Authored by EconomicPrism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

A Good Story with Minor Imperfections

“If you don’t know where you are going, any road will get you there,” is a quote that’s oft misattributed to Lewis Carrol. The fact that there is ambiguity about who is behind this quote on ambiguity seems fitting. For our purposes today, the spirit of the quote is what we are after. We think it may help elucidate the strange and confusing world of fake money in which we all travel.

Consumer price index, y/y rate of change – the Fed is not satisfied with the speed at which monetary debasement raises everybody’s cost of living lately. And no, they don’t think said speed should be lowered. [PT]

For example, the monetary policy outlook immediately following last month’s FOMC meeting was as clear as a flawless (FL grade) diamond. The principal message, if you recall, was that inflation was muted and the Fed, after suffering an overt beating from President Trump, would soon be shaving basis points off the federal funds rate. You could darn near take it to the bank.

Wall Street took the news and acted upon it with conviction. Investors piled into stocks and bonds without pausing to take a closer look for imperfections. Why worry when fortune favors the bold?

From June 19 through Wednesday July 3, everything held up according to plan. The S&P 500 rallied 2.5 percent to close at a new all-time high of 2,995. The yield on the 10-Year Treasury note, over this period, dropped 13 basis points, as mindless buyers positioned to front run the Fed.

But then, in the form of Friday’s job’s report, several feathers of imperfection were identified. According to the Bureau of Labor Statistics, the U.S. economy added 224,000 jobs in June. This far exceeded the consensus estimates of 160,000 new jobs. As this week began, doubt and hesitation crept into the market. What to make of it?

Powell Stays on Point

To begin, in today’s fake money world, clear thinking and honest appraisal are handicaps for investors. What is really important is the inverse relationship between the economy and the stock market. Good economic reports are bad for stocks. Conversely, bad economic reports are good for stocks.

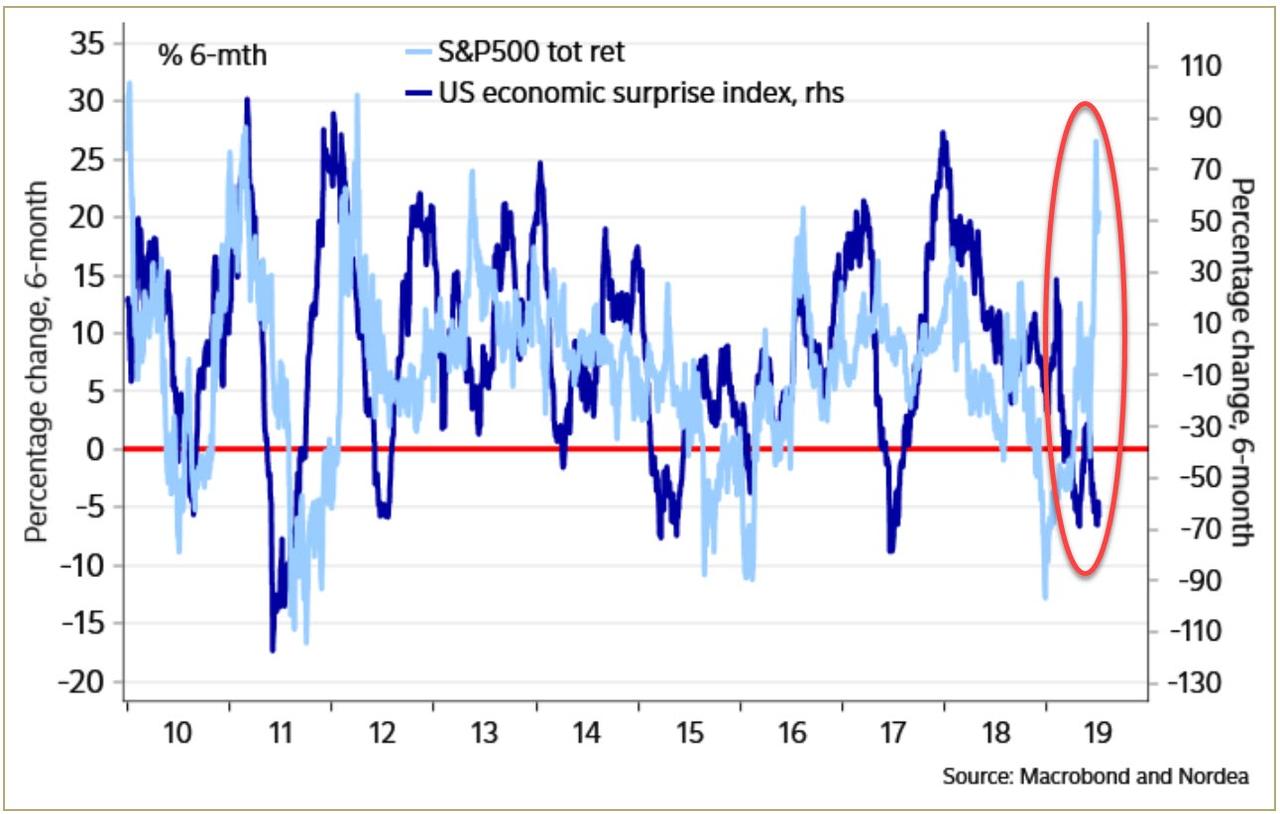

S&P 500 Index performance vs. US macroeconomic data surprises – this is the biggest disconnect ever observed. [PT]

According to the prevailing logic, with unemployment below 4 percent, real GDP growth at an annual rate of 3.1 percent, and stocks at all-time highs, the Fed shouldn’t be cutting rates. Instead, it should be raising rates. But if the Fed raises rates, there will be less cheap credit to speculate on stocks with. Therefore, stocks will go down.

