When even the otherwise bullish Goldman Sachs says that something wicked this way comes, and that the VIX is far too low for the coming close encounter, it probably makes sense to listen.

In his latest note published earlier today, Goldman’s derivatives quant, Rocky Fishman, points out that – with the S&P hugging the 3,000 level – the VIX and S&P realized volatility are not far from 2019 lows, as are many global index volatility levels. Indeed, while implied vol, i.e., VIX, may be just inches away from single digits, realized volatility over the past month has been even lower, or just 8%, which is marginally above recent lows set in April and September, while the VIX has been in the 12 and 13’s.

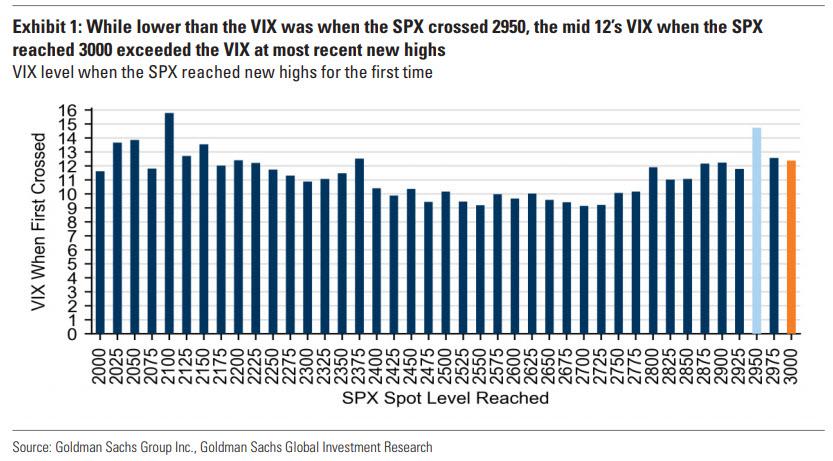

That said, while the VIX may be low, it could certainly be lower. As Fishman points out, “it is normal for the S&P to see low vol as the index deliberately tests new highs,” and he further adds that the mid-12 level in the VIX when the SPX first closed above 3000 “was actually higher than the VIX was when most levels above 2400 were first reached”; as a reminder the VIX spend much of the second half od 2017 below 10.

Yet even so, Fishman – and by implication Goldman – is confident that the market is too complacent, for the simple reason that there are just too many catalysts coming up, the least of which is the upcoming July Fed meeting:

To the extent expectations of Fed easing were the drivers of the recent equity valuation expansion, the coming FOMC meeting will be closely watched for indications of the extent of potential Fed easing over the next year.

Additionally, over the next two months there will also be debt ceiling negotiations and another Brexit deadline. And while Goldman expects trade negotiations with China to wrap up well before 2020 elections there is a high probability of market-moving trade developments in the coming months as well.

As a result, “the combination of these events and weakening economic growth seem incongruous with very low vol, and we expect higher vol in H2 than in 2019-to-date.”

Not convinced? Then here is JPMorgan’s Market Intelligence team, which has listed what it believes are the top 6 risks for markets right now (via themarketear.com)

- Monetary expectations – If the big upcoming decisions (ECB on 7/25 and/or the FOMC on 7/31) were to disappoint, the multiple expansion process could stall (or reverse)

- Earnings – the earnings risks have actually declined a bit in the last few days. Loan growth is one of the best proxies of underlying economic activity and this was a bright spot in bank earnings (bank earnings overall were mixed w/NII-NIM and trading coming in mixed-to-bad but loan growth was strong and loan growth guidance was actually raised by a few firms). The qualitative tone from bank CEOs/CFOs also has been sanguine, at least relative to sentiment among investors. This doesn’t mean the 2020 EPS consensus will improve but it should stop bleeding (for now).

- US-China trade – Substantive negotiations don’t appear to be occurring but neither side is very eager to escalate tensions at the moment (notwithstanding the occasional bellicose utterance from Trump). Note that headline risk may be skewed slightly to the upside to the extent the Commerce Department begins handing out some (partial) waivers for Huawei or if China makes a few (token) agricultural purchases

- Global Growth – data lately has been better-than-feared and while growth has certainly cooled from 2018 and earlier in 2019, evidence suggests trends may be stabilizing (the 7/17 Beige Book certainly doesn’t point to an economy in need of aggressive easing).

- Non-China trade – Trump won’t ever not talk about trade but the risk of the US imposing incremental tariffs on Mexico, Eurozone (autos), Japan, etc., doesn’t seem very high

- US fiscal policy – fiscal policy in Washington is never easy but neither side is showing any appetite to weaponize the debt ceiling and that is all stocks care about (whether or not a shutdown happens is another story but this isn’t something the SPX would be terribly bothered by).

Of course, none of this matters any more. As Richard Clarida delineated the Fed’s new thinking, the US central bank is no longer data dependent, but is pre-data dependent – i.e. a pre-cog Fed – and the Fed will no longer respond to data that is, but to what the Fed believes the data will be. And since at at some arbitrary point in the future the economy will certainly contract and a recession (or depression) will ensue, this is now a sufficient reason for the Fed to cut rates as much as it wants at any given moment. Which is precisely what it will do in three weeks, in the process likely sending the VIX back under 10.

via ZeroHedge News https://ift.tt/2GeFVlB Tyler Durden