GDP beat, record high stocks, tumbling VIX… but corporate profits are weakest since 2011, global bond yields are at record lows, and delinquencies are on the rise… Still , forget all that, it’s all Powell baby!!

Chinese stocks managed gains on the week thanks to a big buying panic Tues/Weds

European stocks ended the week green, thanks to a bounce today after yesterday’s Draghi-driven dump…

The Nasdaq and S&P both reached new record highs as The Dow flatlined on the week…

Let’s hope Powell delivers because global liquidity is starting to diverge again…

Alphabet’s outsized gains led Nasdaq to new record highs

Oh and while we are talking about GOOGL…

FANG stocks were up on the week, retracing about half of last week’s NFLX losses…

BYND is insane!

Today’s gains were dominated by defensives…

“Most Shorted” stocks ended the week unchanged…

VIX dumped back towards an 11 handle today but on the week, HY spreads really collapsed relative to IG…

Bonds and stocks continue to diverge ahead of next week’s FOMC…

Treasury yields were higher on the week, mainly driven by Draghi’s disappointment (with barely any reaction on GDP)…

10Y Yields spiked up to pre-FOMC levels but twice tested 2.10% and faded…

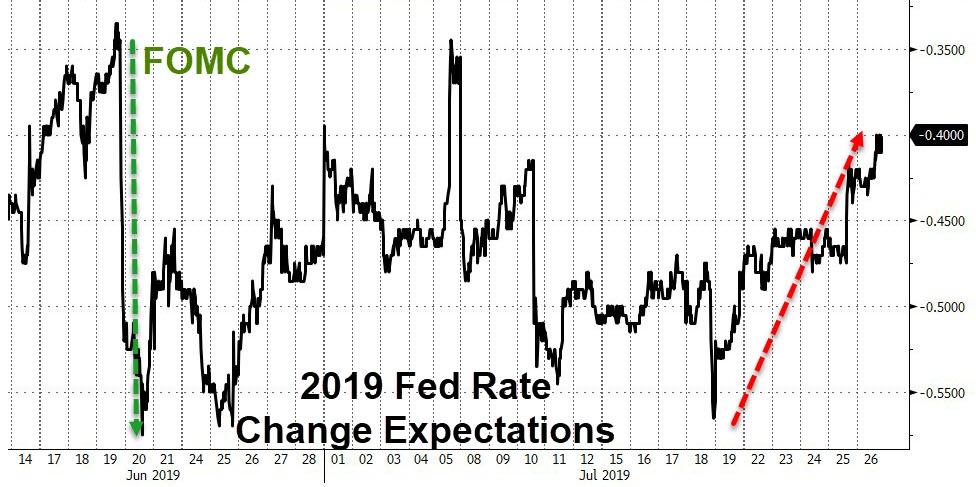

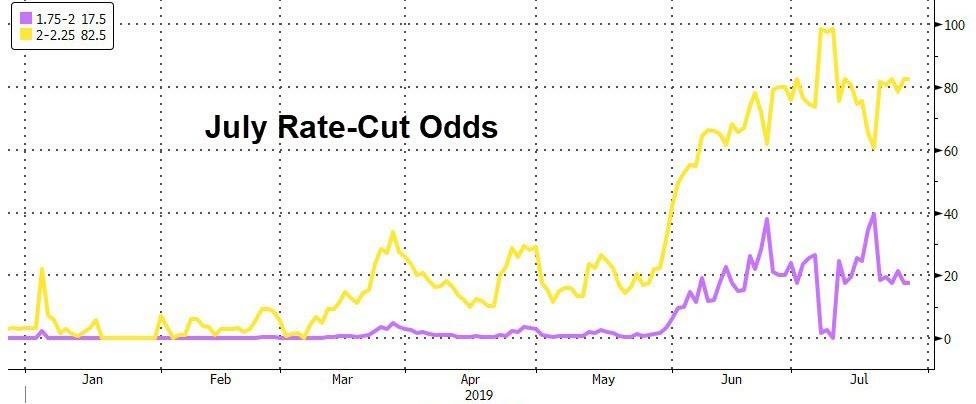

The market’s expectation of what The Fed will do in 2019 tightened quite significantly this week…

