Anyone else feel like we’re “on a highway to the danger zone” in stocks?

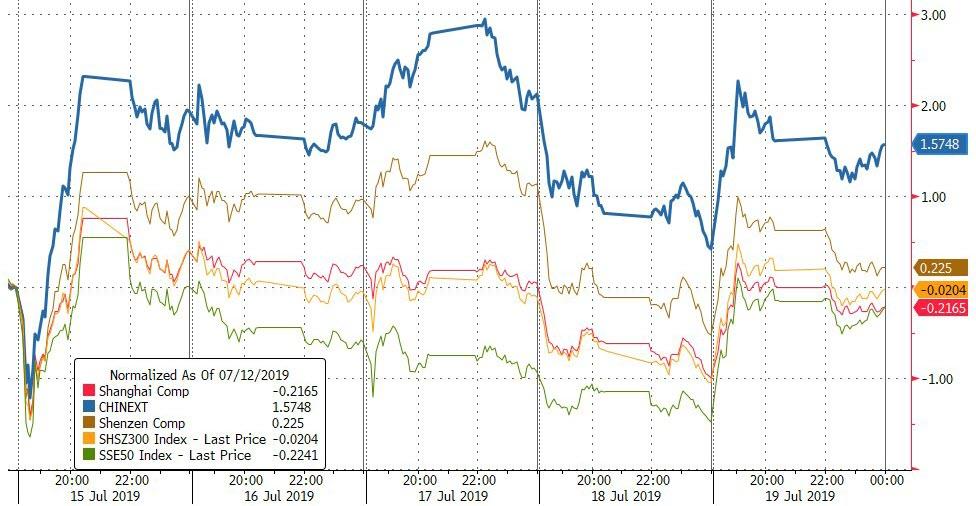

Only China’s tech-heavy ChiNext ended the week positive…

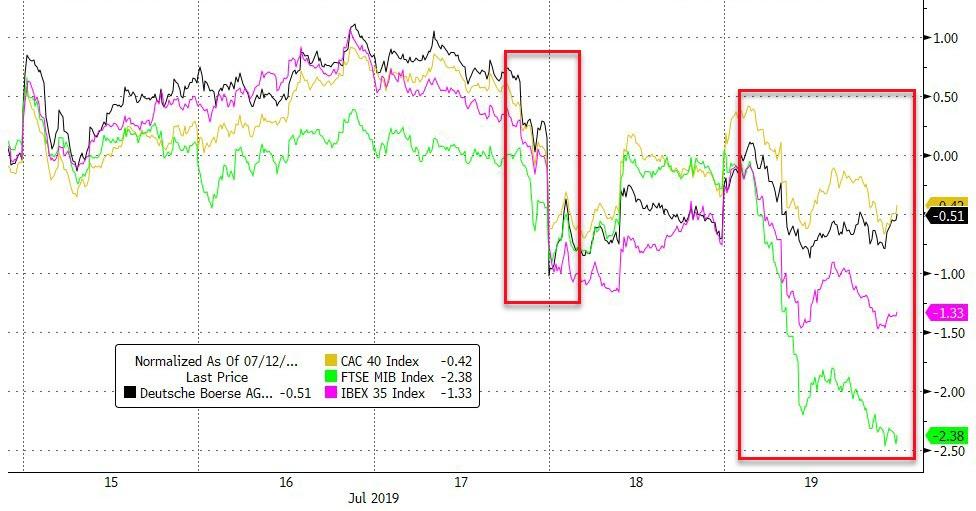

European stocks were red across the board with Italy worst on headlines about a fresh election…

US equities “lost that loving feeling” this week as Iran tensions re-escalated and The Fed teased with 50bps and then took the punchbowl away…Small Caps and Nasdaq were the week’s biggest losers, Trannies outperformed (but were red)

NOTE – major vol in Trannies this week.

