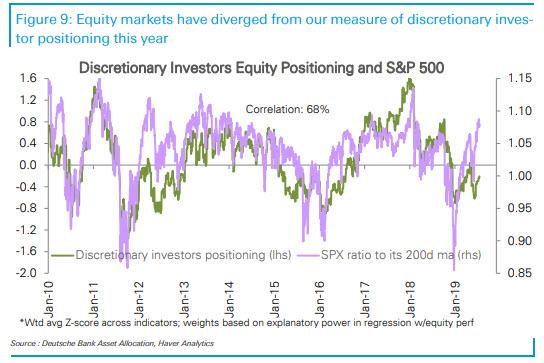

Over the weekend, we pointed out that in addition to the biggest conundrum facing markets in 2019, namely that the higher stocks rise, the greater the (now record) outflows from equity funds, there has recently emerged another especially bizarre divergence: whereas discretionary investors have been cutting equity positioning as growth has slowed…

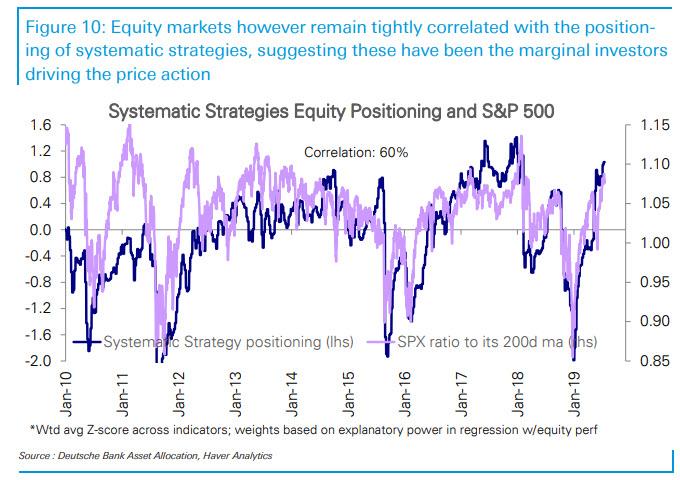

… systematic strategy allocations – i.e., quants, “robots”, and the like – have been buying up stocks the worse the economic picture became, and have been pushing the S&P higher.

A

What this means is that not only do broader markets track systematic rather than discretionary flows, but the marginal price setter is no longer of human (discretionary) origin, but rather robotic.

In other words, the good news is that while humans may have gotten cold feet, robots continued to buy… for now.

And now the bad news: whereas global equities have maintained upward momentum for the most part, that momentum seems to be losing steam, and at least one major class of robotic investors may soon seek to exit too.

