Stocks are at record highs.

Unemployment is near record lows.

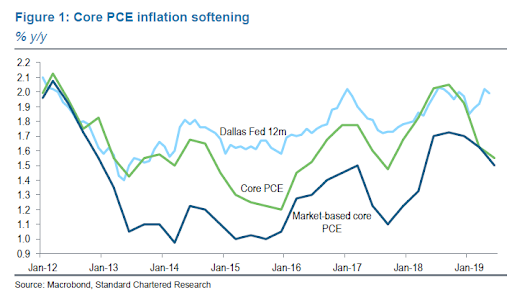

Inflation is only marginally below mandated levels.

And macro data has been surprising to the upside recently.

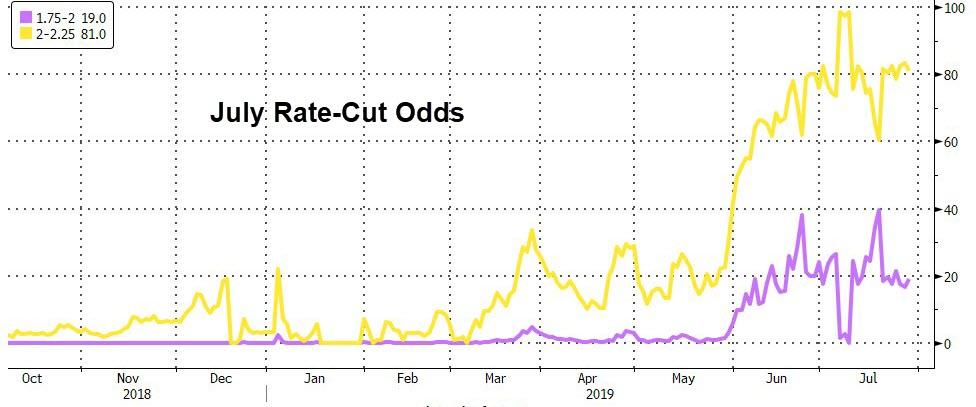

So, why the f**k are markets (and Fed speakers) so adamant that a 25bps (or 50) cut is required (or else)?

Is all of the above a lie and The Fed sees liquidity issues? Maybe, but in a somewhat stunning moment of clarity for the business channel, CNBC’s Steve Liesman just ever-so-quietly dropped a hint as to the real reason why The Fed is so keen to cut-cut-cut…

In a brief 45 seconds, Liesman drops the “existential” threat argument for why Powell will do whatever it takes to stay in Trump’s good graces…

“If The Fed gets this wrong, I think that they think if they make a mistake here, The Fed could be gone…”

Liesman expands on his ominous view:

“Think about what happens when a person gets up at a rally and starts railing against The Federal Reserve, and starts to create what could lead to Congressional pressure on The Fed, then you could imagine that their could be support for a different system.”

“I think they think there’s a lot of political downside risk to getting this wrong.”

With Democratic Party presidential candidate Tulsi Gabbard urging a new ‘Audit The Fed’ Bill, we wonder if Ron Paul will live to see the day when The Fed is ended!

One wonders if that is one of the drivers of gold’s recent run?

via ZeroHedge News https://ift.tt/2SPoPzD Tyler Durden