Hamptons, the beachfront playground for New York City’s financial elite, just recorded the worst second quarter for sales in eight years, according to a report from Douglas Elliman and Miller Samuel, and first reported by CNBC.

Real estates sales and prices in the Hamptons extended lower through 2Q19, indicating the luxury home market continues to stagnate for the last six quarters, the report said.

The weakness in the Hamptons was confusing for CNBC, considering they said real estate in the region should have been positive because the stock market is higher. But as Zerohedge readers know, the stock market has remained extremely disconnected from fundamentals this year, if not the last decade.

The Hamptons is experiencing the same pressures as many luxury markets across the country: an oversupply of mansions, dwindling demand from foreign buyers, changes to SALT deductions, and sellers who have become delusional that real estate prices can still hold 2014 values.

With no end in sight, the bust of the Hamptons real estate market could become more severe through 2020.

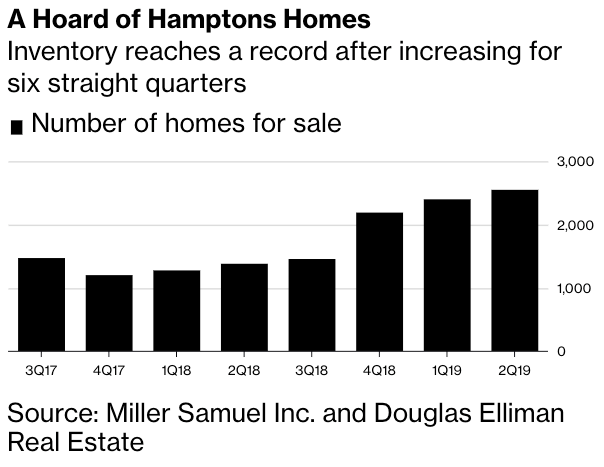

Miller Samuel said the number of homes listed in the region doubled in 2Q19, to 2,500. This is the highest level the research firm has recorded since it started gathering data in 2006.

According to the report, there is a 5-month supply of listings, with more than a three-year supply of luxury properties.

“I think it’s premature to talk about a turnaround until the inventory growth slows down,” said Jonathan Miller, CEO of Miller Samuel, the appraisal firm.

“There is just not a sense of urgency. The buyers are just waiting it out.”

Brokers told CNBC that demand is showing up for more affordable homes but not for +$5 million.

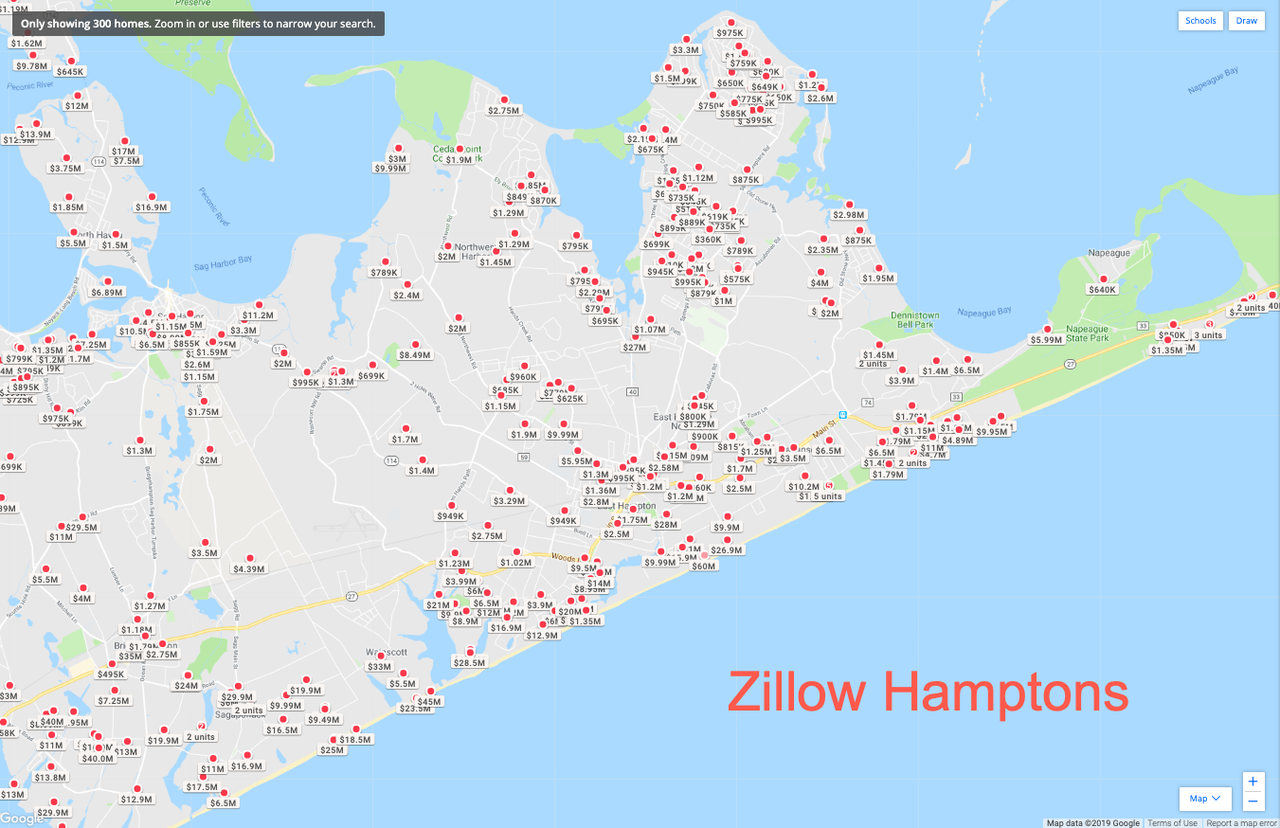

“You might look at Zillow and see nine properties on the oceanfront in Southampton, which looks like a lot,” said Cody Vichinsky of Bespoke Real Estate in the Hamptons.

