US stock futures rose back over 3,000 as blowout results for Microsoft’s cloud business fed into a bullish mood despite confusing signs from NY York Fed President John Williams that the U.S. central bank was set to cut interest rates either once or twice (if one is academically inclined) this month, while Jim Bullard said one rate cut is enough, even as the market is now pricing odds as high as 70% of a 50bps in rate cuts.

Microsoft, now America’s most valuable company, gained 3.5% pre-market, after it topped analysts’ estimates at the end of a week of mixed corporate results in the United States and Europe. Boeing rose 1.7% after disclosing it would take a $4.9 billion after-tax hit in the second quarter on estimated disruptions from the grounding of its 737 MAX passenger jets. Morgan Stanley analyst Rajeev Lalwani said that was a sign that investors were comfortable with the size of the charge and Boeing’s production plans ahead of its results next week.

These bullish signal contrasted with the latest round of ample confusion from the Fed. One of the more notable announcements late on Thursday was the New York Fed’s announcement that comments made by Fed’s Williams were academic, based on research and not about potential policy actions at the upcoming FOMC meeting. As a reminder, earlier in the day, NY Fed head John Williams said it is better to take preventative measures on rates than to wait for a disaster to unfold and that the long-run neutral rate for US interest rates is 0.5%; the move sent the dollar tumbling. Elsewhere, Fed’s Bullard said he would listen to arguments for a larger rate cut, but thinks 25bps is appropriate; doesn’t think the situation calls for a larger cut, the WSJ reported.

US stocks had reversed losses and closed green at the end of a disappointing week for earnings as dovish comments from the two Fed officials spurred bets on a 50 basis-point cut. Schlumberger also rose in premarket trading after reporting revenue that beat estimates. Shares of the world’s largest oilfield services provider rose 1% as it announced better-than-expected revenue numbers and named company insider Olivier Le Peuch as new Chief Executive Officer

Over in Europe, the Stoxx Europe 600 wiped an earlier advance as Italian shares slid on speculation about snap elections, and after the New York Fed downplayed the comments as being more academic than potential near-term policy action.

Anheuser-Busch InBev NV bounced back from last week’s failed IPO of its Asian unit, after it sold Australian beer assets in a deal valued at $11.3 billion and kept alive the prospect of a share sale. The disposal of Foster’s and other brands to Asahi Group Holdings Ltd. less than a week after the IPO was pulled shows that the world’s largest brewer means business about cutting its $100 billion-plus debt pile. AB InBev shares rose as much as 5.6%, its biggest gain in 5 months.

Italy’s FTSE MIB (-1.2%) lags amid reports of a possible coalition crisis as ties between the League and 5SM sour, whilst speculation about the possibility of early Italian elections in Autumn did the rounds in Italian press on Friday. Sectors are mostly higher with some underperformance in defensive sector, albeit the Consumer Staples is buoyed by AB InBev (+4.3%) as shares surged amid the sale of its of its Australian unit to Japan’s Asahi for USD 11.3bln in a bid to nurse part of its debt. Furthermore, reports stated that the Co. is also mulling the sale of its South Korean and Central American units

Asian stocks advanced, set for the biggest gain in a month, as Japanese semiconductor firms led a technology rally amid optimism the chip industry is stabilizing. Most markets in the region were up, with Japan and South Korea among the best-performing countries. The Topix jumped 1.9%, supported by SoftBank Group and Toyota Motor, ahead of Japan’s upper house election on Sunday. A key inflation gauge fell in June, adding to pressure on the Bank of Japan to step up monetary stimulus. The Shanghai Composite Index closed 0.8% higher, snapping a three-day losing streak, as China Merchants Bank, Ping An Insurance and Kweichow Moutai provided the biggest boosts. China’s new stock venue designed for technology startups will start trading on Monday. India’s Sensex fell 1.3%, bucking the regional trend, amid disappointment that the government didn’t offer any respite to foreign investors registered as trusts from the proposed super-rich tax. ICICI Bank and HDFC Bank led large financial firms lower.