Despite desperate efforts to get the S&P green for the week and above 3,000; tensions in Iran and The Fed walking back 50bps cut hopes were too much for the algos…

NFLX was ugly…

And The FANG stocks stalled at critical resistance…

Microsoft surged to a new record high, well north of $1 trillion market cap, after earnings…

VIX was higher on the week, testing 14, and while IG risk was flat, HY spreads jumped notably on the week…

Bonds and Stocks remain extremely decoupled…

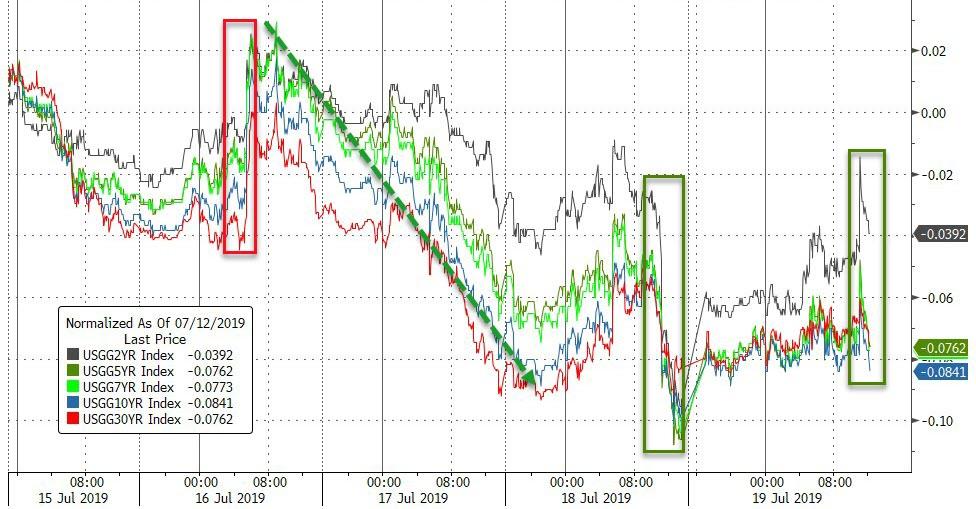

Treasury yields ended the week lower, despite a spike today as The Fed desperately walked back Williams’ comments…

10Y Yields tumbled on the week…

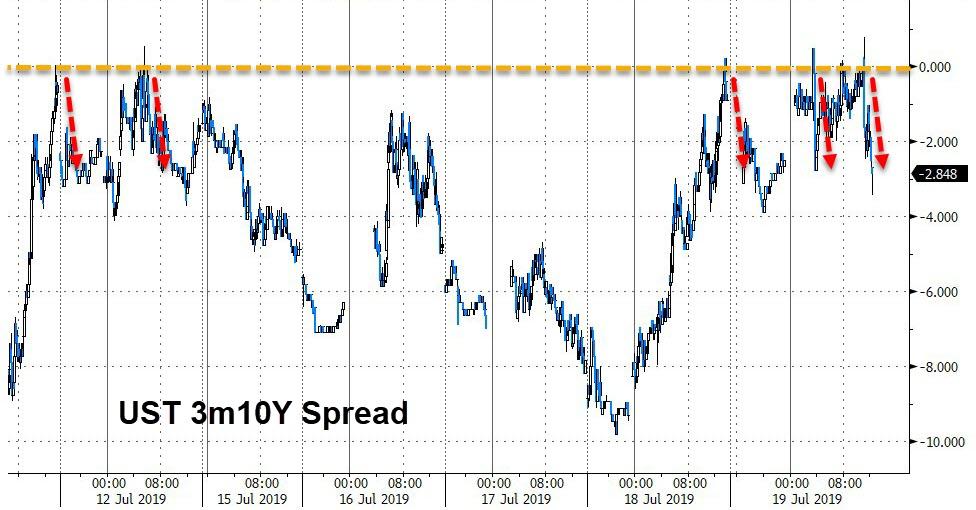

The yield curve (3m10Y) remains inverted for the 40th day (despite testing zero for the 5th time in a week)…

