Authored by Richard Breslow via Bloomberg,

It’s rather extraordinary that so many people are still debating the various scenarios of the impact that U.S. GDP will have on which policy choice the FOMC is likely to make next week. Barring a shocking and unforeseeable result, it’s not supposed to come down to such a fine line. But a lot of that has to do with the fact that the market knows the Fed will do something, but is not really sure why. Which makes some of the outlier calls more game theory than economics.

It is often, and correctly, stated as fact that the Fed is central banker to the world. And, under current political circumstances, that’s more true than ever. Its fellow institutions are waiting for Fed Chairman Jerome Powell to give them the ability, cover and permission to move ahead with their own plans. And that will be forthcoming.

Obviously, the ECB statement and subsequent press conference has gotten the lion’s share of attention this week. But, in retrospect, the remarks given the day before by a senior economic adviser to Japan’s Prime Minister Shinzo Abe read as if he was reflecting the debates of central bankers around the world. And it may explain some of the differences of opinion within the ECB Governing Council that became evident over the course of yesterday’s meeting aftermath.

“If the Fed eases, then the Bank of Japan will need to think about further easing to prevent the yen strengthening.”

Take out the word “yen” and it would be anyone’s guess which country was being referred to. Don’t think of this as currency war talk. It isn’t aggression, or something nefarious. Its common sense and an issue of economic survival.

There isn’t a single proposal that the ECB has tasked their committees to study prior to the September meeting that would do more to help revitalize the European economy, specifically the manufacturing sector, than getting the euro lower. Period.

“Everyone must recognize” that negative interest rates hasn’t worked well, Abe’s adviser also said.

Too true that. The ECB can’t admit to that fact. A suitable explanation has to be found for policy errors. Even ones spawned by desperation. And doubling down is a sign of outright panic.

There’s a good reason certain Council members oppose tiering. It’s seen as a gateway to cutting away. You won’t hear the word “tiering” without someone responding, “reversal rate.” Nevertheless, an ECB rate cut is in the cards. Just be cautious of expecting the shock and awe of something bigger than the 10 basis points generally assumed and priced.

He doesn’t agree that the BOJ is running out of JGBs it can buy. There’s always more to be had. And the ECB, for its part, will change its rules as deemed necessary. Periphery spreads haven’t known what to make of the delay. That’s positioning, and maybe a little politically related prudence. And they certainly have room to correct. But the last thing the ECB is interested in is anything that looks like a lasting reversal. More QE will be the order of the day. Balance sheets will stay huge. Maybe forever.

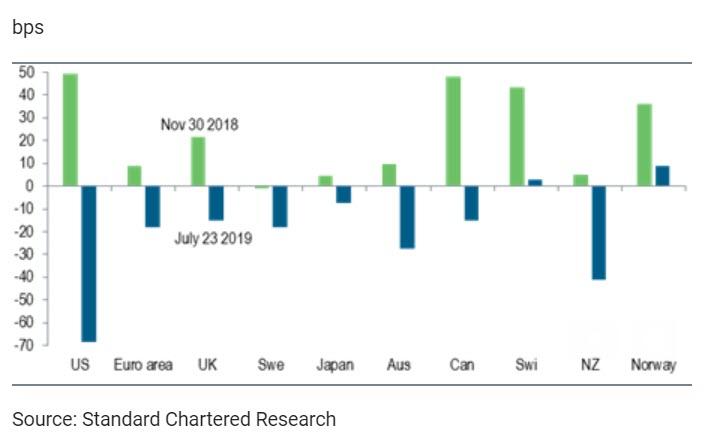

Changes in priced-in policy…

Buying foreign bonds is attractive, but politically difficult. No argument with that. It feels like those that do it have been grandfathered in or are too small to matter. I’d be shocked if the ECB went down this path.

And the most important one of all: Fiscal measures will be needed should the economy weaken. Global headwinds are blowing from all parts of the globe. But it is hard to garner sufficient sympathy for Europe when the German finance minister felt compelled to preempt the ECB meeting by reiterating the lack of plans to do something meaningful about it.

Equities are bid. There are tons of support levels. Pick one that suits your risk tolerance and trade location and then don’t look at them. Resistance, as always, is the all-time high and your level of incredulity.

For the 10-year Treasury, day-traders will be leaning on Thursday’s range. The two-year gets interesting only outside of 1.90% and 1.80%. Through the higher level and it’s a tell that sentiment may be shifting.

via ZeroHedge News https://ift.tt/2ybOAkg Tyler Durden