Global markets were set to end the week mostly in a sea of green, reversing yesterday’s losses, with S&P futures pointing to a higher open as investors greeted the latest batch of corporate earnings, while ignoring Amazon’s downcast outlook and bracing for next week’s Federal Reserve meeting. In the “buy everything” euphoria, the dollar also climbed as did US Treasuries.

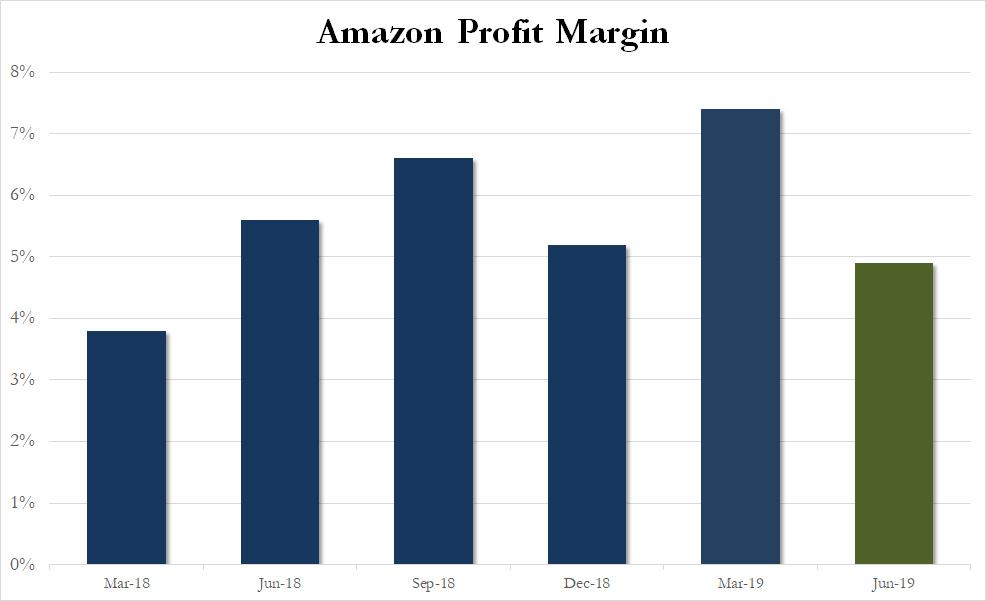

S&P Emini futures rose 0.3%, pointing to a turnaround after Wall Street shares fell from record highs on Thursday. Corporate results were mixed as Amazon missed estimates, its profits unexpectedly dropped and the company guided to a weaker than expected operating income, pushing its stock lower, while Google Alphabet rallied after exceeding revenue estimates.

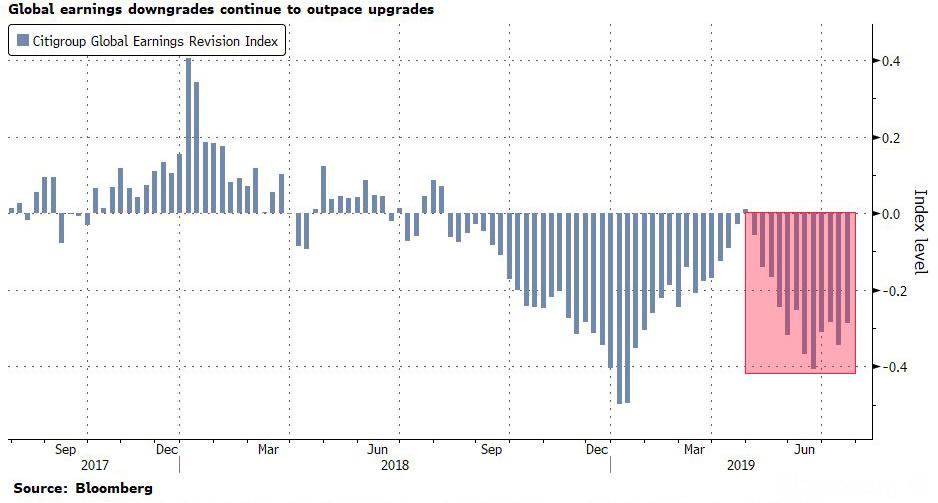

Separately, decent earnings from Intel and Starbucks helped offset worries from weaker Amazon numbers. While corporate results have largely propped up stocks this earnings season, investors continue to watch for any hints of a slowdown in companies’ bottom lines. As a reminder, corporate earnings downgrades continue to sharply outpace upgrades.

