Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

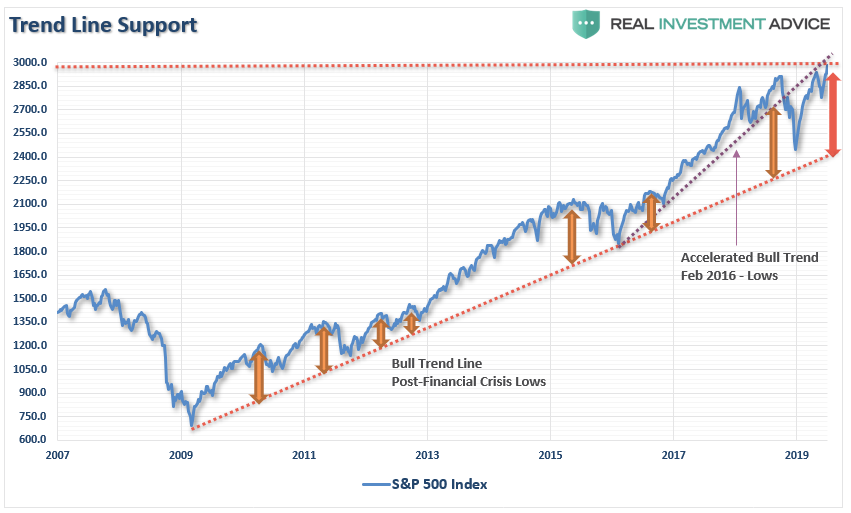

Last week, we discussed the setup for a near-term mean reversion because of the massive extension above the long-term mean. To wit:

“There is also just the simple issue that markets are very extended above their long-term trends, as shown in the chart below. A geopolitical event, a shift in expectations, or an acceleration in economic weakness in the U.S. could spark a mean-reverting event which would be quite the norm of what we have seen in recent years.”

This analysis is what led us to take action for our RIAPRO subscribers last week (30-Day Free Trial), as we added a 2x-short S&P 500 index fund to Equity Long-Short Account to hedge our longs (GOOG, CRM, NVDA, EMN, IVV, RSP) against a potential mean reversion.

“This morning, we are adding a small 2x S&P 500 short position to the trading portfolio to hedge our core long positions against a retracement over the next few weeks. We will remove the short if the market can regain its footing and move higher, or the market sells off and reaches oversold conditions.”

This is the purpose of hedging, as it reduces volatility over time, which inherently reduces the risk of emotionally based trading mistakes.

My friends at Polar Futures Group laid out the same concerns on Friday:

“The mean reversion trade: For the past few weeks I’ve been musing that the “irresistible force” that has moved all markets has been the aggressive repricing of future interest rate expectations since last November. We’ve had a HUGE rally in the bond market, MASSIVE flows into bond funds, record levels (>$13.7T) of negative yielding bonds, inverted yield curves, even Greek bonds trading through Treasuries…as markets anticipate a recession and much more Central Bank largess…which might just take us into MMT and/or never-never land where the Central Banks just buy all the bonds and that’s that. I’ve thought that this irresistible force may have gone too far too fast and was due for a “set-back” which would precipitate mean reversion trades across markets.

The core concepts of the mean reversion trades I’m considering are as simple as, 1) the public buys the most at the top (thank you, Bob Farrell,) and 2) when they’re yelling you should be selling, and 3) positioning risk leaves some markets especially vulnerable.”

They are exactly right.

While the market is rallying in anticipation of more Central Bank easing, especially following the recent announcement by the ECB of lower rates and more QE, the markets are momentarily detached from weaker earnings growth, weaker economic growth, and a variety of other market-related risks.