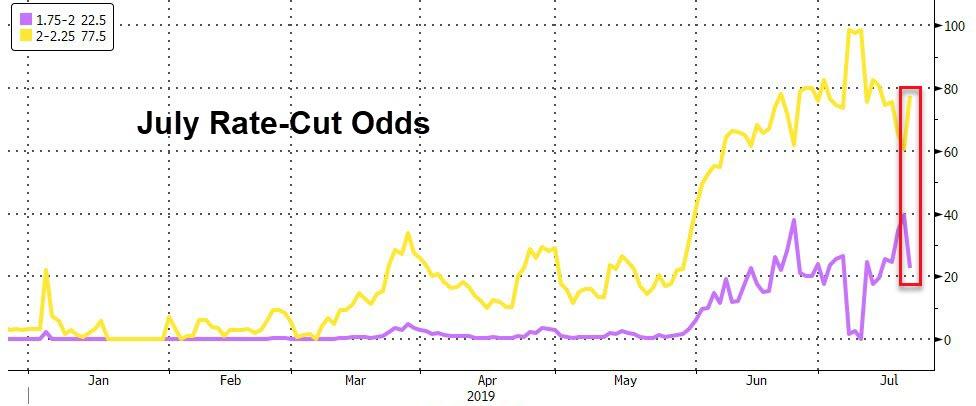

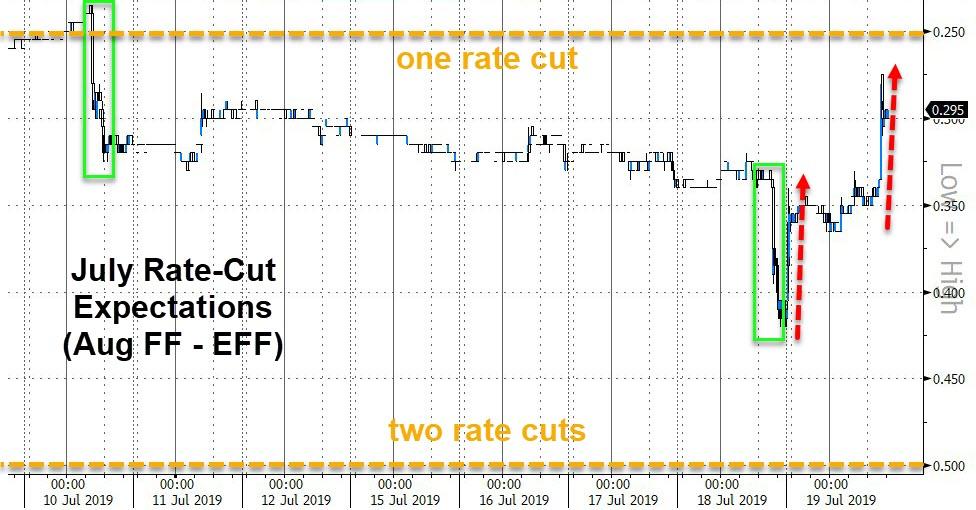

The odds of a 50bps rate-cut plunged from over 70% after Williams’ comments to just 22% tonight…

For now, expectations are for around 30bps of cuts in July…

The Fed’s jawboning has rippled down to Main Street too…

Expectations of lower interest rates in today’s UMich sentiment survey shot up to 19%, the highest level since May 2009! What do households see that investors don’t see?? pic.twitter.com/E0k4W0Lp6x

— David Rosenberg (@EconguyRosie) July 19, 2019

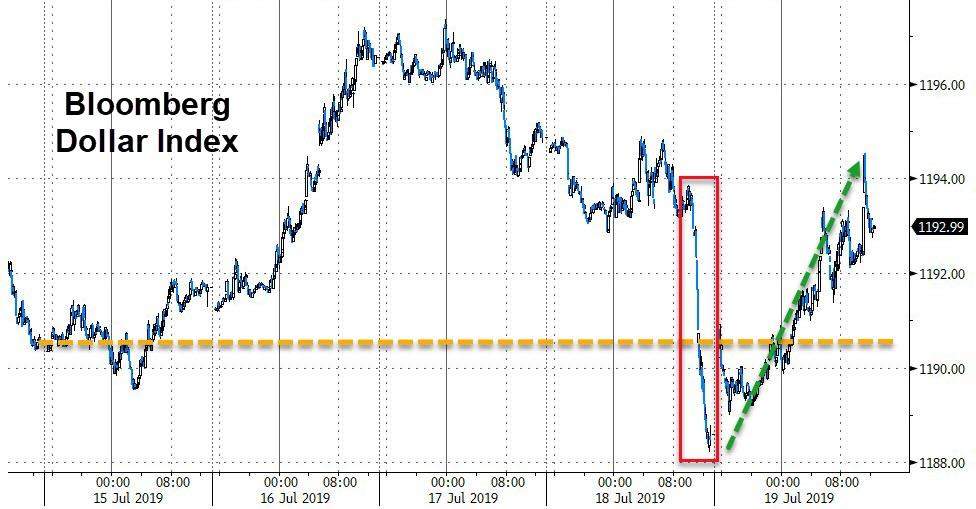

Despite lots of intraday vol, thanks to The Fed’s FUBAR communications strategy, the dollar ended the week higher…

