By Russell Clark of Horseman Capital Management

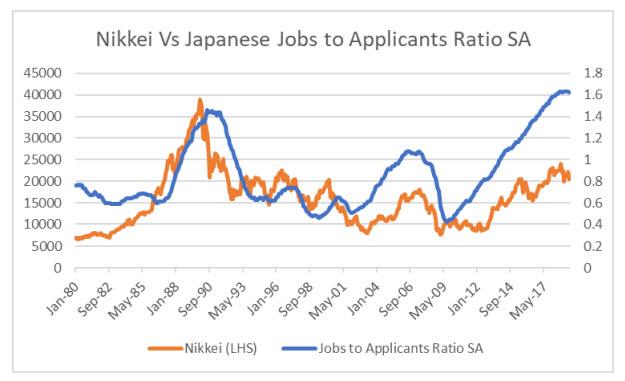

Japan pioneered many of the monetary policies that we now find common in the Western world. Despite the Bank of Japan (“BOJ”) taking monetary policies to ever more extreme levels, including negative interest rates and very large purchases of Japanese government bonds, the Nikkei still languishes well below the all-time highs set in 1989. Despite the BOJ’s best efforts, the Nikkei still has a tendency to move with employment.

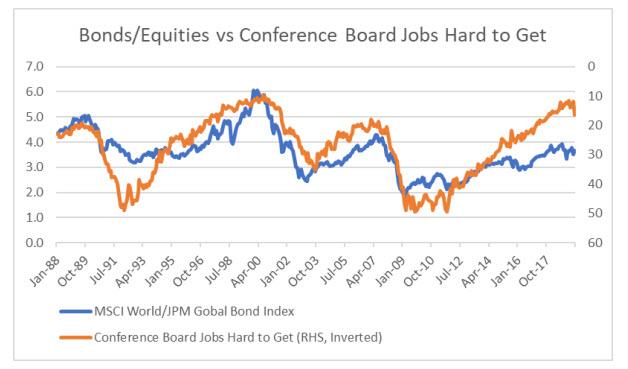

Since the bursting of the dot com bubble, US Equities seem to also follow the Japanese tendency of equities and employment. The below table shows the S&P 500 Index vs the Conference Board Employment Trends Index/Conference Board Consumer Confidence Survey which shows the number of unemployed in the US/percentage of survey respondents who say they find “jobs hard to get.”

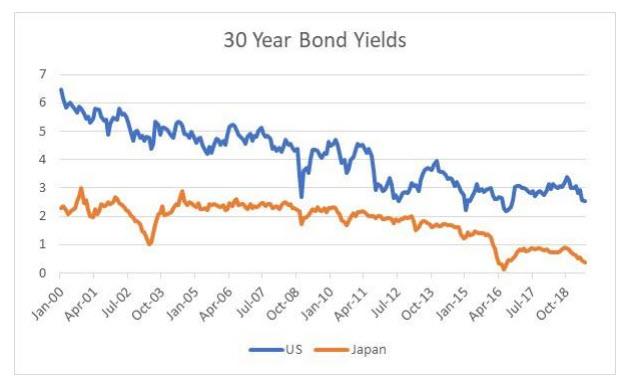

Both in Japan and in the US, the reaction to slowing employment growth has been a violent reaction in bond yields.

The simple reason for this is that some investors prefer the safety of bonds when employment looks toppy, and prefer equities to bonds when employment is rising. A comparison of MSCI World Index/ JPM Aggregate Bond Index versus Conference Board Jobs Hard to Get Index bears this out.

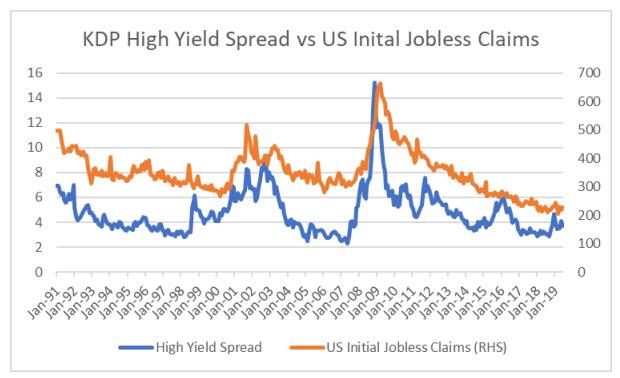

High yield spreads are also very correlated to employment data with spreads tightening as unemployment falls, and widening as unemployment rises. Intriguingly, even when absolute levels of high yield have fallen as bond yields have fallen, spreads in 2018 and 2019 have continued to remain at higher levels than 2017.

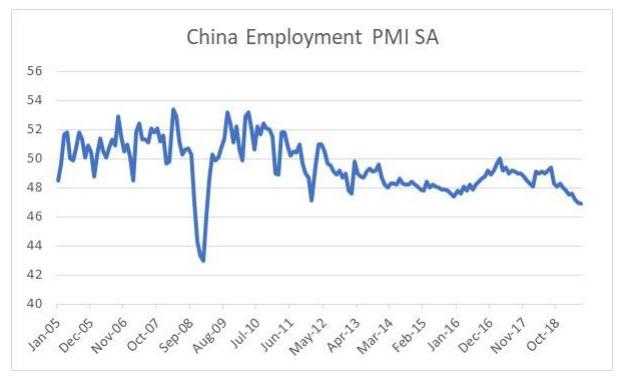

Employment in China is also looking problematic, with Chinese Employment PMI also hitting new post financial crisis lows.

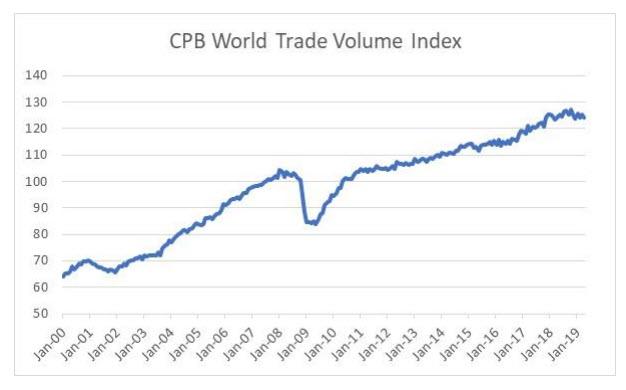

There are several real world (as opposed to financial markets) indicators that would point to unemployment inflecting higher. Trade volumes look to be inflecting lower.

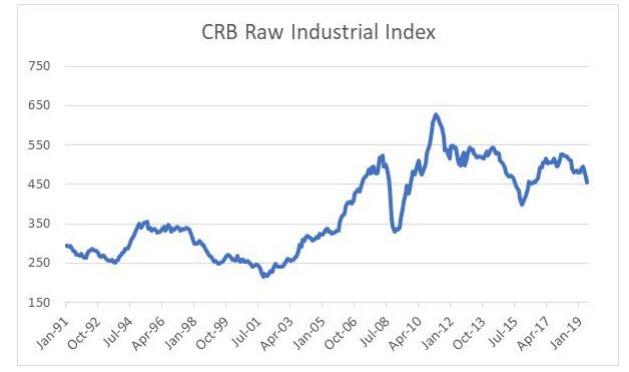

The CRB Raw Industrial index is made up of a number of less traded commodities. This means that it is less subject to correlation with financial markets. This reinforces the trends seen in the trade volume data.

Growth looks to be slowing, high yield spreads are widening. Unemployment could potentially be inflecting higher. If the experience of Japan with quantitative easing is still relevant, it would indicate investors are likely to go into bonds rather than equities.

via ZeroHedge News https://ift.tt/2YbUvjO Tyler Durden