Submitted by Daniel DiMartino-Booth of Quill Intelligence

-

Structural unemployment exists when available workers do not have the skills for the current job openings which continues to be an issue identified by the Fed’s Beige Book; however, the gap has only resulted in wages moderately increasing except for entry level positions

-

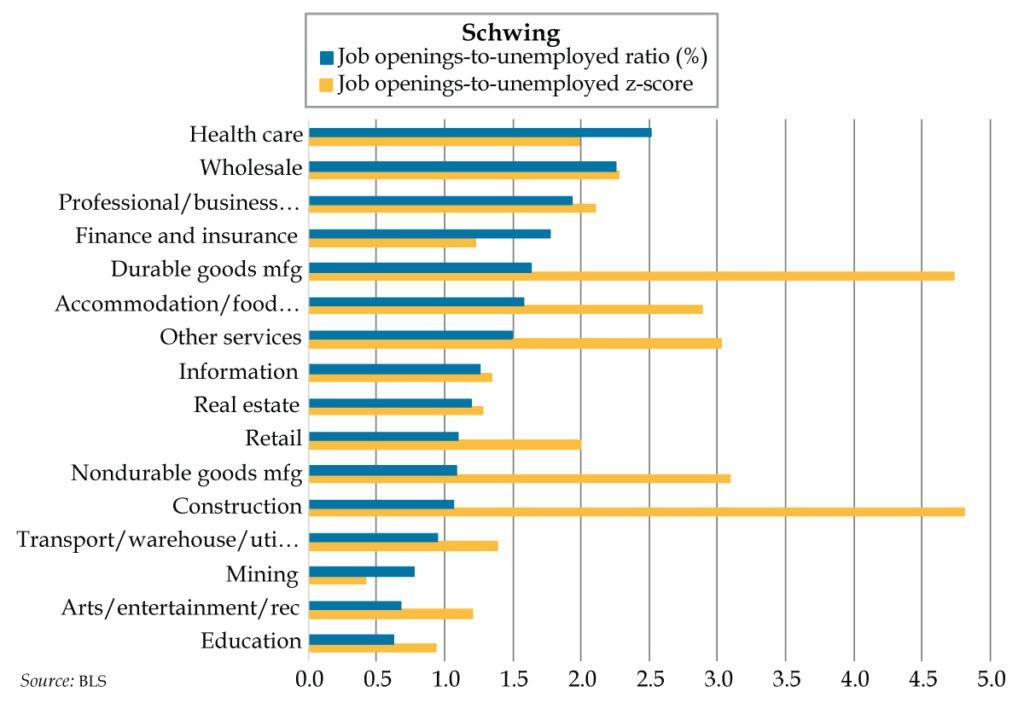

The overall labor skills gap during this cycle began in April 2017 peaking in November of 2018 at 1.5; As of May 12, of 16 industries are experiencing skilled labor shortages with Healthcare and Wholesale encountering the largest gaps on the raw data

-

Adjusting the data for volatility (z-score) indicates the greatest shortages exist in Construction and Durable goods manufacturing; the forward looking view is these industries are slowing, which narrows the current gap

Saturday Night Live has long cultivated a farm system that brings skits to the big screen. The Blues Brothers, Coneheads, Superstar and A Night at the Roxbury all come to mind. But the 1992 comedy film Wayne’s World is one of QI’s favorites. Rock fans Wayne Campbell (Mike Myers) and Garth Algar (Dana Carvey) host their own public-access television show, Wayne’s World, from Wayne’s parents’ basement. After selling the rights of their show to sleazy TV producer Benjamin Kane (Rob Lowe), Wayne falls for rocker Cassandra Wong (Tia Carrere). In true love-triangle fashion, Kane attempts to steal Cassandra from Wayne using his wealth and good looks. He distracts Wayne and Garth with all-access tickets to an Alice Cooper concert in Milwaukee. That backstage scene is pure Hollywood magic. When Wayne and Garth finally realize the dream of meeting metal and rock icon Cooper, they bow down and plead: “We’re not worthy! We’re not worthy!”

A late-cycle labor market brings out the same kind of kowtowing by workers who are not worthy to fill the skills gap — the mismatch between what workers have to offer and those demanded by employers. Another term for this phenomenon is “structural unemployment,” involuntary unemployment that can be long-term and slow to fix because it requires either immigration, migration, re-training or some combination thereof.

The Fed’s Beige Book, or summary of current economic conditions from the twelve District banks, is published eight times a year in advance of Federal Open Market Committee meetings. For what feels like forever, it’s bemoaned the skills gap. Yesterday’s Beige Book was no different:

“Labor markets remained tight, with contacts across the country experiencing difficulties filling open positions. The reports noted continued worker shortages across most sectors, especially in construction, information technology, and health care…A few reports highlighted concerns about securing and renewing work visas, flagging this as a source of uncertainty for continued employment growth. Compensation grew at a modest-to-moderate pace, similar to the last reporting period, although some contacts emphasized significant increases in entry-level wages. Most District reports also noted that employers expanded benefit packages in response to the tight labor market conditions.”

The lamentation was spread across Fed Districts:

-

New York: “Contacts reported persistent difficulties finding workers across the spectrum.”

-

Chicago: “…contacts indicated that the labor market was tight and that it was difficult to fill positions at all skill levels.”

-

Atlanta: “Firms indicated investing significantly in training programs to attract new workers or upskill existing staff.”

-

Dallas: “Contacts noted continued difficulty in finding mid-skilled workers. Shortages of truck drivers and foodservices staff continued.”

-

San Francisco: A large Eastern Washington utility “shifted some of its existing workforce into IT-related functions, given the difficulty of hiring for those roles. To fill vacancies in construction positions, some employers in Idaho discussed whether to relax certain hiring standards related to drug testing.” (Cheech & Chong Build a Home?)

The Beige Book is a qualitative report. To quantify the skills gap, we examined job openings relative to the number of unemployed across the industries that make up the private nonfarm sector. Before turning to the granular results, the aggregate private nonfarm job openings-to-unemployed ratio first crossed over the ‘1’ mark in April 2017 and hasn’t looked back, reaching a peak of 1.50 openings per unemployed in November 2018 before cooling through May 2019’s 1.47 reading. Any reading over 1 highlights the skills gap — there are more openings than warm (skilled, unskilled and able) bodies to fill them.

The industry breakdown illustrated up top reveals 12 of 16 industries with a skills gap – job openings-to-unemployed >1 – in May of this year. Health care and Wholesale top the list with ratios north of 2, ten industries from Professional/Business Services to Construction are above 1 and the remaining four industries are under 1.

There is an alternative way to look at the skills gap though.

Our favorite z-score metric (ratio of the mean adjusted for volatility) unearths those industries with the most acute skill shortages. Construction and Durable goods manufacturing have z-scores above 4, Nondurable goods manufacturing and “Other” services are above 3 and Accommodation and food services are above 2.5. These industries include both skilled and unskilled workers and high-paying and low-paying positions, consistent with the Beige Book’s broad-based findings.

Despite the severity in certain industries’ skills gaps, the Beige Book noted that “compensation grew at a modest-to-moderate pace.” (#GotPricingPower?) Looking ahead, which is what we do, 2019’s industrial recession is in the history books. Add to that a strike by Chinese homebuyers and fresh data showing permits to build homes are down 6.6% over last year. It’s increasingly likely that a housing recession is also in the making. The risk is rising that the inevitable decline in those lofty cyclical z-scores will translate to party time not excellent.

via ZeroHedge News https://ift.tt/2JI3mWF Tyler Durden