“But then you dig into it, and you see that six of them are in places where you’d never want to live, with constant helicopter noise or a triple dune or encumbrances. And then the others, the price is ridiculous. When a property is priced decently, it goes.”

Glancing at Zillow Hamptons, hundreds of homes are for sale ranging from $625k to $60 million.

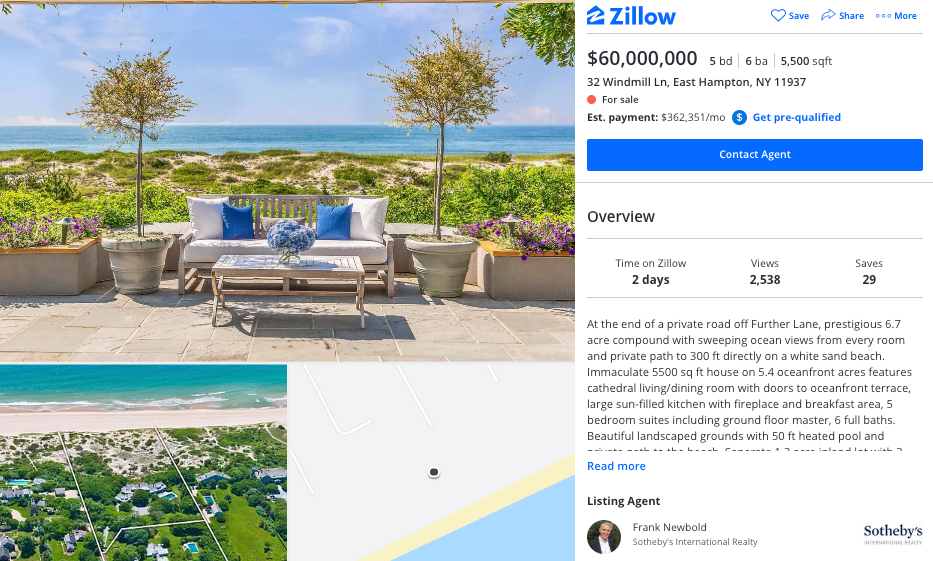

In a recent listing, the family of James Evans, the former chairman of the Union Pacific railroad empire, put their waterfront estate in East Hampton on the market for $60 million. The 5,500-square-foot home sits on 5.4 oceanfront acres, has an estimated mortgage payment of $362k per month.

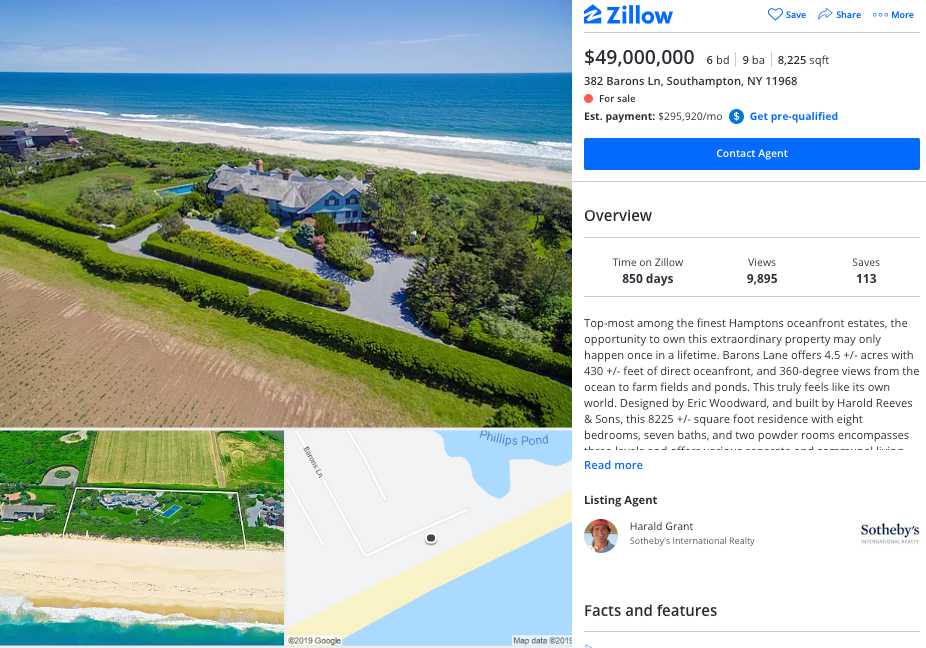

A $49 million mansion on 4.5 acres with 430 feet of direct oceanfront has been on the market for 850 days.

The pullback in Hamptons real estate is a sobering reminder that inventory is building to levels that are making sellers uncomfortable, could unleash panic selling and metastasize into a full-blown market rout with implications beyond New York City.

via ZeroHedge News https://ift.tt/2SJbbOG Tyler Durden