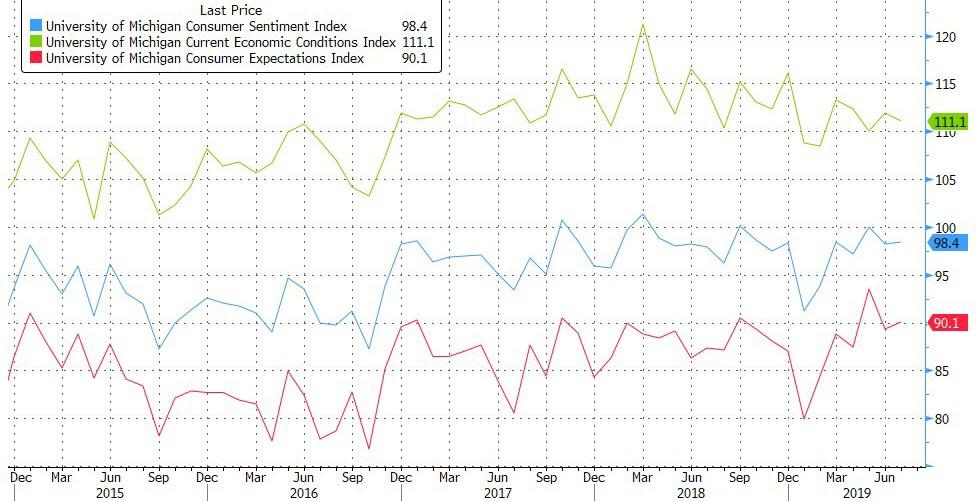

Following June’s dip in ‘hope’, UMich Sentiment was expected to improve in preliminary July data but it disappointed in most aspects.

-

Headline Sentiment rose from 98.2 to 98.4 (but missed 98.8 exp)

-

Current Conditions dipped from 111.9 to 111.1 (missing 112.8 exp)

-

Expectations inched higher from 89.3 to 90.1

Still close to the best level in more than a decade

“ Favorable trends in personal finances remained widespread,” Richard Curtin, director of the University of Michigan consumer survey, said in a statement.

“These favorable financial expectations were supported by gains in household incomes and wealth.”

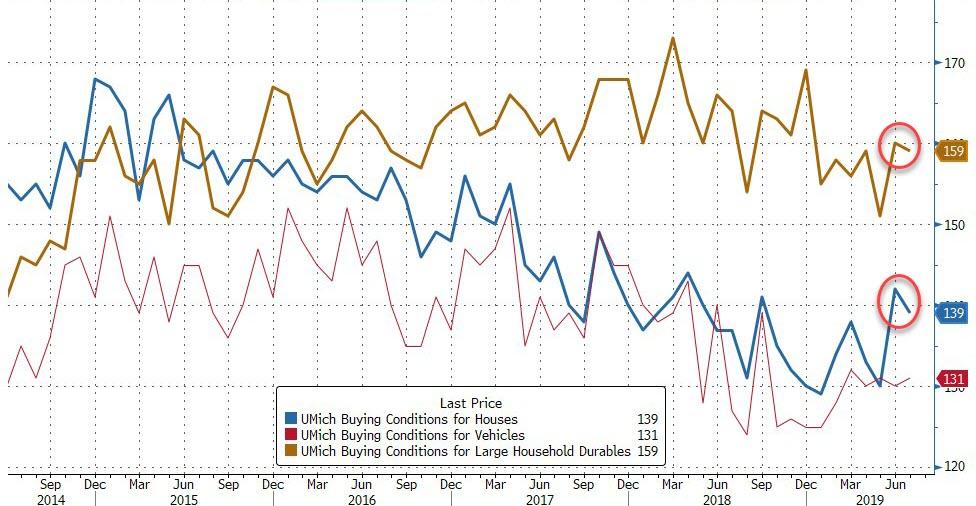

June’s surge in buying conditions dipped in preliminary July data…

However, perhaps most notable – given The Fed’s focus – longer-term inflation expectations spiked from 2.3% to 2.6%…

The Consumer Expectations Index falls as inflation expectations rise, signifying that consumers view higher inflation as a threat to economic growth.

“Consumers’ views appear to be more consistent with the stagflation thesis, which holds that inflation and unemployment move in the same direction. This thesis is more consistent with how consumers process and organize diverse bits of news about the economy.”

Additionally, the reading of expectations for personal finances rose to 136, matching the highest level since 2004.

The share of households that expected interest rate increases fell to 44%, the lowest since May 2013, while 19% expected rates to fall, the most in 10 years.

via ZeroHedge News https://ift.tt/2XY54vT Tyler Durden