“A stream of earnings from the United States has shown people have to pay attention to the corporate cycle as well as the interest rate cycle, and focus is also shifting to the U.S.’s latest GDP numbers this afternoon, which may go some way to influencing what the Federal Reserve decides to do,” said Andrew Milligan, head of global strategy at Aberdeen Standard Investments.

A day after its worst session in three weeks, the European Stoxx 600 index added 0.4%, led by media and telecom shares after positive earnings. Nestle’s higher revenue forecast also lifted the food sector. Among laggards, the retail sector was dragged by disappointing results from luxury giant Kering, while miners slid on metals weakness and after Anglo American’s largest shareholder liquidated its stake. London’s FTSE 100 also revived, helped by Vodafone’s plans to create a separate European tower company and education firm Pearson’s gains from an upbeat trading update.

Meanwhile, it was another bad day for European banks, with the Stoxx 600 Bank Index falling as much as 0.7% as earnings from Spanish banks disappointed. CaixaBank and Sabadell were the worst performers on the gauge, both falling more than 6% after their income from lending missed analysts’ expectations and both banks cut the outlook for core lending. Bankia, which reports on Monday, fell 4.5% and Bankinter also dropped 2.7%.

ECB President Mario Draghi on Thursday all but pledged to ease policy further and even hinted at a reinterpretation of the ECB’s inflation target. But many investors had hoped for an immediate reduction of interest rates.

“After the ECB yesterday opened the door to a looser monetary policy, the Fed is likely to cut interest rates next week,” Joerg Kraemer, chief economist at Commerzbank AG, wrote in a note. “The turnaround in global monetary policy is cementing the low interest rate environment on bond markets.”

Earlier in the session, Asian stocks retreated, led by technology and consumer staples firms, as uncertainties over whether Washington and Beijing will be able to settle gaping differences over trade, technology and even geopolitical ambitions, kept many investors on guard. Negotiators from the two countries will meet in Shanghai next week. MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.6, with Indonesia and Singapore leading declines. The Topix fell 0.4%, driven by Keyence Corp. and Toyota Motor Corp. Nissan Motor dropped 3.2% after announcing its plan to cut 12,500 jobs and reduce production capacity amid a global slump in car demand. The Shanghai Composite Index reversed earlier losses and closed 0.2% higher, bringing its weekly gain to 0.7%. China is allowing several domestic companies to buy U.S. cotton, corn, sorghum and pork free of retaliatory tariffs. India’s Sensex rose 0.2%, with Bajaj Finance Ltd. and Kotak Mahindra Bank Ltd. among the biggest boosts, as investors weighed earnings against bad-debt risk. Most Nifty companies that have reported earnings this season have either met or beat estimates

A rally in global bonds ran out of steam after Draghi cautioned about pulling the trigger too quickly on policy easing. Euro zone government bond yields began to reverse some of the rises seen after the ECB meeting. German 10-year bond yields were around one basis points lower at -0.373%, heading back down towards the record low of -0.422%, recorded on Thursday. Other 10-year yields in the euro zone were also around two basis points lower

In FX, the Bloomberg Dollar Spot Index rose for a second day, headed for its biggest gain since July 5 as traders trimmed bets on the size of expected Federal Reserve interest-rate cuts and helped by a whisper number for U.S. GDP data that was better than economists’ median forecast. The euro traded at $1.1136, a mild recovery from a two-month low of $1.1102 hit after the ECB decision on Thursday but down 0.1% on the day. For the week, the single currency is down 0.7%. Sterling edged down to $1.2428, and was on course for a 0.6% weekly loss. Cable has stabilised since Boris Johnson became Britain’s new prime minister, but uncertainty remains about Britain’s negotiations to leave the European Union.