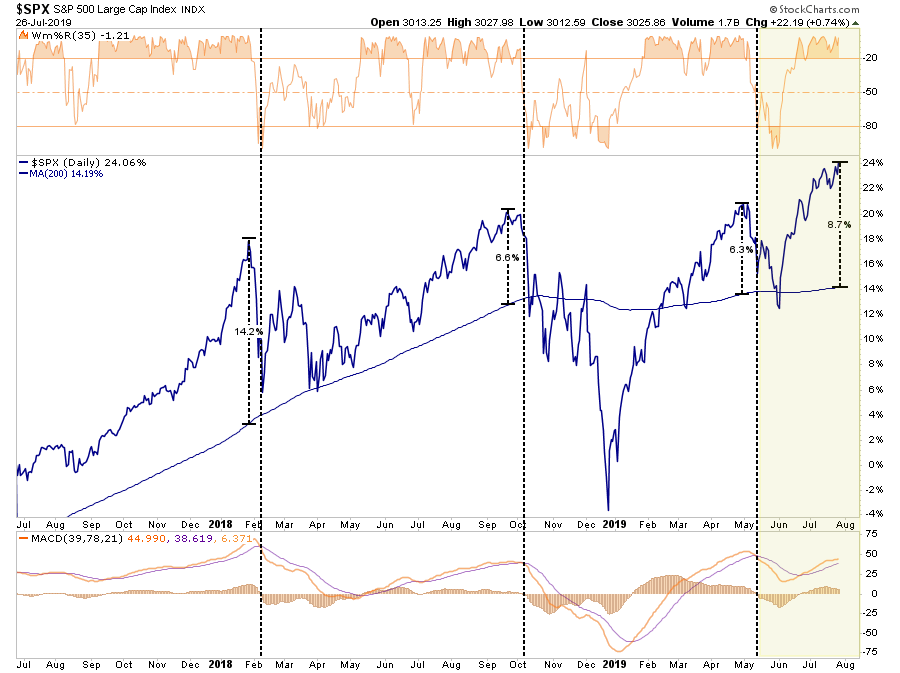

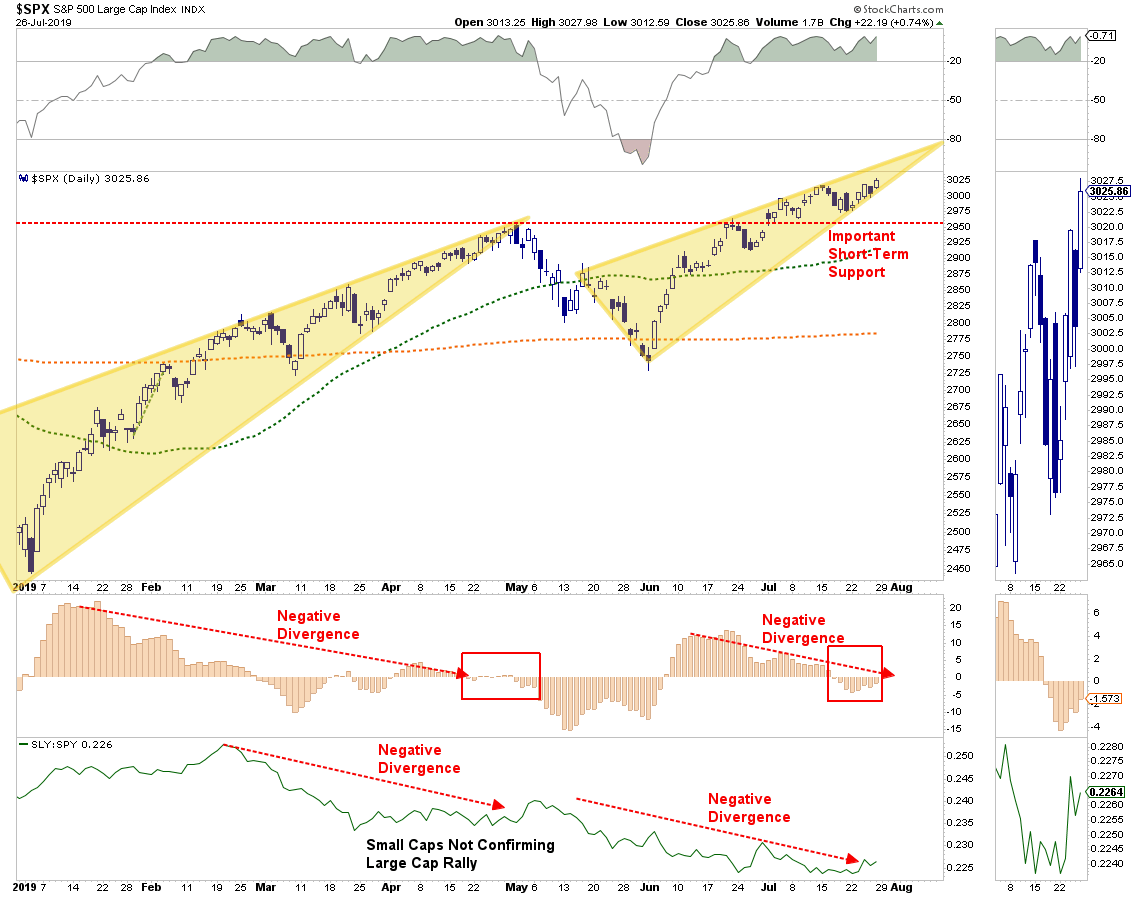

However, in the very short-term, the market is grossly extended and in need of some correction action to return the market to a more normal state. As shown below, while the market is on a near-term “buy signal”(lower panel) the overbought condition, and near 9% extension above the 200-dma, suggests a pullback is in order.

