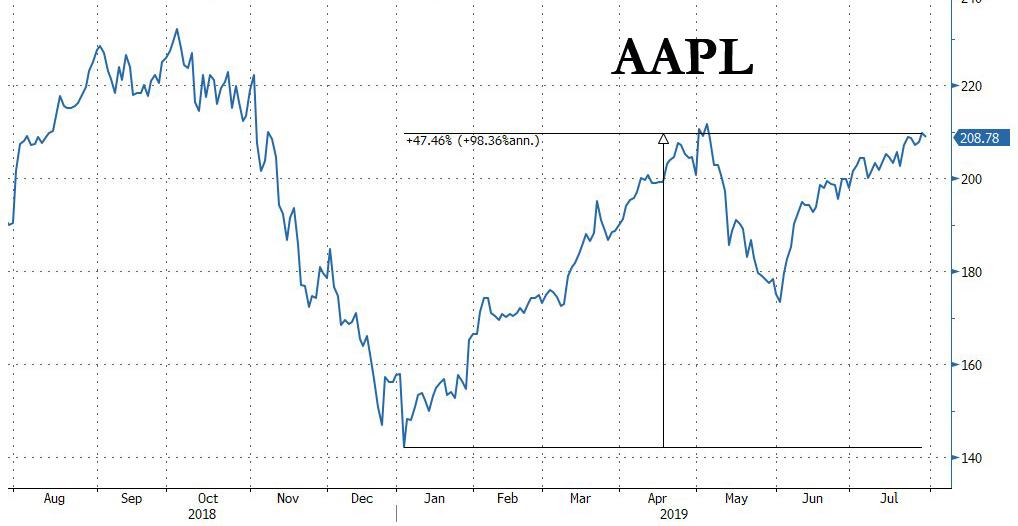

First, three quarters ago, Apple shocked investors when it said it would no longer disclose the number of iPhones it was selling – a clear signal that selling had slowed dramatically. Shocked investors sold off the stocks… then BTFD with gusto sending AAPL sharply higher. A few months later, on January 3 2019, Apple once again shocked the market when it slashed its revenue guidance by 8% for only the first time since this century (naturally, it blamed China). As AAPL stock tumbled, it reveberated across all capital markets, and even prompted a flash crash cascade in most yen and pound pairs. However, just like a quarter earlier, Apple’s “shock” was quickly overcome, and the after hours plunge actually marked the max pain for longs, and as the chart below shows, AAPL has soared 46%. And to think all it had to do was slash revenue guidance..

Then, last quarter, as largely expected, Apple reported that iPhone sales had indeed slumped, but the reason why the market kept bidding up the stocks, was the company’s effervescent outlook, which while declining on a year over year basis, was well above sellside consensus, dispelling fears of a growth slump and boosting hopes that Apple is successfully transitioning to a services company (the new $75 billion stock buyback repurchase authorization did not hurt). As a result, heading into its third quarter, AAPL stocks was trading near the highest levels of the year, and not too far from its all time highs.

So with US-China trade talks resuming today, Trump’s twitter rant notwithstanding, everyone’s attention was glued to the Apple earnings report at 430pm ET to see if all the optimism over the past 3 quarters would be justified. The answer appears to be yes, because moments ago, Apple reported that in fiscal Q3, it beat both revenue and EPS earnings:

- Q3 EPS: $2.18, Exp. $2.10

- Q3 Revenue: $53.8BN, Exp. $53.35BN

- Q3 Gross Margin $20.23BN

- Q3 Product revenue: $42.35 billion

Apple also announced that it had repurchased a whopping $17BN in stock in the quarter, and spent $3.6BN on dividends.

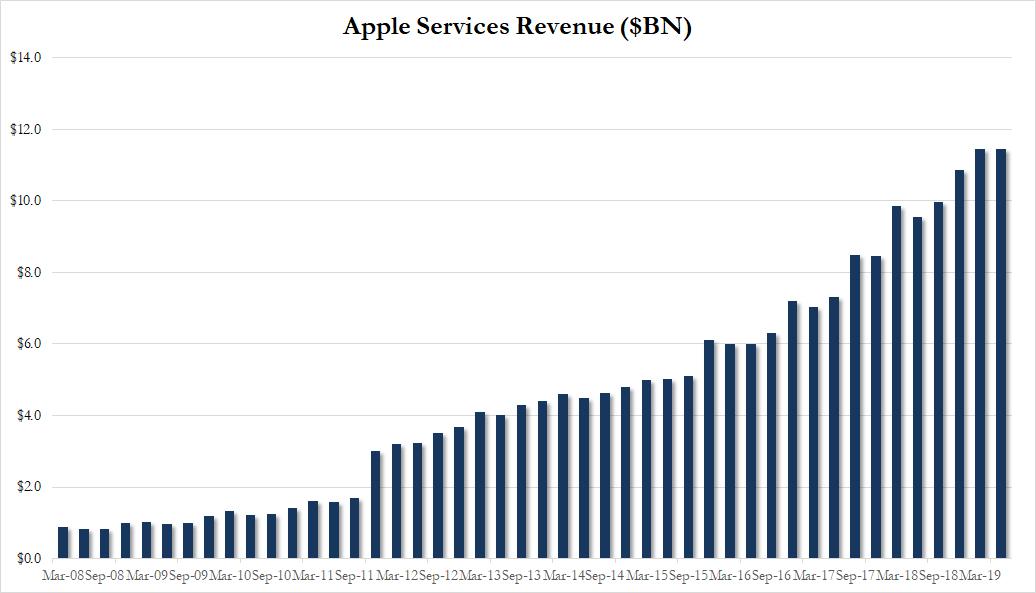

While Apple beating on earnings was great news (and the extravagant buyback certainly did not hurt), less impressive was Apple’s iPhone revenue, which came in at $25.986BN, below the $26.45BN expected, and well below the $29.5 billion from a year ago, as well as the slight miss in services revenue which came in at $11.46BN, below the $11.88BN consensus.

Another disappointing data point: China revenue came in at $9.16BN, down 4.1% Y/Y.

However, the reason why the stock is some 3% higher after hours was largely due to the company’s revenue and gross margin outlook, which came in well above the Sellside estimate:

- Q4 revenue between $61 and $64 billion, exp. $61.04BN

- Q4 gross margin between 37.5% and 38.5%, exp. 37.5%

Commenting on the earnings, Apple CFO Luca Maestri said that “Our year-over-year business performance improved compared to the March quarter and drove strong operating cash flow of $11.6 billion. We returned over $21 billion to shareholders during the quarter, including $17 billion through open market repurchases of almost 88 million Apple shares, and $3.6 billion in dividends and equivalents.”

Looking at the company’s increasingly important service revenue number, Apple reported $11.46BN in service revenue, up from $10.2BN a year ago, but below the $11.88BN expected by analysts, and virtually unchanged from the prior quarter.

So the bottom line: a modest profit beat, coupled with weaker than expected iPhone and Services revenue, offset by very strong guidance, which is enough to push AAPL stock 3.5% higher to $216 after hours.

via ZeroHedge News https://ift.tt/2GPM2x9 Tyler Durden