In geopolitics, North Korea confirmed it tested a new type of short-range ballistic missile yesterday and its leader Kim stated South Korea has been bringing in weapons for attack, while he added that North Korea must keep developing weapons to eliminate national security threats and that the missile firing was a warning to South Korea’s warmongers. Additionally, officials confirmed Iran tested a medium-range ballistic missile yesterday.

Traders will also be scrutinizing today’s GDP figures, which will probably show growth cooled in the second quarter to 1.8% from the 3.1% annualized pace set in the prior period. Central banks remain at the top of the agenda, with policy makers expected to boost stimulus at next week’s Fed meeting.

Macro economic data to watch include second-quarter GDP and personal consumption figures. Aon, Twitter, AbbVie, McDonald’s, Colgate-Palmolive are among companies reporting earnings.

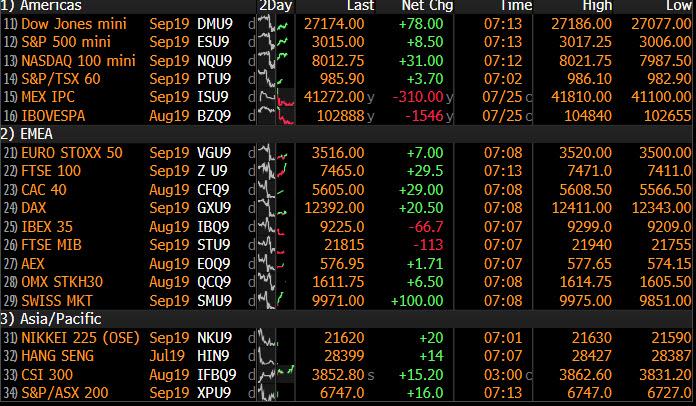

Market Snapshot

- S&P 500 futures up 0.3% to 3,015.00

- STOXX Europe 600 up 0.2% to 390.18

- MXAP down 0.6% to 160.03

- MXAPJ down 0.7% to 526.29

- Nikkei down 0.5% to 21,658.15

- Topix down 0.4% to 1,571.52

- Hang Seng Index down 0.7% to 28,397.74

- Shanghai Composite up 0.2% to 2,944.54

- Sensex up 0.05% to 37,849.14

- Australia S&P/ASX 200 down 0.4% to 6,793.39

- Kospi down 0.4% to 2,066.26

- German 10Y yield fell 0.5 bps to -0.368%

- Euro down 0.1% to $1.1136

- Brent Futures up 0.1% to $63.47/bbl

- Italian 10Y yield rose 2.3 bps to 1.166%

- Spanish 10Y yield fell 0.8 bps to 0.349%

- Gold spot up 0.2% to $1,418.03

- U.S. Dollar Index up 0.08% to 97.89

Top Overnight News from Bloomberg

- Negative interest rates from central banks come with costs. They’re blamed for squeezing banks, punishing savers, keeping dying companies on life support, and fueling a potentially unsustainable surge in asset prices. This isn’t lost on policymakers at the ECB, who pushed a key rate below zero in 2014. But consider their position: Making money cheaper is the main tool they have to boost stubbornly slow growth. And they aren’t getting a lot of help from governments.

- The enormity of the challenge facing Boris Johnson to break Britain’s political deadlock was laid bare in his first days as prime minister, as the EU rejected his demands for a better Brexit deal

- When Christine Lagarde chairs her first meeting as European Central Bank president in November, she might wonder which of her colleagues don’t really want her there.

- Iran earlier this week test fired a medium-range ballistic missile that traveled 1,000 kilometers, CNN reported citing an unnamed U.S. official,move escalating tensions around one of the world’s most important shipping corridors

- U.S. House passed a two-year debt ceiling extension and budget bill Thursday in a bipartisan deal backed by President Trump that will lessen the chance of a shutdown this fall

- Some Bank of Japan officials see little to be gained from strengthening its interest-rate pledge next week, according to people familiar

- Secretary of State Michael Pompeo said he would be willing to travel to Tehran to address the Iranian people about U.S. foreign policy as the Trump administration applies maximum pressure to renegotiate a nuclear accord

- Mario Draghi is shouting louder than ever for help with the euro-area economy, and still no one is listening.

