“There’s an art to knowing when to leave the party,” warns Pilar Gomez-Bravo, a portfolio manager at MFS Investment Management with $4.5 billion AUM, who sees eerie similarities between the current frenzy for risk and the speculative mania that made her cautious on the eve of the last bubble.

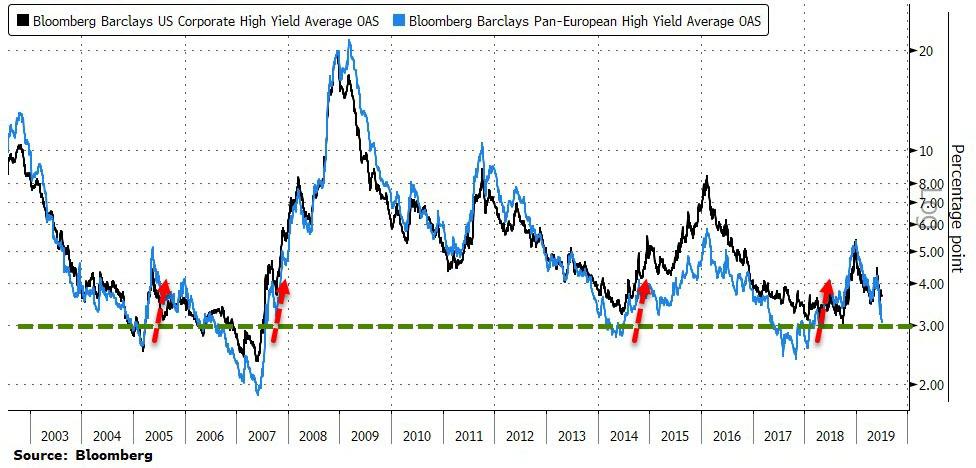

As Bloomberg reports, she’s selling junk bonds in a contrarian bet that the debt rally is on its last legs – with the potential to trap funds with billions staked in levered and often illiquid assets – cutting high-yield exposure to 10% from as high as 30% in 2016, in one of her unconstrained funds.

“There’s more risk than reward right now,” she said.

“There are real end-of-cycle fears about what performs.”

From her vantage point managing a slew of global credit funds, she sees the long-bemoaned opacity and leverage of junk issuers is now at a tipping point.

We’ve seen this farce before, as Bloomberg details, when Lehman went bust, the mother of four was a portfolio manager at its investment arm, but before that, in May 2007, Gomez-Bravo became cautious on U.S. risk and issued warnings on corporate health – which bear echoes with the intense hunt for yield today.

“Everything was bid indiscriminately,” she recalls.

“I knew things were heating up; there were telltale signs. It’s always difficult to leave money on the table, but as a result we avoided the blow-ups.”

So, as far as knowing when to leave the party this time, we come full circle with Gomez-Bravo’s current warning:

“In fact it’s over — people are desperate and they’re hunting down the after-party. We probably only have a few hours left.”

Trade Accordingly.

via ZeroHedge News https://ift.tt/2XHBOJn Tyler Durden