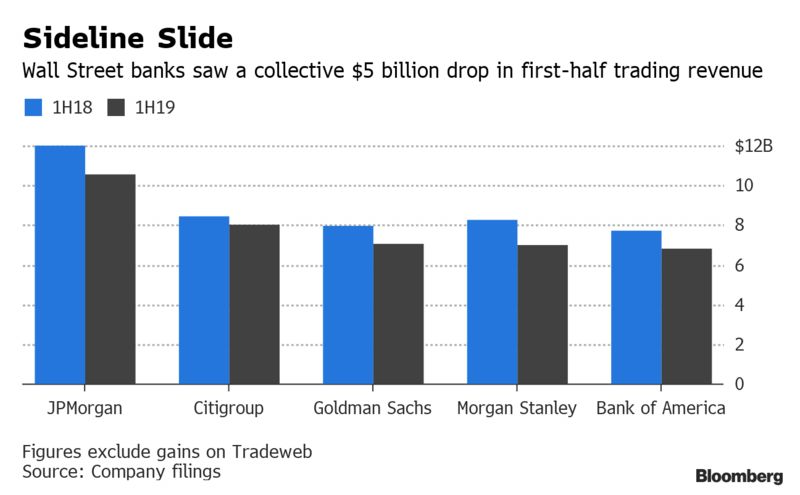

With Morgan Stanley reporting Q2 results yesterday, the first half earnings of all “big 5” US banks are now public, and when it comes to sales and trading they are nothing short of a disaster.

With the S&P at or near all time highs, institutional traders have, paradoxically, been increasingly moving to the “sidelines” for much of the second quarter as Wall Street trading desks posted their worst first half to a year in a decade, according to Bloomberg calculations. David Solomon, CEO of Goldman Sachs, made note of this over the last two quarters, and other major banks like JP Morgan and Citigroup have followed.

The slowdown in trading revenue has been due to uncertainty about trade war politics and global Central Bank policy. However, in the past, these types of uncertainties have spurred more trading, not less. This has raised the question of whether or not the slowdown in trading is permanent, instead of temporary.

Morgan Stanley CFO Jon Pruzan said in an interview Thursday: “It’s more of a subdued up than sort of the animal spirits you would generally characterize in this type of environment. We haven’t seen some of the traditional things in a market like this — we haven’t seen a lot of people repositioning their portfolios, we haven’t seen leverage increase.”

Trading revenue at the five biggest Wall Street banks was down 8% in the second quarter, which followed a 14% slide in the first quarter. European banks are expected to post even larger drop offs next week when they report.

This will likely push revenue from equity and fixed income trading substantially below the $60.8 billion that was posted in the first half of 2017. These major firms generated $77.5 billion as recently as the first half of 2012.

One reason for the shrinkage – hedge funds have suffered outflows, which has also helped slow down trading volume. In addition, new rules that have limited lenders’ ability to make principal bets with their own money have acted as a headwind. Technological advancements have also narrowed spreads in many areas of trading.

And over the last couple of quarters, Wall Street firms can’t decide whether or not they want to complain about too much volatility – or too little.

Jim Shanahan, an analyst at Edward Jones said: “I’m not sure what the Goldilocks scenario is for the banks. Part of the problem is that it’s too late to hedge interest-rate volatility, there’s not currency volatility to hedge. Speculators need volatility to hedge and enter the market.”

As a response, banks have cut costs. Front office headcount in trading units is down over the last five years and divisions like consumer lending and wealth management have picked up the slack that have led banks to record profits. As a result, the six biggest US banks set another record with $32.6 billion in (adjusted, non-GAAP) net income in the second quarter.

Go figure.

Citi CFO Mark Mason bemoaned the top-line sluggishness of the trading business: “Many of the investor clients remained on the sidelines,” he said on Monday.

One can only imagine if equity revenue is slumping when the S&P is at all time high what will happen when the market finally crashes…

via ZeroHedge News https://ift.tt/2GlYaWc Tyler Durden