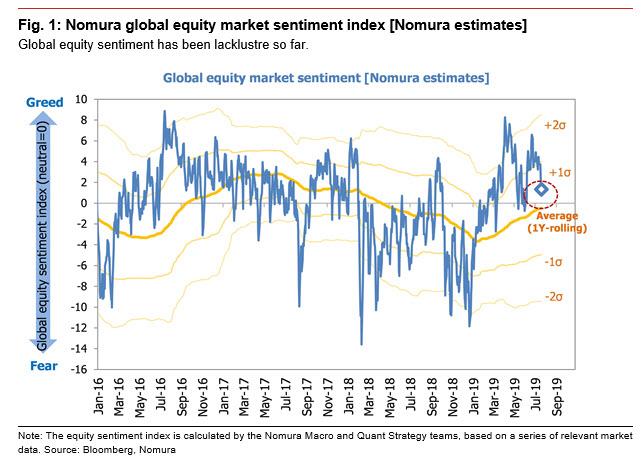

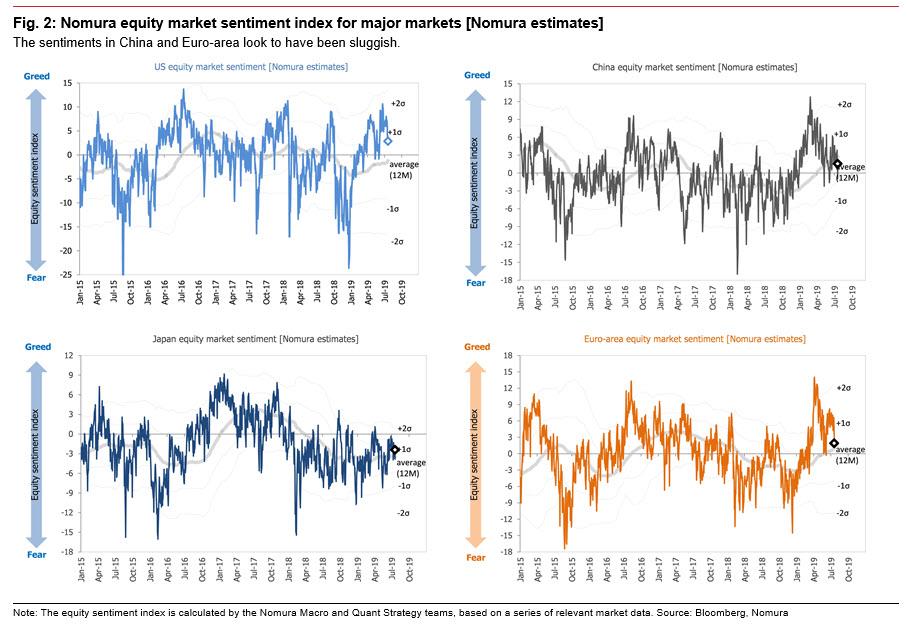

As Nomura’s quant team writes, with the FOMC having now entered the blackout period ahead of next week’s potentially historic FOMC meeting (30-31 July) when the Fed is widely expected to restart monetary easing, market participants are converging on the view that the Fed will cut interest rates by 25bp – but not by more – and as a result market sentiment is softening in markets worldwide.

Indeed, it appears to Nomura that, rather than expecting a risk rally once the rate cut decision has been made, the market is starting to worry that a rate cut would be followed by a round of “selling the fact”. As a result, given that Nomura sees signs of ebbing risk appetite, the Japanese bank thinks it best to be on the lookout for selling of global equities for profit-taking purposes ahead of the event, particularly among speculative traders. Furthermore, the bank’s quant team also notes that “hedge funds have staked out positions that look especially vulnerable to a combination of rising volatility and falling stock prices.”

Global stock market sentiment has continued to soften, most obviously in the US, as the perceived likelihood of a 50bp rate cut has dropped off. Although sentiment is still slightly on the risk-taking side of neutral, we would expect investors to remain fairly unenthusiastic if the July FOMC meeting ends innocuously with a 25bp rate cut.

Hedge funds, meanwhile, are still positioned in a way that would lead one to believe that they:

- expect volatility to remain consistently low; and

- see little downside risk for equities.

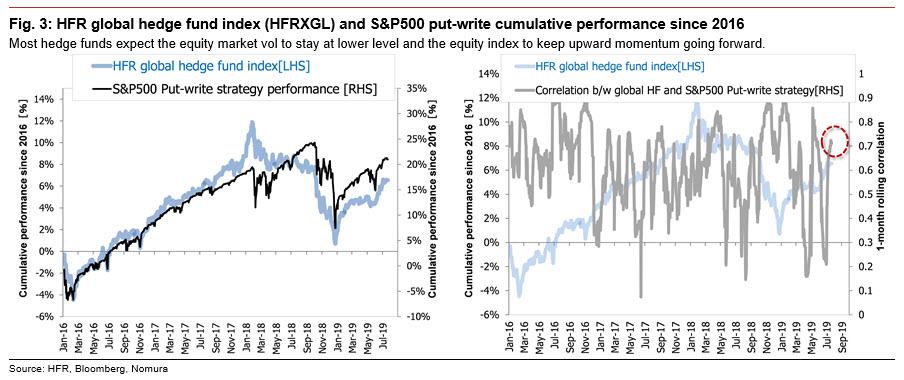

For example, the overall performance of hedge funds as measured by the HFRX Global Hedge Fund Index (HFRXGL) is still closely correlated with returns on an S&P 500 put write strategy, which leads Nomura to believe that speculative traders are by and large not taking profits on this sort of high-risk, bullish position in equities.

