The London property bust continues to gain momentum.

Knight Dragon, a Hong Kong real estate developer, is building 15,000 homes across 150 acres on the riverside Greenwich Peninsula neighborhood near Canary Wharf over the next several decades, reported Financial Times.

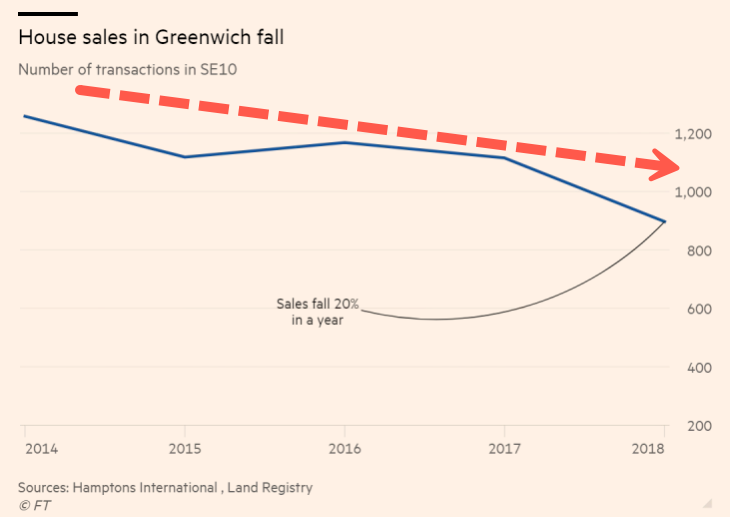

According to Land Registry data compiled by Hamptons International, there were 897 sales in the SE10 postcode area covering Greenwich, Maze Hill, Greenwich Peninsula, down 20% from 2017, and 29% since 2014.

Graham Lawes, director of residential sales at JLL Greenwich, said the decline in sales doesn’t include sales of homes that are currently under construction, but said even those sales are stalling.

The risk of Brexit has triggered uncertainty, diminishing rental yields, and a London real estate property bust has discouraged any new foreign investors from entering the market.

In 2015, foreign investors accounted for 80% of new-build sales in London. Now Lawes indicates their share is less than 40%. A quarter of the transactions in Greenwich Peninsula development have been foreign investors, says Kerri Sibson, sales and marketing director at Knight Dragon.

Jonathan Benarr, director of APAC at Quintessentially Estates, said Knight Dragon is based in Hong Kong, indicating that a lot of Hongkongers and mainland Chinese investors would invest in its oversea projects. But now, “there is definitely a sense of caution.” First-time investors are being cautioned by “scary headlines” about London’s real estate downturn, says Benarr. “That has limited people’s willingness to go into ‘regeneration areas’ .”

“The only sales being done in developments at the moment, frankly, are the ones where they have got Help to Buy,” says Lawes, referring to the government-backed scheme that offers buyers of new homes worth up to £600,000 a 40% equity loan in London and a 20% loan elsewhere.

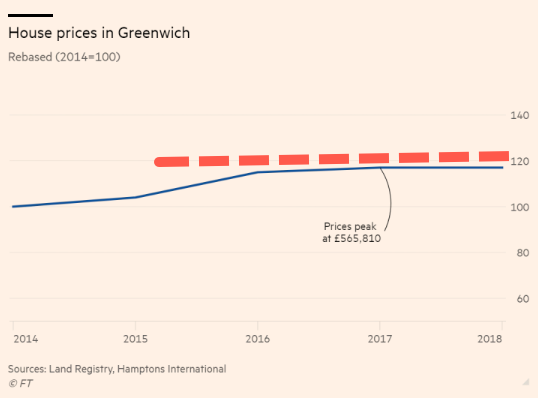

Knight Dragon’s development in focus is called Upper Riverside, has five towers totaling 900 homes, hasn’t seen condo price increases in three years.

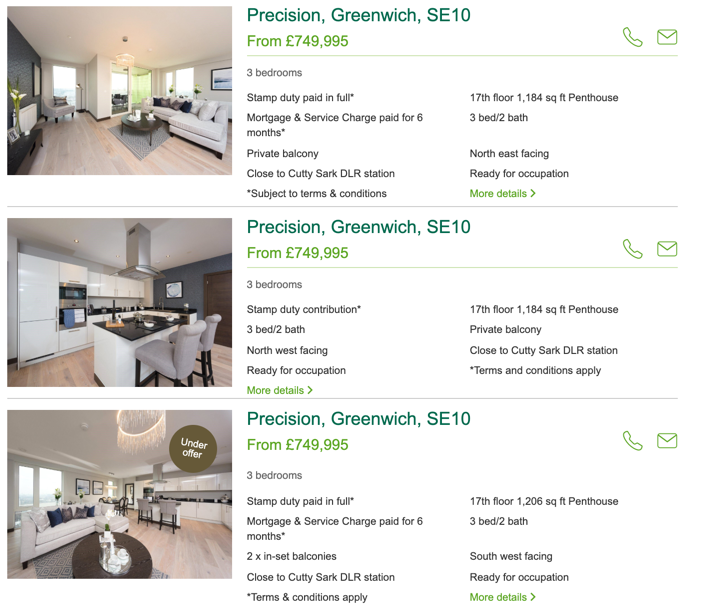

The slowdown in property sales and a downturn in prices have led to increased incentives by developers. In Precision tower, which finished in March, developer Weston Homes has offered to cover buyers’ mortgages for six months.

U.K.’s Office for National Statistics (ONS) revealed earlier this month, that the overall property bust in London continues to gain momentum. Prices across the city dropped 4.4% over the year to May 2019, marking the most significant annual decline in almost a decade.

With foreign investors, mainly Chinese, running for the exit doors amid fears of Brexit, it seems that more pain is ahead for the London property market.

via ZeroHedge News https://ift.tt/2Yt4W6K Tyler Durden