- As more Chinese companies stumble on their debt, one fund manager is turning wary of riskier bonds from the nation, in another sign that the asset class’s strong performance this year may be nearing an end.

Asian equity markets traded negatively as the region conformed to the downbeat global risk tone post-ECB, while disappointing earnings also added to the glum. ASX 200 (-0.4%) and Nikkei 225 (-0.5%) were lower with tech and financials leading the declines in Australia, while sentiment in Tokyo was dampened by disappointing results including Nissan. Elsewhere, Hang Seng (-0.7%) and Shanghai Comp. (+0.2%) were subdued after further PBoC inaction resulted to a net weekly liquidity drain of CNY 410bln with underperformance in Hong Kong after poor trade data for June in which Exports slipped 9.0% Y/Y and as protesters planned to take their rally to the Hong Kong International Airport. Finally, 10yr JGBs were subdued as they mirrored the lacklustre tone in USTs and European counterparts after a less dovish than hoped ECB, although downside was also stemmed amid weakness in stocks and the BoJ’s presence in the market today.

Top Asian News

- Some at BOJ Are Said to Doubt Effectiveness of Stronger Guidance

- Singapore Home Prices on the Rise Again One Year After Curbs

- Tokyo Electron 1Q Profit Beats Estimate Despite Capex Adjustment

- Singapore Opposition Says ‘Fake News’ Law May Be Used as Muzzle

European stocks are relatively directionless amid another earnings-driven morning for the region [Eurostoxx 50 +0.4%] following on from a mostly negatively Asia-Pac handover post-ECB. Sectors are mixed with clear outperformance seen in telecom names as the sector is bolstered by FTSE-giant Vodafone (+9.5%) after the Co. announced a potential IPO of its Towerco unit alongside its numbers. On the flipside, material names lag, heavily weighted on by Anglo American (-5.0%) after metals tycoon Agarwal sold his stake in the mining name. Elsewhere, gains in the consumer discretionary sector is capped by Kering (-6.2%) after the fashion name open lower in excess of 9% amid disappointing Gucci sales. Meanwhile, optimistic numbers from Intel (+4.8% pre-market) buoyed the European chip names ASM (+3.8%) and STMicroelectonics (+2.6%) and Infineon (+0.8%). Finally, Bayer (+1.4%) shares have received further reprieve after a US judge lowered the verdict against the Co. in the Roundup case to USD 86.7mln from USD 2.2bln. State-side, after-hours yesterday, Amazon (-1.5% pre-market) earnings missed on top and bottom line, whilst Alphabet (+8.5% pre-market) beat on both top and bottom line and advertising revenues topped expectations.

Top European News

- Pearson Jumps After Raising Earnings Outlook in Digital Push

- Money Managers Turn to Turkish Exporters After Surge in Banks

- Europcar Drops to Record Low as Analysts Cite 2Q Report Weakness

- Three Charts For Those Who Aren’t Worried About German Growth

In FX, the Antipodean Dollars are extending losses and underperformance on the back of increasingly dovish RBA and RBNZ policy outlooks, with expectations building for another 50 bp easing from both Central Banks on top of the rate cuts already administered in the current cycle. In contrast, consensus for the Fed has narrowed to ¼ point for starters and seems unlikely to change materially barring a major development between now and next week’s FOMC. Hence, Aud/Usd has slipped further below 0.6950 towards 0.6925 and July 10’s 0.6911 base beckons before 0.6900, while Nzd/Usd is looking vulnerable under 0.6650 given no real support ahead of 0.6600 and the mtd trough way down at 0.6568.

- ZAR – The Rand continues to reel after its brief post-SARB rebound on the threat of a SA rating downgrade and bearish technical impulses following the break of 14.0000 against the Buck, with key Fib resistance also breached at 14.1360 on the way to 14.1780 and the next chart target looming just shy of 14.2000 in the form of the 200 DMA (14.1920).

- DXY – Amidst broad Greenback gains vs G10 and other counterparts, the index has finally cleared a key technical hurdle of its own at 97.767 and is now nudging 98.000 ahead of US GDP data that could provide more impetus or hamper further advances.