As we have noted over the last few weeks, the very tight trading range combined with negative divergences also does not historically suggests continued bullish runs higher without some type of corrective action first.

All of this supports why we trimmed our long positions slightly last week and increased our cash holdings for the time being.

Our models still suggest a likely correction over the next two months as we move past the Fed. Such is particularly the case if the Fed signals their “rate cut” may be “one and done” for the time being.

But for now, we are going to opt to “wait and see” what happens.

The $70 Trillion Dollar Graveyard

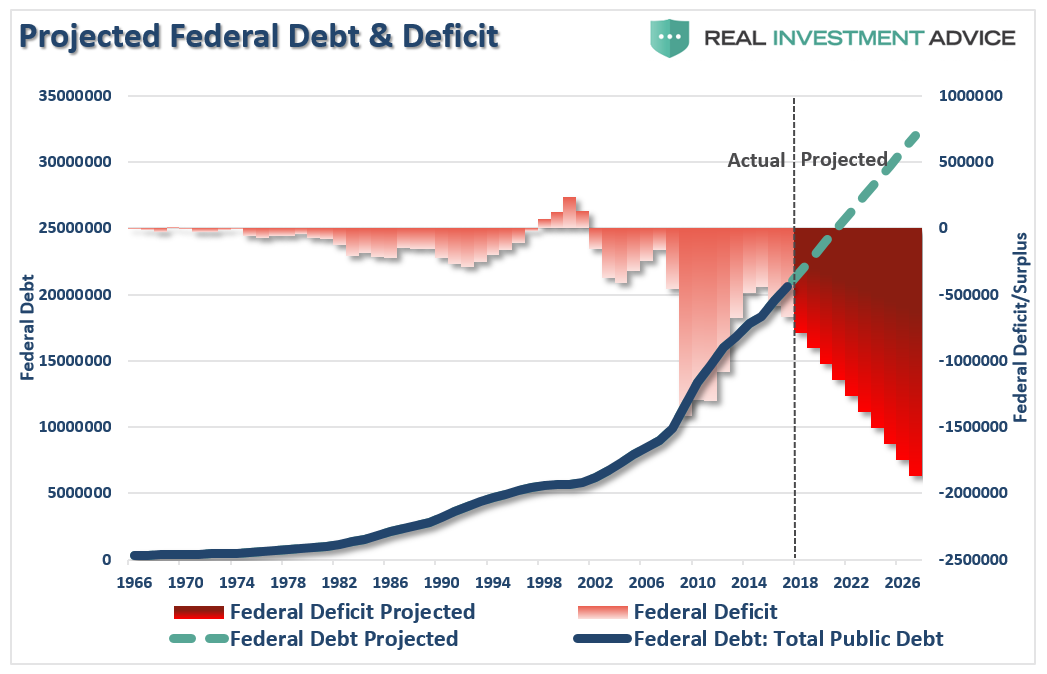

On Thursday, Congress passed the spending bill we discussed last week:

“A divided House on Thursday passed a two-year budget deal that would raise spending by hundreds of billions of dollars over existing caps and allow the Government to keep borrowing to cover its debts, amid grumbling from fiscal conservatives over the measure’s effect on the federal deficit.

65 Republicans joined the Democratic majority in the 284-149 vote, with 132 Republicans voting against the bill, despite President Trump’s endorsement and pressure from key outside groups, including the Chamber of Commerce, to avoid a potentially catastrophic default on the Government’s debt.”

I highlighted the last sentence in red because it is an outright “LIE” used to convince Americans that out of control spending must be done.

The reality is that “interest payments on the debt” are part of the MANDATORY spending in our budget along with social security, medicare, etc. Currently, about $0.75 of every dollar of tax revenue goes to mandatory spending. For the last few months the Government has been at its statutory debt limit, and “surprise” we didn’t default on our debt. Why? Because there is enough revenue currently coming in to cover the mandatory spending.

As I noted specifically last week,

“In 2018, the Federal Government spent $4.48 Trillion, which was equivalent to 22% of the nation’s entire nominal GDP. Of that total spending, ONLY $3.5 Trillion was financed by Federal revenues, and $986 billion was financed through debt.

In other words, if 75% of all expenditures is social welfare and interest on the debt, those payments required $3.36 Trillion of the $3.5 Trillion (or 96%) of revenue coming in.”

Do some math here.

The U.S. spent $986 billion more than it received in revenue in 2018, which is the overall ‘deficit.’ If you just add the $320 billion to that number you are now running a $1.3 Trillion deficit.

