US equity futures followed European stocks higher, following a mixed session in Asia as investors looked ahead to a busy week of corporate earnings in which 145 S&P 500 and 10 of the Dow 30 companies are due to report. Oil gained amid tensions in the Persian Gulf, while the dollar continued to rise amid concerns the Fed may disappoint with a smaller than expected rate cut.

Europe’s STOXX 600 index gained 0.1%, while Germany’s DAX and France’s CAC rose 0.3% and Britain’s FTSE jumped 0.5% as traders reversed the wave of selling observed earlier in the Asian session. Energy and mining shares lead gains after crude oil prices jumped at least $1 per barrel, on concern that Iran’s seizure of a British tanker last week may lead to disruptions in the Middle East. European losses were led by real estate stocks which would benefit from lower interest rates and defensive sectors such as utilities and telecoms ahead of a big week for earnings.

“Sentiment about company earnings potential appears to be mixed at best, with some evidence that we might be seeing a bit of a pickup in economic data, after a slow first half of the year,” said Michael Hewson at CMC Markets. “The pickup in U.S. economic data last week, as well as contradictory commentary from Fed officials, appears to be muddying the waters for investors about the possible reaction function of the U.S. Federal Reserve at the end of this month and whether we can expect to see a 25 basis point or 50 basis point rate cut.”

The MSCI world index dipped 0.2% in early trading, pulling away from the near-year-and-a-half high reached earlier in June after most Asian stocks fell, led by health care and financials, as optimism for aggressive monetary easing dwindled and as the earnings season accelerated. Most regional markets fell, with Hong Kong and China leading losses. The Topix retreated 0.5%, driven by Asahi Group Holdings, Daiichi Sankyo Co. and Nintendo Co., after Japanese Prime Minister Shinzo Abe claimed victory in Sunday’s upper house election. Hong Kong’s Hang Seng Index extended declines in the afternoon even as Chief Executive Carrie Lam condemned political protesters and their aggressors, promising to investigate violent attacks.

Momentum looked better on Wall Street, where S&P500 Emini futures pointed to a 0.3% higher open.

Global stocks rose toward the end of last week after dovish comments by New York Fed President John Williams boosted expectations the world’s top central bank would lower rates by 50 basis points at its July 30-31 meeting. However, they gave back those gains after the New York Fed walked back Williams’ comments by saying his speech was not about upcoming policy action.

Hopes for a larger cut were curtailed even more after the Wall Street Journal reported late on Friday that the Fed was likely to cut rates by 25 bps this month, and may trim further in the future given global growth and trade uncertainties.

In FX, the dollar inched higher and U.S. Treasury yields held steady on the greater likelihood of a shallower rate cut. The dollar index gained to 97.169 against a basket of six major currencies after rising 0.4% on Friday. The euro was little changed at $1.1217 after shedding 0.5% on Friday. The New Zealand dollar leads currency gains; the pound was the biggest loser, falling from the European open as Johnson’s expected victory is predicted to spur at least two more resignations from the Conservative cabinet, further increasing the uncertainty over Britain’s departure from the EU

In rates, the benchmark 10-year Treasury yield lingered at 2.0429%. German bunds gained to support Treasuries, while Italian bonds slipped.

“The market is still exaggerating the most likely scale of Fed rate cuts, in our view, by pricing in close to 100bps of easing over the next 12 months,” according to Mark Haefele, chief investment officer at UBS Global Wealth Management. “It remains possible that the market will be disappointed by the pace of Fed easing, in our view. As a result, we are tactically short U.S. two-year government bonds, and focus on carry strategies rather than aggressively increasing equity exposure.”

Meanwhile in Brexit news, EU countries are reportedly secretly wooing PM candidate Boris Johnson and signalled an intention to work out a deal to avoid a no-deal disaster. In related news, EU is to prepare an aid package for Ireland to soften no-deal Brexit. US President Trump said he spoke with UK PM candidate Johnson and looks forward to working with him and thinks he will work out Brexit, while there were also reports that Trump expressed concerns with France’s Macron regarding the proposed digital services tax.

Investors are set for a busy week ahead as earnings season ramps up and Thursday sees a monetary policy announcement from the European Central Bank. The Fed meanwhile is in a blackout period ahead of next week’s interest rate decision. Also, trade may come back into the picture soon, with face-to-face negotiations potentially resuming between the top Chinese and U.S. trade negotiators, according to Chinese state media. China Global Times Editor tweeted the Chinese side sees a face-to-face meeting with the US as not far away and expects “actions” may happen soon which would be a sign of goodwill from both sides. In related news, China is reportedly mulling a plan to boost US soybean purchases.