So how can the Fed possibly cut rates later this month when the economy’s headline numbers appear so doggone good? This question, and many others, greeted Fed Chairman Jay Powell this week during his two-day semiannual testimony on monetary policy to the House Financial Services Committee and the Senate Banking Committee.

Powell – that is, the post pivot dovish Powell – stayed on point. Specifically, he did what he needed to do to propel stocks to what Irving Fisher once called a “permanently high plateau.” He told Chairman Crapo and other committee members that the economy is soft, but not too soft. And that the Fed will use its policy tools to, somehow, boost the economy.

Of course, Wall Street was tickled pink. First, the S&P 500 hit a new all-time high over 3,000. Then, the Dow Jones Industrial Average eclipsed 27,000 for the first time ever. These milestones were toppled in such rapid succession that Art Cashin hardly had a chance to change hats.

Cashin did find time to don an SPX 3,000 hat – coincident with Powell’s first day of testimony. Powell reassured everyone that the rate cut was still on, regardless of the stronger than expected payrolls report. [PT]

The Four Dimensions of the Fake Money Order

The stock market is no longer about pricing anticipated future earnings or business profits. It is merely about front running the Fed’s applications of cheap credit. That is why weak economic reports, which provide cover for more monetary stimulus, are bullish.

Fake money has taken us to this strange and confusing place. By fake money, we mean legal tender that is conjured at will by central planners. Fake money includes the dollar, euro, yen, yuan, pound, peso, loonie, toonie, and practically all other world currencies.

Remember, if you don’t know where you are going, any road will get you there. Alas, the fake money order has taken us to the four dimensions of debasement, distortion, disfiguration, and destruction. How each dimension progresses to the next is somewhat ambiguous. Though it generally advances as follows…

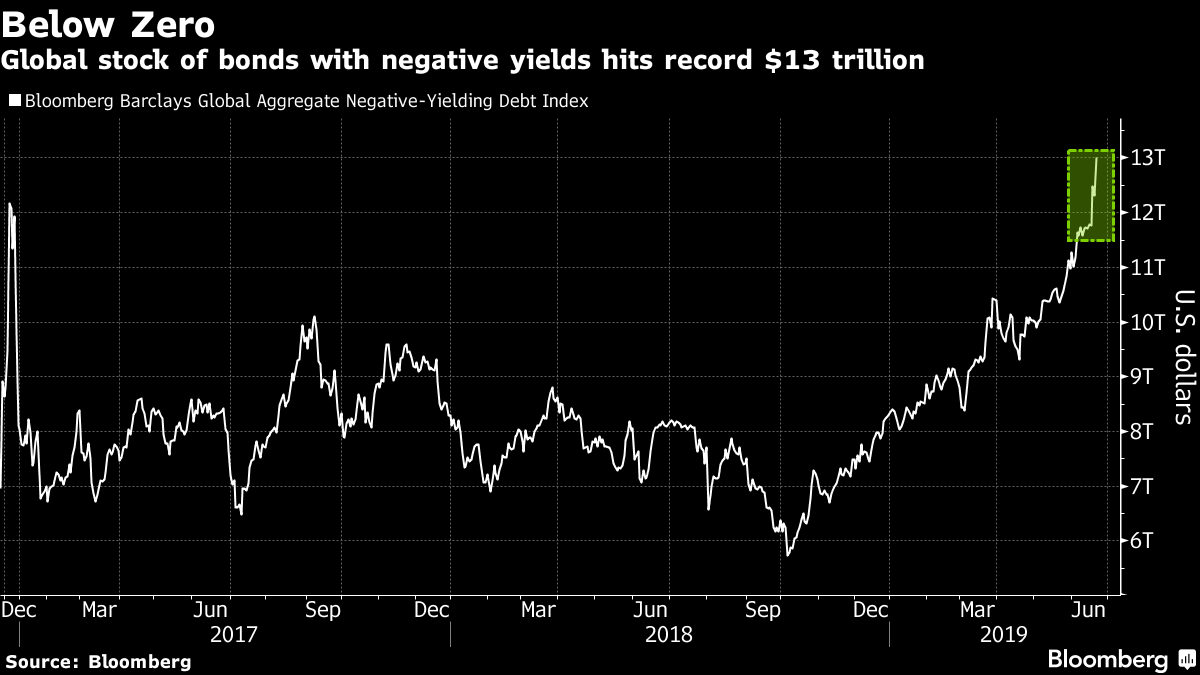

The dollar is debased through centrally planned and coordinated applications of monetary and fiscal stimulus. These stimulus applications distort financial markets to where the S&P 500 is at 3,000, the DJIA is at 27,000, there is $13 trillion in subzero yielding debt, and shacks sell for a million bucks.

Going “parabolic” – in a stunning display of collective insanity, the amount of outstanding government debt with negative yields to maturity hits a new record high of $13 trillion in what appears to be an unseemly hurry. Buying debt securities with a negative yield is a trade that relies 100% on the greater fool theory to be profitable. So far there is evidently no shortage of greater fools, so the theory works – for now. Our wild guess is that this absurdity is not destined for a happy end. [PT]

They disfigure the economy through mass applications of concrete to the landscape, unwarranted building booms, glass skyscrapers with polished concrete floors and urban industrial pendant lighting, demolition of cars that aren’t really clunkers, and other disfigurements undertaken to support a cheap credit induced false demand.

Lastly, is the fourth dimension of destruction. This is when the books are reckoned via hyperinflation, debt deflation, wide-ranging bankruptcy, or any combination thereof.

The fourth dimension is also when government’s become extremely intolerable as they try anything and everything to hold onto their power. This week, no doubt, advanced us further toward this unpleasant end.

via ZeroHedge News https://ift.tt/2LT2AaO Tyler Durden