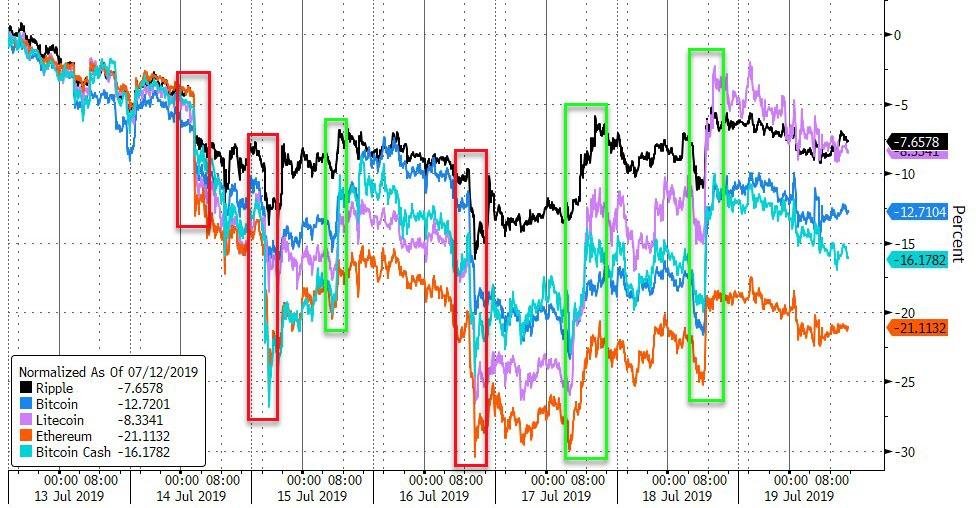

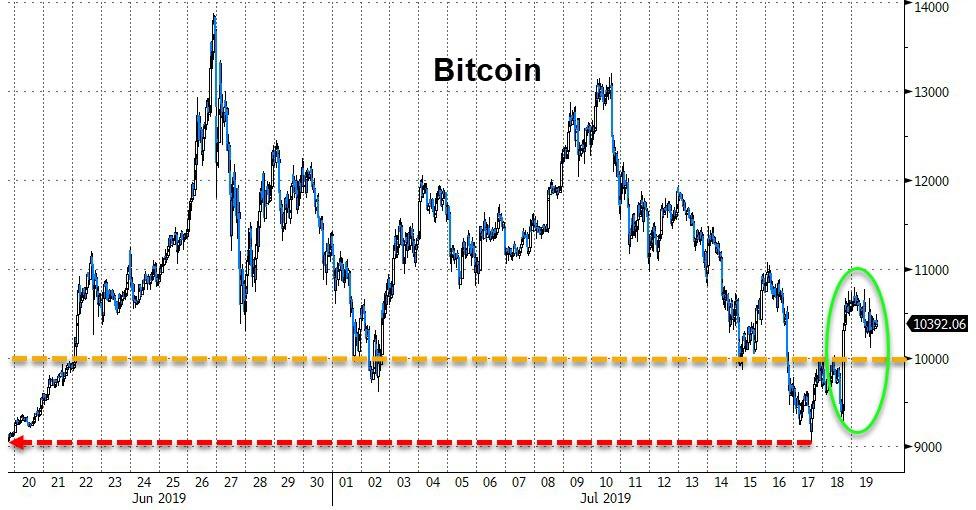

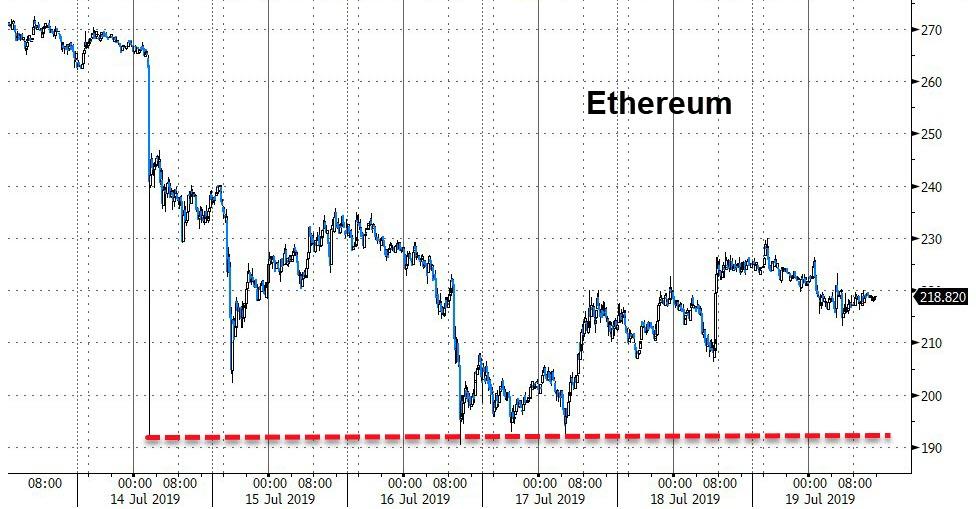

A very noisy week for cryptos with Ethereum the biggest loser…

Bitcoin managed to get back above $10,000…

Ethereum found support around $200 (and last weekend’s flash crash lows)…

