Authored by Bloomberg’s Richard Breslow,

Officially-set interest rates are coming down. This isn’t a surprise. Could Fed Chairman Jerome Powell have been more explicit? But perhaps the breadth of central banks that are going overtly dovish should be given a lot more attention. In a steady stream, more and more are getting in on the act. That fact can have more of a shock-and-awe effect on asset prices than the Fed or the ECB being even more aggressive than expected. It’s more likely to have longer-lasting consequences.

The result is that the monetary policy toolkits we are constantly measuring and assessing are bigger than is commonly assumed. This goes a long way toward countering the assertion that monetary policy has run out of oomph near the zero bound.

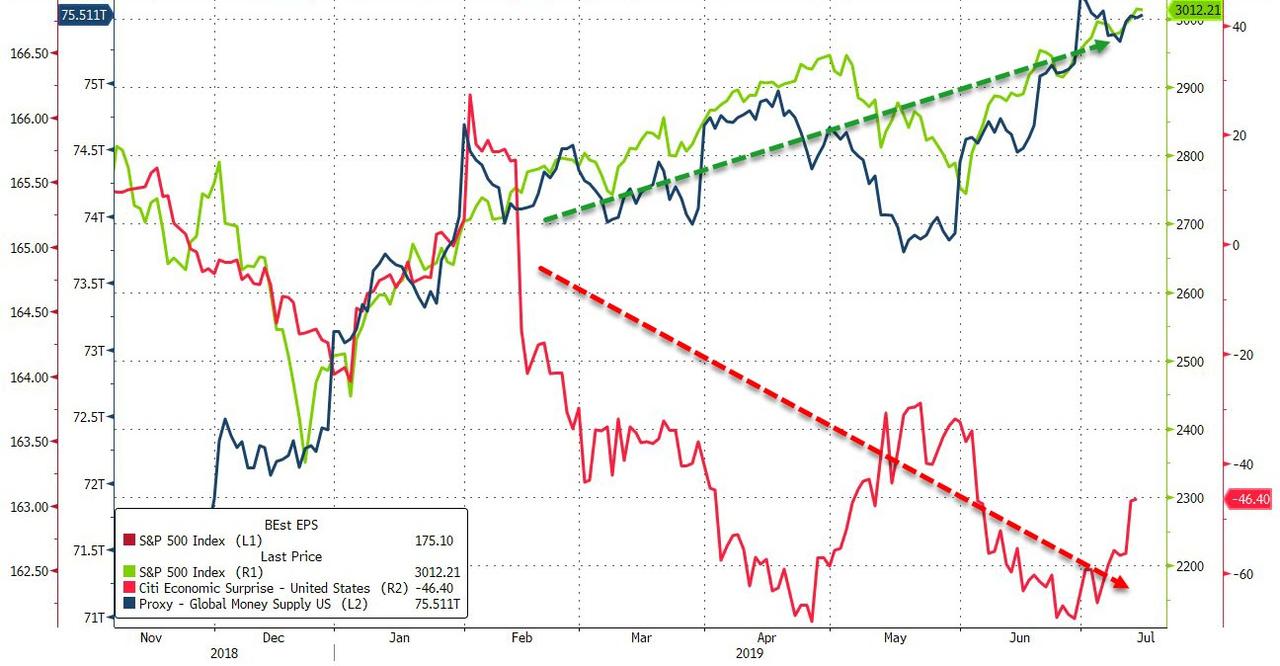

Markets can bounce around. Even correct. But the underlying dynamics of lower for longer and constant central-bank vigilance of financial conditions that have been fueling global asset bubbles are unlikely to change.

Markets, companies and economies are being told to stay leveraged, and that this is no time to be prudent. If you ever needed proof that we are in this trade too deep, this is it. The world’s social order may look like mayhem personified, but its central bankers appear to be drawing ever closer together. One should be careful of rushing to fade the long-term trends, or of taking too much solace from what the price action would ordinarily suggest in a risk-on environment.

Acting IMF Chair David Lipton made the party line quite clear with his latest message. He openly encouraged policy accommodation during an interview with the Financial Times ahead of G-7. Don’t hesitate, was essentially the message. Close calls go to the doves. When he said he didn’t want to mention individual countries, he wasn’t just being circumspect. It read like a green-light exhortation for continued, even greater, liquidity all around.