Expected data include the Chicago Fed National Activity Index. Halliburton, Lennox, and Whirlpool are among companies reporting earnings.

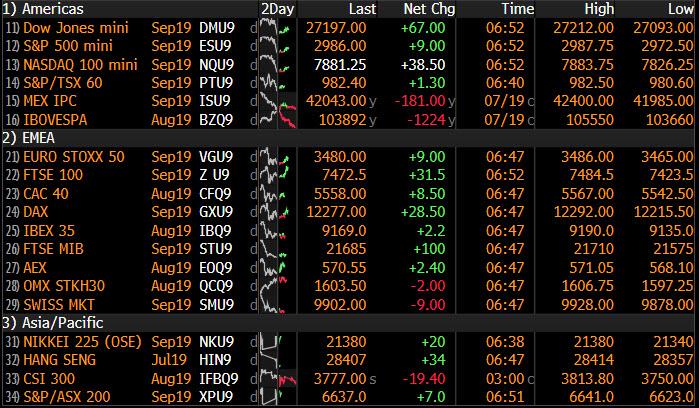

Market Snapshot

- S&P 500 futures up 0.3% to 2,984.75

- STOXX Europe 600 up 0.2% to 387.82

- MXAP down 0.5% to 160.11

- MXAPJ down 0.5% to 527.33

- Nikkei down 0.2% to 21,416.79

- Topix down 0.5% to 1,556.37

- Hang Seng Index down 1.4% to 28,371.26

- Shanghai Composite down 1.3% to 2,886.97

- Sensex down 0.9% to 38,012.94

- Australia S&P/ASX 200 down 0.1% to 6,691.24

- Kospi down 0.05% to 2,093.34

- German 10Y yield fell 0.7 bps to -0.331%

- Euro down 0.02% to $1.1219

- Italian 10Y yield rose 4.9 bps to 1.252%

- Spanish 10Y yield unchanged at 0.387%

- Brent futures up 2.4% to $63.94/bbl

- Gold spot little changed to $1,425.58

- U.S. Dollar Index little changed 97.20

Top Overnight News from Bloomberg

- Face-to-face negotiations between the top Chinese and U.S. trade negotiators could happen soon, according to Chinese state media, after Chinese companies asked U.S. exporters about buying agricultural products and also applied for exemptions from China’s retaliatory tariffs on the goods, state-run Xinhua News Agency reported Sunday

- A night of protests and clashes in Hong Kong — including tear gas volleys and roving groups of masked men attacking protesters — prompted the strongest warnings yet from the Chinese government and fanned fears of escalating violence

- Oil extended gains as tensions in the Persian Gulf remained elevated after Iran seized a British tanker, and Libyan production fell after an unidentified group reportedly shut the country’s largest field

- Prime Minister Theresa May will lead a meeting of the UK government’s emergency committee on Monday to discuss the security of shipping in the Persian Gulf after Iran seized a British oil tanker in the Strait of Hormuz last week

- Japanese Prime Minister Shinzo Abe’s ruling coalition won their sixth straight national election victory in Sunday’s upper house election, but fell short of the supermajority needed to launch a bid to change the pacifist constitution

- U.S. President Donald Trump will meet with a group of senators this week to discuss possible sanctions against Turkey, the Wall Street Journal reported

- Theresa May’s successor must move beyond Brexit to restore economic confidence and spur investment, the Confederation of British Industry said as it launched a “business manifesto” for the new government.

- Some Chinese companies are applying for tariff exemptions as they make inquiries about buying U.S. agricultural products, more than a week after Donald Trump complained that China hasn’t increased its purchases of American farm products

- Italy’s fractious populist coalition lurches into a make-or-break week as Matteo Salvini decides whether to try to force snap elections while Prime Minister Giuseppe Conte struggles to salvage the government

Asian equity markets traded mostly lower with the region cautious amid dampened hopes for a more aggressive Fed rate cut and geopolitical concerns after Iran seized 2 UK tankers. ASX 200 (-0.1%) and Nikkei 225 (-0.2%) were both subdued at the open although strength in commodity-related stocks briefly spurred a rebound in Australia, while the Japanese benchmark failed to take advantage of a weaker currency as participants reflected on the Upper House election results in which PM Abe’s ruling coalition won a majority of seats but failed to retain the supermajority needed to push ahead with revising the constitution. Elsewhere, Shanghai Comp. (-1.3%) and Hang Seng (-1.5%) declined despite continued liquidity efforts by the PBoC and more constructive language regarding US-China trade talks, with a rotation of funds seen into China’s new Nasdaq-style tech board known as the STAR Market which launched today and saw all of its 25 stocks surge by an average 126% in early trade and with some higher by more than 200%. Finally, 10yr JGBs were steady with only minimal support seen from the lacklustre tone in stocks and BoJ presence for JPY 1.265tln of JGBs mostly in 1yr-10yr maturities.