With a 17.5% chance of a 50bps cut next week…

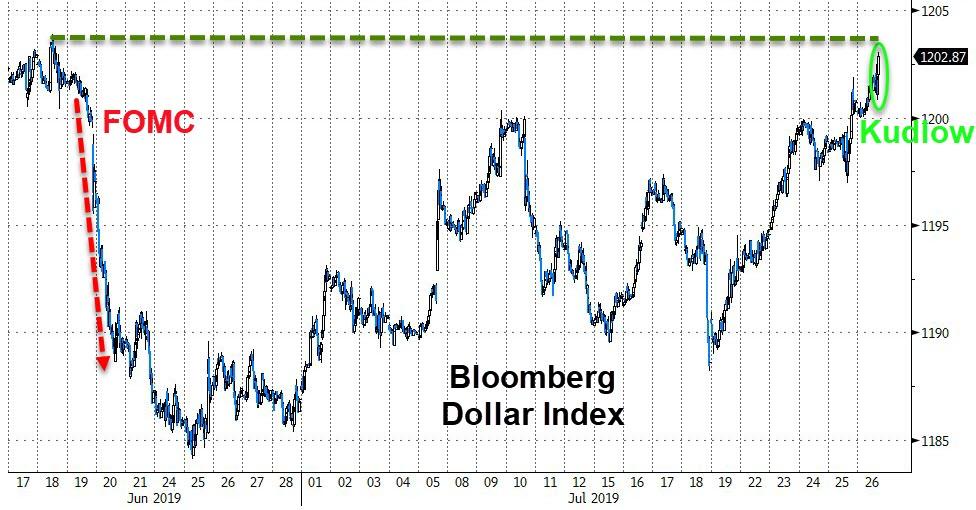

Despite all the talk about weak dollar policies and sources claiming WH discussions, the dollar spiked back to 6-week highs around the pre-FOMC levels…

Yuan ended the week unchanged…

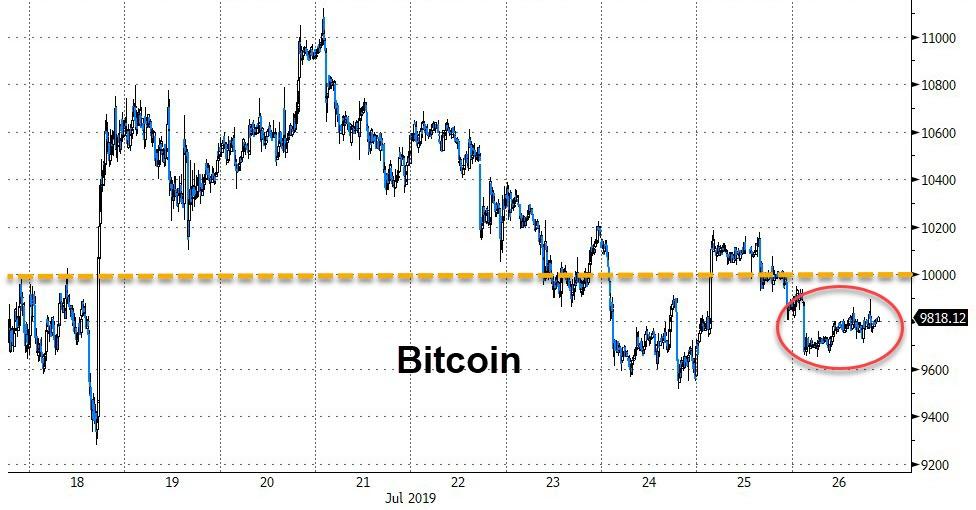

Mixed picture in cryptos this week with Bitcoin worst and Bitcoin Cash best…

Bitcoin is down for the 3rd week in a row and closed the week below $10k…

And just in case you think Bitcoin is in another bubble… “that’s not a bubble, this is a bubble”

Ugly week for Dr.Copper and a down week for gold as silver outperformed…

What is Dr.Copper telling us?

After a 10-day run of silver outperformance, gold has gained more than silver in the last two days…