The U.S. will not default on its debt.

This is particularly the case since we no longer have any budgetary controls.

Importantly, the spending increase of $320 billion is on top of the annual 8% automated budget increase and the preexisting deficit. My original projection above is too conservative by $500 billion, or more.

But that’s not the real story.

The crux of that article was focused on the roughly $6 Trillion of unfunded liabilities of U.S. pension funds which Congress is now drafting a piece of legislation for entitled the “Rehabilitation For Multi-employer Pensions Act.”

As noted in that article, while Congress is preparing a bailout for U.S. pension funds, there is a $70 Trillion pension problem globally which is not being addressed.

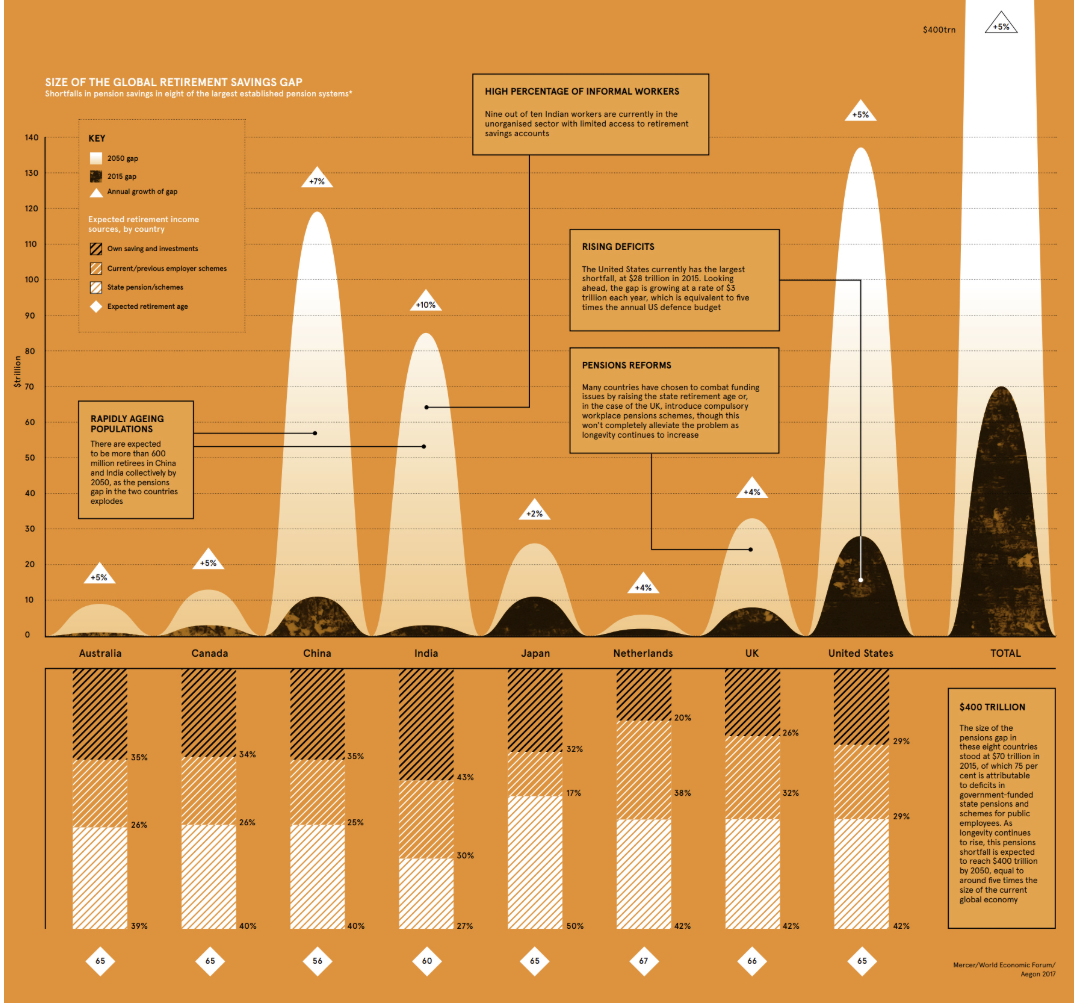

“According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…

However, this isn’t the $70 Trillion graveyard we are addressing today. From CNN:

“America’s debt load is about to hit a record. The combination of cheap money and soaring debt helped fuel the decade-long economic expansion and bull market, but America’s gluttony of loans could work against it if its fragile economic balance shifts.