Top Asian News

- RBI Easing Is More Than India’s Rate Cuts Suggest, Das Says

- New Thai Government to Pursue Policies Championed by Junta

- India Faces ‘Silent Fiscal Crisis’ on Tax Gap, Modi Adviser Says

Major European indices are relatively flat [Eurostoxx 50 +0.1%], albeit near highs of the day following on from a cautious Asia-Pac trade. Sectors are mixed with outperformance seen in the energy sector amid the price action in the complex. In terms of individual movers, Philips (+4.0%) shares rose on the back of optimistic earnings whilst Julius Baer (+2.7%) shares are supported by an 8% in assets under management.

Top European News

- Italy’s Populists Near Crunch Time, With Salvini Playing God

- Brexit Nightmare Looms for U.K. Lawyers Forced Out of EU Courts

- U.K.’s Hammond to Quit If Boris Johnson Wins Race to Succeed May

- Philips Profit Shows How Plant Rejig Offers Trade War Remedy

In FX, the DXY index has consolidated recovery gains above the 97.000 handle within a relatively tight 97.126-247 range following the final official Fed rhetoric ahead of the pre-FOMC backout period from Bullard who reiterated his preference for a 25 bp cut instead of anything larger. Meanwhile, WSJ sources chimed in with similar ‘guidance’ as recent economic developments do not suggest an imminent downturn that would warrant bolder action, although more easy could be flagged after July, and current market pricing reflects the latest commentary with less than 20% chance of a 50 bp ease.

- NZD/CAD/AUD – The non-US Dollars are outperforming or at least holding up better than G10 peers, with the Kiwi leading the way on favourable cross-winds as Aud/Nzd retreats through 1.0400 and Nzd/Usd holds nearer last week’s peaks than Aud/Usd between 0.6782-58 and 0.7047-32 respective bands. From a fundamental perspective, the Aussie may glean fresh direction from RBA Assistant Governor Kent later, while the Loonie will be watching Canadian wholesale trade alongside crude prices that are currently supportive and nudging Usd/Cad down through 1.3050 within 1.3068-41 parameters.

- GBP/JPY/CHF/EUR – All on the backfoot vs the Greenback, and the Pound in particular awaiting the Tory leadership result that is widely expected to see Brexit hard-liner Boris Johnson appointed as new PM and fresh Cabinet faces before the whole process of negotiating with the EU really starts again. Cable is back below 1.2500 and from a chart standpoint looking more bearish as it slips beneath last Friday’s 1.2476 base. Next up would be July 18’s 1.2429 session low, but Sterling is keeping its head just above 0.9000 vs the Euro that is only just maintaining 1.1200+ status vs the Buck ahead of preliminary PMIs on Wednesday and the ECB on Thursday. Note, the probability of a 10 bp reduction in the depo rate is 50%, while some are also looking for the QE taps to be reopened, albeit not this month. Elsewhere, the Franc is hovering just below 0.9800 and 1.0100 vs the single currency, wary that any ECB stimulus or more pronounced safe-haven gains will be countered by the SNB in some shape or form. Similarly, with this month’s BoJ policy meeting looming on the eve of the FOMC the Yen is erring towards the side of caution closer to 108.00 compared to recent highs and unlikely at this stage to arouse decent option interest sitting from 107.50 to 107.35 in 2.3 bn).

- EM – The Lira has Central Bank action to look forward to as well, but US sanctions may be back on the radar to undermine sentiment given reports that President Trump is scheduling a meeting with Republican Senators to discuss options. Meanwhile, the consensus range is suitably wide for the CBRT as estimates cover a whopping 100-500 bp easing, and Usd/Try is near the top of a 5.6925-6490 at present.