This week’s meetings hold out the promise of being more interesting than one would normally expect. Watch to see if there is a single song sheet used jointly by the assembled. Any and all academic discussions about Phillips Curves and the like are a smoke screen for decisions already made. We are back in the central-bank comfort zone. The global economy is slowing, so go out and buy risk.

What a strange place to find ourselves, that the biggest threat to current asset prices could be a resolution of the tariff issue. It makes it really hard to differentiate between where it’s best to go in search of yield in the interim. Good news could, counter-intuitively, lead to a bout of risk-off for markets, if not the real economy, and that could have differing effects on various carry trades. Most particularly in foreign-exchange trades involving countries especially sensitive to higher rates.

There was a modicum of optimism after the G-20 that there might be some light at the end of the tunnel on the trade disputes. But it’s very difficult to hear the message on rates and the state of the global economy and not wonder how these officials are handicapping the imminence of a breakthrough. And hence, the frustrating current market calm.

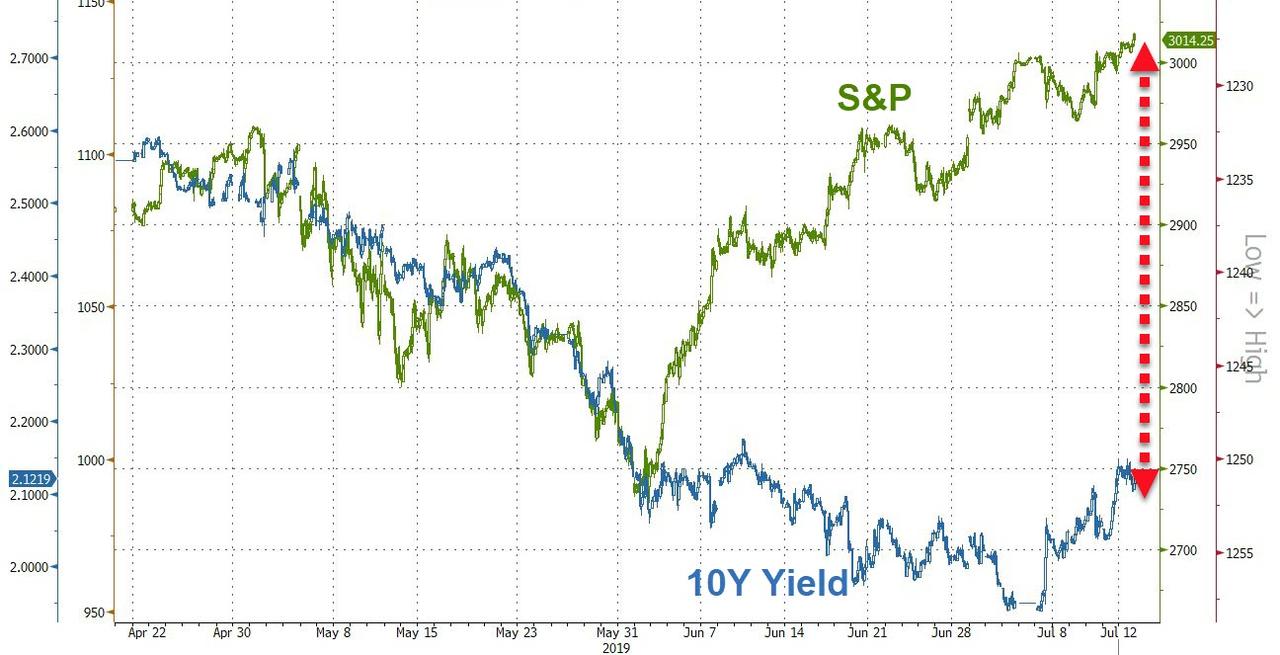

If trade barriers are inflationary, any uptick in the readings will be completely ignored in rate-setting meetings. But the effect on prices won’t be completely ignored. The longer end of the yield curve will have to take some notice.

As the recent steepening approaches technical-resistance levels that have proven themselves to be quite important, the yield curve may be the most interesting trade to watch.

via ZeroHedge News https://ift.tt/2jZZHJC Tyler Durden