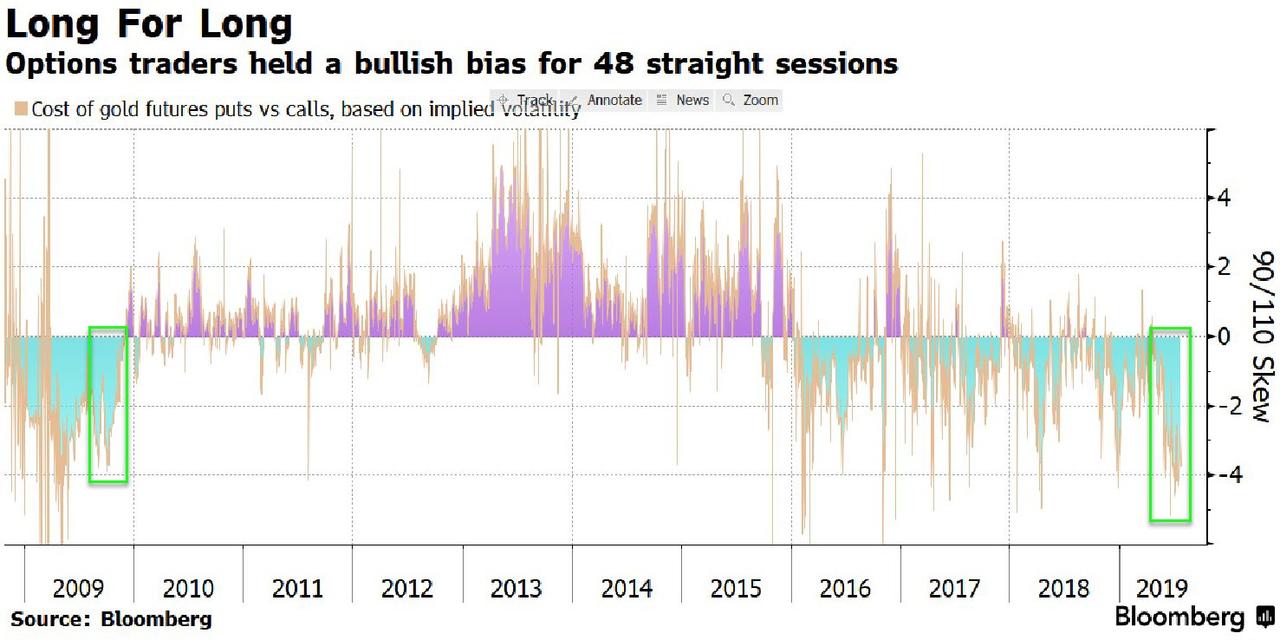

Hedge funds have held a net-long position in Gold since April, and the options markets registered a bullish skew for 48 sessions — the longest run since 2009.

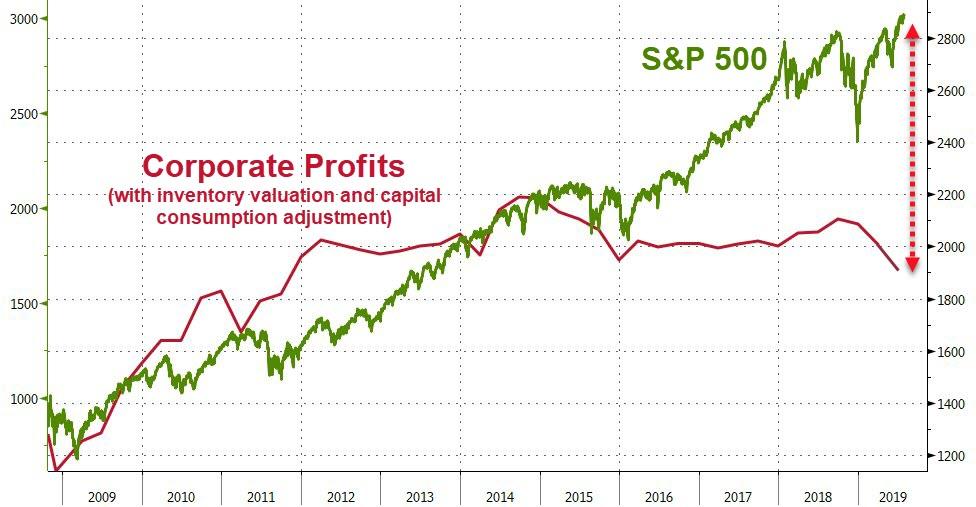

Finally, with stocks spiking to new record highs ahead of next week’s FOMC meeting, we note that today’s historical GDP data revisions indicate that revised numbers of corporate profits show that operating profits peaked in Q3 2014 and have been moving sideways ever since… dipping to the lowest since 2011.

Operating profits in the GDP accounts and S&P 500 operating profits over the long run track fairly close to one another, although there can be large differences in any given year… and they don’t tend to end well.

Like in 2007…

And in 2000…

Allocate accordingly!

via ZeroHedge News https://ift.tt/2SFt296 Tyler Durden