- JPY/GBP/EUR/CHF/CAD – All on the backfoot, as the Yen fails to glean any traction from mixed Japanese inflation data ahead of the BoJ meeting and meanders between 105.57-73 parameters, while Cable has topped out around 1.2520 yet again and saw stops tripped through trend-line support circa 1.2445 to 1.2425 low. Elsewhere, the single currency has drifted back down from post-ECB rebound highs not far from 1.1200, but holding above the minor new pre-Draghi presser 2019 low and the Franc remains off recent highs in 0.9900-20 and 1.050-38 respective bands vs the Dollar and Euro respectively, with perhaps some acknowledgement of a 25 bp SNB rate cut call from UBS. Similarly, the Loonie is softer within a 1.3157-83 range and prone to the aforementioned US data ahead of Canada’s May budget balance.

- EM – Unlike the depreciating Zar, the Try is still unwinding initial post-CBRT losses as Turkish President Erdogan applauds the bold 425 bp move and concurs with the more cautious approach towards further easing between now and the end of the year. The Lira is holding ‘comfortably’ above 5.7000 vs the Buck and the Rouble seems almost as content or prepared for the CBR to cut rates again, with Usd/Rub around 63.1000 and at the lower end of 63.2500-0695 parameters.

In commodities, there was little to report on the energy front as WTI and Brent futures are relatively flat following the decline in the complex heading into yesterday’s settlement. The former currently hovers just above the 56/bbl ahead of its 50 and 200 DMAs at 56.73/bbl and 57.03/bbl respectively, whilst the latter resides around the 63.50/bbl mark. Looking at this week’s performance so far, both benchmarks are currently poised to post gains, albeit off highs. WTI and Brent kicked the week off around 55.70/bbl and 62.60/bbl and have reached highs of 57.62/bbl and 64.64/bbl respectively, bolstered by geopolitical woes. Next up, traders will be eyeing the US Q2 GDP release as the next potential catalyst, with headline expectations of 1.8% annualized growth (Prev. 3.1% in Q1) which would mark the lowest quarterly growth rate since early 2016. Elsewhere, gold is flat despite a firmer Buck as the yellow metal eyes the US tier 1 data release at 1330BST. The precious metal looks set to end the week on the backfoot (weekly range: 1411-33/oz) as the gains seen from rising geopolitical tensions earlier in the week was erased during the ECB press conference yesterday. Meanwhile, copper is lackluster and has dipped below the 2.70/lb amid the cautious risk tone and is currently at the bottom of the weekly 2.68-76/lb range thus far. Finally, Dalian iron ore prices climbed over 3% overnight with traders citing a rise in demand as smaller steel mills take advantage of the production curb on larger competitors amid pollution.

US Event Calendar

- 8:30am: Revisions: National Income and Accounts (GDP)

- 8:30am: GDP Annualized QoQ, est. 1.8%, prior 3.1%

- 8:30am: Personal Consumption, est. 4.0%, prior 0.9%

- 8:30am: GDP Price Index, est. 2.0%, prior 0.9%

- 8:30am: Core PCE QoQ, est. 2.0%, prior 1.2%

DB’s Jim Reid concludes the overnight wrap

For those of you reading across large parts of Europe I hope you haven’t melted in light of what for many has been both the hottest day and hottest night in history. Having been in an air-conditioned office all morning yesterday, stepping out at lunch was like nothing I’d experienced before apart from times where I have been in Singapore! Not only was it hot, it was incredibly humid. Very unlike London. It seems that the surprise cloud mid-afternoon left London a few decimal points away from its hottest day in history and instead we saw the second hottest day on record. The trains home were relatively chaotic last night as fears that the tracks would melt led to multiple cancellations and speed restrictions. There was also a dog on the track and an owner that decided to chase him across the line. This led to a major multi-hour shut down of the network and all power. This left those stranded on trains without air-con. If there’s one job I never want to have it’s the owner of the Twitter account of the help desk of my railway line operator. Never have I read so many angry tweets to them about cancellations, slow trains, dogs on the track, and a lack of aircon. After all the abuse, I think had it have been me I would have cracked and sent back a series of “stop (expletive) moaning” type responses. Remind me never to get into PR.