Adding to the dovish mood, investors are also looking to next week when the ECB could shed light on plans to ease monetary policy. Meanwhile, European bond yields mostly inched lower, with the exception of Italian BTPs as reported earlier. The Italian government debt saw increased yields after a solid rally this month and speculation over early elections.

In FX, the dollar outperformed all Group-of-10 peers amid signs of progress in U.S-China trade talks and after the Federal Reserve clarified that New York Fed President Williams’s comments on the need for action if the economy stumbles were not in reference to its July meeting. The pound slipped as the U.K.’s budget deficit widened while the euro weakened ahead of next week’s European Central Bank meeting. The Japanese yen fell and Treasuries slipped as risk sentiment improved.

In commodities, oil rose to $56 a barrel in New York, trimming a weekly decline which was exacerbated by refineries in the Gulf of Mexico restarting operations after the passing of storm Barry, with reports stating that only 19% of production is currently offline vs. 73% on Sunday. Upside in the complex is also supported by the rising geopolitical tensions after US President Trump stated that the US took defensive actions and downed an Iranian drone, a statement which was denied by Iranian officials. Gold fell and silver gained for a sixth straight day.

Expected data include the University of Michigan Consumer Sentiment Index. American Express and BlackRock are among companies reporting earnings.

Market Snapshot

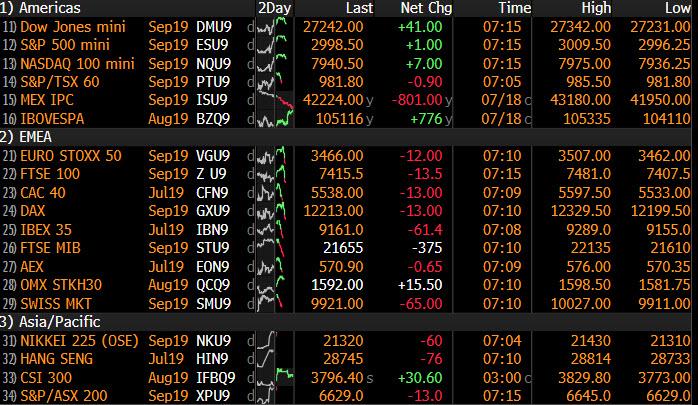

- S&P 500 futures up 0.3% to 3,007.50

- STOXX Europe 600 up 0.6% to 389.25

- MXAP up 1.3% to 161.01

- MXAPJ up 0.9% to 530.19

- Nikkei up 2% to 21,466.99

- Topix up 1.9% to 1,563.96

- Hang Seng Index up 1.1% to 28,765.40

- Shanghai Composite up 0.8% to 2,924.20

- Sensex down 1.2% to 38,421.36

- Australia S&P/ASX 200 up 0.8% to 6,700.35

- Kospi up 1.4% to 2,094.36

- German 10Y yield fell 0.7 bps to -0.317%

- Euro down 0.2% to $1.1257

- Italian 10Y yield fell 3.9 bps to 1.203%

- Spanish 10Y yield fell 1.3 bps to 0.392%

- Brent futures up 1.4% to $62.78/bbl

- Gold spot down 0.4% to $1,440.27

- U.S. Dollar Index up 0.2% to 96.95

Top Overnight News

- Fed Vice Chairman Richard Clarida and New York Fed chief John Williams stressed the need to act quickly if the U.S. economy looked likely to stumble, reinforcing bets the central bank could cut interest rates by as much as half a percentage point later this month

- Federal Reserve Bank of New York President John Williams says the lessons for central banks from operating near the zero lower bound on interest rates is “don’t keep your powder dry” though a New York Fed spokeswoman later clarified that Williams’s prepared remarks were an academic speech and not about policy actions at the upcoming meeting.

- European Central Bank policy makers will give a clear signal next week that interest rates are about to fall even further below zero, economists predict.

- Foreign-exchange strategists say the risk of a U.S. move to weaken the dollar has risen after Treasury Secretary Steven Mnuchin said there’s no change in the nation’s currency policy “as of now.”

