureau of Safety and Environmental Enforcement said Friday.

Port Impact

Shipping disruptions by US Gulf Coast port closures have supported European diesel and gasoline markets as market players there expect delays in getting product from the USGC, which pushed down refined product futures during morning US trading.

NYMEX August RBOB settled 1.25 cents lower at $1.9770/gal, while August ULSD finished 15 points higher at $1.9801/gal.

In the spot market, USGC USGC RBOB at 7.8 RVP traded at NYMEX RBOB plus 3.50 cents/gal on Friday morning, up from plus 2.25 cents/gal Thursday, a level not seen since early May.

Prices were being driven both by storm concerns as well as reports of work planned at Marathon’s Galveston, Texas, refinery.

A spokeswoman for the Louisiana Department of Environmental Quality said the Stolthaven terminal in New Orleans had shut down. The facility has 85 tanks.

The Port of New Orleans late Thursday was set at Port Condition Yankee, closing it to incoming traffic. However, along the more western Gulf Coast export facilities shipping restrictions were lifted and operations returned to normal as the USCG rescinded the Port Condition Whiskey in effect at the ports of Houston, Galveston, Freeport, and Texas City.

LNG Output

There are six US Gulf Coast liquefaction trains with total capacity of about 3.6 Bcf/d in operation at two terminals within range of potential impact from Tropical Storm Barry, based on the current track.

Based on feedgas flows, LNG production appeared to be continuing Friday at Cheniere Energy’s Sabine Pass terminal in Cameron Parish, Louisiana, and Sempra Energy’s Cameron LNG facility in Hackberry, Louisiana.

The biggest impact to the terminals in operation could come from vessel traffic restrictions along the intracoastal waterways that serve the terminals.

Sabine Pilots lifted a suspension on inbound tanker transits along the intracoastal waterway that serves the Sabine Pass terminal, and as of mid-afternoon Friday one tanker was in the inlet, while two more were positioned outside in the Gulf of Mexico, cFlow, Platts trade flow software, showed.

At Cameron LNG, however, the facility was not scheduled to receive any tankers to load for export for the duration of the storm, a spokeswoman said after Lake Charles pilots advised they would be temporarily suspending service along the intracoastal waterway that serves the Louisiana terminal.

Crude Impact

Mars was heard bid Friday morning at WTI cash plus $3.80/b and offered at plus $4.10/b. That’s up from Thursday’s assessment of Mars at WTI plus $3.60/b.

Chevron, Anadarko, and BP Wednesday started shutting US Gulf of Mexico production and evacuating staff from drilling and production platforms, while Shell evacuated nonessential staff, but continued with reduced production.

BSEE said 191 platforms and seven non-dynamically positioned rigs have been evacuated, and 11 dynamically positioned rigs have been moved off site.

Tropical Storm Barry could cut Gulf of Mexico crude production 230,000-320,000 b/d in July, according to S&P Global Platts Analytics estimates Friday.

Chevron shut production at its Big Foot, Blind Faith, Genesis, Petronius and Tahiti platforms but will continue production at the Jack St. Malo deepwater project. Chevron Pipe Line stopped receiving and delivering crude out of its Fourchon and Empire terminals

Anadarko shut production at its Constitution, Heidelberg, Holstein, and Marco Polo platforms in the central Gulf of Mexico and removed all staff from the facilities. The driller also removed nonessential staff from its eastern Gulf of Mexico facilities.

BP started removing staff and shutting production at BP-operated platforms “across the Gulf,” without giving further details. Sources said Thunder Horse, Atlantic, Mad Dog, and Na Kika were affected. Shell has slowed production at its Olympus project by 1,835 b/d and at its Mars project by 700 b/d. It also cut production at Appomattox.

Natural Gas

Natural gas cash prices in the Southeast and East Texas were mixed Friday, as Tropical Storm Barry has greatly reduced Gulf of Mexico gas production.

With the exception of Henry Hub, Florida Gas Zone 3, and Transco Zone 3, prices in the Southeast trended slightly down in Friday trading. Henry Hub was trading 1.1 cents higher at $2.487/MMBtu. Houston Ship Channel was trading 4.6 cents lower at $2.388/MMBtu and Carthage Hub was trading 7.5 cents lower at $2.30/MMBtu.

Barry’s impact has not only been felt in reduced production; demand forecasts also have been lowered as a result.

Power Interests

Meanwhile, in the electricity sector, the wholesale power price outlook for the central Gulf Coast area expected to feel the main brunt of the storm remained murky, as traders on the Intercontinental Exchange avoided posting bids or offers for most of Friday for the Midcontinent Independent System Operator’s Louisiana Hub.

But MISO forecast higher peakloads across its vast footprint Saturday, 106.7 GW, compared with 100.5 GW last Saturday and an average of 95.6 GW for every July Saturday since 2014. This may reflect greater heat outside of the MISO South region, and may mitigate lower Louisiana Hub prices that might be expected as the storm cuts service to customers in the region.

Entergy’s Louisiana utilities have assembled a team of 1,200 people to respond to the storm and restore service, and another 770 workers from neighboring Entergy utilities have been mobilized.

via ZeroHedge News https://ift.tt/32om6Sj Tyler Durden