Mr Draghi has been the master at absorbing all the criticism markets have thrown at him over the years and then come out fighting. Indeed, given what happened yesterday its rather apt that seven years ago today, Mr Draghi made his seminal “whatever it takes” speech which was the main turning point in terms of reversing a then rolling European sovereign crisis. In terms of saving the Euro project, this speech was a great success. Indeed Italian yields which were trading above 6.5% when he stood up to speak are now 1.52%. However the subsequent policies associated with this speech have seen much collateral damage with negative policy rates, €2.6 trillion of QE, 50% of the €11.8 trillion European bond market now trading at a negative yield, mixed growth performance and with lower and lower expectations of inflation. Indeed, 5y5yr forward inflation swaps have fallen from 2.2% back on this day in 2012 to 1.13% before Sintra last month and 1.315% last night. The ECB have succeeded in keeping the Euro together to date, but have failed by a large margin on their inflation mandate.

One day ahead of this anniversary, Mr Draghi pulled out yet another bazooka from his arsenal with the aim of getting inflation higher. However, for markets it was a case of buy the story, sell the delivery as it became clear in the press conference that the written words in the statement were more powerful than the verbal message. Nevertheless yesterday’s meeting lays the groundwork for another big set of policy easing going forward. In more detail, perhaps the key change was strengthening the commitment to price stability by elevating the symmetry of the inflation target, saying that interest rates would be held “for as long as necessary to ensure the continued sustained convergence of inflation to its aim”, whereas previously that had been the convergence of inflation “to levels that are below, but close to, 2%”. Later in the statement, they also referred to the Governing Council’s “commitment to symmetry in the inflation aim” and reintroduced the phrase “or lower” to the rates guidance. The problem is whether monetary policy alone is enough to help. We’ll likely need fiscal policy to get consistent inflation around 2%.

As Mark Wall discussed in his review note, Draghi now has seven weeks to convince the Council to keep with him and deliver a strong enough easing package. Our team have slightly updated their baseline expectation for what the ECB will announce in the coming months. They continue to expect a 10bp deposit rate cut and tiering in September and a further 10bp cut in December. In light of both the breadth of the Policy Decision statement – a sign of Draghi’s powers of persuasion – and the worrying signals on the external side of the economy from the latest PMI and Ifo data and the ECB’s sensitivity to this, they are now including new net asset purchases in their baseline view for September. They expect EUR30bn per month for a minimum 9-12 months split evenly between public and private assets. This move to new QE is still a close call. If data and events surprise to the upside in the meantime, the ECB could stall on this element of the easing package. For more detail on the ECB and our economists’ thoughts see the piece here ( link ).

Markets were all over the place as they digested the ECB statement and press conference. Initially, risk assets rallied strongly, the euro weakened, and rates fell, but the moves completely reversed during the press conference. For example, the Stoxx was +0.86% higher after the statement but dipped to -1.04% lower after the presser ended. It eventually closed -0.56%. In terms of bunds, a -4.4bps rally immediately after the statement (and a fresh all-time low) led to a +8.8bps sell-off into the end of the Q&A before rallying back -2.9bps into the close to end the session +1.5bps higher. Other sovereign markets mirrored the erratic bund moves, with BTPs and OATs ending up +2.4bps and +0.8bps higher, after roundtrip moves of c.20bps and c.11bps, respectively. Swiss 10-year yields fell -1.8bps, and their ultra-long 2064 bond dipped to yield as low as -0.05%, taking the entire universe of Swiss government debt into negative territory. In equities, the Dax (-1.28%), CAC 40 (-0.50%) and the FTSE MIB (-0.80%) all closed lower.

