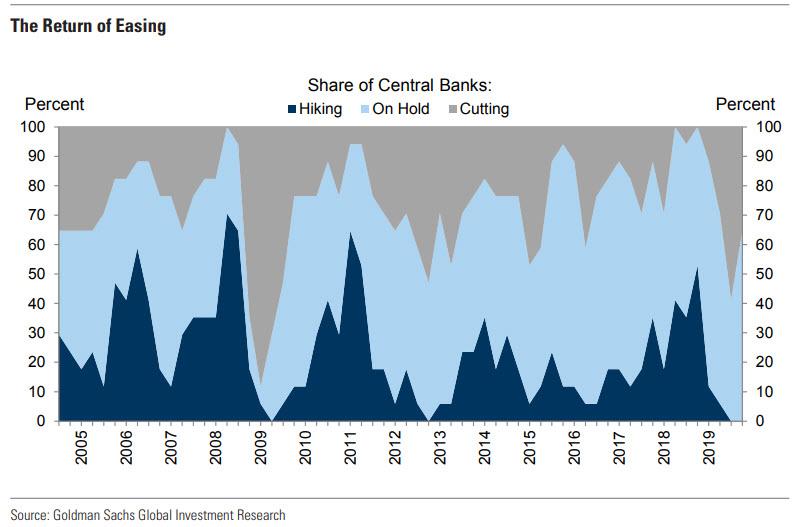

The global central bank experiment with renormalization is officially over.

After roughly half the world’s central banks hiked rates at least once in 2018, the major central banks have returned to easing mode, and as the chart below shows, for the first time since 2013, not a single central bank is hiking rates.

Commenting on the violent reversal away from tightening financial conditions which emerged following the Q4 2018 selloff, Goldman’s Jan Hatzius writes that “The FOMC looks set to cut the funds rate next week, the ECB today sent a strong signal that action in September is likely, and China has resumed easing policy after a spring pause. With global growth running at a below-trend rate of 2¾%—down from about 4% a year ago—a synchronized tilt towards easing looks like a natural response to a weaker outlook.”

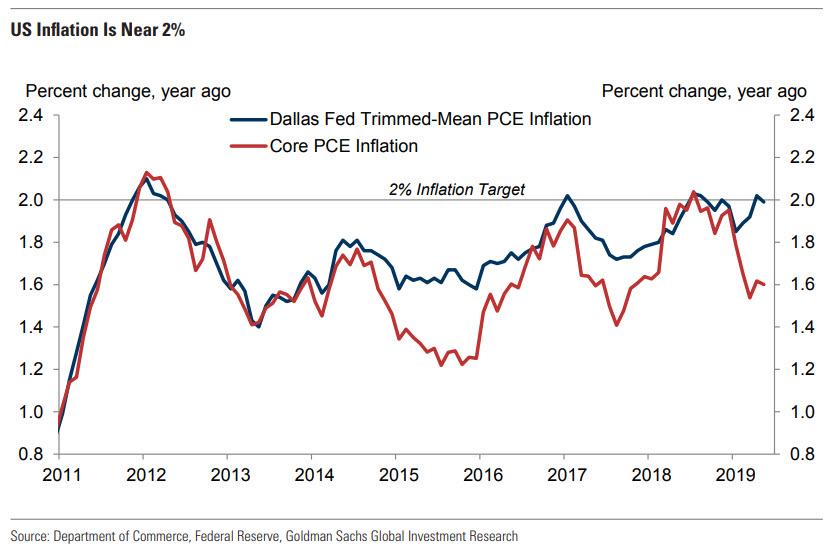

Yet even Goldman can’t help but ask just why the Fed is rushing to commence the first easing cycle in years, pointing out that “the US economy is in decent shape, with a tight labor market, inflation close to target and— in our forecast— growth running a little above 2% both this year and next. We are modestly above consensus because we expect the negative inventory cycle to end and final demand to continue growing robustly on the back of easier financial conditions.”

This, according to the Goldman economist, should limit Fed easing to two 25bp insurance cuts, one next week and another in September, although the bank, which until very recently did not expect any rate cuts at all, fails to justify just why the Fed is doing what it is about to do, unless of course Powell is merely folding to Trump pressure.