In the first quarter of 2019, the United States’ total public- and private-sector debt amounted to nearly $70 trillion, according to research by the Institute of International Finance. Federal government debt and liabilities of private corporations excluding banks both hit new highs.”

Oh…you are talking about THAT $70 Trillion.

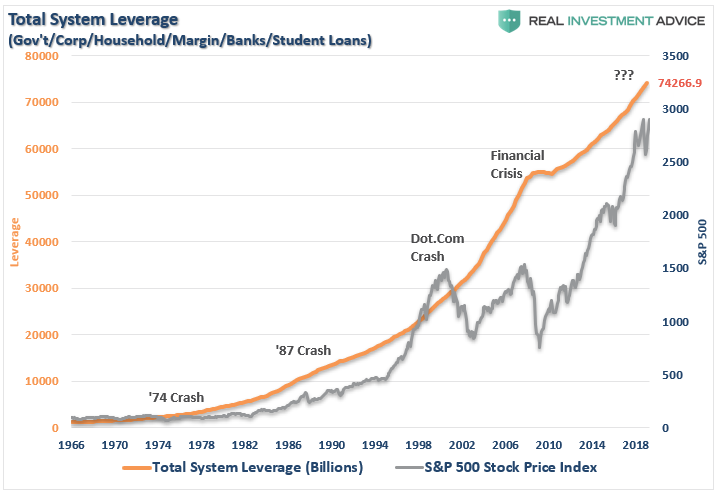

The chart below is Total U.S. Credit Market Debt (including Student Loans) which is currently running just a smidgen over $74 Trillion.The last time there was even a hint of deleveraging was during the “Financial Crisis.”

Corporate debt is a problem.