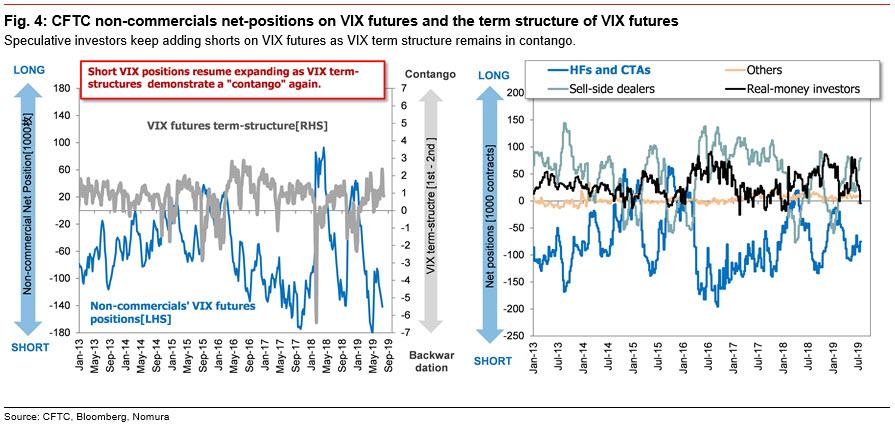

At the same time, the growth in VIX futures shorts is another manifestation of this risk-taking behavior on the part of speculative traders. According to latest data from the CFTC (dated 16 July), the net short position of non-commercial traders has grown to around 140,000 contracts, which is to say that the outstanding net position of hedge funds is now highly vulnerable to a rise in volatility paired with a drop in stock prices.

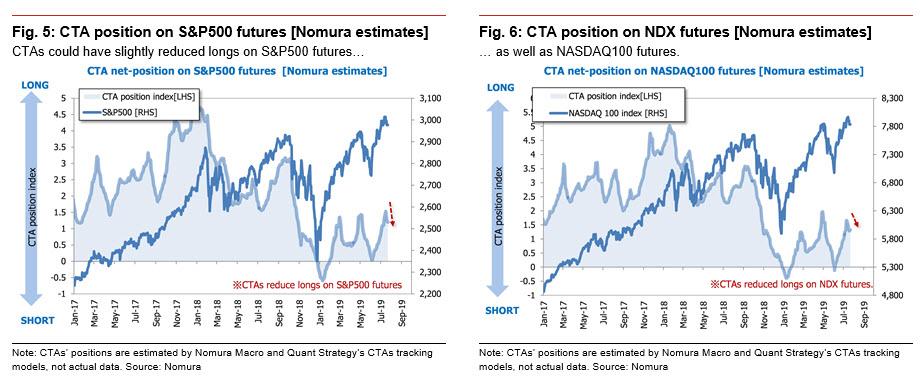

Which brings us to the proverbial “robots”, or CTAs, which after bidding up stocks for much of the past month are preemptively taking profits on long positions in US equity futures.

As mentioned above, US stock market sentiment has softened somewhat. Even if the Fed were to go through with a 25bp rate cut at the July FOMC meeting, the appetite for risk may continue to fade unless the Fed pairs the rate cut with some additional dovish surprise. And, as the charet below shows, trend-following CTAs have already begun preemptively taking profits on long positions in US equity futures.

And as Nomura’s Masanari Takada writes, “trend-following CTAs are in the process of scaling back their net long position in US equity futures.” Specifically, CTAs have been shrinking their net position in S&P 500 futures in increments since 17 July.

Finally, because the outstanding net long position of CTAs breaks even at around 2,955 (based on what Nomura calculates the average cost of their net buying since the beginning of June), this selling is still mostly a matter of preemptive profit-taking commensurate with what the market is actually doing.

Said otherwise, should the S&P dip below 2,955 ahead of next week’s FOMC, the Fed may have no choice but to cut 50bps as the market will be delighted to once again force Powell’s hand.

On the other hand, discretionary traders (global macro hedge funds and equity long/short funds) following aggressive selling for much of 2019, are slightly on the side of adding to their net exposure and BTFD, or as Takada notes, “the buying of US equities by global macro hedge funds sticks out here.”

Nomura’s conclusion: “The US stock market is currently the scene of a head-on collision between selling by technically minded CTAs and buying by fundamentals-oriented global macro hedge funds.”

Whether this collision will result in an acceleration in the market’s meltup, or a painful reacquaintance with gravity will depend on what the Fed does next week.

via ZeroHedge News https://ift.tt/30OY15k Tyler Durden