In commodities, WTI and Brent futures are on the rise as sentiment in the complex is underpinned amid late-Friday reports that the IRGC seized a UK tanker in the Strait of Hormuz due to an alleged violation of maritime law. Meanwhile, UK Chancellor Hammond noted that the UK has been working closely with US and EU partners regarding a response to Iran’s actions. Energy markets are particularly sensitive to developments in the Strait of Hormuz, given that a fifth of the world’s oil exports passes through the corridor everyday whilst geopolitical tensions intensifies in the area. WTI and Brent futures have tested 57/bbl and 64/bbl to the upside as a result, albeit failed to convincingly breach the levels. Also of note; on Friday Libya’s NOC announced a force majeure at its El-Sharara (300k BPD) oilfield, although this has now been lifted, according to a statement. Elsewhere, spot gold remains within a narrow range amid an uneventful USD and heading into a key meeting for the ECB, in which markets are pricing in a 50% chance of a 10bps cut to its Deposit rate. Meanwhile, copper prices are marginally softer amid the overall cautious risk tone whilst Dalian iron ore prices declined as port inventory across China rose to over 1-month highs.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 0.1, prior 0

- 11am: BoJ’s Kuroda Speaks at IMF in Washington

DB’s Jim Reid concludes the overnight wrap

Happy Monday. I hope you had a good weekend. Mine was slightly ruined by a late cancellation for a round of golf by a friend who pulled a hamstring on Friday in a Father’s race at a school sports day. That’s the type of middle age thing that now happens to my circle of friends. He was a very good runner in his day and I can imagine him being very competitive about it and overdoing things. The good news for me as I approach such events in the years ahead is that I was always absolutely dreadful at running with no turn of speed so I have no ambition in such events and will gladly sit them out. However if they start a Father’s cycle race, golf tournament or cricket game I’m bound to overdo it, try to prove I’m the best dad and get an injury! Thank goodness this is unlikely.

The race to be the most dovish central bank hots up this week with the much anticipated ECB meeting on Thursday. The Fed is now in a public appearance blackout period and after a jumbled messaging on rate cuts from them towards the end of last week (more later) markets will continue to speculate in the background on the 25bps vs 50bps debate for the FOMC in 9 days time. 25bps remains the overwhelming favourite but the market stubbornly refuses to minimise the probability of 50bps. Before we preview the ECB, this week is also important for Wednesday’s flash global PMIs, Q2 US GDP (Friday), a new UK PM announced (Tuesday), and 145 S&P 500 companies reporting as earnings season hits its first peak week.

At Sintra last month Draghi laid the foundations to make further policy easing feel less conditional. Our economists, in their preview note last week ( link ), believe that September is the natural occasion for the big decisions and details however some preparation is anticipated this week. They expect the “or lower” easing bias to be reintroduced into rates guidance and that this will be the prelude to a 10bp deposit rate cut and tiering in September. They also expect a further 10bp cut in December. They also believe we will see upgraded forward guidance used to underline the ECB’s “absolute commitment” to the price stability mandate. If the Council is unable to strengthen forward guidance sufficiently, a new wave of net asset purchases may be required. If so, the team would not be surprised by new QE of EUR30bn per month for a minimum 9-12 months split equally between public and private assets and with a commitment to relax the limits if necessary.

Before this, the July global flash PMIs come out on Wednesday with most of the attention on Europe. The last few months have seen some stabilisation in the data with the manufacturing PMI for the Euro Area hitting 47.6 in June (vs. 47.7, 47.9 and 47.5 in the three months prior). The consensus expects a 47.8 reading for July. As for the services reading the consensus expects a 53.5 print which compares to 53.6 last month. We should note that we’ll also get country level PMI data for Germany, France and also Japan and the US.

Meanwhile, earnings season continues to rev up this week with 145 S&P 500 companies due to report. The highlights include Harley Davidson, Coca-Cola, United Technologies and Visa tomorrow, Boeing, Caterpillar, Ford, Facebook and AT&T on Wednesday, Amazon, Google and Intel on Thursday, and McDonalds and Twitter on Friday. With 15% of the S&P 500 having reported results, earnings are coming in around +4.9% better than consensus forecasts, which is above the historical average of 3.5%. US bank results have been mostly strong so far, though they did note pressure on their NIMs as rates fall. Outside of the Netflix subscriber numbers shock (stock -15.58% on the week), another negative release came from CSX, the shipping firm (-10.52% on the week), who reported soft guidance amid expectations for stagnant revenue this year.

As for the rest of the data this week, the advance Q2 GDP reading in the US on Friday will be in the spotlight with the consensus expecting a +1.8% reading following +3.1% in Q1. In Europe the only other data worth flagging is the July IFO survey in Germany on Thursday and perhaps the CBI survey data for July in the UK tomorrow and Thursday. This will be the latest check on Brexit Britain’s recent data reversal. The new UK PM this week will have a lot of political headwinds to face with Chancellor Hammond saying over the weekend that he will immediate resign if the overwhelming favourite Boris Johnson gets the job. The weekend press in the UK was also full of further speculation that Tory remainers will do all they can to limit the chances of Mr Johnson leaving the EU without a deal. A fascinating three and a bit months ahead for the UK.