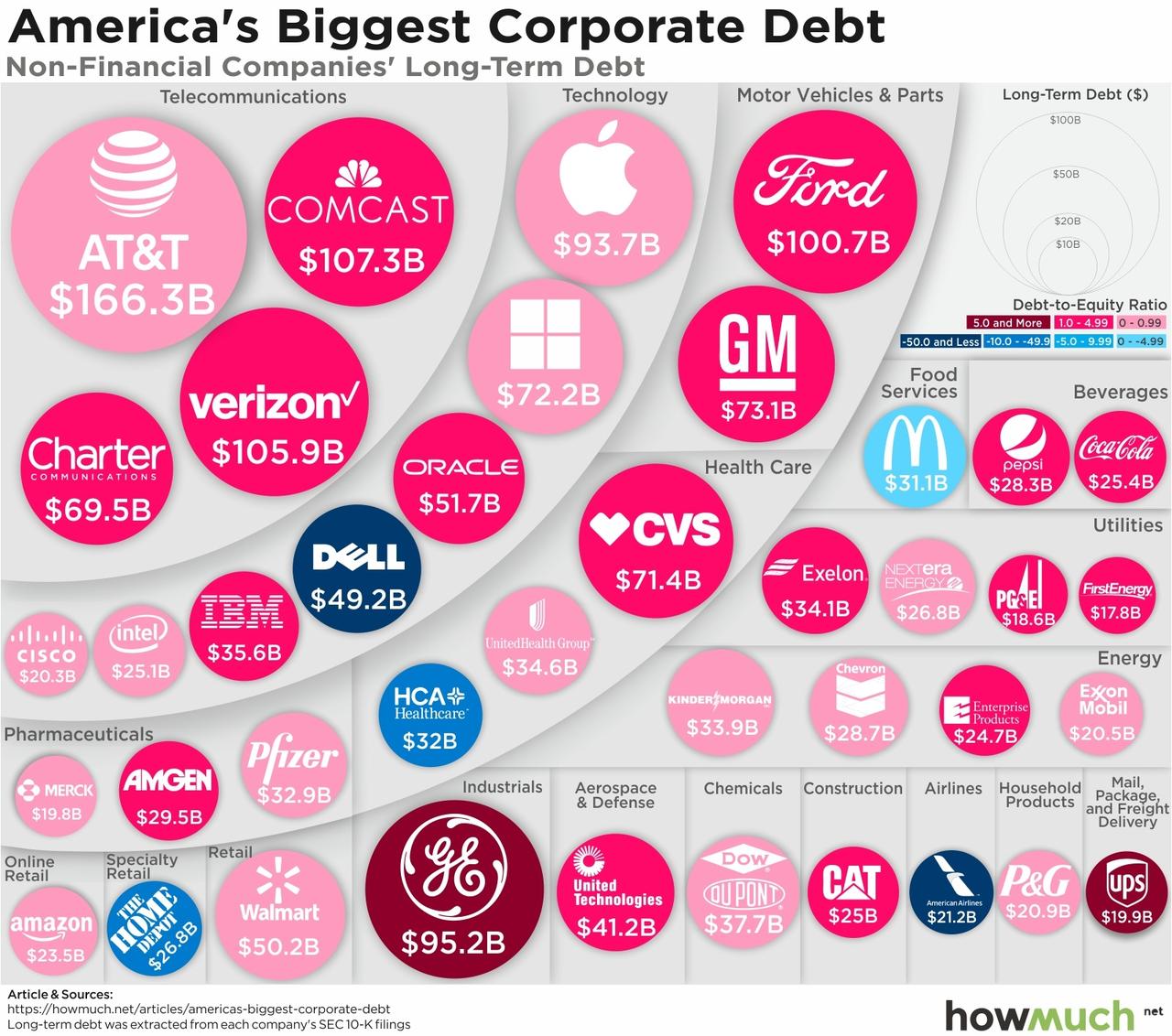

The wonderful website “HowMuch” put the corporate debt bubble into a graphic to help us visualize the potential for widespread defaults during the next economic and market downturn.

The problem with corporate debt is the amount of debt which is at risk of default during the next economic recession. (This isn’t an “IF,” it’s a “WHEN” statement.)

Let’s start with a note from Michael Lebowitz:

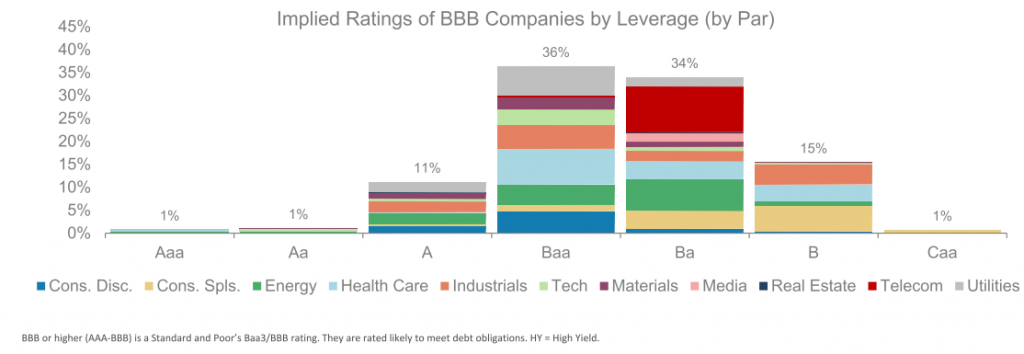

“The graph shows the implied ratings of all BBB companies based solely on the amount of leverage employed on their respective balance sheets. Bear in mind, the rating agencies use several metrics and not just leverage. The graph shows that 50% of BBB companies, based solely on leverage, are at levels typically associated with lower rated companies.”

“If 50% of BBB-rated bonds were to get downgraded, it would entail a shift of $1.30 trillion bonds to junk status. To put that into perspective, the entire junk market today is less than $1.25 trillion, and the subprime mortgage market that caused so many problems in 2008 peaked at $1.30 trillion.Keep in mind, the subprime mortgage crisis and the ensuing financial crisis was sparked by investor concerns about defaults and resulting losses.”

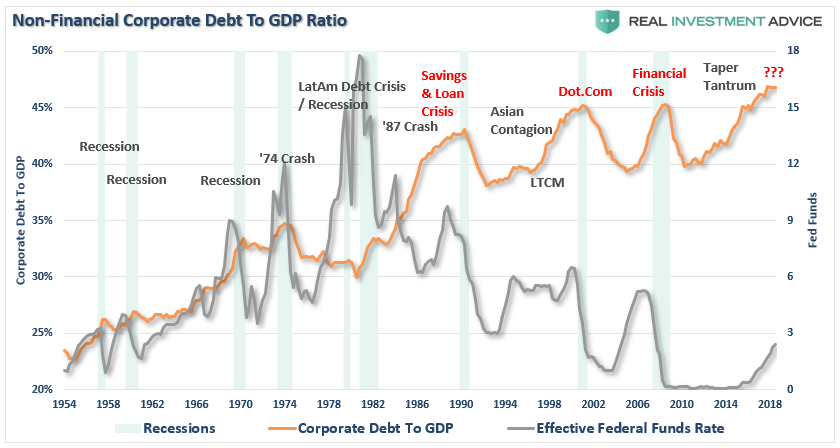

The reason BBB-rated debt is so plentiful is due to the Fed’s ultra-low interest rate policy over the last decade. Near zero rates, and easy credit terms, has seduced companies into taking on debt to fund operations, dividends, and stock buybacks. The consequence is we are now seeing corporate debt exceeding the levels of the global financial crisis.