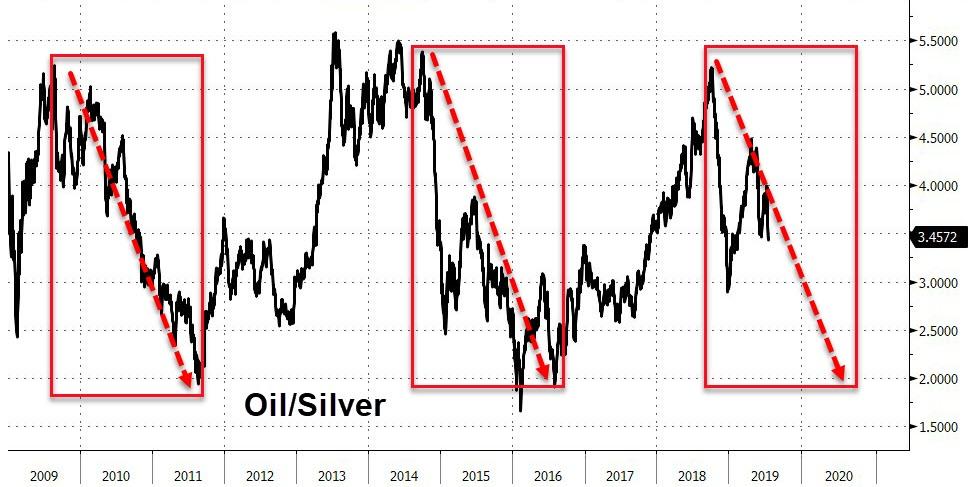

Oil suffered its biggest weekly loss of the year (down over8%) as silver spiked…

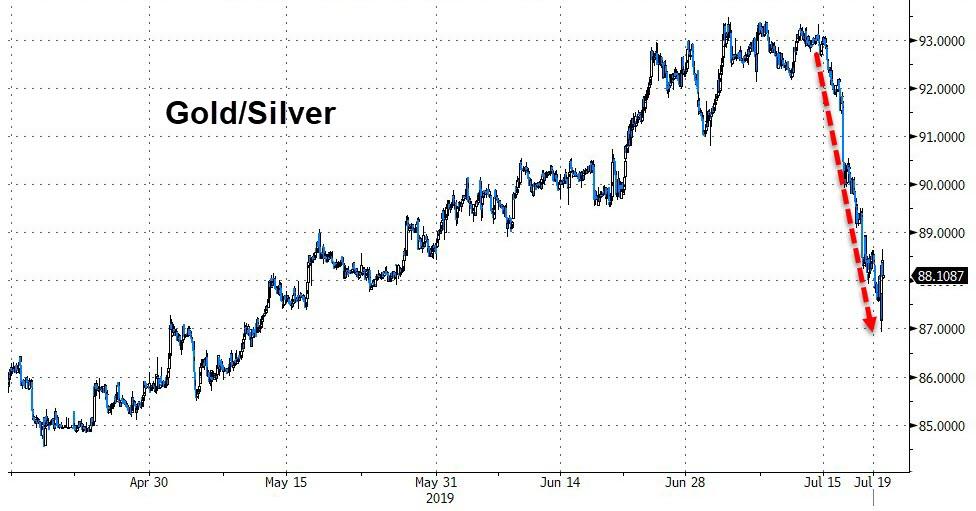

Silver soared over 6% on the week – the biggest weekly gain since July 2016; back above $16 (the highest in a year)…

NOTE – Silver is very close to triggering a golden-cross.