A few of Draghi’s unscripted comments were noteworthy. He said that though there was “broad agreement” on the economic outlook, the council was not unanimous on other topics, thus admitting that there is some pushback against easing in September. He also declined, despite repeated questions, to comment on the size of future cuts, or the scale or composition of QE. Finally, he said that no one argued for immediate action and he did not mention a formal review of the inflation target. These were all hawkish compared to expectations, and drove the reversal in price action. Markets did react positively to Draghi’s attempts to raise inflation, with five-year forward five-year inflation swaps rising by 2.4 bps to a two-month high of 1.315%, although this was below the intra-day peak of 1.3598%. The euro hit its lowest intraday level against the dollar in over two years of 1.1102, before strengthening back to 1.1146 as it was also a victim of the intra-day swing. After European markets closed, anonymously-sourced articles circulated from Reuters and Bloomberg, saying that a September rate cut “appears certain” but that “some ECB policymakers still need to be convinced about tiering.”

In a further sign of the Eurozone slowdown and the perceived need to act, the Ifo business climate index from Germany fell to 95.7 in July (vs. 97.2 expected), the lowest reading since April 2013 and the fourth consecutive monthly decline. There wasn’t much consolation in the other readings either, with the current assessment falling to a 3-year low of 99.4 (vs. 100.4 expected) while the expectations reading fell to a ten-year low of 92.2 (vs. 94.0 expected). Echoing the PMIs from Wednesday, where the German manufacturing reading was at a seven-year low, the Ifo statement said that for manufacturing, “the business climate indicator is in freefall”.

As for US markets, they mostly took their cue from Europe, opening lower and unable to rebound throughout the session. The S&P 500 and DOW retreated -0.51% and -0.47%, with all sector groups retreating. The NASDAQ (-1.00%) and NYFANG (-2.46%) underperformed, with a notable selloff for Tesla (-13.61%) after poorly-received earnings Wednesday evening. The chemicals sector also lagged, shedding -0.75%, as Dow Inc. (-3.83%) reported below-average revenues with management saying that “buying patterns remain cautious due to ongoing trade and geopolitical uncertainties.” There were some positive results from Raytheon (+4.58%) and Bristol-Myers Squibb (+5.02%), who beat expectations and raised guidance.

After markets closed, Google (+7.93% afterhours) announced strong revenue growth of +21% yoy, beating even the most optimistic forecasts. That overnight gain is worth over $60bn in market cap. Intel (+5.10%) said that the second quarter was “much stronger than expected,” with revenues falling only 3% to $16.5bn, compared to expectations for a drop of around 8%. Both companies seem to be adjusting relatively smoothly to tariff-related disruptions. In contrast, Amazon (-1.66%) reported disappointing profit figures of $5.22 per share compared to consensus expectations for $5.57, which outweighed positive revenue growth of +20% yoy. In aggregate, these moves helped NASDAQ futures to gain +0.47% overnight.

Amidst the dovish emphasis from the ECB, the data from the US was more positive. Durable goods orders rose by 2.0% mom in June (vs. 0.7% expected), while the ex-transportation measure rose 1.2% mom (vs. 0.2% expected). Initial jobless claims fell to 206k last week (vs. 218k expected), which brings the 4-week average down to 213k, the lowest since April. Elsewhere, wholesale inventories rose by 0.2% mom in June, (vs. 0.5% expected), and the Kansas City Fed’s Manufacturing index fell to -1 (vs. 3 expected), the first negative reading since August 2016. The June trade deficit was also wider than expected at $74.2bn from a downwardly-revised -$75.0bn. Overall, the data pushed the Atlanta Fed’s estimate of second quarter GDP down -0.3pp to 1.3%, mostly as a function of a wider trade deficit and weaker inventories.

This morning in Asia markets are following Wall Street’s lead with the Nikkei (-0.46%), Hang Seng (-0.45%), Shanghai Comp (-0.16%) and Kospi (-0.54%) all lower. Elsewhere, futures on the S&P 500 are up +0.26%.