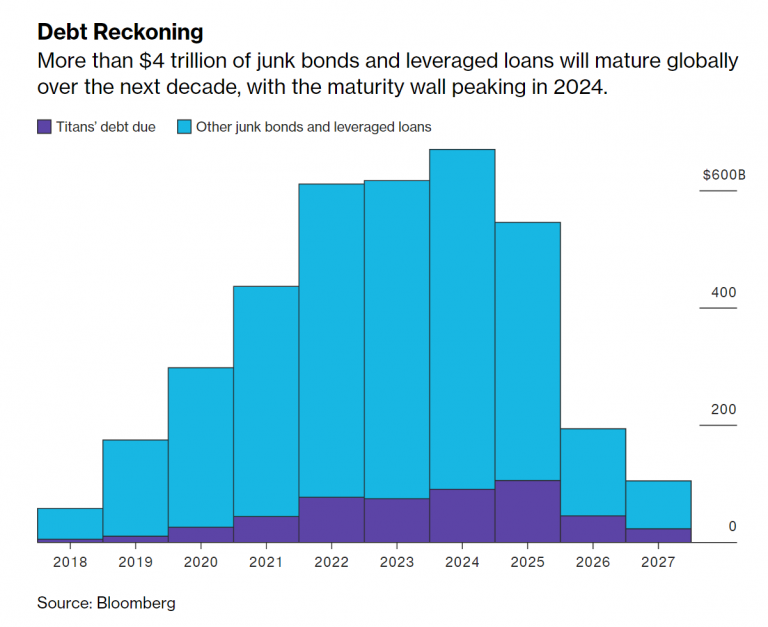

The real risk is that over the next 5-years more than 50% of the junk-bonds and leveraged-loans (which is sub-prime debt for corporations) is maturing and must be refinanced.

Let that sink in for a minute.

A weaker economy, recession risk, falling asset prices, or rising rates could well lock many corporations OUT of refinancing their share of this $4.88 trillion debt. Defaults will move significantly higher, and much of this debt will be downgraded to junk.

But it isn’t just corporate debt, that’s a problem.

Whistling Past The $246+ Trillion Graveyard

“According to the latest IIF Global Debt Monitor released today, debt around the globe hit $246 trillion in Q1 2019, rising by $3 trillion in the quarter, and outpacing the rate of growth of the global economy as total debt/GDP rose to 320%.

This was the second-highest dollar number on record after the first three months of 2018, though debt was higher in 2016 and 2017 as a share of world GDP. Total debt was broken down as follows:

Households: 60% of GDP

Non-financial corporates: 91% of GDP

Government 87% of GDP

Financial Corporations: 81% of GDP

And while the developed world has some more to go before regaining the prior all time leverage high, with borrowing led by the U.S. federal government and by global non-financial business, total debt in emerging markets hit a new all time high, thanks almost entirely to China.”

This is why Central Banks, from the ECB to the Federal Reserve, are terrified of an economic recession or downturn. As I said previously, “debt is the ‘weapon of mass destruction’”

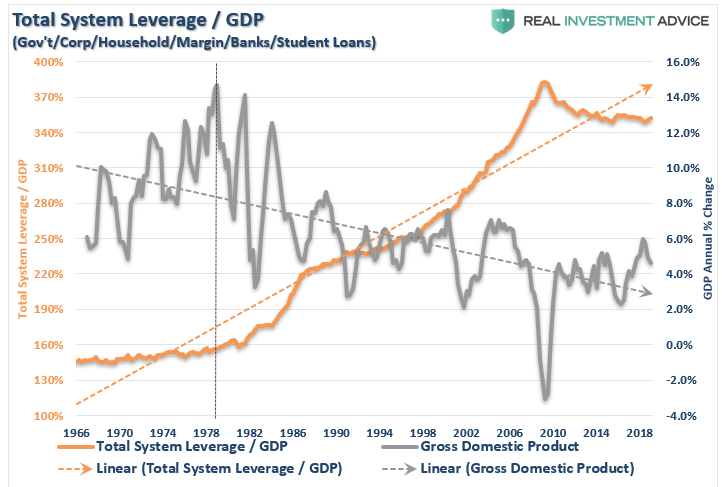

Given that global debt is 320% of global GDP, a deleveraging cycle will be too large for Central Banks to contain.

The deleveraging cycle WILL occur, all that Central Banks can do is hope to extend the current cycle long enough that “maybe” economic growth will catch up with the problem and lower the risk.

The irony is that it is the Central Banks on actions (lowering interest rates to zero and flooding the system with liquidity) which has inflated the debt bubble.