- U.S. and Chinese senior officials spoke by phone on Thursday in Washington, the second call since the late June summit at which the two sides agreed to a truce in their ongoing trade conflict.

- Mnuchin said the Trump administration and congressional Democrats have agreed on spending levels for a budget deal that could clear the way for raising the federal debt limit before Congress leaves town.

- Japan’s key inflation gauge fell again in June, adding to pressure on the Bank of Japan to join its global peers in increasing monetary stimulus

- UK Justice Secretary David Gauke is set to resign, while Chancellor of the Exchequer Philip Hammond and International Development Secretary Rory Stewart are also considering departing, The Times reports, citing unidentified allies. They seek to depart before Boris Johnson takes office

- The UK should expect a “rigorous” assessment of its regulations before financial firms will be allowed to do business in the European Union after Brexit, according to a draft document to be presented by officials in Brussels later this month.

- President Donald Trump said the U.S. “immediately destroyed” an Iranian drone that approached the USS Boxer near the Strait of Hormuz, the latest sign of escalating military tensions around the critical oil choke point

- Oil snapped four days of losses after the drone incident, which stoked concerns crude flows from the Middle East may be disrupted.

- Jeremy Hunt is counting on a late surge to beat Boris Johnson and become U.K. Prime Minister but YouGov reckons he’d have to have a huge swing behind him to win at this stage.

Asian equity markets were positive across the board as the region took its cue from the late gains in US following dovish comments from Fed’s Williams who suggested it is better to take preventative measures on rates and that the long-run neutral rate for US interest rates is 0.5%, although the New York Fed later clarified the rhetoric was academic and not about potential policy action this month. Nonetheless, ASX 200 (+0.8%) was led higher by strength in the mining sector especially gold-related stocks after the precious metal surged to a fresh 6-year high on the Fed comments and with NAB front running the gains for financials after it appointed RBS head McEwan as its next CEO. Nikkei 225 (+2.0%) outperformed as exporters cheered currency outflows, while Hang Seng (+1.1%) and Shanghai Comp. (+0.8%) conformed to optimism after US-China trade negotiators resumed discussions via telephone and with the PBoC’s liquidity efforts resulting to a net weekly liquidity injection of CNY 460bln. Finally, 10yr JGBs gained as they tracked the upside in T-notes amid the dovish Fed bets, but with upside limited by the lack of safe-haven demand and slightly softer demand in the enhanced-liquidity auction for 2yr-20yr JGBs.

Top Asian News

- China’s New Nasdaq-Style Venue Set for Monday Trading Start

- China’s Biggest Carmaker Braces for Its First Annual Sales Drop

- China Minsheng Investment Can’t Pay Bond as Debt Woes Deepen

European equities have given up earlier gains and now trade mostly lower [Eurostoxx 50 -0.2%] as the initial upside momentum seen in Asia and on Wall St. following the dovish comments from Fed voter Williams somewhat waned. The New York Fed downplayed the comments as being more academic than potential near-term policy action. It’s also worth noting that the initial support for equities also came amid comments from Fed’s Vice Chair Clarida who acknowledged the increased global uncertainties and soft US inflation, which somewhat revived market pricing for a 50bps manoeuvre at the July 31st meeting. Italy’s FTSE MIB (-1.2%) lags amid reports of a possible coalition crisis as ties between the League and 5SM sour, whilst speculation about the possibility of early Italian elections in Autumn did the rounds in Italian press on Friday. Sectors are mostly higher with some underperformance in defensive sector, albeit the Consumer Staples is buoyed by AB InBev (+4.3%) as shares surged amid the sale of its of its Australian unit to Japan’s Asahi for USD 11.3bln in a bid to nurse part of its debt. Furthermore, reports stated that the Co. is also mulling the sale of its South Korean and Central American units. On the flip side, shares in Publicis (-8.4%) declined due to a cut in its FY 19 organic growth guidance, as such WPP (-3.0%) fell in sympathy.

