In a time when the pain to be a value investor is the highest in almost two decades, with Bloomberg recently pointing out that value returns are now the weakest versus growth since the tech bubble…

… one of the most prominent value investors, David Einhorn, refuses to throw in the towel, and after a disastrous 2018, he managed to stage an impressive rebound, with his Greenlight Capital returning 5.8% for the quarter, and a remarkable 17.4% for the YTD period. In a welcome – for the fund’s LPs – change from recent history, each of the long portfolio, the short portfolio and macro generated a positive return in the quarter: “We had five significant winners – Tesla (TSLA, short), gold, Adient (ADNT), General Motors (GM) and AerCap (AER) – which were partially offset by losses in CNX Resources (CNX) and Ensco (ESV)” the letter noted.

Additionally, for those keeping tabs on such things, at quarter-end Greenlight’s largest disclosed long positions were AerCap Holdings, Brighthouse Financial, CONSOL Coal Resources, General Motors and Green Brick Partners for an average exposure of 120% long and 74% short.

And while we will leave readers to read on their own the fund’s discussion of why Einhorn believes Brighthouse Financial is undervalued, why he is still short Assured Guarantee, or why he took new positions in Chemours, Dillards and Scientific Games, and exited several positions including Deutsche Pfandbriefbank, BT Group and its Mowi short, we will highlight Einhorn’s take on what he believes is the poster child of the current stock market bubble: the recent IPO of Chewy stock (which we discussed here):

In many respects, Pets.com is remembered as the poster child of the 2000 internet bubble. After all, who can forget a sock puppet and a business model of distributing pet food and supplies over the internet at negative margins? But some context is in order. Pets.com was backed and majority-owned by Amazon.com. It raised approximately $82 million in its IPO and achieved a peak market capitalization of less than $400 million. It acquired over 500,000 customers before it eventually failed. Pets.com described itself in a 10-Q from 2000 as follows:

Pets.com, Inc. is a leading online retailer of pet products, integrating product sales with expert information on pets and their care. We are committed to serving pets and their owners with the best care possible through a broad product selection, expert information and superior service. We seek to address the entire pet products market, transcending the limited product selection of superstores, specialty stores and grocery stores. Our broad selection of approximately 15,000 SKUs is integrated with extensive pet-related information and resources designed to help consumers make informed purchasing decisions.

For those that think the 2000 bubble was the big kahuna, consider Chewy (CHWY), which went public in June 2019. CHWY described itself in its registration statement as follows:

Our mission is to be the most trusted and convenient online destination for pet parents everywhere. Since our launch, we have created the largest pure-play pet e-tailer in the United States, offering virtually everything a pet needs. We believe that we are the preeminent online destination for pet parents as a result of our broad selection of high-quality products, which we offer at great prices and deliver with an exceptional level of care and a personal touch. We are the trusted source for pet parents and continually develop innovative ways for our customers to engage with us. We partner with more than 1,600 of the best and most trusted brands in the pet industry, and we create and offer our own outstanding private brands.

Over its life, Pets.com chewed through just over $200 million of investor capital. CHWY has burned $1.6 billion and counting. Analyst consensus is that CHWY will achieve modest operating profits in 2023. Its market value is nearly $14 billion – more than 30x Pets.com at its peak. There is a saying that over the short-term the market is a voting machine and over the long-term it is a weighing machine. We look forward to a time when there is more weighing and less voting.

We doubt that Einhorn is alone in desperately looking forward to the time this biggest asset bubble in human history finally bursts, and takes with it the most manipulative entity ever conceived – the world’s central banks.

But we digress: here is the balance of Einhorn’s lament:

In our early training, there was a concept that news was priced in. This meant that for high-multiple stocks, expectations of good results were already baked into the share price, and for low-multiple stocks, bad results were already discounted. The high multiple would often provide a ceiling for prized stocks – such that it took genuine incremental positive news to drive them higher. Conversely, the low multiple on out-of-favor stocks would often provide a floor such that it took genuine bad news to drive them lower.