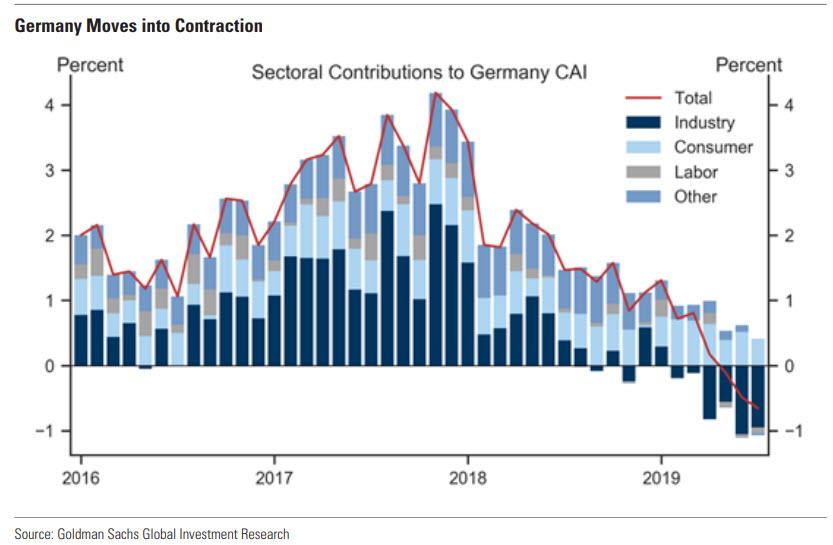

But if the Fed’s upcoming rate cut remains a mystery, what the ECB is about to do is relatively straightforward, as the European picture has continued to deteriorate, and as Draghi defined it yesterday, the outlook is “getting worse and worse.” Following the weak manufacturing flash PMIs, Goldman’s Current Activity Indicator for Europe in July stood at just +0.5% on an area-wide basis, and at -0.6% in Germany. Underlying inflation remains stuck at 1% “and the slide in inflation expectations points to risks of de-anchoring.” Moreover, fears of a “no deal” Brexit have re-intensified and volatility is likely to return in Italy as the 2020 budget is prepared. Therefore, Goldman expects forceful action from the ECB in September, “including a 20bp deposit rate cut (flanked by a move to a tiered reserve system), a return to QE (including corporate and sovereign debt) and a further strengthening of forward guidance.”

Elsewhere the picture is similar, and after what looked like a strong Q1 rebound, Goldman notes that Chinese growth has slowed again to the bottom end of the government’s 6-6½% target range, with the “slower growth and the threat of trade war escalation have persuaded policymakers to return to a gradual easing path.” As a result, short-term interest rates remain in the mid-2% range, fiscal borrowing has stepped up, and credit growth beat expectations in June. Finally, with the 70th anniversary of the founding of the People’s Republic coming up in October, Goldman expects policy settings to stay supportive in coming months, “likely easing slightly further on the margin.”

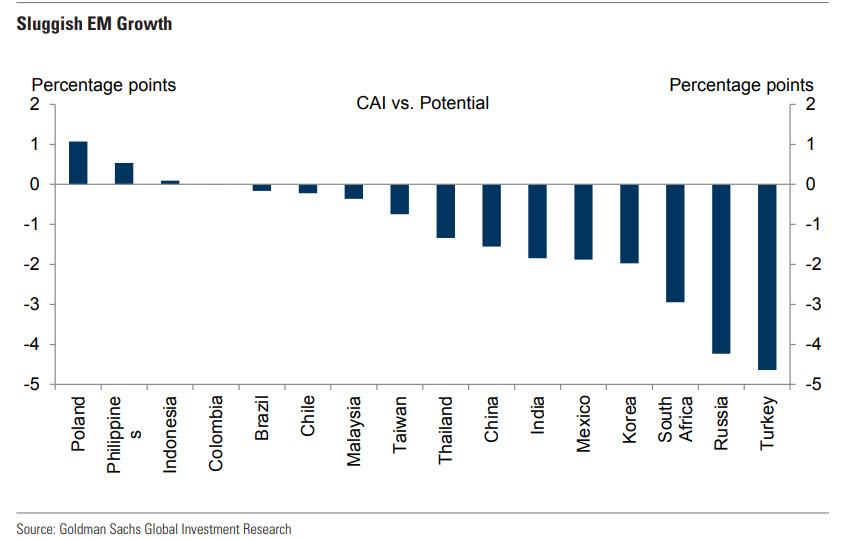

Additionally, in a world where China has long become the marginal source of growth for much of the emerging world, EM growth outside of China remains sluggish as well, and most large EMs are growing below Goldman’s estimates of long-term potential, and well below policymakers’ aspirations, to wit:

Exports have decelerated sharply (mainly due to weak DM growth) and domestic demand has disappointed (reflecting tighter financial conditions, especially where policy tightened in 2018). That said, we see slightly brighter prospects for the second half, as low inflation and a dovish Fed will allow EM policymakers to ease policy and support growth.

And visually:

Finally, the risk of a no deal Brexit has returned to center stage as Boris Jonson took over as Prime Minister, pledging that the UK will leave the EU by October 31 with “no ifs, no buts” according to Hatzius, who expects the tail risks to intensify into Q4 and raised Goldman’s odds of a no deal Brexit to 20%. Even so, Goldman thinks PM Johnson will, on balance, seek to avoid a general election before having delivered Brexit. The only way to avoid a general election may be to avoid a no deal Brexit, and the only way to avoid a no deal Brexit may be to deliver Brexit with a deal. From this perspective, the scope for the new Prime Minister to depart from his predecessor looks very limited, and Goldman’s base case remains a negotiated Brexit deal (with a 45% probability).

So with the entire world now in easing mode, it is relative easy to predict that Goldman expects smooth sailing. As Hatzius summarizes, “following the sharp rally in most asset prices this year, our near-term market views are fairly neutral.

- On the rates side, we see scope for a further duration rally as the ECB over-delivers relative to current market pricing, but ultimately see rates drifting higher again as the Fed only delivers two insurance cuts and returns to tightening policy after the presidential election.

- Pressure on the Euro looks likely in the near term, but we do not expect a large move given that the Euro is already undervalued relative to long-run fundamentals.

- On the equity side, the S&P 500 trades near fair value relative to interest rates, although we believe policy uncertainty and negative revisions to 2020 earnings forecasts will limit the upside from here.

- Finally, we see commodity prices stuck in a mid-cycle pause, with no strong near-term direction.

And now we look ahead to next week’s historic catalyst: the Fed’s first rate cut in over a decade… just as the S&P closes at 3,205 – a new all time high.

via ZeroHedge News https://ift.tt/2JXf7bR Tyler Durden