Silver dramatically outperformed gold on the week (after gold reached 26 year highs relative to silver)…

WTI plunged from $61 to a $54 handle during the week as Iran tensions apparently de-escalated (just ignore the drone-shooting)…

NOTE – WTI prices spiked late in the day after headlines that Iran captured a British tanker…

Are we set for another cyclical shift lower in oil in silver terms?

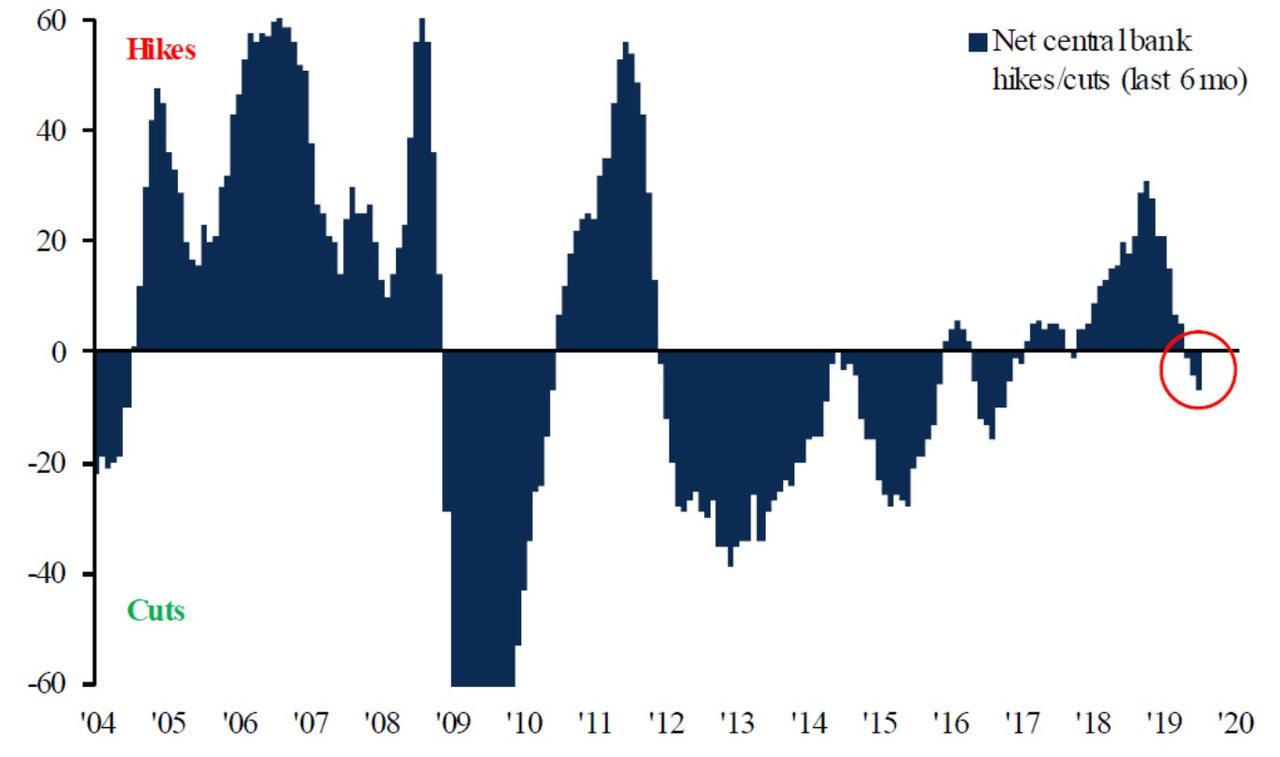

Finally, global central banks have officially flipped from hawkish to dovish…

Because stocks are really in the “danger zone”…

via ZeroHedge News https://ift.tt/2Ssv6RM Tyler Durden