Top European News

- ECB Seen Priming Markets in July for Rate Cut After Summer Break

- U.K. June Budget Deficit Widens Sharply Amid Spending Surge

- Orlen Earnings Beat Provides Tonic for Languishing Polish Market

- Salvini Flirts With New Elections as Russiagate Rumbles On

In FX, – The Buck continues to see-saw through US data points, survey findings and the final pre-FOMC commentary from Fed officials ahead of the black-out period that begins at COB today. On that note, Williams and Clarida provided ‘guidance’ and despite denials or clarification of the former rate expectations have shifted again, with the probability of a 25 bp or 50 bp ease now much closer to even vs circa 75%/25% after Thursday’s upbeat Philly Fed survey. In response, the Greenback weakened vs all major rivals and the index hit a 96.750 low before tentatively regaining 97.000 status and holding above support, as Usd/G10 pairs pare back or rebound from late yesterday/overnight extremes. Note, remarks from renowned dove Bullard are not really impacting as he repeats his preference for smaller policy adjustment, though would countenance arguments in favour of ½ point.

- JPY – Having benefited most from the aforementioned Dollar retreat, and with added safe-haven premium gleaned via another US-Iran dispute (former claims that a drone was downed and latter denies any damage), the Yen is now ‘underperforming’. However, Usd/Jpy remains well below the 108.00 axis that has been constricting trade and with decent option expiries now capping the pair along with technical resistance (1.1 bn between 107.90-108.05, 55 DMA at 107.87 and daily chart level at 107.88).

- EUR – The single currency is still flanked between 1.1200 and 1.1300 parameters with ECB policy stimulus weighing against Fed easing and only days separating the respective July policy meetings. Note also, Italian coalition Government conflicts are coming to a head and expiry interest may also be dragging Eur/Usd down given 1.2 bn rolling off from 1.1240-25 and 1.55 bn at 1.1210-00.

- AUD/CHF/NZD/GBP/CAD – The Aussie ran up against some key chart hurdles ahead of 0.7100, like the 200 DMA (0.7090) after extending its rebound from just under 0.7000 with some encouragement from the US and China conducting trade dialogue over the phone. However, Aud/Usd is holding above 0.7050 where export bids are touted and if those are filled there are said to be more underlying buy orders between 0.7040-30 linked to 900 mn expiries residing from 0.7035 to 0.7025. Elsewhere, the Franc has faded into 0.9800 and Kiwi not far from 0.6800, while the Pound topped out around 1.2550 and the Loonie continues to pull-up on approaches to 1.3000, with Canadian retail sales data looming.

- EM – Amidst widespread declines vs the Usd, Zar losses or rather retracement from post-SARB highs has been compounded by more SA political issues as current President Ramaphosa joins a former counterpart in the corruption dock. Rand currently closer to the base of 13.9410-8165 parameters.

In commodities, WTI and Brent futures are consolidating following the recent decline which was exacerbated by refineries in the Gulf of Mexico restarting operations after the passing of storm Barry, with reports stating that only 19% of production is currently offline vs. 73% on Sunday. Upside in the complex is also supported by the rising geopolitical tensions after US President Trump stated that the US took defensive actions and downed an Iranian drone, a statement which was denied by Iranian officials. Furthermore, IRGC said that Iran will release images to disprove US’ claim. WTI and Brent futures currently reside just above 56/bbl and 63/bbl and with little by way of notable DMAs given the recent slump in prices. Elsewhere, precious metal prices have drifted lower after rallying on the dovish comments from Fed voters Williams and Clarida coupled with the aforementioned geopolitical developments, in which gold hit a fresh 6yr high and briefly breached 1450/oz to the upside. Meanwhile, copper prices are also supported by the overall risk appetite. Finally, iron ore prices were mildly pressured as Iron ore exports from Australia’s port Hedland increased 6% M/M to a record high as miners increased shipments to meet targets.

US Event Calendar

- 10am: U. of Mich. Sentiment, est. 98.8, prior 98.2;

- Current Conditions, est. 112.8, prior 111.9

- Expectations, est. 90, prior 89.3

DB’s Jim Reid concludes the overnight wrap

via ZeroHedge News https://ift.tt/2Y0u4Ob Tyler Durden