In other overnight news, ahead of next week’s BoJ monetary policy meeting ( on July 30th), Bloomberg has reported that some of the BoJ officials see little to be gained from strengthening the bank’s interest rate pledge while adding that the officials would accept a change if pressed at the meeting, but they are concerned that just bolstering the pledge would simply highlight the BOJ’s limited firepower or even backfire, especially with the Fed widely expected to cut US interest rates the following day. As a reminder, the BoJ had changed its guidance just three months back, pledging to keep its interest rates extremely low “at least through around spring 2020,” versus “an extended period of time” previously. Elsewhere, Xinhua reported that China has rejected FedEx claims that it rerouted some Huawei shipments to the US by mistake thereby raising the risks that the delivery giant will be blacklisted in the world’s second-largest economy. The report further added that FedEx’s previous statements are inconsistent with the facts and the company is suspected of holding up more than 100 inbound deliveries involving Huawei.

Staying with Asia, in a sign of escalating geopolitical risks, CNN reported (citing an unnamed US official), that Iran test-fired a medium-range ballistic missile earlier this week that traveled 1,000 kilometers. This is escalating tensions around one of the world’s most important shipping- and air-traffic corridors. Elsewhere, the US Secretary of State Michael Pompeo said that the US still wants talks with North Korea despite launches of short-range missiles while adding that he hopes working-level talks between the two countries will begin in the next month or so. Meanwhile, North Korea said the missile launches were a warning to South Korean “warmongers,” while adding that the missile launches were intended to convey the Kim regime’s displeasure over approaching military exercises in South Korea.

Here in the UK, sterling was ended -0.26% weaker as new Prime Minister Boris Johnson made his first statement as PM to the House of Commons yesterday. In his remarks, Johnson rejected the existing Withdrawal Agreement, saying that it “has been three times rejected by this House. Its terms are unacceptable to this Parliament and to this country.” On the backstop, he said that “the way to the deal goes by way of the abolition of the backstop”, and said that a time-limit, which had been suggested by some as a compromise solution to the issue, was “not enough”. In terms of the EU’s response, the FT’s Alex Barker reported yesterday that the EU’s chief Brexit negotiator, Michel Barnier, said that Johnson’s desire to eliminate the backstop “is of course unacceptable and not within the mandate of the European Council.” Meanwhile, the EC President Juncker told Boris Johnson over a phone conversation that the current WA is the best and only deal possible. In a note yesterday ( link here), DB’s Oliver Harvey increased the probability of a no-deal Brexit to 50% (from 45% previously), and Oliver writes that Johnson’s demands of an end to the backstop as opposed to modifications are “setting a near impossibly high bar for an agreement.” The political developments came as the CBI’s survey showed the retail sales balance at -16 (vs. -15 expected). Although the July reading was up from June’s -42, this was the third consecutive month with a negative reading, the first time that’s happened since 2011.

Meanwhile the political stalemate in Spain following the country’s inconclusive elections in April continued yesterday as Prime Minister Sanchez lost a vote in Parliament on forming a new government by 155-124, with 67 abstaining. The defeat came after negotiations between Sanchez’s Socialist Party and the left-wing Podemos failed to reach an agreement, and Podemos ended up abstaining in the investiture vote. With Sanchez’s Socialists only having a minority in parliament, he’ll need to find support elsewhere to form a government or the country will face fresh elections, having already had three over the last four years.

The Turkish lira paradoxically strengthened almost 1 percent against the dollar yesterday, following the central bank’s decision to cut the one-week repo rate by 425bps to 19.75%, bigger than the 250bp cut which the consensus expected. The currency ultimately retraced to close flat. In the central bank’s statement, they said that “recent forecast revisions suggest that inflation is likely to materialise slightly below the projections of the April Inflation Report by the end of the year.” The move comes after President Erdogan, who has called for more expansionary monetary policy, replaced the previous Governor earlier this month. Our CEEMEA team ( link here) say after today’s move that they think the one-week repo rate could fall to 15% by end-2019.

Looking at the day ahead, the data highlight will be the advance estimate of Q2 GDP from the US, including personal consumption and core PCE. Elsewhere, we have consumer confidence data from France and Italy for July, and French PPI for June. In terms of earnings releases today, the highlights include Twitter, Nestle and McDonald’s, while the Russian central bank will be deciding rates.

Oh… and it’s going to rain!!!!! I would say happy days but that might mean it doesn’t stop rather than just being a temporary chance for us all to cool down a bit.

via ZeroHedge News https://ift.tt/2yfzLNK Tyler Durden