In this market, such ceilings and floors don’t seem to exist. Prized stocks continue to rise sharply based on the continuation of existing trends, without deviation, and there is no price too low for unloved stocks. The saying used to be “good things happen to cheap stocks.” Our long portfolio appears to be laden with them – most trade at low- to mid-single digit P/E ratios despite improving business performance.

Alas, as long as central banks keep jawboning or injecting liquidity, value stocks will continue to underperform growth, “story” and cult names, at least until central banks lose their last shred of credibility, but when that happens, the entire financial system will slam shut so it is unclear if and when Einhorn will get his last laugh.

Until then, however, he is piling on the short side by taking a bet against the one instrument which even Pimco in May said was the riskiest market ever: we are referring of course, to corporate credit. Here’s Einhorn:

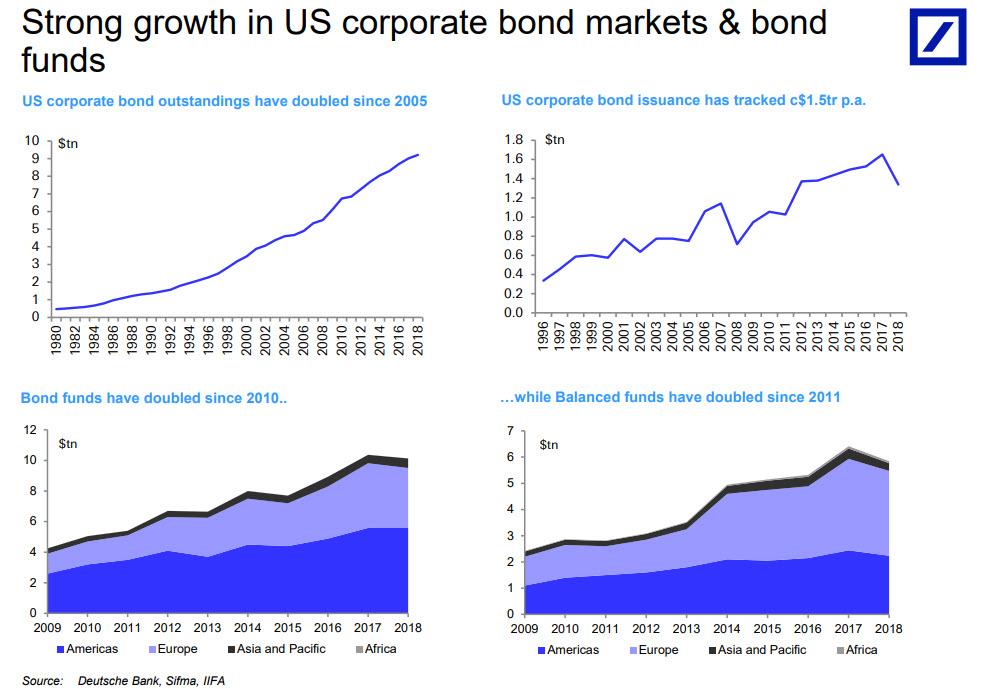

…we have taken a new macro position against U.S. corporate credit, both investment grade and high yield. Over the last few years, corporate debt has expanded dramatically, while covenant packages and other bond-holder protections have weakened considerably. Rating agencies have been complacent and allowed debt/EBITDA and debt/equity ratios to deteriorate without a corresponding reduction in credit ratings.

Meanwhile, we are a decade into an economic recovery and there are signs the economy may be slowing. Finally, credit spreads are approaching historical tights, such that the cost of betting against corporate credit is quite low. We have a fair amount of cyclical risk in our equity portfolio (which we added to by buying CC), and believe shorting corporate credit, in addition to having attractive standalone asymmetric risk-reward characteristics, provides a hedge to our long equity portfolio.

Finally, tor those curious what will happen once the bond bubble bursts and the corporate bond market suddenly goes bidless, please read our latest post on this topic, “$1.6 Trillion Fund Spots A New, Ticking Time Bomb In The Market.”

via ZeroHedge News https://ift.tt/2LGn479 Tyler Durden