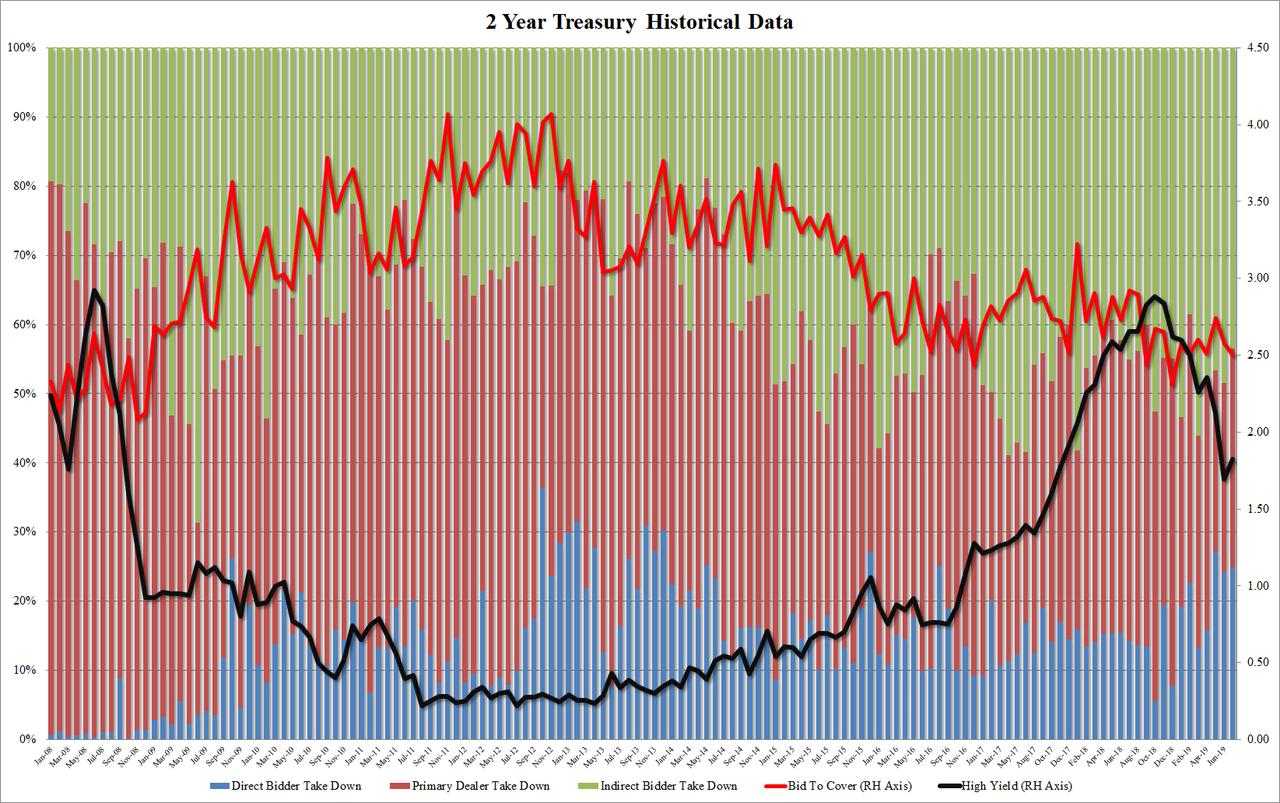

After six consecutive auctions without a tail, moments ago the US Treasury finally was met with subpar demand for its just auctioned off $40 billion in 2Y notes, which priced at a high yield of 1.825%, a 0.2bps tail to the 1.823% When Issued, and the first tail since December 2018 (which for some may come as a surprise considering that for virtually all of 2019 the Fed had made clear its intentions to soon start cutting rates).

The internals were similarly disappointing, with the Bid to Cover dipping from 2.576 in June to 2.500, below the 6 month average of 2.58. Foreign demand slumped, with Indirects taking down jkust 43.5%, the lowest since February and well below the 48.46% recent average. And with Directs taking down 24.9%, it left Dealers holding 31.6% of the auction, the highest since April, and below the 34.5% average.

Overall, a subpar auction in every aspect, which however is surprising considering that it is certainly the market’s consensus that a recession will take place some time in 2020, and as such the yield on 2Y paper will only continue to slide.

via ZeroHedge News https://ift.tt/2OctgpH Tyler Durden