But that’s everyone else’s problem, right.

As noted above, the U.S. is currently running a debt-to-GDP ratio of roughly 350% so we are certainly not immune to the risk of a global “debt contagion.”

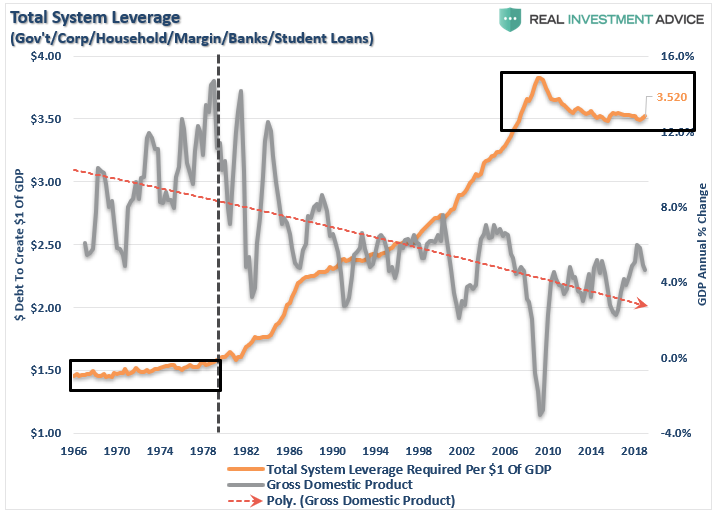

We can look at this a bit differently. The economy currently requires $3.50 of NEW debt just to generate $1 of new growth.

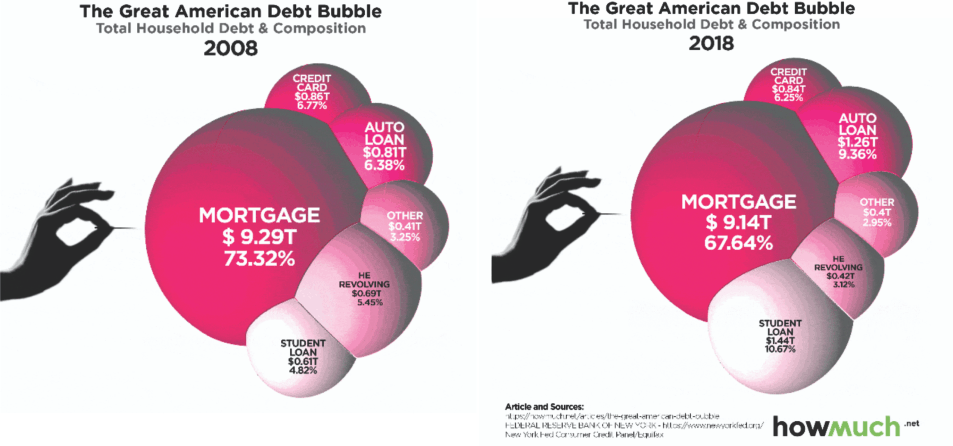

The problem with the exceedingly high debt levels is that since economic growth is a function of debt-supported spending, there is a finite limit to how much debt can be absorbed. As “HowMuch” showed, 10-years after the financial crisis, individuals are more levered today than they were then. (Notice the doubling of auto and student loan debt in particular.)

The Real Crisis Is Coming

As I noted this past week, the real crisis comes when there is a “run on pensions.” With a large number of pensioners already eligible for their pension, and a near $6 trillion dollar funding gap, the next decline in the markets will likely spur the “fear” that benefits will be lost entirely.

The combined run on the system, which is grossly underfunded, at a time when asset prices are dropping, credit is collapsing, and shadow-banking freezes, the ensuing debacle will make 2008 look like mild recession.

It is unlikely Central Banks are prepared for, or have the monetary capacity, to substantially deal with the fallout.

As David Rosenberg previously noted:

“There is no way you ever emerge from eight years of free money without a debt bubble. If it’s not a LatAm cycle, then it’s energy the next, commercial real estate after that, a tech mania years after, and then the mother of all of them, housing over a decade ago. This time there is a huge bubble on corporate balance sheets and a price will be paid. It’s just a matter of when, not if.”

Never before in human history have we seen so much debt. Government debt, corporate debt, shadow-banking debt, and consumer debt are all at record levels. Not just in the U.S., but all over the world.

If you are thinking this is a “Goldilocks economy,” “there is no recession in sight,” “Central Banks have this under control,” and that “I am just being bearish,” you would be right.

But that is also what everyone thought in 2007.

via ZeroHedge News https://ift.tt/2SLyIi4 Tyler Durden