Elsewhere the IMF’s latest World Economic Outlook update on Tuesday will get a lot of headlines as will former Special Counsel Mueller testifying before the House Judiciary and Intelligence committees on Russian election interference on Wednesday. The full day by day week ahead is at the end today as usual.

Asian markets have started the week on a cautious note with the Nikkei (-0.30%), Hang Seng (-0.77%), Shanghai Comp (-0.57%) and Kospi (-0.17%) all down. However, most indices are off their intraday lows. In terms of news flow there is a story that Chinese companies have asked US exporters about buying agricultural products and also applying for exemptions from China’s retaliatory tariffs on the goods (per state-run Xinhua News Agency). This perhaps shows that China is trying to buy more US goods in the negotiation period. Elsewhere, in a separate commentary from Taoran Notes, a blog run by the state-owned Economic Daily newspaper, it was suggested that the US and China have been “cautiously showing each other sincerity and goodwill” recently and may meet for discussions soon. Meanwhile, Hu Xijin, the editor-in-chief of the Chinese state newspaper Global Times also tweeted that “Based on what I know, Chinese importers have started arrangement of purchasing US agricultural products. This is a prominent part from Chinese side as the two countries have signalled goodwill to each other recently. It also indicates China-US trade consultations will restart soon.”

Elsewhere, futures on the S&P 500 are trading flattish while WTI oil prices are up another +0.84% as tensions in the Persian Gulf remain elevated after Iran seized a British tanker, and Libyan production fell after an unidentified group reportedly shut the country’s largest field.

In other news, China’s commerce ministry said in a statement that it will conduct an anti-dumping probe into stainless steel billet and hot-rolled stainless steel plate (coil) imports from the EU, Japan and Indonesia while adding that it will collect anti-dumping duties (duty rate to be between 18.1%-103.1%) on stainless steel products imports from EU, Japan, South Korea and Indonesia for five years starting from July 23.

Before the week ahead a quick recap of the last week. Attention continued to focus on the Fed, as investors weighed the odds of a 25 versus 50 basis point rate cut at the upcoming 31 July meeting. Last week, a few hawkish members of the committee, Kansas City’s George and Dallas’s Kaplan, both signalled that they may support a rate cut. At the same time, some of the committee’s more dovish members signalled support for a cut, but not an immediate 50bps move, i.e. Chicago’s Evans and St. Louis’s Bullard. The Fed’s leadership, Chair Powell and Vice Chair Clarida, both spoke but neither gave a firm policy signal either way. Markets gyrated after NY Fed President Williams spoke on Thursday, where he argued in favour of quick and aggressive action to pre-empt a downturn. Markets moved to price in around a 72% chance of a 50bps move this month in the aftermath. However, there were major signs that the Fed was uncomfortable with this pricing, as the NY Fed walked back William’s comments, saying they were not about policy. A WSJ article on Friday, similarly emphasized support for a 25bps move but not 50bps. Meanwhile the Fed’s Rosengern (a voter this year) said in an interview with CNBC on Friday that no interest rate cut is warranted at this stage, given the positive data that’s rolled in since mid-June. He said, “The economy’s doing actually quite well. We’re not really having an economic slowdown,” while adding, “as long as the economy’s doing well, if that continues we don’t need accommodation.” Markets ended the week pricing in around a 24% chance of a larger 50bps rate cut.

The Fed news drove action in markets all last week, with 10-year treasuries rallying -6.7bps (+3.1bps Friday) and two-year yields down -2.9bps (+6.2bps Friday). Rates rallied early in the week on dovishly-perceived Fedspeak, but subsequently rebounded higher when the Fed walked back its signal. This caused the 2y10y curve to flatten -4.2bps (-3.6bps Friday) to 23.1bps. The moves were similar in Europe, where German yields fell -11.4bps (-1.4bps Friday). The euro weakened -0.43% versus the dollar (-0.50% Friday), as US macro data outperformed, highlighted by a very strong retail sales report. In contrast, European data was soft, with the ZEW survey deteriorating.

European equities outperformed a touch, with the Stoxx 600 rising +0.10% (+0.12% Friday). The S&P 500 retreated -1.23% (-0.62% Friday), with the NASDAQ performing similarly down -1.41% (-0.50% Friday). So a softer week for risk ahead of a big fortnight for central banks on both sides of the Atlantic.

via ZeroHedge News https://ift.tt/2GnUyTE Tyler Durden